William Penn Association Review (2026)

William Penn Association stands out as a reputable insurance provider, offering a diverse range of policies, including life insurance and annuities, with a commitment to financial security and exemplary member benefits.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we delve into the world of the William Penn Association, a venerable institution with over the years of history, providing a diverse range of insurance solutions to individuals and families.

Offering an array of policies, including life insurance, annuities, disability insurance, and final expense insurance, William Penn Association has earned an A.M. Best Rating of A (Excellent), signifying its exceptional financial stability.

With a low complaint level and a straightforward application process, the company’s sterling reputation is bolstered by positive customer reviews attesting to their exemplary customer service.

Membership benefits, competitive rates, and a commitment to financial strength make the William Penn Association a compelling choice for those seeking reliable insurance coverage and financial planning resources.

William Penn Association Insurance Coverage Options

William Penn Association offers a variety of coverage options to meet the diverse needs of its members. These coverage options encompass different aspects of financial security and protection. Here is a bullet list of the coverage options offered by the company:

- Life Insurance: William Penn Association provides various life insurance policies, including term life, whole life, and universal life insurance. These policies offer financial protection for policyholders and their beneficiaries in the event of death.

- Annuities: The company offers annuity products, allowing individuals to invest for retirement and receive regular payments, ensuring a steady income stream in their post-working years.

- Disability Insurance: William Penn Association offers disability insurance coverage, which provides income protection in case of a disability that prevents policyholders from working.

- Final Expense Insurance: This type of insurance helps cover funeral and burial expenses, relieving financial burdens for families during a difficult time.

- Supplemental Insurance: While primarily focused on life insurance, the company may offer supplemental insurance options that provide additional coverage for specific needs, such as critical illness or accident insurance.

- Retirement Planning Services: In addition to insurance, the company may provide retirement planning and financial advisory services to help members secure their financial future.

These coverage options cater to a wide range of financial needs, from protecting loved ones with life insurance to ensuring a stable retirement with annuity products. William Penn Association’s diverse offerings aim to provide comprehensive financial security and peace of mind for its members.

Read more: What is supplemental life insurance and what does it cover?

