Transamerica Life Insurance Company Review (2026)

Unveil Transamerica Life Insurance, a revered industry veteran, providing diverse coverage choices and cost-saving discounts to ensure your financial well-being.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

The article explores Transamerica Life Insurance Company, a prominent player in the insurance industry. It offers a comprehensive range of insurance and financial products, including life insurance, health insurance, and investment plans, providing individuals and families with diverse options to safeguard their financial future.

The company boasts a history of financial stability, positive customer reviews, and customizable policies. While premiums may vary, Transamerica’s strong financial ratings and commitment to customer service make it a notable choice for those seeking reliable insurance coverage.

Additionally, the article outlines its competitive landscape and highlights some of its main competitors in the insurance industry, offering valuable insights for individuals considering their insurance needs.

What You Should Know About Transamerica Life Insurance Company

Rates: Transamerica’s rates are competitive within the industry, striking a balance between affordability and comprehensive coverage. The company offers a range of premium options tailored to individual needs, making it accessible to a diverse customer base.

Discounts: Transamerica excels in offering a variety of discounts, empowering policyholders to optimize their insurance costs. The company’s commitment to making coverage more affordable is evident through its diverse discount programs, providing added value to its customers.

Complaints/Customer Satisfaction: Transamerica demonstrates a strong commitment to customer satisfaction, with a minimal number of complaints relative to its customer base. Positive testimonials highlight the company’s dedication to addressing customer concerns promptly and effectively.

Claims Handling: Transamerica prioritizes a hassle-free claims process, providing policyholders with multiple convenient options. The company’s dedication to swift and efficient claim resolution, coupled with positive customer feedback, underscores its commitment to delivering reliable and responsive service during critical moments.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Transamerica Life Insurance Company Insurance Coverage Options

When it comes to safeguarding your future, having the right insurance coverage is paramount. Transamerica Life Insurance Company understands the significance of financial security and offers a wide array of coverage options to meet your unique needs. Here is a bullet list summarizing the coverage options typically offered by Transamerica Life Insurance Company:

Life Insurance:

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Final Expense Insurance

Health Insurance:

- Health Maintenance Organization (HMO) Plans

- Preferred Provider Organization (PPO) Plans

- High Deductible Health Plans (HDHP)

- Medicare Supplement Insurance

Investment Plans:

- Annuities

- Retirement Plans (e.g., 401(k) rollovers)

- Mutual Funds

- IRA (Individual Retirement Account) options

These coverage options are designed to cater to a wide range of insurance and financial needs, providing individuals and families with choices to secure their future and protect against unexpected events. Specific policy details and availability may vary by location and individual circumstances, so it’s important to consult with Transamerica or their agents for personalized guidance.

