Unitrin Direct Property & Casualty Company Review (2026)

Unitrin Direct Property & Casualty Company, renowned for its diverse insurance offerings, combines competitive rates and efficient claims processing, positioning itself as a reliable choice for comprehensive coverage, with availability subject to location.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we delve into the world of Unitrin Direct Property & Casualty Company, a trusted name in the insurance industry. Offering an impressive array of coverage options, including auto, home, renters, condo, and motorcycle insurance, Unitrin Direct stands out for its commitment to customer satisfaction.

Competitive pricing and a range of discounts, they make quality insurance accessible to a diverse clientele. Moreover, their efficient claims process and positive customer reviews attest to their reliability. Overall, this article provides a detailed and engaging overview of Unitrin Direct’s offerings, making it an informative guide for those seeking quality insurance solutions.

Unitrin Direct Insurance Coverage Options

Having a variety of coverage options is crucial to finding a policy that suits your needs. Unitrin Direct Property & Casualty Company understands this, and they offer a broad range of coverage options to ensure their customers have the protection they require. In this section, we’ll explore the diverse coverage options offered by Unitrin Direct.

Auto Insurance:

- Liability Coverage

- Collision Coverage

- Comprehensive Coverage

- Personal Injury Protection (PIP)

- Uninsured/Underinsured Motorist Coverage

Home Insurance:

- Dwelling Coverage

- Personal Property Coverage

Renters Insurance:

- Personal Property Coverage

- Liability Coverage

Condo Insurance:

- Dwelling Coverage

- Personal Property Coverage

- Liability Coverage

Motorcycle Insurance:

- Liability Coverage:

- Collision Coverage

- Comprehensive Coverage

- Uninsured/Underinsured Motorist Coverage

Unitrin Direct Property & Casualty Company stands out for its extensive coverage options, allowing customers to build insurance policies that provide peace of mind. From basic liability coverage to comprehensive protection for your home and personal property, offers a wide range of choices to meet your insurance needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