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

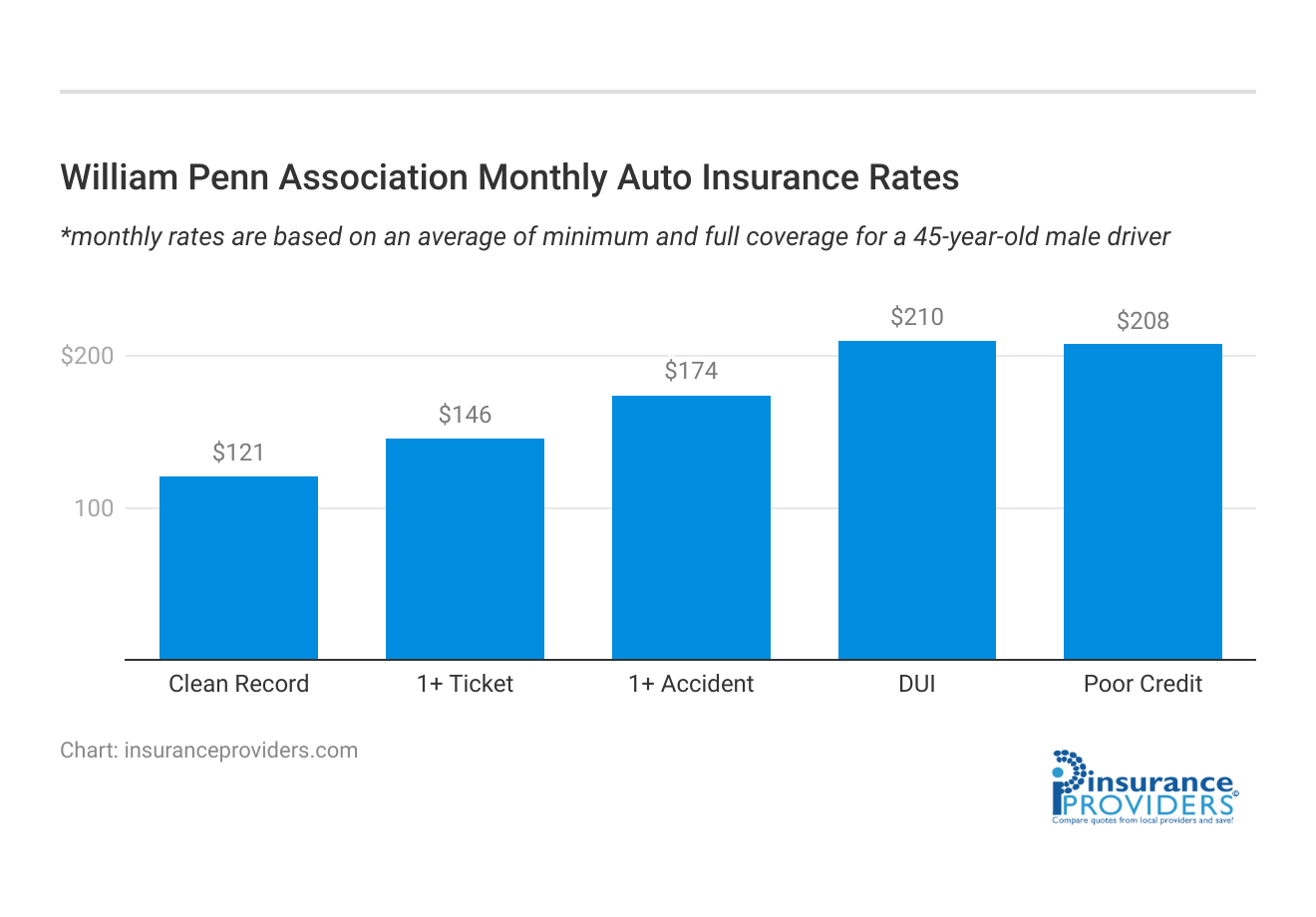

William Penn Association Insurance Rates Breakdown

| Driver Profile | William Penn Association | National Average |

|---|---|---|

| Clean Record | $121 | $119 |

| 1+ Ticket | $146 | $147 |

| 1+ Accident | $174 | $173 |

| DUI | $210 | $209 |

| Poor Credit | $208 | $205 |

William Penn Association Discounts Available

| Discount | William Penn Association |

|---|---|

| Anti Theft | 9% |

| Good Student | 12% |

| Low Mileage | 8% |

| Paperless | 11% |

| Safe Driver | 10% |

| Senior Driver | 7% |

William Penn Association offers a range of discounts and benefits to its members, enhancing the value of their insurance policies. These discounts can help policyholders save money and enjoy additional perks. Here are the discounts and benefits offered by the company:

- Membership Benefits: As a member of the William Penn Association, policyholders gain access to a variety of benefits, including competitive insurance rates, financial planning resources, and a supportive community.

- Multi-Policy Discount: Policyholders who bundle multiple insurance policies with William Penn Association, such as life insurance and annuities, may be eligible for a multi-policy discount, reducing their overall insurance costs.

- Good Health Discounts: Individuals who maintain good health and demonstrate healthy lifestyle choices may qualify for discounts on their insurance premiums.

- Loyalty Discounts: William Penn Association often rewards long-term policyholders with loyalty discounts, offering reduced rates to those who stay with the company over time.

- Preferred Payment Discounts: Policyholders who opt for convenient payment methods, such as automatic bank withdrawals, may be eligible for preferred payment discounts.

- Safe Driver Discounts: While primarily known for life insurance, the company may offer safe driver discounts or benefits for policyholders with auto insurance policies.

- Community Engagement Discounts: William Penn Association values community involvement. Policyholders actively participating in community events and engagement may receive special discounts or recognition.

Keep in mind that specific discount eligibility criteria may vary, so it’s advisable to contact the William Penn Association directly or consult with a local agent to explore the available discounts tailored to your insurance needs.

How William Penn Association Ranks Among Providers

William Penn Association operates in a competitive insurance industry where several notable companies offer similar insurance products and services. Some of the main competitors of the William Penn Association include:

- Metlife: Metlife is a global insurance giant known for its wide range of insurance products, including life insurance, annuities, and employee benefits. They have a significant presence and a strong financial position, making them a formidable competitor.