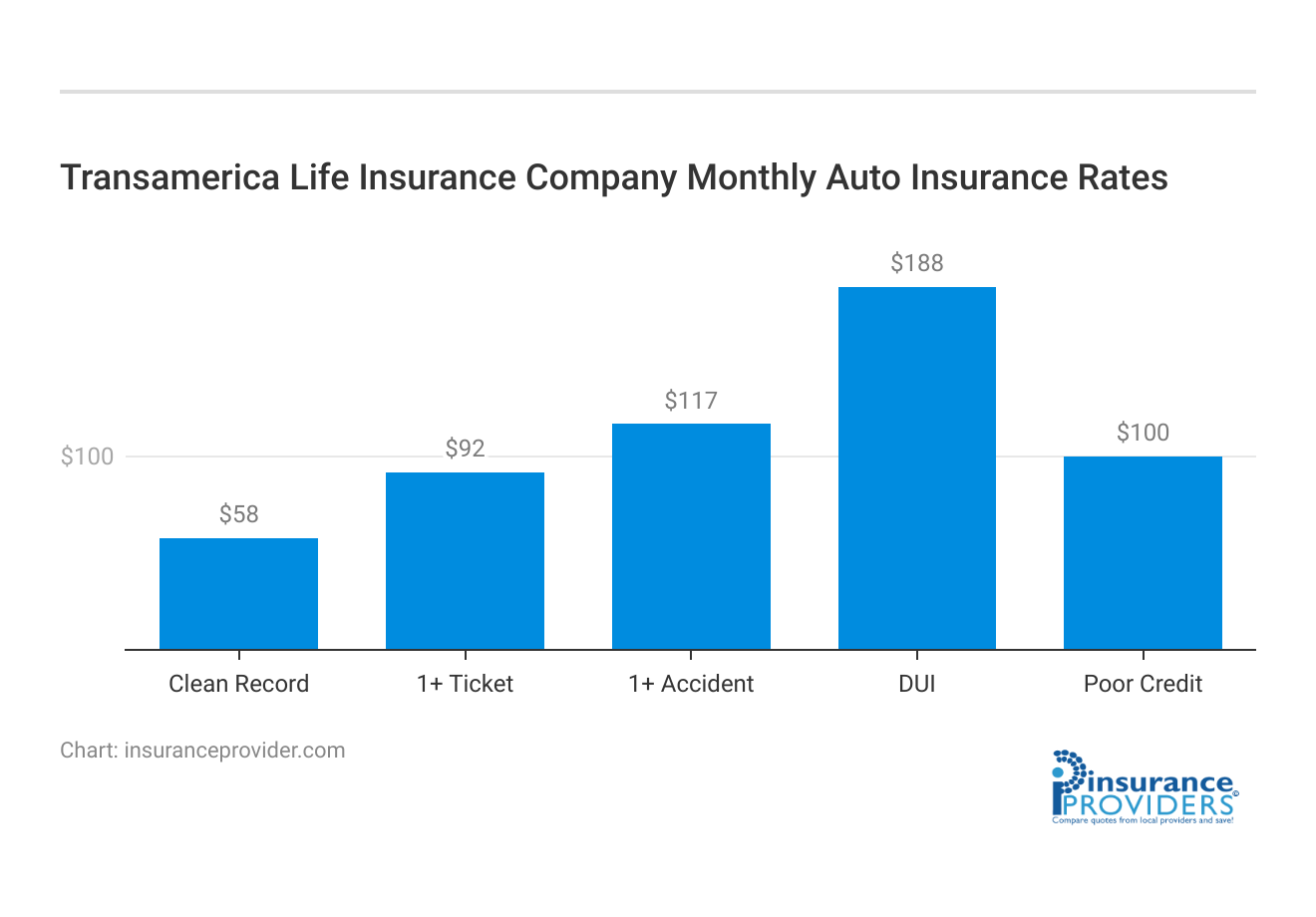

Transamerica Life Insurance Company Insurance Rates Breakdown

| Driver Profile | Transamerica | National Average |

|---|---|---|

| Clean Record | $58 | $119 |

| 1+ Ticket | $92 | $147 |

| 1+ Accident | $117 | $173 |

| DUI | $188 | $209 |

| Poor Credit | $100 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Transamerica Life Insurance Company Discounts Available

| Discounts | Transamerica |

|---|---|

| Anti Theft | 13% |

| Good Student | 20% |

| Low Mileage | 14% |

| Paperless | 11% |

| Safe Driver | 22% |

| Senior Driver | 15% |

Let’s delve into the discounts offered by Transamerica, giving you insights into how you can secure the coverage you need while keeping your budget in check. Here are some common types of discounts that insurance companies, including Transamerica, often provide:

- Multi-Policy Discount: Customers can often save by bundling multiple insurance policies with Transamerica, such as combining auto and home insurance.

- Safe Driving Discount: For auto insurance policies, safe drivers with a clean driving record may qualify for lower premiums.

- Good Student Discount: If you have a student on your policy who maintains good grades, you may be eligible for a discount.

- Safety Features Discount: Installing safety features in your home or vehicle, such as alarms or anti-theft devices, may lead to reduced premiums.

- Military Discount: Some insurance companies offer discounts to active duty or retired military personnel.

- Payment Discounts: Policyholders may save money by paying their premiums annually or through electronic funds transfer (EFT).

- Paperless Billing Discount: Opting for paperless billing and electronic communication can sometimes result in cost savings.

- Loyalty Discount: Customers who have been with Transamerica for an extended period may receive loyalty discounts.

- Non-Smoker Discount: Life insurance policies often offer lower rates to non-smokers due to reduced health risks.

When it comes to securing insurance coverage, every discount counts, and Transamerica Life Insurance Company is committed to making your financial goals more attainable. By offering various discounts, they empower you to protect your loved ones and assets without sacrificing your budget.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Transamerica Life Insurance Company Ranks Among Providers

In the realm of insurance and financial services, competition fuels innovation and offers consumers a wealth of choices. Transamerica Life Insurance Company stands as a formidable presence in this industry, but it doesn’t exist in isolation. Some of Transamerica’s main competitors at that time included:

- Prudential Financial: Prudential is a large and reputable insurance and financial services company with a wide range of life insurance, retirement, and investment products.

- Metlife: Metlife is another major player in the insurance industry, known for its life insurance, annuities, and employee benefits offerings.

- New York Life: New York Life is a mutual insurance company that has been in the industry for over 175 years, specializing in life insurance, retirement income, and long-term care insurance.

