Wausau Business Insurance Company Review (2026)

Unlock tailored business coverage with Wausau Business Insurance Company, your trusted partner for a diverse range of options, robust financial stability, and efficient claims processing.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Delve into the offerings of Wausau Business Insurance Company, a trusted name in the insurance industry. With a diverse range of coverage options, including general liability, commercial property, workers’ compensation, business interruption, and professional liability insurance, Wausau stands out as a reliable partner for businesses across various sectors.

Their commitment to customization, financial stability, efficient claims processing, and a broad industry reach make them a top choice for safeguarding businesses. They offer a range of discounts to help clients manage insurance costs effectively. They combine industry expertise with personalized service, ensuring businesses can thrive with peace of mind.

What You Should Know About Wausau Business Insurance Company

Rates: Wausau’s rates are competitive, reflecting a balance between affordability and the comprehensive coverage options they offer. Our analysis takes into account the value businesses receive in relation to the cost of their insurance policies.

Discounts: Wausau’s discount programs are designed to help businesses effectively manage insurance costs. Our evaluation considers the diversity and accessibility of these discounts, recognizing their impact on the overall affordability of coverage.

Complaints/Customer Satisfaction: Wausau’s high customer satisfaction rating reflects positive experiences with their services. Our analysis considers the frequency and nature of complaints, providing insights into the company’s commitment to addressing customer concerns promptly and effectively.

Claims Handling: Wausau’s efficient claims processing contributes to a positive customer experience. Our assessment accounts for the convenience of filing claims through various channels, the speed of processing, and the overall satisfaction of policyholders with the resolution and payout process.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Wausau Business Insurance Company Insurance Coverage Options

Wausau Business Insurance Company understands that every business is unique, and so are its insurance needs. They offer a comprehensive range of coverage options designed to provide tailored protection for your specific industry and circumstances. Here’s a closer look at the coverage options they offer to safeguard your business.

- General Liability Insurance: This foundational coverage shields your business from liability claims related to bodily injury, property damage, or personal injury. It’s a must-have for any business to protect against unforeseen accidents.

- Commercial Property Insurance: Wausau’s property insurance safeguards your physical assets, including buildings, equipment, inventory, and more, from damage or loss due to covered events like fire, theft, or natural disasters.

- Workers’ Compensation Insurance: Designed to protect your employees and your business, workers’ comp covers medical expenses and lost wages for employees injured on the job. It helps you fulfill your legal obligations and provide support to your team.

- Business Interruption Insurance: This coverage steps in when a disaster disrupts your operations. It helps cover ongoing expenses and lost revenue, allowing your business to recover smoothly without crippling financial losses.

- Professional Liability Insurance: For businesses offering specialized services, this insurance provides protection against claims of negligence or errors. It’s essential for professionals like doctors, lawyers, and consultants.

Choosing the right coverage for your business is crucial, and Wausau Business Insurance Company excels in tailoring solutions to meet your needs. Their comprehensive range of coverage options ensures that you can focus on growing your business with the peace of mind that comes from knowing you’re protected.

