Unitrin Preferred Insurance Company: Customer Ratings & Reviews [2026]

Explore the comprehensive offerings of Unitrin Preferred Insurance Company as we delve into a detailed review of their products, pricing, and customer service, providing insights to help you secure the coverage you need.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Updated April 2024

Unitrin Preferred Insurance Company is a well-established insurance provider offering coverage options for homeowners, renters, and drivers. The company’s mission is to provide affordable and reliable insurance coverage while maintaining a high level of customer service.

They offer a range of products and services, including auto, home, and renters insurance, with coverage available in many states. The cost of coverage will vary depending on several factors, but the company offers several discounts to help reduce premiums.

Customer reviews of the company are generally positive, with many praising their competitive rates and excellent customer service. Overall, Unitrin Preferred Insurance Company is a solid choice for individuals and families looking for affordable and reliable insurance coverage.

What You Should Know About Unitrin Preferred Insurance Company

Company Contact Information:

- Phone: 1-800-456-1919

- Address: P.O. Box 3057 Scranton, PA 18505-3057

- Website: https://www.unitrindirect.com/

Parent Company:

- Unitrin Inc.

Financial Ratings:

- Unitrin Preferred Insurance Company has an “A-” (Excellent) rating from A.M. Best, a leading insurance rating agency.

- This rating indicates that the company has a strong financial outlook and can meet its financial obligations to policyholders.

Customer Service Ratings:

- Unitrin Preferred Insurance Company has received mixed reviews for customer service.

- Some customers have reported positive experiences with the company’s customer service representatives, while others have complained about long wait times and difficulty getting issues resolved.

Claims Information:

- Unitrin Preferred Insurance Company offers a simple and straightforward claims process. Customers can file a claim online, over the phone, or through the company’s mobile app.

- Claims are processed quickly and efficiently, and the company works closely with customers to ensure that their needs are met.

Company Apps:

- Unitrin Preferred Insurance Company offers a mobile app that allows customers to manage their policies, file claims, and make payments on the go.

- The app is available for free download on both iOS and Android devices.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Unitrin Preferred Insurance Company Insurance Coverage Options

Unitrin Preferred Insurance Company offers a range of coverage options to meet the needs of their customers. The types of coverage available may vary depending on the state and the type of policy. Here are some of the coverage options that are commonly offered:

Auto Insurance:

- Liability Coverage: This coverage is required by law and pays for damages and injuries you cause to other people in an accident.

- Collision Coverage: This coverage pays for damages to your vehicle in the event of a collision, regardless of who is at fault.

- Comprehensive Coverage: This coverage pays for damages to your vehicle that are not caused by a collision, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for you and your passengers in the event of an accident, regardless of who is at fault.

- Uninsured/Underinsured Motorist Coverage: This coverage pays for damages and injuries you incur in an accident caused by a driver who does not have insurance or does not have enough insurance to cover your damages.

Homeowners Insurance:

- Dwelling Coverage: This coverage pays for damages to your home and any attached structures, such as a garage or porch.

- Personal Property Coverage: This coverage pays for damages to your personal belongings, such as furniture, clothing, and electronics.

- Liability Coverage: This coverage pays for damages and injuries you cause to other people on your property.

- Additional Living Expenses Coverage: This coverage pays for additional living expenses, such as hotel stays, if you are unable to live in your home due to a covered loss.

- Medical Payments Coverage: This coverage pays for medical expenses for guests who are injured on your property.

Renters Insurance:

- Personal Property Coverage: This coverage pays for damages to your personal belongings, such as furniture, clothing, and electronics.

- Liability Coverage: This coverage pays for damages and injuries you cause to other people in your rental unit.

- Additional Living Expenses Coverage: This coverage pays for additional living expenses, such as hotel stays, if you are unable to live in your rental unit due to a covered loss.

It is important to note that the specific coverage options and limits may vary depending on the policy and state. Customers should review their policy carefully and consult with their insurance agent to ensure that they have the coverage they need.