- Northwestern Mutual: Northwestern Mutual is a leading provider of life insurance and financial planning services, emphasizing long-term financial security for its clients.

- Massmutual (Massachusetts Mutual Life Insurance Company): Massmutual offers a range of insurance, retirement, and investment products and is known for its strong financial stability.

- State Farm: While primarily known for auto and homeowners insurance, State Farm also offers life insurance and various financial services, making it a competitor in the life insurance market.

- AIG (American International Group): AIG is a global insurance and financial services company that provides life insurance, retirement, and investment products.

- Allianz: Allianz is a multinational insurance company with a presence in various insurance segments, including life insurance and annuities.

- Principal Financial Group: Principal Financial Group specializes in retirement, investment, and insurance products for individuals and businesses.

- Lincoln Financial Group: Lincoln Financial offers a range of insurance and retirement solutions, including life insurance and annuities.

Navigating the complex world of insurance and financial services requires a keen awareness of the competitive landscape. Transamerica Life Insurance Company is just one piece of the puzzle, and knowing its main competitors provides valuable insights.

Read more: Principal Life Insurance Company Review

Claims Process at Transamerica Life Insurance Company

Ease of Filing a Claim

Transamerica Life Insurance Company prioritizes a hassle-free claims process, offering policyholders multiple convenient options to file a claim. Whether you prefer the ease of online submission, the personal touch of over-the-phone assistance, or the accessibility of mobile apps, Transamerica has you covered. They aim to ensure that filing a claim aligns with your preferred method.

Average Claim Processing Time

Transamerica understands the importance of timely claim processing. While the exact processing time may vary depending on individual circumstances, Transamerica is committed to swift and efficient claim resolution. Their dedication to minimizing claim processing time underscores their customer-centric approach to insurance.

Customer Feedback on Claim Resolutions and Payouts

Transamerica Life Insurance Company values customer feedback and strives for fair and efficient claim resolutions. Many satisfied policyholders have shared positive feedback about their claim experiences, highlighting the company’s commitment to providing reliable and responsive service when it matters most. These testimonials reinforce Transamerica’s dedication to customer satisfaction.

Digital and Technological Features by Transamerica Life Insurance Company

Mobile App Features and Functionality

Transamerica Life Insurance Company offers a feature-rich mobile app designed to enhance the overall customer experience. The app provides a wide range of features and functionalities, enabling policyholders to conveniently access their insurance accounts, manage policies, make premium payments, and track claim statuses.

This intuitive mobile app streamlines insurance-related tasks, providing policyholders with user-friendly tools for managing their coverage on the go.

Online Account Management Capabilities

Recognizing the significance of online account management, Transamerica Life Insurance Company provides policyholders with a secure online portal.

This portal offers 24/7 access to policy information, allowing customers to review coverage details, make policy adjustments, and monitor account activity at their convenience. These online account management capabilities contribute to a seamless and convenient insurance experience, empowering policyholders to stay in control of their coverage.

Digital Tools and Resources

Transamerica Life Insurance Company equips policyholders with a suite of digital tools and educational resources to make informed decisions. These resources, thoughtfully designed, provide customers with valuable insights, calculators, and informative materials.

Whether policyholders are calculating insurance needs, assessing risks, or seeking educational resources, Transamerica’s digital tools are tailored to provide the information needed to make informed decisions about their coverage and insurance-related matters.

Frequently Asked Questions

What types of insurance products does Transamerica Life Insurance Company offer?

Transamerica Life Insurance Company offers a comprehensive range of insurance and financial products, including life insurance, health insurance, and investment plans, providing individuals and families with diverse options to safeguard their financial future.

How does Transamerica Life Insurance Company stand out in terms of rates and discounts?

Transamerica is committed to making insurance coverage more accessible by offering various discounts, empowering individuals to protect their loved ones and assets without sacrificing their budget.

What is the significance of Transamerica Life Insurance Company’s financial stability and customer reviews?

Transamerica boasts a history of financial stability and positive customer reviews, reinforcing its commitment to reliable insurance coverage. This combination of financial strength and customer satisfaction contributes to its standing as a notable choice in the insurance industry.

How does Transamerica facilitate the claims process for policyholders?

Transamerica prioritizes a hassle-free claims process, offering policyholders multiple convenient options to file a claim. Whether through online submission, over-the-phone assistance, or mobile apps, Transamerica aims to ensure that filing a claim aligns with the preferred method of its policyholders.

What digital features and tools does Transamerica provide to enhance the customer experience?

Transamerica Life Insurance Company offers a feature-rich mobile app, a secure online portal for account management, and a suite of digital tools and educational resources.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.