Post

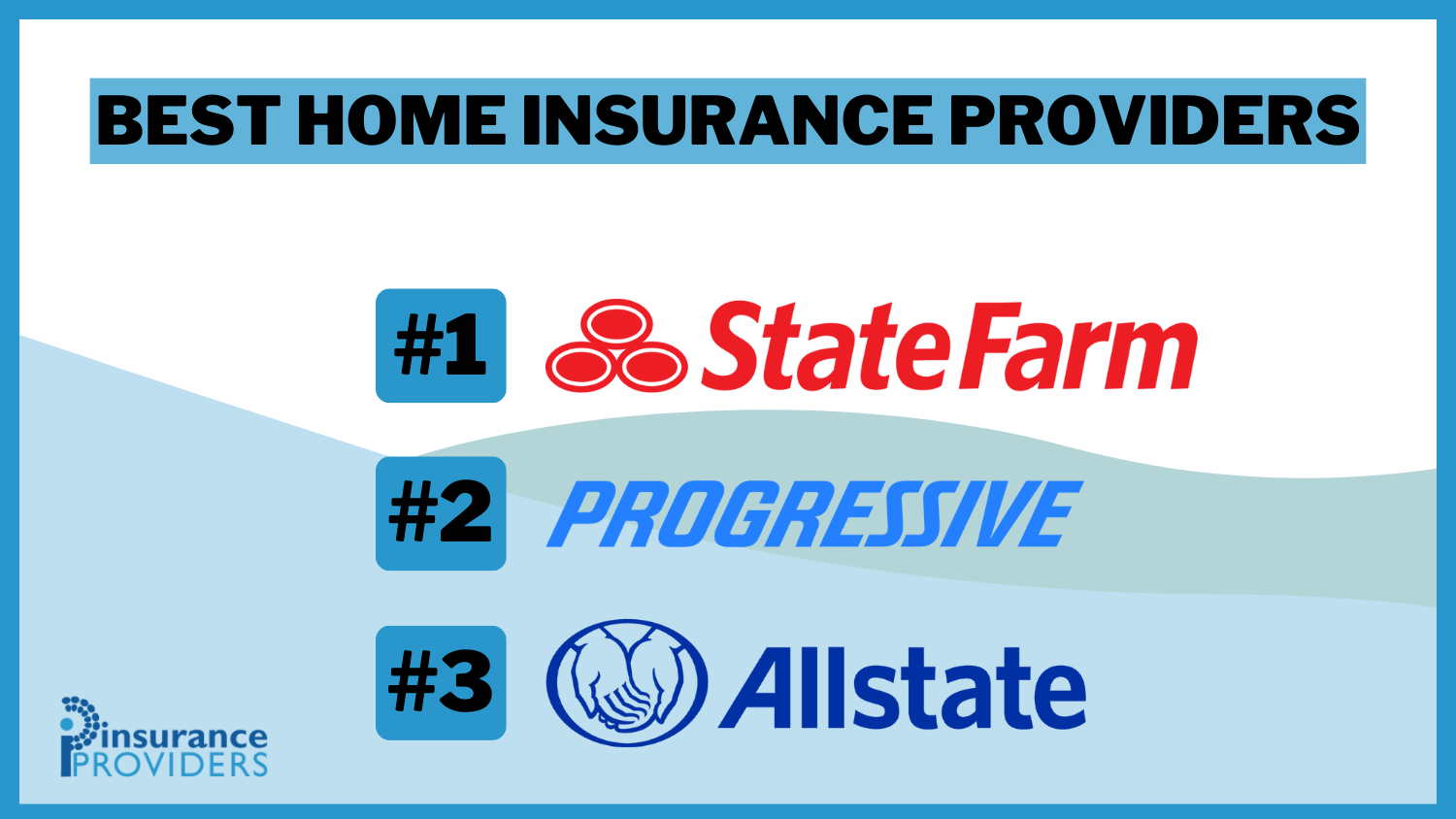

PostBest Home Insurance Providers 2025 (Your Guide to the Top 10 Companies)

State Farm stands out as the best home insurance provider, offering competitive rates and comprehensive coverage for as low as $140/month. Together with Progressive and Allstate, they guarantee cost-effectiveness and high-quality protection customized to meet the needs of homeowners. With strong financial ratings and positive customer feedback, homeowners trust these insurers to safeguard their investments...

State Farm stands out as the best home insurance provider, o...