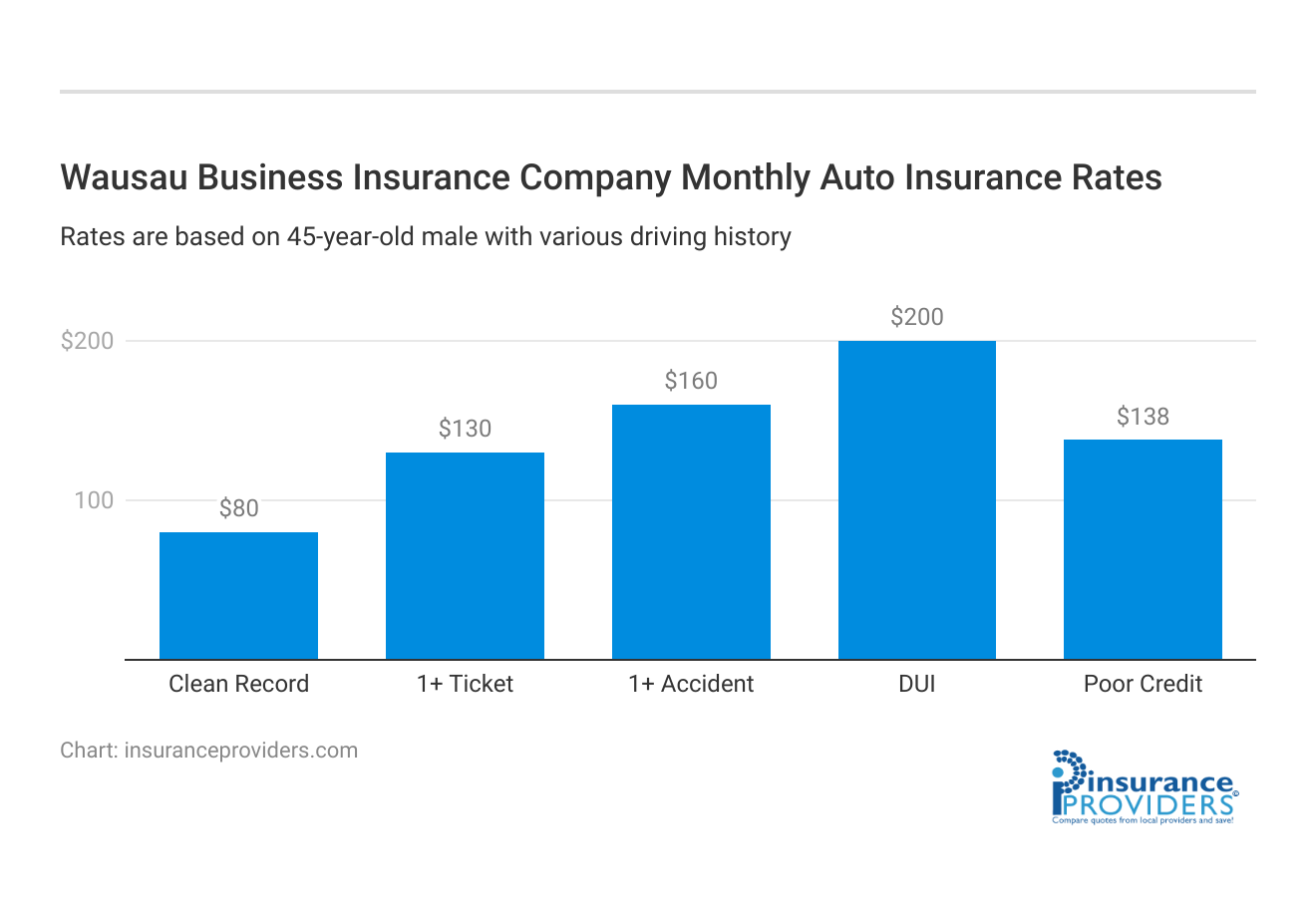

Wausau Business Insurance Company Insurance Rates Breakdown

| Driver Profile | Wausau Business | National Average |

|---|---|---|

| Clean Record | $80 | $119 |

| 1+ Ticket | $130 | $147 |

| 1+ Accident | $160 | $173 |

| DUI | $200 | $209 |

| Poor Credit | $138 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Wausau Business Insurance Company Discounts Available

| Discount | Wausau Business |

|---|---|

| Anti Theft | 5% |

| Good Student | 10% |

| Low Mileage | 8% |

| Paperless | 12% |

| Safe Driver | 15% |

| Senior Driver | 6% |

Wausau Business Insurance Company values its clients and strives to provide them with not only comprehensive coverage but also opportunities for cost savings. Here are some of the discounts they offer to help businesses manage their insurance costs effectively:

- Multi-Policy Discount: Combining multiple insurance policies, such as general liability and property insurance, can lead to substantial savings on your premiums.

- Claims-Free Discount: If your business has a history of few or no insurance claims, you may be eligible for a claims-free discount, rewarding you for your commitment to safety.

- Safety Training Discount: Investing in employee safety training and risk management programs can lead to lower premiums, as it demonstrates your dedication to minimizing workplace accidents.

- Loyalty Discount: Long-term clients often enjoy loyalty discounts, providing incentives to stay with Wausau Business Insurance Company over time.

- Professional Association Discounts: If your business belongs to a specific professional association or industry group, you may qualify for special discounts tailored to your profession.

- Security System Discount: Installing security systems and safety measures in your business premises can result in lower insurance costs by reducing the risk of theft and damage.

- Payment Options Discount: Some insurers offer discounts if you choose to pay your premiums annually or through automatic payments.

- Good Credit Discount: Maintaining a strong credit history can lead to lower insurance rates, as it reflects financial responsibility.

- Early Renewal Discount: Renewing your policy well in advance of its expiration date may make you eligible for an early renewal discount.

It’s important to note that eligibility for these discounts may vary based on your business’s location, industry, and specific circumstances. To get detailed information about the discounts available to you and how they can impact your insurance premiums it is best to contact their agent.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Wausau Business Insurance Company Ranks Among Providers

Wausau Business Insurance Company operates in a competitive insurance industry, and it competes with several prominent insurers. The main competitors of Wausau Business Insurance Company can vary based on location, industry focus, and specific insurance products offered. Here are some of the notable competitors in the marketplace:

- The Hartford: The Hartford is a well-established insurance company known for its business insurance offerings. They provide a wide range of coverage options tailored to various industries, similar to Wausau.

