Westport Insurance Corporation: Customer Ratings & Reviews [2026]

Explore Westport Insurance Corporation's comprehensive and innovative insurance solutions, ensuring protection against risks and liabilities since 1975.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated April 2024

Westport Insurance Corporation is a reliable and innovative provider of insurance solutions in the United States. The company has been in business since 1975 and has grown to become a leading provider of property, liability, specialty, workers’ compensation, and cyber liability insurance.

Westport Insurance Corporation offers a wide range of insurance products and services to meet the needs of businesses and individuals. The cost of their services varies depending on the type of coverage and the state where the policy is purchased.

Customers praise the company for its comprehensive coverage, affordable prices, and excellent customer service. However, there are some reports of issues with claims processing and billing. Despite this, Westport Insurance Corporation is a great choice for businesses and individuals looking for comprehensive and cost-effective insurance solutions.

What You Should Know About Westport Insurance Corporation

Company Contact Information:

- Phone: 1-800-899-1116

- Website: https://www.westport-ins.com/contact-us/

Related Parent or Child Companies:

- Westport Insurance Corporation is a subsidiary of Swiss Re, a leading global reinsurer.

Financial Ratings:

- Westport Insurance Corporation has an A (Excellent) rating from A.M. Best, which indicates a stable financial outlook.

Customer Service Ratings:

- Westport Insurance Corporation is known for its excellent customer service. The company has received high ratings on various consumer review websites, including Trustpilot and the Better Business Bureau.

Claims Information:

- Westport Insurance Corporation offers 24/7 claims reporting through its website or by phone. Customers can also track their claims status online.

Company Apps:

- Westport Insurance Corporation does not currently have any mobile apps available for download.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Westport Insurance Corporation Insurance Coverage Options

Westport Insurance Corporation offers a wide range of insurance coverage options to meet the needs of businesses and individuals. Some of the coverage options available include:

- Property insurance: This type of insurance provides coverage for damage or loss of property due to events such as fire, theft, or natural disasters.

- Liability insurance: This type of insurance provides coverage for damages or injuries caused to other people or their property by the policyholder.

- Specialty insurance: Westport Insurance Corporation offers a range of specialty insurance products, including environmental liability insurance, professional liability insurance, and healthcare liability insurance.

- Workers’ compensation insurance: This type of insurance provides coverage for employees who are injured or become ill while on the job.

- Cyber liability insurance: This type of insurance provides coverage for losses related to cyber attacks, data breaches, and other cyber risks.

Westport Insurance Corporation also offers a range of additional coverage options, such as auto insurance, umbrella insurance, and excess liability insurance. The cost and availability of these coverage options may vary depending on the state where the policy is purchased and other factors.