Unitrin Preferred Insurance Company Insurance Rates Breakdown

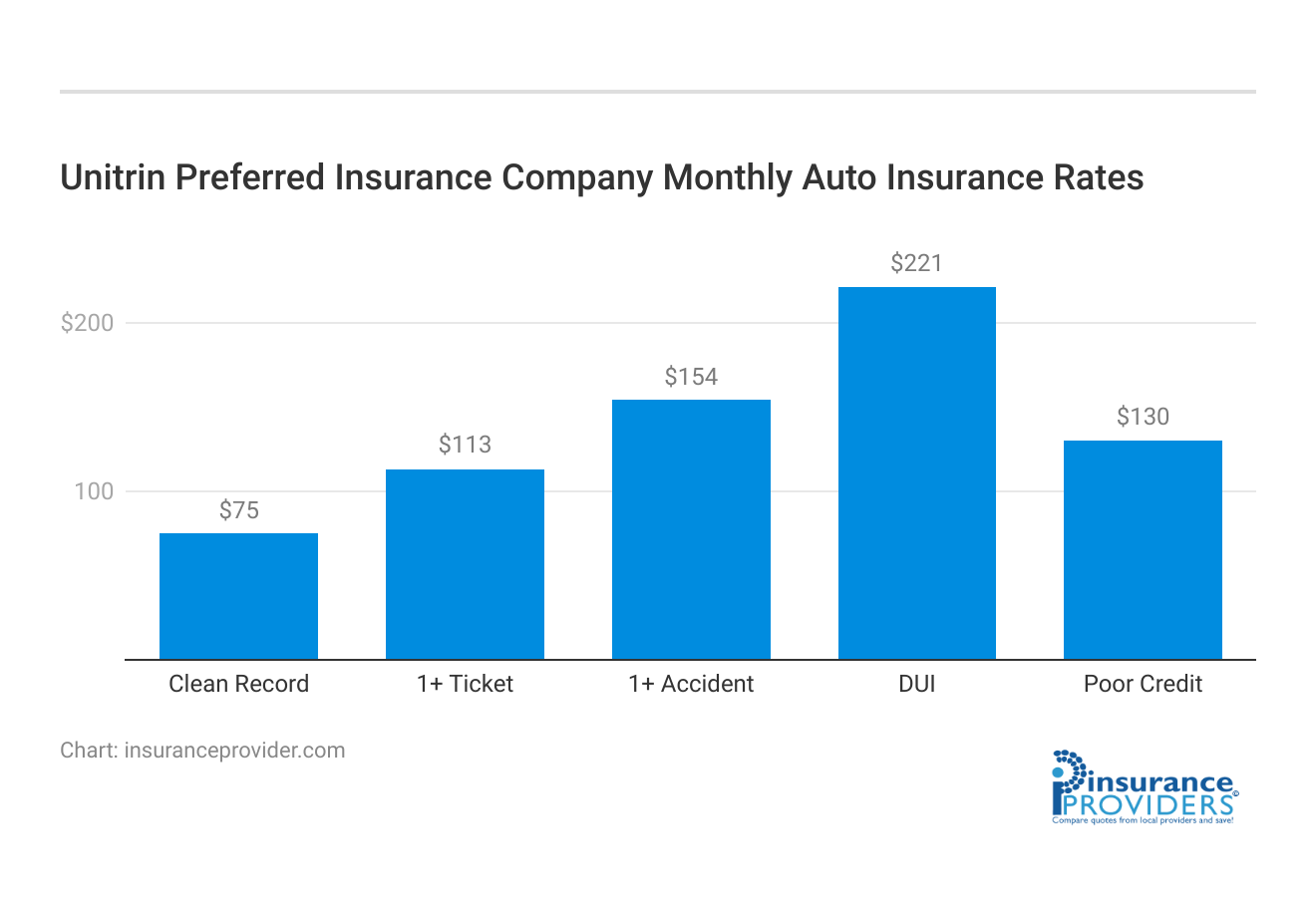

| Driver Profile | Unitrin Preferred Insurance | National Average |

|---|---|---|

| Clean Record | $75 | $119 |

| 1+ Ticket | $113 | $147 |

| 1+ Accident | $154 | $173 |

| DUI | $221 | $209 |

| Poor Credit | $130 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Unitrin Preferred Insurance Company Discounts Available

| Discounts | Unitrin Preferred Insurance |

|---|---|

| Anti Theft | 19% |

| Good Student | 23% |

| Low Mileage | 21% |

| Paperless | 12% |

| Safe Driver | 27% |

| Senior Driver | 18% |

Unitrin Preferred Insurance Company offers a range of discounts to help customers save money on their insurance premiums. These discounts may vary depending on the state and the type of insurance policy. Here are some of the discounts that are commonly offered:

- Multi-Policy Discount: Customers who have multiple insurance policies with Unitrin Preferred Insurance Company can save money by bundling their policies together.

- Safe Driver Discount: Drivers with a clean driving record may qualify for a safe driver discount.

- Good Student Discount: Full-time students who maintain a high grade point average may be eligible for a discount on their auto insurance premiums.

- Home Safety Discount: Homeowners who have installed safety features in their homes, such as smoke detectors or burglar alarms, may be eligible for a discount on their home insurance premiums.

