Travelers Commercial Casualty Company Review (2026)

Navigating the intricate landscape of business risk demands a steadfast ally, and Travelers Commercial Casualty Company, tracing its heritage back to 1853, stands as a reliable and adaptable insurance partner for diverse industry needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Travellers Commercial Casualty Company, a venerable insurance provider with a rich history dating back to 1853, offers a versatile array of insurance solutions tailored to meet diverse business needs.

Their comprehensive offerings encompass liability insurance, property insurance, workers’ compensation, and commercial auto insurance, providing businesses with robust protection against unforeseen risks.

Renowned for its financial stability and a nationwide presence in all 50 states, Travellers boasts a low complaint level and consistently garners high customer satisfaction. With a commitment to innovation and industry impact, this insurance stalwart is a compelling choice for businesses seeking reliable, customized coverage to safeguard their assets and operations.

Travellers Commercial Casualty Company Insurance Coverage Options

Travellers Commercial Casualty Company offers a comprehensive range of coverage options tailored to meet various business needs. Here’s a bullet list of the coverage options they provide:

Liability Insurance

- General Liability

- Professional Liability

- Product Liability

- Umbrella Liability

Property Insurance

- Property Damage

- Business Interruption

- Equipment Breakdown

- Inland Marine Coverage

Workers’ Compensation

- Coverage for Workplace Injuries

- Medical Benefits for Employees

- Wage Replacement for Injured Workers

- Rehabilitation Services

Commercial Auto Insurance

- Fleet Vehicle Coverage

- Business Car Insurance

- Commercial Truck Insurance

- Cargo and Transportation Coverage

These coverage options are designed to address a wide range of risks and protect businesses from potential financial losses. Businesses can customize their policies to suit their specific requirements, ensuring they have the right protection in place.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

