Does Allstate offer GAP insurance?

GAP insurance protects you from paying on an upside-down loan for a car that’s been stolen or totaled. Allstate GAP insurance is an affordable option that comes with the unique benefit of paying for your collision or comprehensive deductible.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Updated March 2024

- GAP insurance protects you from paying on an underwater loan if your car is totaled or stolen while you owe more than its worth

- While Allstate offers GAP insurance, it does have a Payoff Protector benefit for customers who have a State Farm auto loan

- Alternatives to Allstate for GAP insurance include Progressive and Nationwide

While buying a new car is exciting and can give you a sense of accomplishment, it comes with an unfortunate truth: your car’s value depreciates quickly. Many people think your car loses half its value once you drive it off the lot. While that’s not true, your vehicle does depreciate.

When you buy a new car, a worst-case scenario is getting into an accident that totals your vehicle. Or, someone spots your new car and decides to steal it.

It doesn’t feel fair, but drivers find themselves in situations like these all the time. The value of your car is less than what you paid for it, but your loan doesn’t change. What do you do if your new car is declared a total loss, but you owe more on the loan than it’s worth?

Guaranteed Asset Protection — or GAP — auto insurance covers this situation. GAP coverage pays the difference between what your car is worth and how much you owe on the loan. If you’re wondering where to buy GAP insurance, most major providers offer it, including Allstate.

If you’re interested in Allstate GAP insurance, you should compare rates with other auto insurance companies. Enter your ZIP code into our free tool to see what quotes might look like for you.

Does Allstate sell GAP insurance?

Not every company sells GAP insurance, but Allstate does. When speaking with an Allstate agent, they may refer to a GAP insurance policy as loan/lease insurance, but they mean the same things in this case.

With Allstate, you must be the vehicle’s original loan- or leaseholder to be eligible for GAP insurance.

Allstate recommends GAP insurance anytime you’re leasing or financing a new car. Allstate GAP insurance works in conjunction with collision and comprehensive insurance to make sure your vehicle is completely covered.

Collision and comprehensive coverage will pay for your car’s Actual Cash Value (ACV) after an incident covered by your policy. GAP insurance is a smart investment since most vehicles lose around 20 percent of their value in the first year of ownership.

Allstate’s GAP insurance is fairly standard compared to competitors, but it does offer one unique benefit. Your GAP insurance will pay for the deductible on your comprehensive or collision coverage, up to $1,000.

How does GAP insurance work?

There’s an old wives tale about driving your car off the lot and it immediately losing a quarter or half of its value. Depreciation isn’t that extreme, but your car does drop in value from the first day of ownership.

Unless you made a large down payment or your loan life is short, your loan will likely become upside-down or underwater at the beginning of your ownership. That means you owe more on the car than it’s worth.

GAP insurance prevents you from paying for a car you no longer own. Consider the following example: someone runs a red light and smashes into your car. Your insurance company assesses the damage and declares the car a total loss.

After evaluating, the ACV of your car is $12,000. However, you still owe $20,000 on your loan. Without GAP insurance, you’re left with $8,000 to pay on your loan without owning the car anymore.

If you have GAP coverage, it will step in and pay the $8,000 left on the loan.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Who else sells GAP insurance?

While Allstate GAP insurance reviews are great, you might want to consider other companies. After all, why would you go to Allstate if you’re a customer somewhere else?