- Paid-in-Full Discount: Customers who pay their annual insurance premium upfront may be eligible for a discount.

- Senior Discount: Customers who are over a certain age may be eligible for a discount on their insurance premiums.

It is important to note that not all discounts are available in all states, and eligibility requirements may vary. Customers should check with their insurance agent to determine which discounts they may qualify for.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Unitrin Preferred Insurance Company Ranks Among Providers

Unitrin Preferred Insurance Company operates in a highly competitive insurance industry. Some of the main competitors in the market include:

- State Farm: State Farm is a leading insurance company in the United States, offering a wide range of insurance products, including auto, home, and life insurance.

- Allstate: Allstate is another major insurance company that offers a range of insurance products, including auto, home, and life insurance.

- Progressive: Progressive is known for its innovative use of technology and its focus on providing affordable auto insurance to its customers.

- Geico: Geico is a popular insurance company that is known for its catchy advertising campaigns and its commitment to providing affordable auto insurance.

- Nationwide: Nationwide is a large insurance company that offers a range of insurance products, including auto, home, and life insurance. It is known for its focus on customer service and its strong financial ratings.

Unitrin Preferred Insurance Company competes with these companies and others by offering a range of insurance products, competitive pricing, and excellent customer service. The company also focuses on building long-term relationships with its customers and providing personalized solutions to meet their unique needs.

Read More: American States Preferred Insurance Company: Customer Ratings & Reviews

Streamlining Claims Excellence: A Deep Dive Into Unitrin Preferred Insurance Company’s Hassle-Free Process

Ease of Filing a Claim

Unitrin Preferred Insurance Company ensures a hassle-free claims process by providing multiple channels for filing claims. Policyholders can conveniently submit claims online through the company’s website, over the phone with dedicated representatives, or via the user-friendly mobile app.

This flexibility caters to diverse preferences, offering a seamless experience for customers when initiating a claim.

Average Claim Processing Time

Efficiency is a priority for Unitrin Preferred Insurance Company in processing claims. The company is committed to a swift turnaround, aiming to resolve claims promptly. The average claim processing time reflects the company’s dedication to providing timely responses, minimizing any potential disruptions for policyholders during the claims resolution process.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback plays a crucial role in assessing the effectiveness of Unitrin Preferred Insurance Company’s claim resolutions and payouts. Generally positive, policyholders appreciate the fair and efficient handling of claims.

While occasional concerns may arise, the majority of customers report satisfactory experiences, highlighting the company’s commitment to providing reliable and customer-centric claims services.

Elevating Convenience: Exploring Unitrin Preferred Insurance Company’s Cutting-Edge Digital and Technology Features

Mobile App Features and Functionality

Unitrin Preferred Insurance Company offers a feature-rich mobile app designed to enhance customer convenience. The app provides a range of functionalities, including seamless claims filing, easy access to policy information, and efficient payment processing.

With user-friendly navigation, the mobile app ensures that policyholders can manage their insurance needs conveniently from the palm of their hands.

Online Account Management Capabilities

Recognizing the importance of online account management, Unitrin Preferred Insurance Company provides robust capabilities on its website. Policyholders can efficiently manage their accounts online, updating policy information, handling billing matters, and accessing essential documents.

The online platform is designed for user-friendly interactions, providing a convenient avenue for customers to manage their policies digitally.

Digital Tools and Resources

Unitrin Preferred Insurance Company leverages digital tools and resources to empower its policyholders. These tools may include educational resources on insurance topics, coverage calculators, and interactive features to assist customers in making informed decisions about their insurance needs.

The incorporation of digital resources goes beyond transactional processes, enhancing the overall customer experience with valuable information and tools.

Frequently Asked Questions

What types of insurance coverage does Unitrin Preferred Insurance Company offer?

Unitrin Preferred Insurance Company provides coverage options for homeowners, renters, and drivers, including auto, home, and renters insurance.

How does Unitrin Preferred Insurance Company handle the claims process?

Customers can file a claim with Unitrin Preferred Insurance Company by contacting a representative by phone or online, with claims typically processed within a few days.

What payment options does Unitrin Preferred Insurance Company offer?

Unitrin Preferred Insurance Company offers several payment options, including electronic funds transfer (EFT), credit card, and mailed checks.

Is it possible to cancel a policy with Unitrin Preferred Insurance Company, and are there cancellation fees?

Yes, customers can cancel their policy at any time, but it’s important to note that cancellation fees may apply, and reviewing policy terms and conditions is advisable before canceling.

Does Unitrin Preferred Insurance Company offer roadside assistance?

Yes, Unitrin Preferred Insurance Company provides roadside assistance as an optional add-on to their auto insurance policies.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.