- Travelers: Travelers is a large and reputable insurance provider offering commercial insurance solutions, including property, liability, and workers’ compensation coverage. They have a strong presence in the business insurance sector.

- Chubb: Chubb is a global insurance company with a strong focus on commercial insurance, including specialized coverage for high-net-worth individuals and businesses. They are known for their comprehensive policies and attentive customer service.

- Liberty Mutual: Liberty Mutual is a major insurer that provides a variety of business insurance products. They offer customizable policies to meet the specific needs of businesses, similar to Wausau.

- Cna Financial: is another insurance company that specializes in commercial insurance. They have a strong presence in sectors such as construction, healthcare, and professional services.

- Allianz: Allianz is a global insurance and financial services company that offers commercial insurance solutions to businesses worldwide. They are known for their international reach and diverse portfolio.

- Zurich Insurance Group: Zurich is a multinational insurer offering a broad spectrum of commercial insurance products. They cater to businesses of all sizes and have a strong global presence.

- Nationwide: Nationwide is a well-known insurer that offers a variety of business insurance products. They have a focus on small to mid-sized businesses and provide tailored solutions.

- Farmers Insurance: Farmers Insurance offers commercial insurance coverage for businesses of all sizes. They are recognized for their local agent network and personalized service.

- State Farm: While primarily known for personal insurance, State Farm also offers some commercial insurance options. They have a vast customer base and may compete with Wausau in certain markets.

Businesses looking for insurance coverage should carefully assess the offerings, pricing, and reputation of these competitors, among others, to determine the best fit for their needs. Comparing multiple insurance providers and obtaining quotes is often the best approach to find the right coverage at a competitive price.

Wausau Business Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Wausau Business Insurance Company understands the importance of a streamlined claims process. They offer multiple convenient avenues for policyholders to file claims, ensuring a hassle-free experience. Whether you prefer to file a claim online, over the phone, or through their mobile app, Wausau strives to accommodate your preferences.

Average Claim Processing Time

Timely claim processing is crucial for businesses seeking quick resolutions to unexpected events. Wausau Business Insurance Company has a reputation for efficient claims processing. They are committed to minimizing business disruptions by swiftly assessing and processing claims, allowing you to get back to business as usual.

Customer Feedback on Claim Resolutions and Payouts

Customer satisfaction is a priority for Wausau. They value feedback from policyholders and work diligently to ensure fair and satisfactory claim resolutions and payouts. The experiences and opinions of their customers play a significant role in shaping their commitment to excellence in claims handling.

Wausau Business Insurance Company Digital and Technological Features

Mobile App Features and Functionality

Wausau Business Insurance Company offers a user-friendly mobile app designed to enhance your insurance experience. The app provides convenient access to policy information, claims filing, and other essential features, all at your fingertips. Explore the app’s functionalities to make managing your insurance even more convenient.

Online Account Management Capabilities

With Wausau’s online account management capabilities, policyholders can easily access and manage their insurance accounts. This digital platform empowers you to review policy details, make payments, and track claims progress from the comfort of your computer or mobile device.

Digital Tools and Resources

Wausau provides a range of digital tools and resources to assist policyholders in making informed decisions. Whether you need assistance in assessing coverage options or understanding insurance terms, their online resources are designed to empower you with knowledge about your insurance choices.

Frequently Asked Questions

What types of insurance coverage does Wausau Business Insurance Company offer?

Wausau Business Insurance Company provides a comprehensive range of coverage options tailored to meet the unique needs of businesses. This includes general liability, commercial property, workers’ compensation, business interruption, and professional liability insurance.

How does Wausau Business Insurance Company stand out in the competitive insurance industry?

Wausau distinguishes itself through its commitment to customization, financial stability, and efficient claims processing. The company’s broad industry reach and personalized service make it a top choice for businesses seeking reliable and comprehensive protection.

What discounts are available through Wausau Business Insurance Company?

Wausau offers various discounts to help businesses manage insurance costs effectively. However, eligibility for these discounts may vary based on factors such as business location, industry, and specific circumstances. For detailed information, it is recommended to contact their agent directly.

How does Wausau Business Insurance Company handle the claims process?

Wausau prioritizes a streamlined claims process to minimize disruptions for policyholders. Whether filing a claim online, over the phone, or through their mobile app, the company ensures a hassle-free experience. With efficient claim processing, businesses can expect timely resolutions to unexpected events.

What digital features and tools does Wausau Business Insurance Company offer?

Wausau provides a user-friendly mobile app for convenient access to policy information, claims filing, and other essential features. Additionally, their online account management capabilities empower policyholders to review policy details, make payments, and track claims progress digitally, enhancing the overall insurance experience.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.