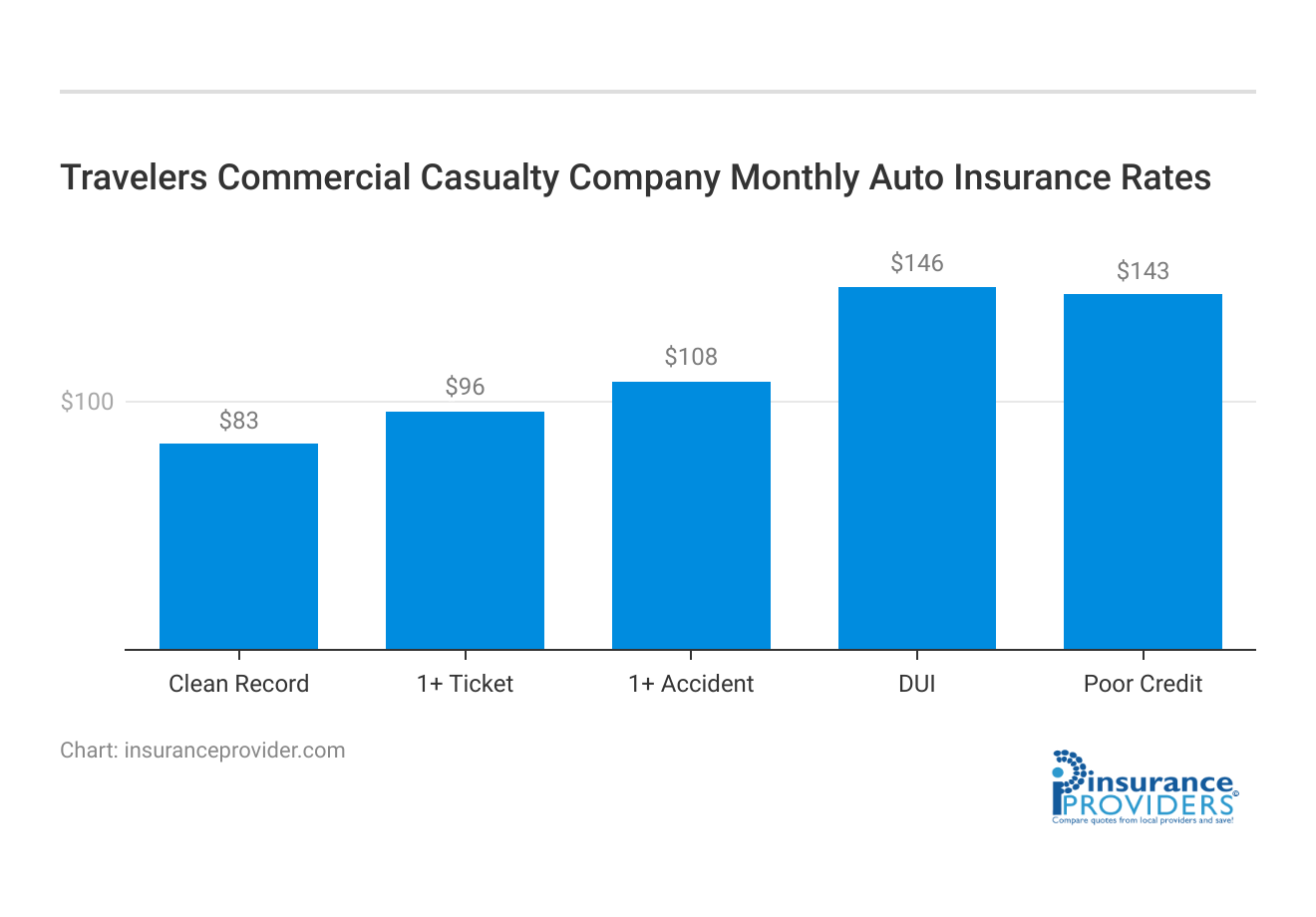

Travellers Commercial Casualty Company Insurance Rates Breakdown

| Driver Profile | Travelers Commercial | National Average |

|---|---|---|

| Clean Record | $83 | $119 |

| 1+ Ticket | $96 | $147 |

| 1+ Accident | $108 | $173 |

| DUI | $146 | $209 |

| Poor Credit | $143 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Travellers Commercial Casualty Company Discounts Available

| Discounts | Travelers Commercial |

|---|---|

| Anti Theft | 8% |

| Good Student | 11% |

| Low Mileage | 15% |

| Paperless | 11% |

| Safe Driver | 16% |

| Senior Driver | 13% |

They typically provide various ways for policyholders to save on their insurance premiums. Here’s a bullet list of common discounts you may be eligible for:

- Multi-Policy Discount: You can often save by bundling multiple insurance policies, such as combining your business liability and property coverage.

- Safety and Risk Management Programs: Travellers encourages businesses to implement safety measures and risk management programs. Demonstrating a commitment to safety can lead to lower premiums.

- Claims-Free Discount: Maintaining a claims-free record over time can earn you a discount on your premiums as a reward for responsible management.

- Group Discounts: If you are part of an industry association or group that has partnered with Travellers, you may be eligible for group discounts.

- Early Renewal Discount: Renewing your policy before its expiration date can sometimes lead to discounts on your premium.

- Safety Equipment and Measures: Installing safety equipment, such as fire alarms, security systems, or workplace safety measures, may result in reduced premiums.

- Good Payment History: Consistently paying your premiums on time and without any lapses can help you qualify for a good payment history discount.

- Claims-Free Discount: If your business has a history of avoiding insurance claims, you might be eligible for a claims-free discount.

- New Business Discount: Travellers may offer incentives for new businesses or businesses switching from other providers.

It’s important to note that the availability of these discounts can vary by location and policy type. To get the most accurate information on discounts available for your specific circumstances, it’s advisable to contact a Travellers Commercial Casualty Company agent or visit their official website for the latest discount details.

How Travellers Commercial Casualty Company Ranks Among Providers

Travellers Commercial Casualty Company operates in the highly competitive insurance industry, where several well-established and respected companies vie for market share. Some of Travellers’ main competitors include:

- State Farm: State Farm is one of the largest insurance providers in the United States, offering a wide range of insurance products, including auto, home, and business insurance. They are known for their extensive network of agents and strong customer service.

- Allstate: Allstate is another major player in the insurance industry, offering a variety of insurance options for individuals and businesses. They are known for their innovative insurance features and digital tools.