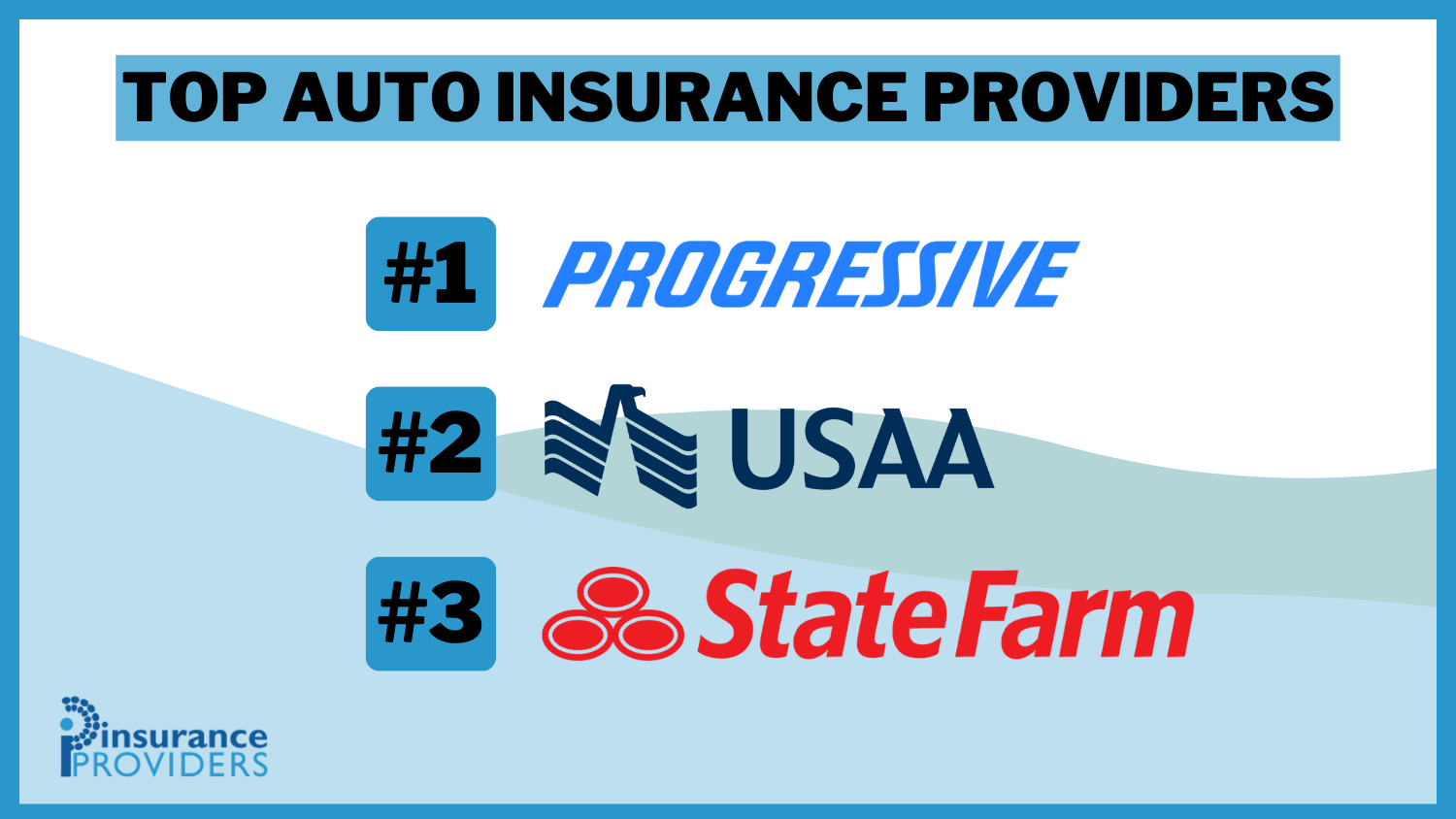

There are several options for GAP insurance outside of Allstate. However, many companies either don’t sell it or only sell a version of GAP to customers that take out car loans through the company.

Progressive GAP Insurance

Progressive offers an easy-to-understand policy that covers up to 25 percent of the ACV of your vehicle. That means if your car is worth $20,000, Progressive’s GAP will cover up to $5,000 for your loan.

While not as extensive as Allstate’s plan, Progressive is very affordable. Prices vary, but you can expect to pay around $5 a month. However, you need an existing policy with Progressive to buy their GAP insurance.

Nationwide GAP Insurance

Nationwide offers GAP insurance, but they are one of the only companies to charge a deductible on it. That means that you’ll have to meet your deductible before your GAP insurance kicks in.

Nationwide prices are low, but you should speak with an agent before signing up to make sure your deductible is affordable.

Other Companies That Sell GAP insurance

American Family, Travelers, and Safeco sell GAP insurance.

