Top Cryptocurrency Insurance Coverage: What You Need to Know [2026]

You’ve worked hard to study the markets, and you want to hold on tight to your hard-earned cryptocurrency gains. Learn more about how to protect your assets through the use of cryptocurrency insurance below.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Heidi Mertlich

Updated November 2023

- The cryptocurrency market is on the rise

- In 2022, it is estimated that more than 1,500 bitcoins will be lost every day

- The illicit acquisition of crypto grew more than $6 billion in one year from 2020 to 2021

- Cryptocurrency insurance protects your investments in case of theft, scams, and other losses

The Rise of Cryptocurrency

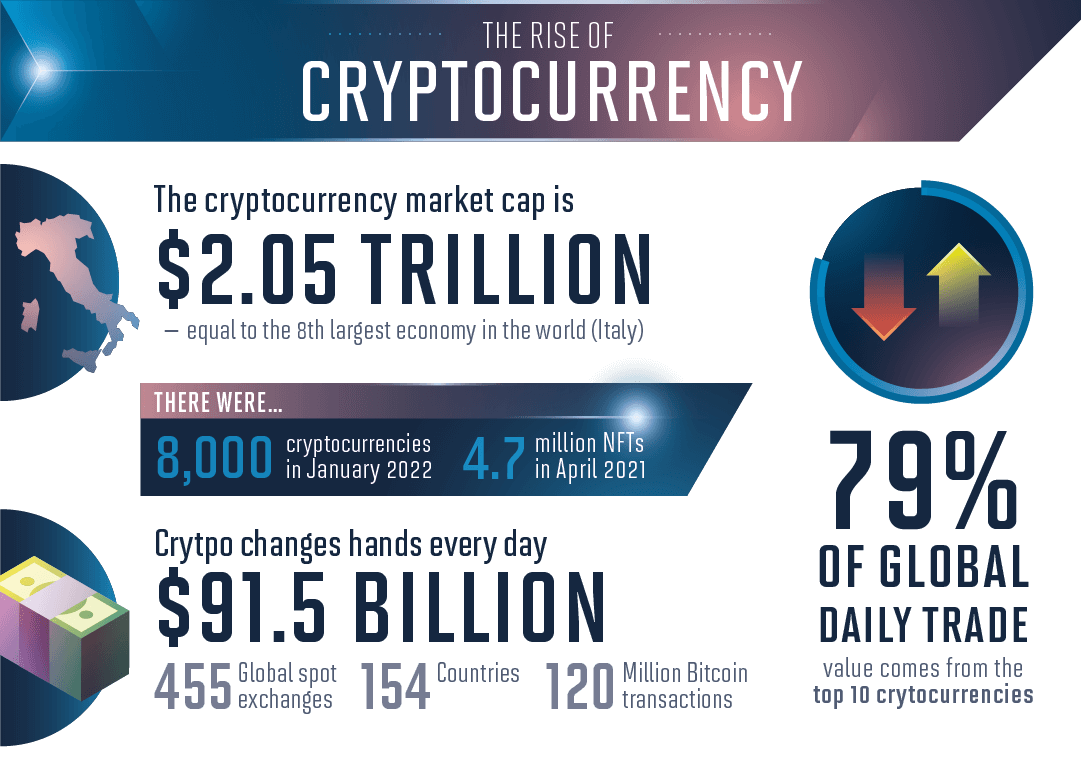

Cryptocurrency is now hard to ignore by the markets and the masses as it has been sharply increasing in value over the last few years. At the time of this writing, the overall cryptocurrency market cap is currently at a whopping $2.05 trillion. This would make it a larger market than Italy — the 8th largest GDP nation globally.

As of January 2022, over 8,000 cryptocurrencies and over 4.7 million non-fungible tokens (NFTs) were on record. There is also a significant trading volume for cryptocurrency. Seventy-nine percent of the world’s global trading comes from the top 10 cryptocurrencies. A total of over $91.5 billion in cryptocurrency is transacted daily across 455 exchanges, 154 counties, and 120 million Bitcoin transactions.

