UnitedHealthcare Insurance Company Review (2026)

UnitedHealthcare Insurance Company, a leader in comprehensive insurance, offers unparalleled coverage across health, life, dental, vision, and Medicare, ensuring client satisfaction through a vast network of healthcare providers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

UnitedHealthcare Insurance Company stands as a comprehensive insurance provider, offering a diverse array of coverage options to cater to individuals’ health, life, dental, vision, and Medicare needs. This reputable company boasts a rich history, a commitment to customer satisfaction, and an extensive network of healthcare providers.

UnitedHealthcare’s health insurance encompasses everything from doctor visits to preventive care, while their life insurance options secure financial futures. Dental and vision insurance plans ensure optimal well-being, and Medicare options cater to retirees.

Their competitive premiums, flexible payment plans, and user-friendly services set them apart, making UnitedHealthcare a trusted partner for those seeking peace of mind through comprehensive insurance protection.

UnitedHealthcare Insurance Company Insurance Coverage Options

When it comes to safeguarding your health, finances, and overall well-being, UnitedHealthcare Insurance Company offers a comprehensive range of coverage options. Whether you’re seeking protection for your health, life, dental, vision, or Medicare needs, our diverse policies are designed to cater to your specific requirements.

Explore the various coverage options provided by UnitedHealthcare below and discover the peace of mind that comes with comprehensive insurance protection.

- Health Insurance: Our health insurance policies provide extensive coverage, including doctor visits, hospital stays, prescription medications, and preventive care. We prioritize your health, ensuring you have access to the care you need when you need it.

- Life Insurance: UnitedHealthcare offers various life insurance options to secure your family’s financial future. Whether you’re looking for term life, whole life, or other options, our policies provide peace of mind in uncertain times.

- Dental Insurance: A healthy smile is essential for your overall well-being. Our dental insurance plans cover routine check-ups, dental procedures, and even orthodontic care, helping you maintain optimal oral health.

- Vision Insurance: Clear vision is crucial for daily life. With our vision insurance, you can access regular eye exams, glasses, and contact lenses, ensuring your vision remains sharp.

- Medicare Plans: As you approach retirement, our Medicare plans are tailored to meet your evolving healthcare needs. We provide comprehensive coverage and peace of mind during your golden years.

Read more: UnitedHealthcare Life Insurance Company Review

No matter where life takes you, UnitedHealthcare is here to ensure that you and your loved ones are protected. Our commitment to providing comprehensive, customer-centric coverage options has made us a trusted name in the insurance industry.

With a rich history, a dedication to customer satisfaction, and an extensive network of healthcare providers, we are here to help you navigate life’s uncertainties with confidence. Choose UnitedHealthcare for all your insurance needs and experience the peace of mind that comes with comprehensive coverage.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

