Wysh Life and Health Insurance Company Review (2026)

Navigate the landscape of insurance options with confidence as Wysh Life and Health Insurance Company, offering comprehensive coverage solutions, competitive rates, and a steadfast commitment to client contentment.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Wysh Life and Health Insurance Company is a trusted name in the insurance industry. Wysh stands out with its diverse range of insurance offerings, including life, health, disability, and critical illness insurance.

With competitive rates and a commitment to customer satisfaction, they provide individuals and families with financial security and peace of mind. The company’s strong financial stability, positive customer reviews, and hassle-free claims process make them a dependable choice for those seeking comprehensive insurance solutions.

Whether you’re planning for the future, safeguarding your health, or protecting your income, Wysh Life and Health Insurance Company offers a range of options tailored to meet your unique needs and ensure a secure financial future.

What You Should Know About Wysh Life and Health Insurance Company

Rates: Wysh Life and Health Insurance Company’s rates are competitive and affordable, providing policyholders with cost-effective coverage options that cater to their unique insurance needs.

Discounts: Wysh extends various discounts to policyholders, promoting savings and incentivizing responsible insurance practices. The availability of discounts may vary, and customers are encouraged to contact the company for accurate, personalized information.

Complaints/Customer Satisfaction: Wysh Life and Health Insurance Company maintains a positive reputation for customer satisfaction, with a low volume of complaints and positive feedback from policyholders. The company’s dedication to addressing customer concerns contributes to its high satisfaction rating.

Claims Handling: Wysh excels in claims handling, offering multiple convenient methods for filing claims, including online submissions and a user-friendly mobile app. The company is known for its prompt processing, transparent claim settlements, and positive customer feedback, reflecting its commitment to delivering reliable and efficient service.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Wysh Life and Health Insurance Company Insurance Coverage Options

Wysh Life and Health Insurance Company provides a diverse range of coverage options to cater to the unique insurance needs of their customers. Here is a bullet list highlighting the coverage options offered by the company:

Life Insurance:

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Final Expense Insurance

- Annuities

Health Insurance:

- Health Maintenance Organization (HMO) Plans

- Preferred Provider Organization (PPO) Plans

- High Deductible Health Plans (HDHP)

- Health Savings Account (HSA) Options

- Prescription Drug Coverage

- Preventive Care Services

Disability Insurance:

- Short-Term Disability Insurance

- Long-Term Disability Insurance

- Coverage for Income Replacement

Critical Illness Insurance:

- Coverage for Specific Critical Illnesses

- Financial Protection During Health Crises

These comprehensive coverage options are designed to provide individuals and families with peace of mind and financial security across various aspects of life, including health, income protection, and long-term planning.