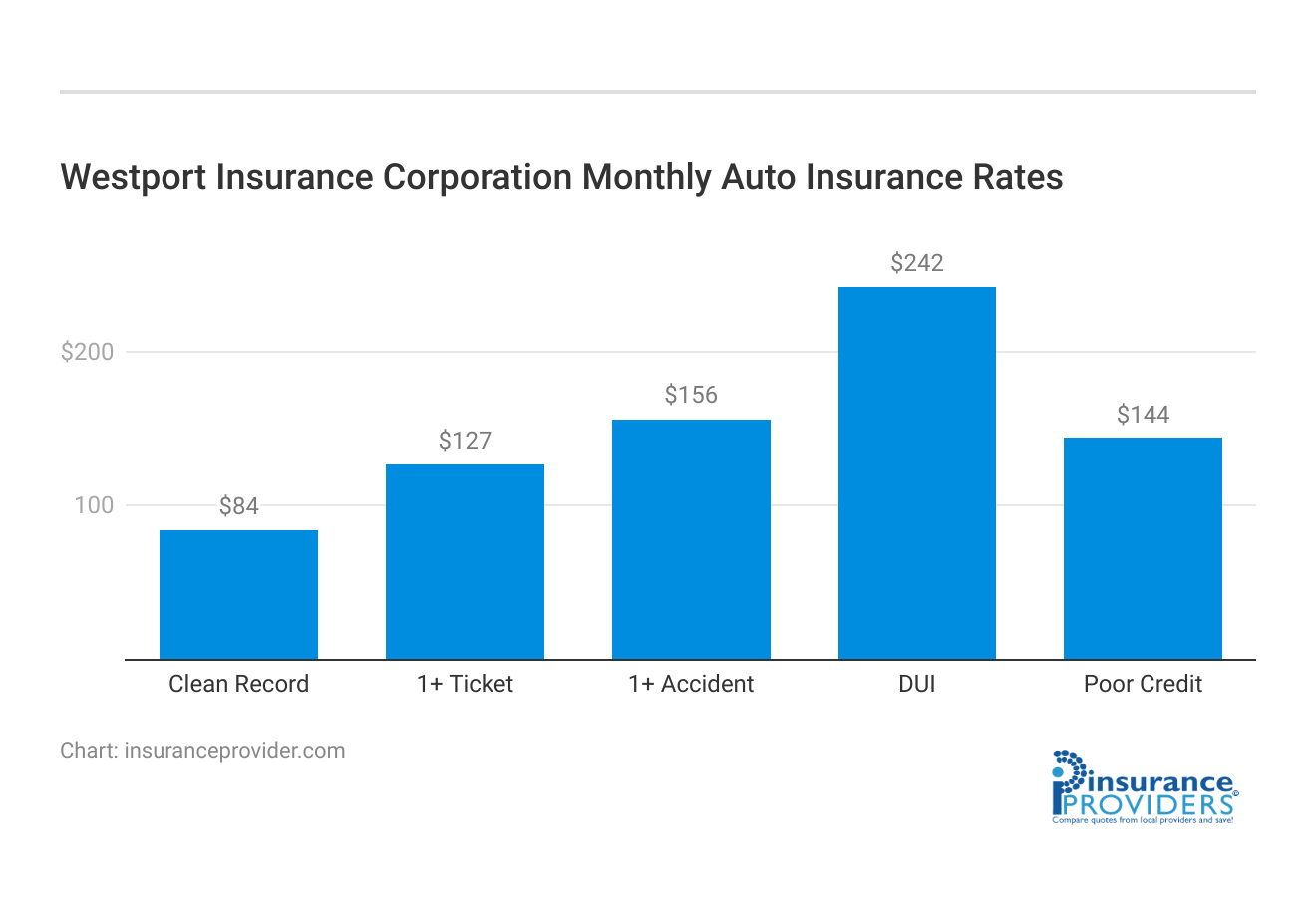

Westport Insurance Corporation Insurance Rates Breakdown

| Driver Profile | Westport Insurance | National Average |

|---|---|---|

| Clean Record | $84 | $119 |

| 1+ Ticket | $127 | $147 |

| 1+ Accident | $156 | $173 |

| DUI | $242 | $209 |

| Poor Credit | $144 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Westport Insurance Corporation Discounts Available

| Discounts | Westport Insurance |

|---|---|

| Anti Theft | 15% |

| Good Student | 18% |

| Low Mileage | 17% |

| Paperless | 10% |

| Safe Driver | 24% |

| Senior Driver | 15% |

Westport Insurance Corporation offers a range of discounts to help customers save money on their insurance premiums. Some of the discounts available include:

- Multi-policy discount: Customers who bundle multiple policies with Westport Insurance Corporation, such as home and auto insurance, can receive a discount on their premiums.

- Safe driver discount: Customers who maintain a clean driving record and have no accidents or traffic violations may qualify for a safe driver discount.

- Good student discount: Full-time students who maintain a certain grade point average may qualify for a discount on their auto insurance premiums.

- Anti-theft device discount: Customers who install an approved anti-theft device in their vehicle can receive a discount on their auto insurance premiums.

- Safety features discount: Customers who have certain safety features installed in their vehicle, such as airbags or anti-lock brakes, may qualify for a discount on their auto insurance premiums.

- Loyalty discount: Customers who have been with Westport Insurance Corporation for a certain amount of time may qualify for a loyalty discount on their premiums.

These discounts can help customers save money on their insurance premiums and make Westport Insurance Corporation a more affordable option for many people.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Westport Insurance Corporation Ranks Among Providers

Westport Insurance Corporation has a number of competitors in the insurance industry. Some of the main competitors of the company include:

- State Farm: State Farm is one of the largest insurance companies in the United States and offers a range of insurance products, including auto, home, and life insurance.

- Allstate: Allstate is another large insurance company that offers a range of insurance products, including auto, home, and life insurance.

- Nationwide: Nationwide is a major insurance company that offers a range of insurance products, including auto, home, and business insurance.

- Travelers: Travelers is a leading insurance company that offers a range of insurance products, including auto, home, and business insurance.

- Liberty Mutual: Liberty Mutual is one of the largest insurance companies in the world and offers a range of insurance products, including auto, home, and business insurance.

These companies offer similar types of insurance coverage and may compete with Westport Insurance Corporation for customers. However, Westport Insurance Corporation differentiates itself from its competitors by offering a range of specialty insurance products and excellent customer service.

Frequently Asked Questions

What types of insurance does Westport Insurance Corporation offer?

Westport Insurance Corporation provides a range of insurance products, including property, liability, specialty, workers’ compensation, and cyber liability insurance.

How long has Westport Insurance Corporation been in business?

Established in 1975, Westport Insurance Corporation has decades of experience in the insurance industry, making it a reliable choice for coverage.

What sets Westport Insurance Corporation apart from its competitors?

Westport Insurance Corporation distinguishes itself by offering specialty insurance products and maintaining a reputation for excellent customer service.

Are there any reported issues with Westport Insurance Corporation’s services?

While customers praise the company for its comprehensive coverage and affordable prices, there have been some reports of challenges with claims processing and billing.

What additional coverage options does Westport Insurance Corporation provide?

In addition to its core offerings, Westport Insurance Corporation offers additional coverage options such as auto insurance, umbrella insurance, and excess liability insurance, tailored to meet diverse needs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.