UnitedHealthcare Insurance Company Insurance Rates Breakdown

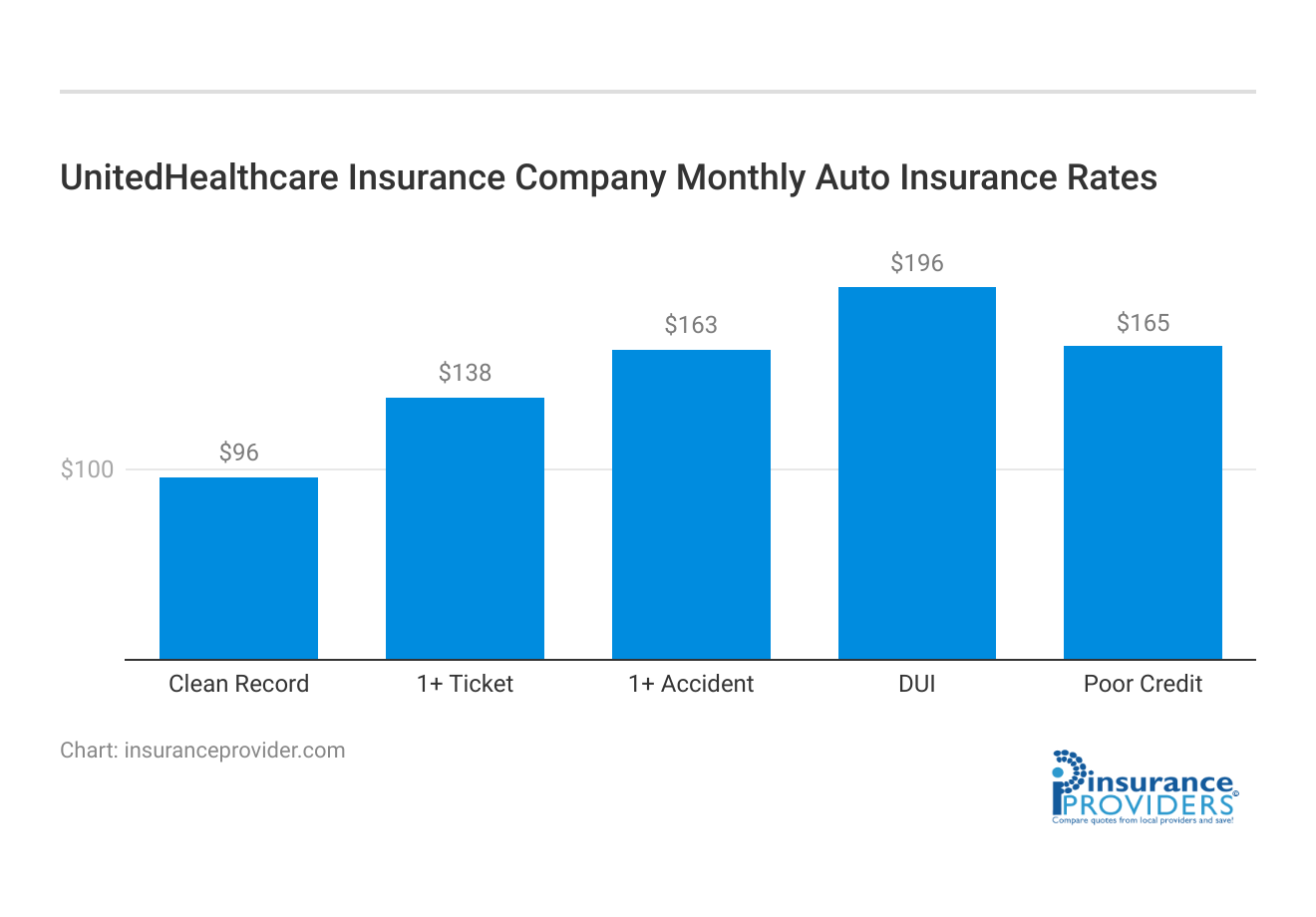

| Driver Profile | UnitedHealthcare Insurance | National Average |

|---|---|---|

| Clean Record | $96 | $119 |

| 1+ Ticket | $138 | $147 |

| 1+ Accident | $163 | $173 |

| DUI | $196 | $209 |

| Poor Credit | $165 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

UnitedHealthcare Insurance Company Discounts Available

Compare RatesStart Now →

"}” data-sheets-userformat=”{"2":4737,"3":{"1":0},"10":2,"12":0,"15":"Arial"}”>

| Discounts | UnitedHealthcare Insurance |

|---|---|

| Anti Theft | 14% |

| Good Student | 16% |

| Low Mileage | 13% |

| Paperless | 6% |

| Safe Driver | 23% |

| Senior Driver | 14% |

At UnitedHealthcare Insurance Company, we understand that affordability is a significant factor when considering insurance coverage. That’s why we offer various discounts to help you make the most of your insurance investment.

These discounts are designed to make comprehensive coverage more accessible, ensuring that you can protect what matters most without breaking the bank. Explore the discounts we provide to our valued policyholders and see how you can save while securing your health, life, dental, vision, or Medicare needs.

- Multi-Policy Discount: Combine multiple insurance policies with us, such as health and dental, to enjoy a discounted rate on your premiums.

- Healthy Lifestyle Discount: Maintain a healthy lifestyle and participate in wellness programs to qualify for lower insurance costs.

- Good Driver Discount: Safe drivers with a clean driving record may be eligible for reduced premiums on certain insurance policies.

- Loyalty Discount: We value your loyalty. Policyholders who have been with us for an extended period may qualify for loyalty discounts.

- Military and Veteran Discount: We appreciate the service of our military personnel and veterans. Special discounts may be available for those who have served our country.

UnitedHealthcare Insurance Company is committed to making insurance coverage accessible and affordable for our customers. Our diverse range of discounts is just one way we strive to meet that commitment. We believe that everyone deserves the peace of mind that comes with comprehensive insurance coverage, and these discounts are designed to help you achieve just that.

Whether you’re insuring your health, life, dental, vision, or Medicare needs, explore these discounts to find the savings that are right for you. Partner with UnitedHealthcare, where your well-being and financial security are our top priorities.

How UnitedHealthcare Insurance Company Ranks Among Providers

UnitedHealthcare Insurance Company operates in a highly competitive insurance industry, with several prominent competitors vying for the attention of consumers. These competitors offer similar insurance products and services, making it essential for UnitedHealthcare to continuously innovate and provide outstanding customer service. Here are some of UnitedHealthcare’s main competitors:

- Anthem, Inc.: Anthem is a major player in the health insurance industry, offering a wide range of health and related insurance products. They have a substantial market presence, particularly in the United States, and compete with UnitedHealthcare in various regions.

- Aetna (a subsidiary of CVS Health): Aetna is known for its diverse health insurance offerings, including medical, dental, and Medicare plans. The company’s partnership with CVS Health has strengthened its position in the healthcare market and intensified competition with UnitedHealthcare.

- Cigna: Cigna is a global health services company that offers health, dental, and Medicare insurance, as well as related healthcare services. Cigna’s extensive network of healthcare providers and international presence make it a strong competitor.

- Humana: Humana specializes in Medicare Advantage plans and has a significant presence in the Medicare market. Their focus on senior healthcare aligns with UnitedHealthcare’s offerings, making them direct competitors for this demographic.