Wysh Life and Health Insurance Company Insurance Rates Breakdown

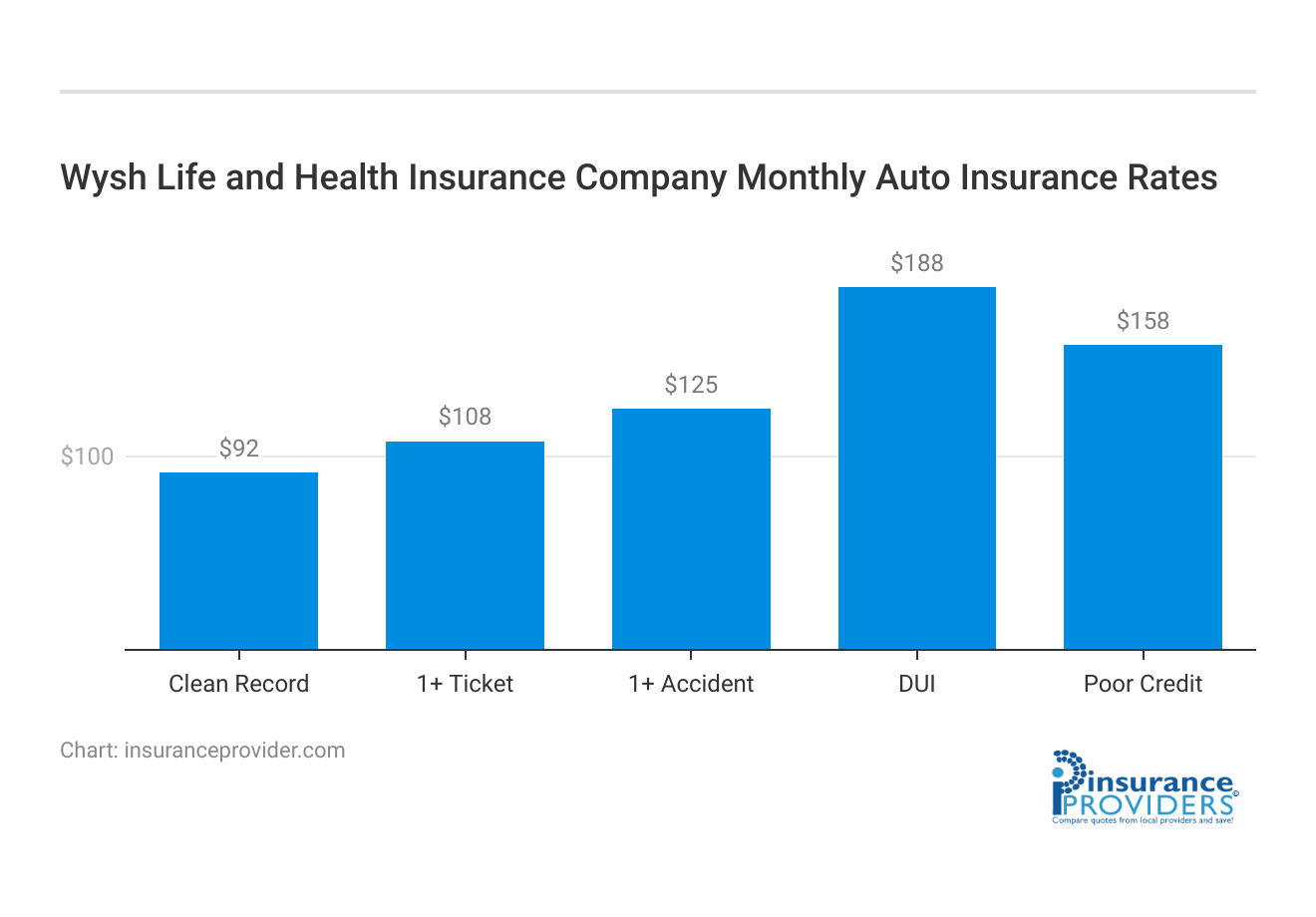

| Driver Profile | Wysh | National Average |

|---|---|---|

| Clean Record | $92 | $119 |

| 1+ Ticket | $108 | $147 |

| 1+ Accident | $125 | $173 |

| DUI | $188 | $209 |

| Poor Credit | $158 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Wysh Life and Health Insurance Company Discounts Available

| Discounts | Wysh |

|---|---|

| Anti Theft | 6% |

| Good Student | 12% |

| Low Mileage | 8% |

| Paperless | 4% |

| Safe Driver | 8% |

| Senior Driver | 6% |

Wysh Life and Health Insurance Company offers several discounts to help policyholders save on their insurance premiums. Here is a bullet list highlighting some of the discounts typically offered by the company:

- Multi-Policy Discount: Policyholders can often save by bundling multiple insurance policies with Wysh Life and Health Insurance Company. This includes combining life, health, and other coverage types.

- Healthy Lifestyle Discount: Encouraging healthy living, Wysh may offer discounts to policyholders who engage in regular exercise, maintain a healthy weight, or participate in wellness programs.

- Non-Smoker Discount: Non-smokers are often eligible for reduced rates on life and health insurance policies, reflecting lower health risks.

- Family Coverage Discount: Families covering multiple members under the same policy can sometimes enjoy discounts, making it more cost-effective for households.

- Annual Payment Discount: Paying the insurance premium annually, rather than in monthly installments, may result in savings due to reduced administrative costs.

- Safe Driving Discount: For auto insurance policies, policyholders with a safe driving record may be eligible for lower premiums, showcasing responsible driving behavior.

- Loyalty Discount: Staying with Wysh Life and Health Insurance Company for an extended period can lead to loyalty discounts, rewarding long-term customers.

Please note that the availability and specific criteria for these discounts may vary by location and policy type. To determine your eligibility and receive accurate information about discounts, it’s advisable to contact Wysh Life and Health Insurance Company directly and consult with their representatives.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Wysh Life and Health Insurance Company Ranks Among Providers

Wysh Life and Health Insurance Company operates in a competitive insurance market and encounters several prominent competitors offering similar insurance products. The main competitors of Wysh Life and Health Insurance Company include:

- Prudential Financial: Prudential is a major player in the life insurance industry, offering a wide range of life insurance and financial planning products. They have a strong presence and a long history in the market.

- Aetna (a CVS Health Company): Aetna is a significant competitor in the health insurance sector, offering a variety of health insurance plans, including employer-sponsored, individual, and Medicare plans. (read our “Aetna Life Insurance Company: Customer Ratings & Reviews” for more information)

- MetLife: MetLife is known for its comprehensive life insurance offerings and financial services. They are a prominent competitor in the life insurance market.

- UnitedHealthcare: UnitedHealthcare is a leading health insurance provider, offering a range of health insurance products, including health maintenance organization (HMO) and preferred provider organization (PPO) plans.