If you have invested heavily in cryptocurrency, you’re likely looking for a way to insure your assets. Read on to understand how your cryptocurrency could get lost or stolen, along with ways to insure your cryptocurrency and crypto-assets.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How does cryptocurrency get lost?

While cryptocurrency is designed to be secure, it is still relatively easy to get lost or stolen. If you think that it will only happen to those that lack preparation and security precautions, think again. In 2022, it is projected that more than 1,500 bitcoins will be lost every day.

Some of the ways that cryptocurrency is lost or stolen may surprise you. Missing private keys are a signficant culprit — 20% of Bitcoin is stranded due to lost wallets. Drops in the cryptocurrency market also factor in here in a big way. Americans lost $1.7 billion in the cryptocurrency markets in 2018 alone. Crashes and corruption are also major factors as roughly 1 in every 1,500 files will get corrupted.

You Should Be Worried About Cryptocurrency Theft

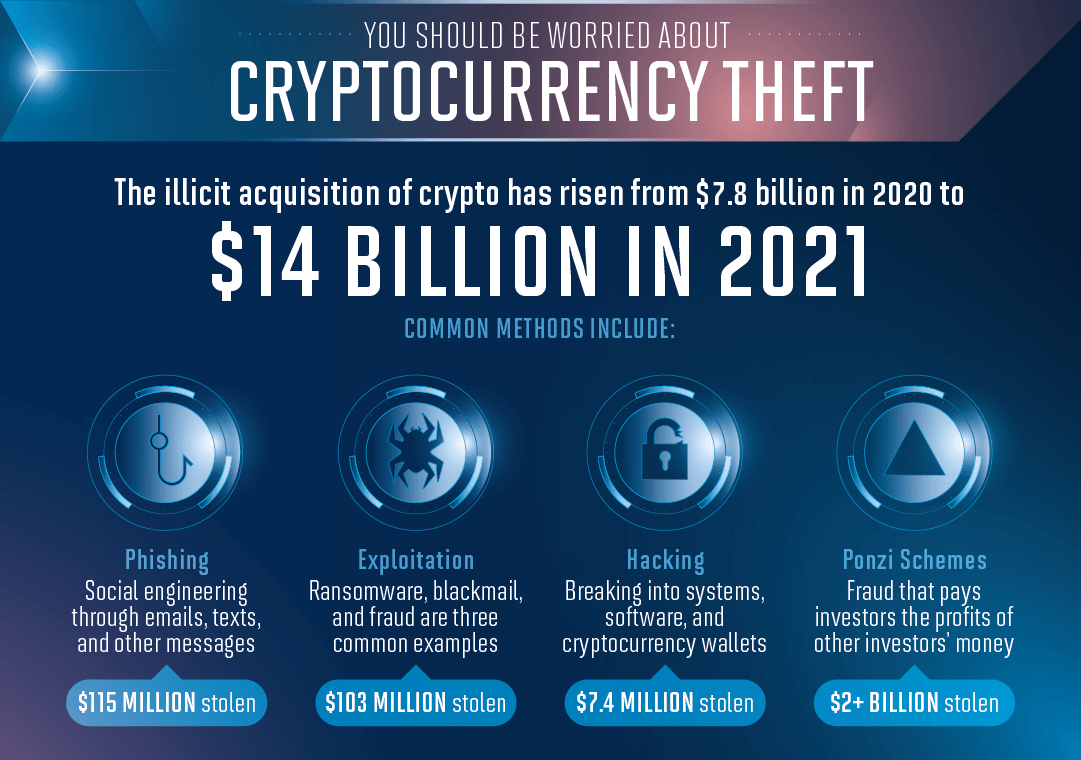

Illicit acquisition of cryptocurrency is at an all-time high. Two years ago, cryptocurrency theft reached a $7.8 billion valuation and almost doubled to $14 billion by the following year. The amount is shocking and will likely grow as more people own cryptocurrency and NFTs.

What makes cryptocurrency theft tricky is that there are many ways the theft can occur. Phishing uses social engineering via emails, texts, and other messages to gain access. In this method alone, $115 million has been stolen.