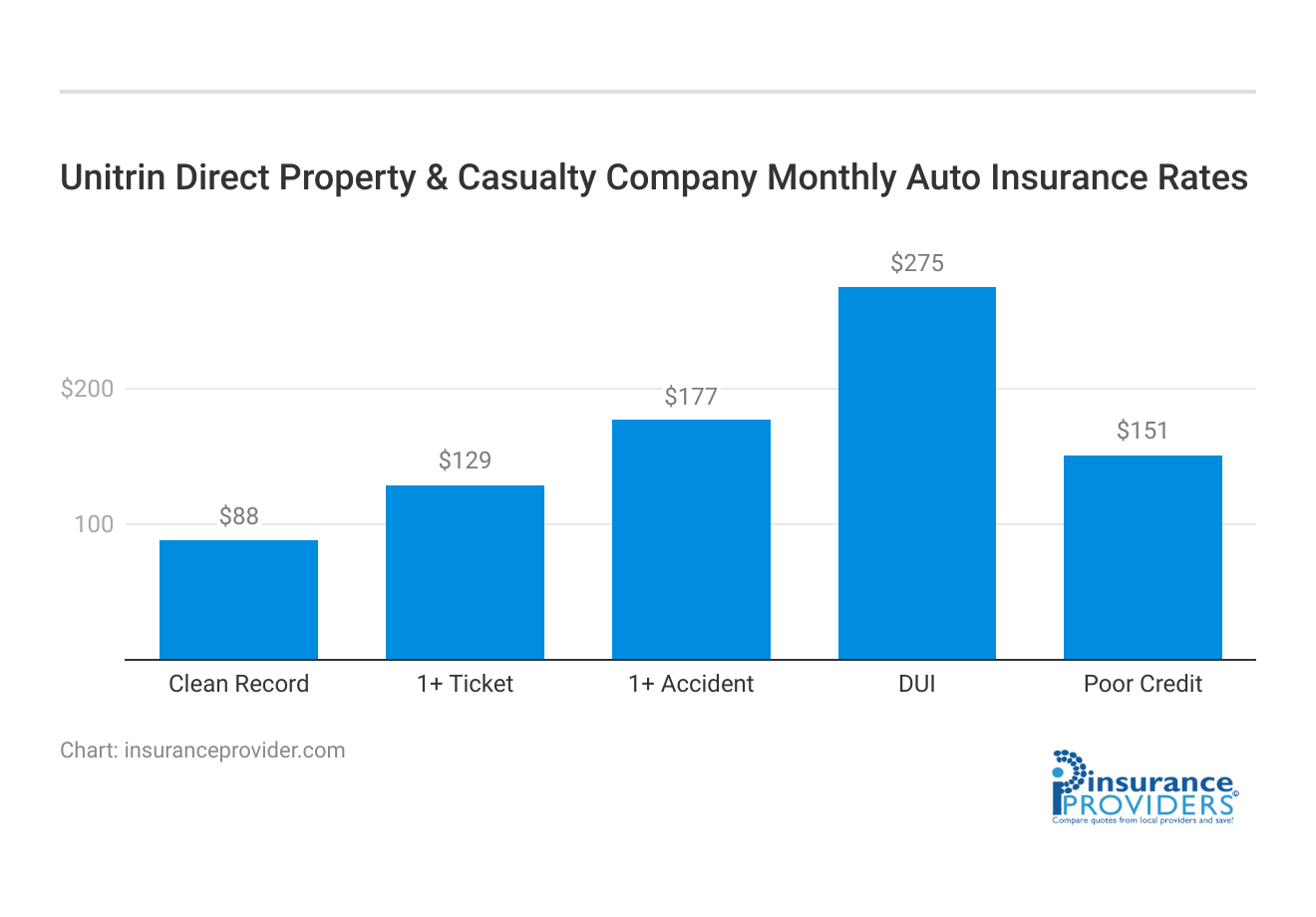

Unitrin Direct Insurance Rates Breakdown

| Driver Profile | Unitrin Direct Property & Casualty | National Average |

|---|---|---|

| Clean Record | $88 | $119 |

| 1+ Ticket | $129 | $147 |

| 1+ Accident | $177 | $173 |

| DUI | $275 | $209 |

| Poor Credit | $151 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Unitrin Direct Discounts Available

| Discounts | Unitrin Direct Property & Casualty |

|---|---|

| Anti Theft | 16% |

| Good Student | 23% |

| Low Mileage | 21% |

| Paperless | 11% |

| Safe Driver | 29% |

| Senior Driver | 17% |

Unitrin Direct Property & Casualty Company not only provides a diverse range of insurance coverage but also offers a variety of discounts to help customers save on their insurance premiums. These discounts can significantly reduce the cost of your policy while ensuring you still receive the quality coverage you need.

- Safe Driver Discounts: Unitrin Direct rewards policyholders with a history of safe driving by offering discounts for maintaining a clean driving record without accidents or violations.

- Multi-Policy Discounts: Customers can enjoy significant savings by bundling multiple insurance policies with Unitrin Direct, such as auto and home insurance, leading to reduced overall premiums.

- Good Student Discounts: If you have a student on your policy who maintains good grades in school, Unitrin Direct offers discounts as an incentive for academic excellence.

- Homeowner Discounts: Homeowners may be eligible for discounts when they purchase home insurance from Unitrin Direct, adding another layer of savings for those who own their homes.

- Paid-in-Full Discounts: Policyholders who choose to pay their premiums in full upfront rather than in installments can benefit from additional savings on their insurance costs.

These discounts reflect Unitrin Direct’s commitment to making insurance more affordable for their customers while still providing comprehensive coverage. The availability and specifics of these discounts may vary by location and individual policy details, so it’s advisable to contact Unitrin Direct directly to discuss the discounts applicable to your situation.

How Unitrin Direct Ranks Among Providers

In the highly competitive world of insurance, Unitrin Direct Property & Casualty Company faces stiff competition from several key players in the industry. To make informed decisions about your insurance needs, it’s essential to understand who these competitors are and how they compare.

- Geico: Geico is one of the largest auto insurance providers in the United States. Known for its memorable advertising campaigns and competitive pricing, Geico offers a wide range of insurance products, including auto, home, and renters insurance.

- State farm: State farm is a well-established insurance company with a strong presence nationwide. They provide various insurance options, including auto, home, life, and more. State Farm is often praised for its personalized customer service.

- Progressive: Progressive is known for its innovative approach to insurance and offers a range of auto, home, and specialty insurance products. They are particularly recognized for their Snapshot program, which tracks driving habits to potentially lower insurance rates.