You can also find GAP insurance coverage (or a version of it) from other companies that have an additional requirement.

For example, State Farm offers a payoff protection plan that works like GAP insurance, but you have to use them as the lender for your car. USAA has a Total Loss Protection plan, but you have to be a military member or close relative to be eligible. (For more information, read our “Understanding Gap Insurance: What is it and how does it work?“).

Surprisingly, some of the biggest insurance companies simply don’t offer GAP coverage. Geico, for example, has no GAP protection plan.

Read more: Does State Farm offer GAP insurance?

Is GAP insurance worth it?

GAP insurance might be worth it, depending on your situation. Consider if the following scenarios apply to you.

- You made a small down payment. The smaller the down payment, the quicker your loan will go upside down. GAP insurance protects you from paying on a loan you owe a lot on.

- You have an extended loan period. If your loan is longer than 60 months, your payments will probably be fairly low, which means your loan will decrease slowly. Since your car loses about 20 percent of its value in the first year, you have a high chance of going upside-down.

- You’re leasing your car. A lot of car leases have GAP protection built in to protect the dealership. You typically make smaller payments on a car you lease, which makes more opportunity for your loan to outweigh your car’s ACV.

- Your car depreciates quickly. While the average depreciation time is pretty slow, some cars lose value quickly. High-end vehicles like sports or luxury cars lose value quicker than other cars.

If none of these apply to you, you probably don’t need to purchase GAP insurance coverage.

Find GAP Insurance Today

If you think you need the coverage, it might be time to call the Allstate GAP insurance phone number and set up a plan. You typically have 30 days to get coverage after you buy a new car, so you shouldn’t wait too long.

However, before you sign up for Allstate GAP insurance, you should look at what rival companies offer. Enter your ZIP code into our free tool if you’re ready to see what rates could look like for you.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Unveiling Real-Life Case Studies and Scenarios for GAP Insurance.

Case Study 1: Sarah’s Total Loss

Sarah bought a new car with a loan but had an accident, making her car a total loss. Allstate’s GAP insurance covered the $4,000 difference between the car’s value and her loan, relieving her of any financial obligation.

Case Study 2: John’s Leased Vehicle

John leased a luxury car but it was stolen after one year with a remaining balance of $30,000. Allstate’s GAP insurance covered the $5,000 difference between the car’s value and the lease balance, relieving John of any financial obligation.

Case Study 3: Maria’s Financing Situation

Maria bought a used car and financed it with an auto loan. Unfortunately, she experienced a significant accident that rendered her vehicle unrepairable. The insurance company assessed the car’s actual cash value at $10,000, while Maria still owed $12,000 on her loan. Fortunately, Maria had taken out Allstate’s GAP insurance when she financed the car.

Allstate covered the $2,000 shortfall, enabling Maria to pay off her loan without having to dip into her savings.

Read more: Best Auto Insurance for Used Cars

Frequently Asked Questions

Does Allstate offer GAP insurance?

Yes, Allstate does offer GAP (Guaranteed Asset Protection) insurance.

What is GAP insurance?

GAP insurance is a type of coverage that helps bridge the gap between what you owe on your car loan or lease and the actual cash value of your vehicle. It is designed to protect you from financial loss in the event of theft or a total loss accident.

How does Allstate GAP insurance work?

Allstate’s GAP insurance works by covering the difference between the outstanding balance on your auto loan or lease and the amount your primary auto insurance company pays if your vehicle is totaled or stolen. It can help prevent you from having to pay out-of-pocket to settle the remaining loan or lease balance.

What does Allstate GAP insurance cover?

Allstate’s GAP insurance covers the “gap” between what you owe on your vehicle and its actual cash value. In the event of a total loss or theft, it can cover the remaining loan or lease balance, deductible, and possibly other expenses, depending on the specific terms of the policy.

How do I purchase Allstate GAP insurance?

To purchase Allstate GAP insurance, you can contact a local Allstate insurance agent or visit the Allstate website. They will guide you through the process, explain the coverage options, and provide you with a quote based on your specific needs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.