Exploitation is another attack vector that seeks to use ransomware, blackmail, and fraud, which has stolen $103 million. Hacking, defined as breaking into systems, software, and cryptocurrency wallets, has stolen $7.4 million. But by far, the method that has stolen the most is the use of Ponzi schemes — collecting an impressive $2+ billion. This fraudulent method pays investors the profits of other investors’ money.

Biggest Cryptocurrency Mega Losses

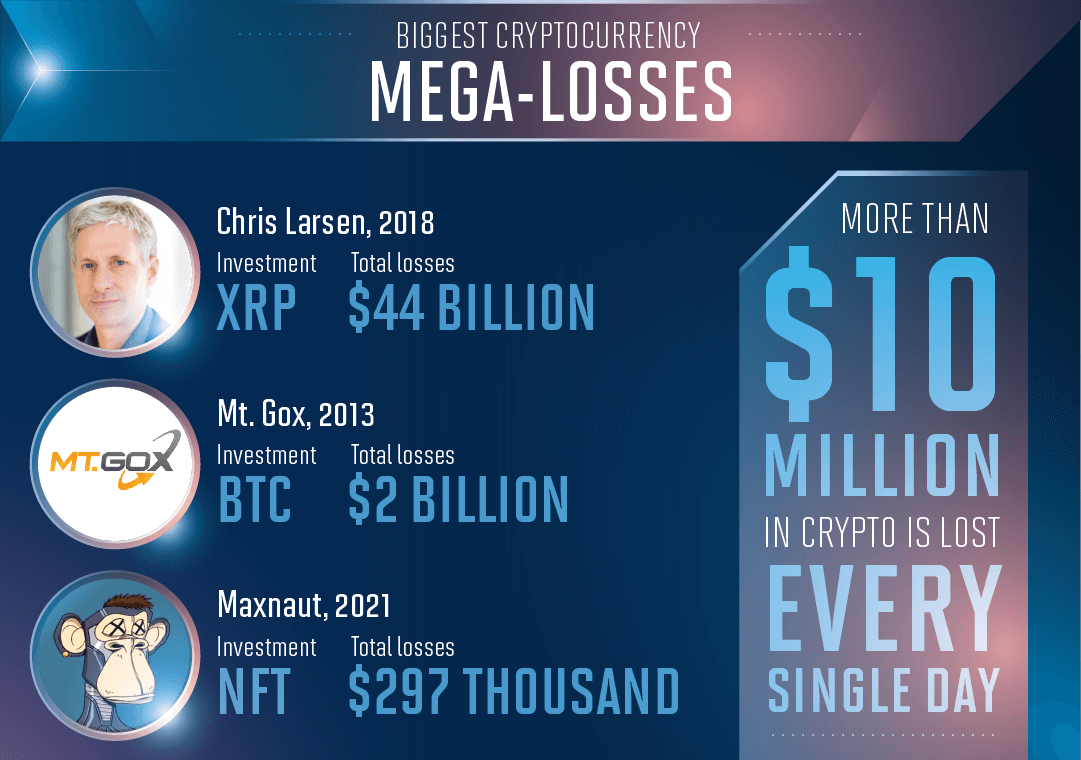

There have been several massive individual and institutional losses of cryptocurrency and NFTs on record. Every day, more than $10 million in cryptocurrency is lost. While the losses can scatter across many individuals and not amount to much for some, others have a very different story and have lost a great deal.

In 2018, Chris Larsen invested in XRP and lost $44 billion. One of the former largest houses of Bitcoin, Mt. Gox, had invested in BTC and had lost $2 billion in 2013. More recently, Maxnaut invested in NFTs and has now lost $297,000 as of 2021.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why are people worried about cryptocurrency?

As it turns out, only 50% of Americans believe that cryptocurrency is stable to invest in — not a huge reassurance of confidence. According to Charlie Brooks of Crypto Asset Recovery: “To your average retail investor, the crypto and DeFi world is full of opportunities but fraught in insecurity by the lack of a safety net in the way of a centralized entity controlling their login details and securing their assets.”