- Allstate: Allstate is another major player in the insurance industry, offering a comprehensive suite of insurance products, including auto, home, and life insurance. They are often chosen for their customizable coverage options.

- Liberty mutual: Liberty mutual provides various insurance options, including auto, home, and renters insurance. They are known for their customer-friendly approach and diverse coverage options.

- Farmers insurance: Farmers insurance offers a variety of insurance policies, including auto, home, and renters insurance. They are recognized for their local agents who provide personalized service to policyholders.

- Nationwide: Nationwide is a large insurance provider offering auto, home, and life insurance. They are known for their “On Your Side” promise and a range of coverage options.

- Esurance: Esurance, owned by Allstate, is an online-focused insurance provider that offers competitive rates for auto, home, and renters insurance. They appeal to customers looking for digital convenience.

To stay competitive, insurance companies often differentiate themselves through unique offerings, discounts, and customer-centric approaches. It’s essential for customers to compare these competitors and their offerings to find the best insurance solution that suits their individual needs and preferences.

Read more: Unitrin Direct Insurance Company Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Unitrin Direct Property & Casualty Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Unitrin Direct Property & Casualty Company makes it convenient for policyholders to file insurance claims by offering multiple channels. Whether you prefer the ease of online submissions, the convenience of filing over the phone, or the accessibility of mobile apps, Unitrin Direct has you covered.

Their commitment to providing a seamless claims process ensures that you can report incidents and begin the resolution process quickly and efficiently.

Average Claim Processing Time

When it comes to handling claims, Unitrin Direct Property & Casualty Company strives for promptness. While claim processing times can vary depending on the nature and complexity of the claim, Unitrin Direct is known for its efficient handling. On average, policyholders can expect timely responses and resolutions, minimizing the stress and inconvenience associated with claims.

Customer Feedback on Claim Resolutions and Payouts

The true measure of an insurance company’s reliability lies in its ability to deliver on its promises when policyholders need it the most. Unitrin Direct has received positive feedback from customers regarding their claim resolutions and payouts.

The company’s commitment to customer satisfaction shines through in its ability to provide fair and timely settlements, ensuring that policyholders can rely on their coverage when they need it.

Unitrin Direct Property & Casualty Company Digital and Technological Features

Mobile App Features and Functionality

Unitrin Direct Property & Casualty Company offers a robust mobile app that empowers policyholders with convenient features and functionalities. From accessing policy information and digital ID cards to initiating claims and tracking their progress, the mobile app provides a user-friendly experience that puts essential insurance tools at your fingertips.

Stay connected with your coverage and manage your policies with ease, all from the convenience of your smartphone.

Online Account Management Capabilities

Unitrin Direct understands the importance of easy and accessible account management. Through their online platform, policyholders can efficiently manage their accounts, view policy details, make payments, and update information as needed. The user-friendly interface simplifies the insurance management process, allowing you to stay organized and in control of your coverage.

Digital Tools and Resources

In today’s digital age, having access to helpful resources and tools can make a significant difference in understanding and managing your insurance. Unitrin Direct provides a range of digital tools and resources, including educational materials, insurance calculators, and informative content, designed to empower policyholders to make informed decisions about their coverage.

These digital resources enhance your insurance experience and ensure you have the information you need at your fingertips.

Frequently Asked Questions

What types of insurance coverage does Unitrin Direct offer?

Unitrin Direct provides a range of coverage options, including auto, home, renters, condo, and motorcycle insurance.

What discounts are available with Unitrin Direct insurance policies?

Unitrin Direct offers various discounts to help customers save on premiums; specifics may vary by location and individual policy details.

How does Unitrin Direct handle the claims process?

Unitrin Direct makes it convenient for policyholders to file claims through online submissions, phone calls, or mobile apps, with a commitment to prompt and efficient processing.

What digital features does Unitrin Direct offer to policyholders?

Unitrin Direct provides a robust mobile app for managing policies, accessing digital ID cards, initiating claims, and offers online account management capabilities for easy and accessible policy control.

Is Unitrin Direct competitive in the insurance market, and how do they compare with other providers?

In the competitive insurance landscape, Unitrin Direct distinguishes itself through competitive pricing, a variety of discounts, and a commitment to customer satisfaction; comparing options is essential to finding the best insurance solution.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.