- Kaiser Permanente: Kaiser Permanente operates as both an insurance provider and healthcare provider, offering integrated care plans. They have a unique model that competes with traditional insurance companies like UnitedHealthcare.

- Blue Cross Blue Shield: The Blue Cross Blue Shield Association is a network of independent health insurance companies that operate under the Blue Cross and Blue Shield brand. These companies provide health insurance in various states and regions, often competing directly with UnitedHealthcare.

- WellCare (now owned by Centene Corporation): WellCare specializes in government-sponsored healthcare programs, such as Medicaid and Medicare. Its acquisition by Centene has expanded its reach and competitiveness in this segment.

- Molina Healthcare: Molina primarily focuses on providing Medicaid and Medicare health plans. Their emphasis on government-sponsored programs makes them a competitor for UnitedHealthcare, especially in the public health insurance sector.

- Aflac: Aflac is known for its supplemental insurance products, such as accident and critical illness insurance. While they have a different niche, they compete with UnitedHealthcare in the supplemental insurance market.

- MetLife: MetLife offers a range of insurance products, including dental, vision, and life insurance. They compete with UnitedHealthcare in the dental and vision insurance sectors.

UnitedHealthcare faces competition not only in terms of the breadth of services but also in terms of regional market dominance. To stay competitive, UnitedHealthcare continuously adapts its offerings, customer service, and pricing strategies to meet the evolving needs of consumers and respond to the challenges posed by these formidable competitors.

Read more: UnitedHealthcare Insurance Company of America Review

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating UnitedHealthcare Insurance Company’s Claims Process

Ease of Filing a Claim

UnitedHealthcare Insurance Company prioritizes a hassle-free claims process, offering multiple convenient channels for members to file claims. Whether it’s through their intuitive online platform, a dedicated phone line for over-the-phone submissions, or user-friendly mobile apps, members have the flexibility to choose the method that best suits their needs.

This commitment to accessibility ensures that members can easily initiate the claims process with ease and convenience.

Average Claim Processing Time

UnitedHealthcare Insurance Company is known for its efficient claim processing. While the exact processing time may vary depending on the nature of the claim, members can generally expect a prompt resolution. The organization’s dedication to expeditious claim handling ensures that members receive timely support, contributing to their overall satisfaction and peace of mind.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback regarding claim resolutions and payouts with UnitedHealthcare Insurance Company has been overwhelmingly positive.

Members consistently express satisfaction with the organization’s approach to handling claims, emphasizing its responsiveness and commitment to providing fair and swift settlements. This positive feedback underscores the organization’s dedication to delivering a seamless and member-centric claims experience.

Exploring UnitedHealthcare Insurance Company’s Digital and Technological Features

Mobile App Features and Functionality

UnitedHealthcare Insurance Company offers a comprehensive mobile app designed to enhance the overall member experience. The app provides a wide array of features and functionalities aimed at simplifying insurance management.

Members can easily access and manage their policies, file claims, and stay updated on their benefits through this user-friendly platform. The mobile app empowers members to efficiently handle their insurance needs, all from the convenience of their mobile devices.

Online Account Management Capabilities

Recognizing the importance of online account management, UnitedHealthcare Insurance Company provides members with a secure and accessible online portal. This portal allows members to access their policy information at any time, from anywhere. Members can review their coverage details, make necessary policy adjustments, and monitor their account activity with ease.

These online account management capabilities contribute to a seamless and member-focused insurance experience, giving members the tools they need to take control of their financial well-being.

Digital Tools and Resources

UnitedHealthcare Insurance Company offers a robust set of digital tools and educational resources to empower its members with health and insurance knowledge. These resources include informative articles, calculators, and materials covering various health and insurance topics.

These digital tools are designed to provide valuable guidance, ensuring that members are well-informed and equipped to make educated decisions about their health and insurance coverage, promoting their overall well-being.

Frequently Asked Questions

What types of health insurance plans does UnitedHealthcare offer?

UnitedHealthcare offers a variety of health insurance plans, including individual and family plans, Medicare Advantage, and Medicaid options, catering to different healthcare needs.

Can I receive discounts on dental and vision insurance with UnitedHealthcare?

Yes, UnitedHealthcare provides discounts on dental and vision insurance plans, covering routine check-ups, vision exams, glasses, and contact lenses.

Is bundling insurance policies with UnitedHealthcare available for cost savings?

Certainly, UnitedHealthcare offers discounts for bundling multiple insurance policies, allowing customers to save on health, dental, vision, and life insurance coverage.

How does UnitedHealthcare prioritize a hassle-free claims process for its members?

UnitedHealthcare ensures a hassle-free claims process through multiple channels, including an online platform, phone line, and user-friendly mobile apps, aiming for accessibility and prompt resolutions.

What wellness programs are available with UnitedHealthcare’s health insurance plans?

UnitedHealthcare provides various wellness programs, such as fitness facility access, smoking cessation programs, and nutritional counseling, promoting a healthier lifestyle for its members.