Also, according to Trevor Maynard of Lloyd’s: “As more money flows into the crypto asset market, losses from hacks are on the rise. Nevertheless, cryptocurrency companies have found ways to protect their digital assets from theft.”

How does cryptocurrency insurance work?

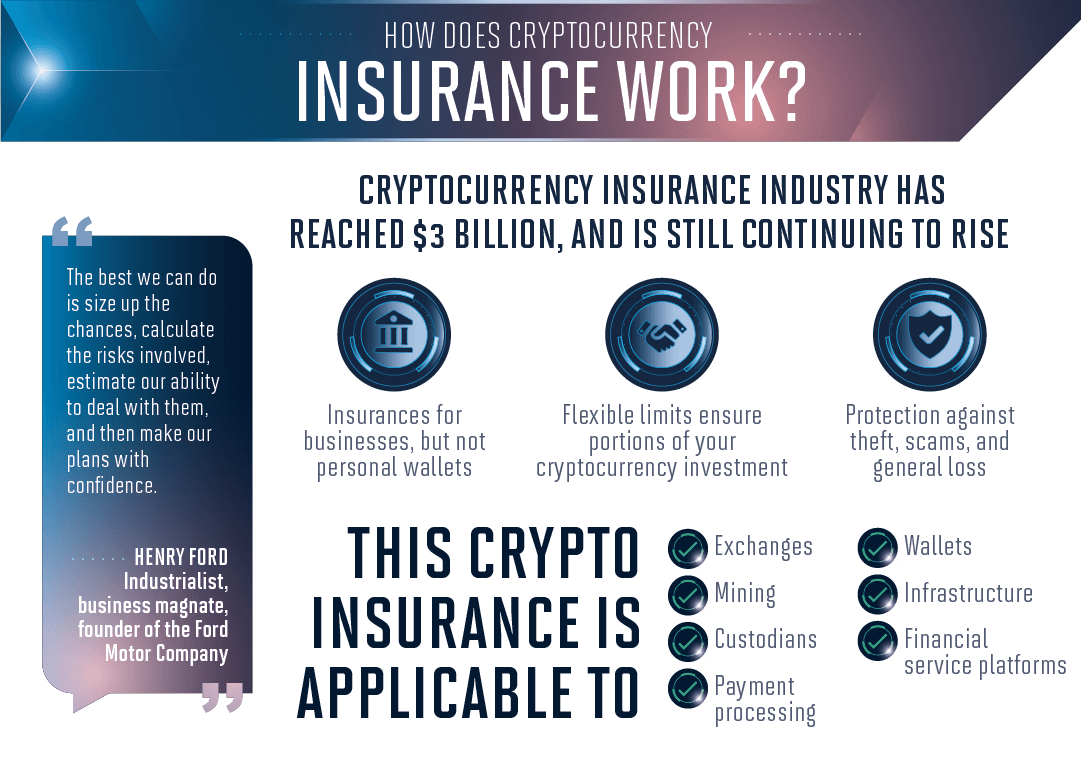

With the likelihood of losses in owning cryptocurrency given its inherent volatility, the cryptocurrency insurance industry is growing rapidly and has already reached over the $3 billion mark. Cryptocurrency insurance works for the following items: exchanges, mining, custodial, payment processing, wallets, infrastructure, and financial service platforms.

It provides insurance for businesses but not for personal wallets. With flexible limits, it ensures portions of your cryptocurrency investment and protects against theft, scams, and general losses. For businesses, cryptocurrency insurance can extend your business insurance protection.

How to Insure Cryptocurrency & NFTs

The best way to insure your cryptocurrency or NFT is to begin as you would with any type of insurance. Start by looking for providers and collecting quotes. Once you have this information in hand, compare the different insurance premiums for each quote.

Lastly, choose your needed umbrella insurance types such as fraud insurance, exchange insurance, business cryptocurrency insurance, mining, custody insurance, and DeFi insurance. After evaluating your cryptocurrency situation needs, you should have enough information to make an informed decision in the right direction.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

So, is cryptocurrency insurance worth it?