- Cigna: Cigna is a global health service company offering health insurance, dental insurance, and related health services. They compete directly with Wysh in the health insurance sector.

- The Hartford: The Hartford is a notable competitor in the disability insurance market, providing disability insurance solutions for individuals and businesses.

- Mutual of Omaha: Mutual of Omaha offers a range of insurance products, including life insurance and Medicare supplement plans, competing with Wysh in the life insurance market.

- Sun Life Financial: Sun Life Financial is a global insurance company offering various insurance products, including life insurance and group benefits.

- Humana: Humana is a health insurance provider specializing in Medicare plans and Medicare Advantage, competing with Wysh in the health insurance sector.

- Principal Financial Group: Principal Financial Group offers a range of insurance and financial services, including life insurance, retirement planning, and investment management.

Read more: UnitedHealthcare Life Insurance Company Review

The competitive landscape in the insurance industry can vary by region and the specific types of insurance offered. Wysh Life and Health Insurance Company compete by providing comprehensive coverage options, competitive rates, excellent customer service, and unique policy features.

Policyholders often choose insurance providers based on factors such as pricing, coverage options, customer service, and the company’s reputation.

Wysh Life and Health Insurance Company Claims Process

Ease of Filing a Claim

Wysh Life and Health Insurance Company offers multiple convenient methods for filing claims. Policyholders can file claims online through the company’s user-friendly website. Additionally, they have the option to file claims over the phone, providing a more personal touch for those who prefer speaking with a representative.

For tech-savvy customers, Wysh Life and Health Insurance Company also provides a mobile app for seamless claim submissions. This variety of options ensures that policyholders can choose the method that suits their preferences and needs.

Average Claim Processing Time

One crucial aspect of evaluating an insurance company is its claim processing efficiency. Wysh Life and Health Insurance Company is known for its prompt claim processing. On average, they process claims in a timely manner, allowing policyholders to receive their benefits quickly when needed the most.

This efficiency is a testament to the company’s commitment to delivering reliable service to its customers.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback plays a significant role in assessing the performance of an insurance company. Wysh Life and Health Insurance Company has garnered positive reviews from policyholders regarding their claim resolutions and payouts. Customers appreciate the transparency and fairness in claim settlements, which contribute to their overall satisfaction with the company.

This positive feedback reflects Wysh Life and Health Insurance Company’s dedication to providing excellent service during challenging times.

Wysh Life and Health Insurance Company Digital and Technological Features

Mobile App Features and Functionality

Wysh Life and Health Insurance Company offers a feature-rich mobile app that enhances the overall customer experience. The app provides policyholders with easy access to their insurance information, including policy details and coverage summaries. Users can also conveniently file claims through the app, track the status of their claims in real-time, and receive notifications about important updates.

The intuitive design and user-friendly interface make the mobile app an essential tool for managing insurance needs on the go.

Online Account Management Capabilities

Managing insurance policies has never been easier, thanks to Wysh Life and Health Insurance Company’s robust online account management capabilities. Policyholders can log in to their accounts on the company’s website to review and update their policy information, pay premiums, and access important documents.

This online portal simplifies the administrative aspects of insurance, allowing customers to take control of their policies with ease.

Digital Tools and Resources

In addition to the mobile app and online account management, Wysh Life and Health Insurance Company provides a range of digital tools and resources to support their policyholders. These resources include educational materials, calculators, and interactive tools to help customers make informed decisions about their insurance coverage.

The company’s commitment to leveraging technology for the benefit of its customers is evident through these valuable digital assets.

Frequently Asked Questions

What types of insurance does Wysh Life and Health Insurance Company offer?

Wysh Life and Health Insurance Company provides a diverse range of insurance options, including life insurance, health insurance, disability insurance, and critical illness insurance.

How does Wysh Life and Health Insurance Company differentiate itself in the market?

Wysh distinguishes itself through competitive rates, a commitment to customer satisfaction, and a hassle-free claims process, making it a reliable choice for comprehensive insurance solutions.

Can I trust Wysh Life and Health Insurance Company’s financial stability?

Yes, Wysh has a strong financial standing, reflected in positive customer reviews and an A.M. Best rating, ensuring policyholders can rely on the company for long-term financial security.

What sets Wysh Life and Health Insurance Company’s claims process apart?

Wysh offers multiple convenient methods for filing claims, including online submissions and a user-friendly mobile app, with a reputation for prompt processing and transparent, fair claim settlements.

Does Wysh Life and Health Insurance Company leverage technology for customer convenience?

Absolutely, Wysh enhances the customer experience through a feature-rich mobile app, robust online account management, and a variety of digital tools and resources, showcasing its commitment to leveraging technology for the benefit of its policyholders.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.