- Prudential Financial: Prudential is another major player in the insurance industry, offering a diverse portfolio of life insurance, retirement solutions, and investment products. They have a long history and a strong reputation for financial stability.

- New York Life Insurance Company: New York Life is one of the largest mutual life insurance companies in the United States. They are known for their comprehensive life insurance policies and financial planning services.

- Northwestern Mutual: Northwestern Mutual is a well-established insurance and financial services company that emphasizes financial planning and wealth management. They offer a wide range of insurance and investment products.

- Aflac: Aflac specializes in supplemental insurance products, such as accident, critical illness, and disability insurance. While they have a narrower focus compared to the William Penn Association, they are a significant competitor in the supplemental insurance market.

- State Farm: State Farm is known for its extensive network of agents and a variety of insurance products, including auto, home, and life insurance. They compete with the William Penn Association in the life insurance segment.

- Mutual of Omaha: Mutual of Omaha offers a range of insurance and financial products, including life insurance, annuities, and Medicare supplement insurance. They are a notable competitor in the life and retirement planning market.

William Penn Association distinguishes itself through its long history, membership benefits, and personalized approach to insurance, which may appeal to a specific niche of customers seeking community-oriented, financially stable insurance solutions.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

William Penn Association Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

When it comes to filing a claim with William Penn Association, policyholders have the convenience of choosing from multiple channels. The company offers a user-friendly online platform, allowing customers to file claims from the comfort of their own homes.

Additionally, claims can also be filed over the phone, providing a more personal touch for those who prefer speaking with a representative. Furthermore, William Penn Association provides a mobile app that streamlines the claims process, making it accessible on the go for added convenience.

Average Claim Processing Time

One of the crucial aspects of insurance is the speed at which claims are processed. William Penn Association is known for its efficient claims processing system.

On average, the company strives to process claims promptly, minimizing the waiting time for policyholders in their times of need. Swift claim processing is essential for ensuring that beneficiaries receive the financial support they require when facing unexpected events.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback plays a vital role in assessing the effectiveness of an insurance provider’s claims process. William Penn Association has received positive reviews from its policyholders regarding the resolution of claims and the timeliness of payouts.

This feedback underscores the company’s commitment to fulfilling its promises and providing financial relief to its members when they need it most.

William Penn Association Digital and Technological Features

Mobile App Features and Functionality

William Penn Association’s mobile app offers a range of features and functionalities designed to enhance the overall customer experience. Policyholders can use the app to manage their insurance policies, file claims, view policy documents, and even make premium payments seamlessly.

The user-friendly interface and intuitive design make it easy for customers to navigate and access important information on their mobile devices.

Online Account Management Capabilities

The company’s online account management capabilities provide policyholders with a convenient way to access their insurance information and make updates to their policies.

Through the online portal, customers can review policy details, update personal information, and track the status of their claims. This digital platform empowers policyholders to have greater control over their insurance accounts and stay informed about their coverage.

Digital Tools and Resources

In addition to its mobile app and online account management, William Penn Association offers a suite of digital tools and resources to assist policyholders in their insurance journey. These resources may include educational materials, calculators for estimating insurance needs, and guides on various insurance-related topics.

The company’s commitment to providing valuable digital resources underscores its dedication to helping members make informed decisions about their insurance coverage.

Frequently Asked Questions

What types of life insurance policies do they offer?

William Penn Association offers term life, whole life, and universal life insurance policies to cater to different financial needs.

How can I apply for insurance with the William Penn Association?

You can apply for insurance online or through a local agent, making the process convenient and accessible.

Is William Penn Association financially stable?

Yes, they maintain a strong financial position, ensuring they can meet their commitments to policyholders and provide peace of mind.

Can I bundle multiple insurance policies with the William Penn Association?

Yes, the company offers a multi-policy discount for policyholders who bundle multiple insurance products, potentially reducing overall insurance costs.

Do they offer any special discounts for long-term policyholders?

Yes, the William Penn Association often rewards loyalty with discounts for policyholders who stay with the company over time.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.