In the end, it’s best to do your research and shop for cryptocurrency insurance rates before you take the plunge. The good news is that it’s possible to find insurance for your cryptocurrency and NFTs. Given how volatile the cryptocurrency market is, it’s imperative to give yourself some peace of mind by carefully protecting your cryptocurrency assets from external threats, scams, software and hardware failure, and hacking attempts.

Case Studies: Cryptocurrency Insurance Coverage

Case Study 1: The Lost Private Keys

John, an avid cryptocurrency investor, had accumulated a substantial amount of Bitcoin over the years. However, he made the unfortunate mistake of misplacing his private keys.

As a result, he lost access to his cryptocurrency wallet, with an estimated value of $100,000. Had John insured his cryptocurrency, he could have filed a claim and recovered his losses.

Case Study 2: Victim of Phishing Attack

Sarah, a crypto enthusiast, fell victim to a phishing attack. She received an email seemingly from a legitimate cryptocurrency exchange, asking her to update her account information.

Unknowingly, Sarah provided her login credentials, and hackers gained access to her account. They quickly transferred her entire portfolio, worth $50,000, to their own wallets. If Sarah had cryptocurrency insurance, she could have been reimbursed for the stolen funds.

Case Study 3: Exchange Hack

Mark, a trader on a popular cryptocurrency exchange, woke up one morning to find out that the exchange had suffered a major security breach.

The hackers managed to steal funds from the exchange’s hot wallets, resulting in the loss of $1 million worth of cryptocurrencies belonging to Mark and other users.

Fortunately, the exchange had comprehensive insurance coverage, and Mark was able to recover his losses through the insurance claim.

Case Study 4: NFT Investment Gone Wrong

Lisa, an art collector, decided to invest in non-fungible tokens (NFTs) to diversify her portfolio. She purchased a rare digital artwork for $10,000.

Unfortunately, a few months later, the platform hosting the NFT experienced a technical glitch, resulting in the loss of the artwork. With NFT insurance coverage, Lisa could have been compensated for the value of the lost NFT.

Case Study 5: Hardware Failure

Robert stored his cryptocurrency in a hardware wallet, considering it a secure option. However, due to a manufacturing defect, his wallet malfunctioned and became inaccessible.

He was unable to recover his private keys or access his funds, which amounted to $250,000. If Robert had insured his cryptocurrency holdings, he could have been protected against such hardware failures.

Frequently Asked Questions

What is cryptocurrency insurance?

Cryptocurrency insurance is a type of coverage designed to protect individuals, businesses, and cryptocurrency exchanges from losses or damages related to theft, hacking, or other security breaches involving cryptocurrencies. It provides financial protection against the risks associated with holding or transacting in cryptocurrencies.

What does cryptocurrency insurance typically cover?

Cryptocurrency insurance policies vary, but they generally cover losses caused by theft, hacking, fraud, employee dishonesty, and other security breaches. Coverage may extend to both online and offline storage of cryptocurrencies, including hot wallets, cold wallets, and exchanges. It’s important to review the specific terms and conditions of each policy to understand the scope of coverage.

Who needs cryptocurrency insurance?

Cryptocurrency insurance can be beneficial for various stakeholders in the cryptocurrency ecosystem. This includes individuals holding significant amounts of cryptocurrency, businesses accepting cryptocurrency payments, cryptocurrency exchanges, custodians, and other service providers involved in the storage or management of cryptocurrencies. It provides an extra layer of protection against potential financial losses.

What factors should I consider when choosing a cryptocurrency insurance provider?

When selecting a cryptocurrency insurance provider, consider factors such as the provider’s reputation, financial strength, coverage limits, policy exclusions, and the breadth of coverage offered. It’s also important to assess their experience and expertise in dealing with cryptocurrency-related risks. Consulting with a knowledgeable insurance agent or broker can help you navigate the options and find the most suitable provider.

Are all cryptocurrencies covered by cryptocurrency insurance?

Cryptocurrency insurance providers typically offer coverage for a range of cryptocurrencies, including popular ones such as Bitcoin and Ethereum. However, the availability of coverage for specific cryptocurrencies may vary among providers. It’s important to verify which cryptocurrencies are covered under a particular policy before making a decision.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.