- Progressive: Progressive is known for its auto insurance offerings and its emphasis on technology, including the use of telematics for auto coverage. They compete aggressively in the auto insurance market and have a significant presence in commercial auto insurance as well.

- Geico: Geico is renowned for its competitive rates and extensive advertising campaigns. They offer a wide range of insurance products, including auto, home, and business insurance.

- Liberty Mutual: Liberty Mutual is a global insurer with a strong presence in the United States. They provide various insurance solutions, including business insurance, and are known for their focus on customization.

- Chubb: Chubb is a major player in the commercial insurance market and often competes with Travellers in offering specialized coverage for businesses. They have a strong reputation for providing high-value, tailored insurance solutions.

- Nationwide: Nationwide is known for its diverse insurance offerings, including commercial policies. They emphasize customer service and offer various discounts and programs to policyholders.

- The Hartford: The Hartford specializes in providing insurance solutions for businesses, including small and medium-sized enterprises. They are recognized for their expertise in commercial lines.

- CNA Financial: CNA is a leader in commercial insurance and risk management services. They compete with Travellers in providing comprehensive business insurance solutions.

- Zurich Insurance Group: Zurich is a global insurance provider with a significant presence in the commercial insurance sector. They offer a wide range of coverage options for businesses of all sizes.

These competitors, like Travellers, strive to differentiate themselves through various factors, including coverage options, customer service, pricing, and technological innovations.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travelers Commercial Casualty Company Claims Process

Ease of Filing a Claim

Travelers Commercial Casualty Company offers a seamless claims filing experience to its customers, allowing them to file claims through various convenient channels. Customers can submit claims online through the company’s website, over the phone, or via their mobile apps.

This multi-channel approach ensures accessibility and ease for individuals with different preferences and technological comfort levels.

Average Claim Processing Time

The company is committed to efficient claim processing. On average, Travelers Commercial Casualty Company strives to process claims in a timely manner. The precise processing time may vary based on the complexity and nature of each claim. However, the company prioritizes quick and efficient claims handling to provide customers with a smooth experience during the claims process.

Customer Feedback on Claim Resolutions and Payouts

Travelers Commercial Casualty Company values customer feedback on claim resolutions and payouts. Customers’ experiences and satisfaction with the claim settlement process are taken seriously. The company actively seeks feedback to continuously improve its claims handling procedures and ensure fair and satisfactory resolutions for its customers.

Travelers Commercial Casualty Company Digital and Technological Features

Mobile App Features and Functionality

Travelers Commercial Casualty Company offers a feature-rich mobile app to its customers. The app allows policyholders to easily manage their insurance policies, view and download policy documents, submit and track claims, and access important resources. The intuitive design and user-friendly interface make it convenient for customers to navigate and utilize the app’s features effectively.

Online Account Management Capabilities

The company’s online account management platform provides customers with a comprehensive suite of tools to manage their policies and accounts. Policyholders can access their accounts to update personal information, view policy details, make payments, and review claims history.

The online portal is designed to empower customers with the ability to manage their insurance needs conveniently from the comfort of their own homes.

Digital Tools and Resources

Travelers Commercial Casualty Company offers a range of digital tools and resources to enhance the overall customer experience. These include educational materials, risk assessment tools, safety guidelines, and informative articles to help customers make informed decisions about their insurance coverage.

The company’s commitment to leveraging technology for the benefit of its customers is reflected in the array of digital resources available to assist and support policyholders.

Frequently Asked Questions

What types of insurance does Travellers Commercial Casualty Company offer?

Travellers offers liability insurance, property insurance, workers’ compensation, and commercial auto insurance, among other options.

How long has Travellers been in the insurance industry?

Travellers has been serving businesses since its founding in 1853, accumulating over a century of experience.

Is Travellers available nationwide?

Yes, Travellers operates in all 50 states, providing insurance coverage to businesses across the United States.

What sets Travellers apart from other insurance providers?

Travellers’ strong financial stability, customer-focused approach, and industry impact make them a standout choice in the insurance sector.

How can I get a quote from Travellers Commercial Casualty Company?

To get a quote, you can visit their official website or contact one of their local agents to discuss your insurance needs and receive a personalized quote.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.