Importance of Cyber Insurance for Businesses

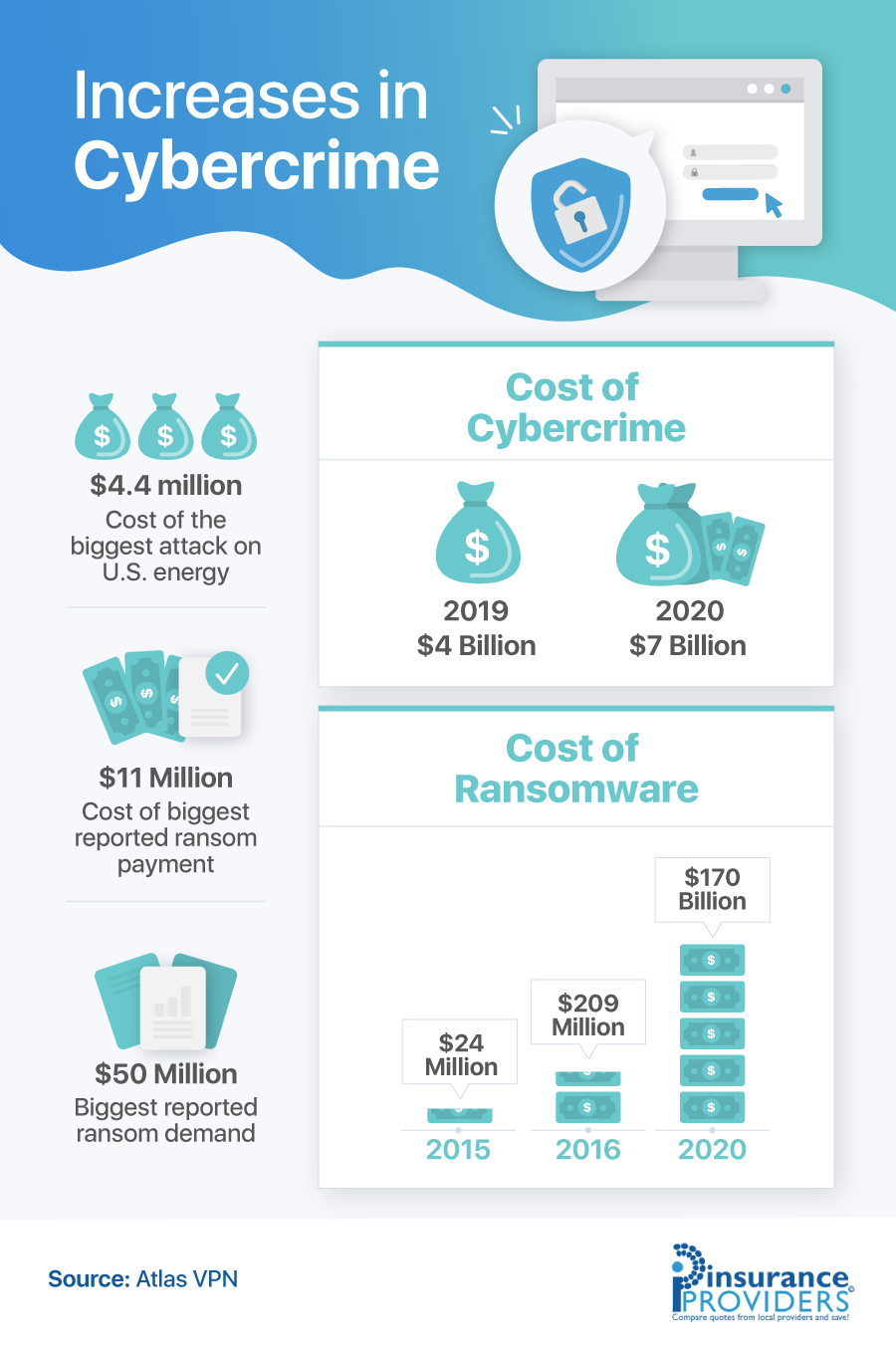

Businesses should not underestimate the importance of cyber insurance. Cybercrime costs rose $3 billion in just a year, and ransomware costs increased by $146 billion in just five years. Not having cyber insurance can devastate a small company that can't afford the cost of data recovery and legal fees after a cyberattack.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Updated February 2024

- In 2020, the cost of ransomware was $170 billion

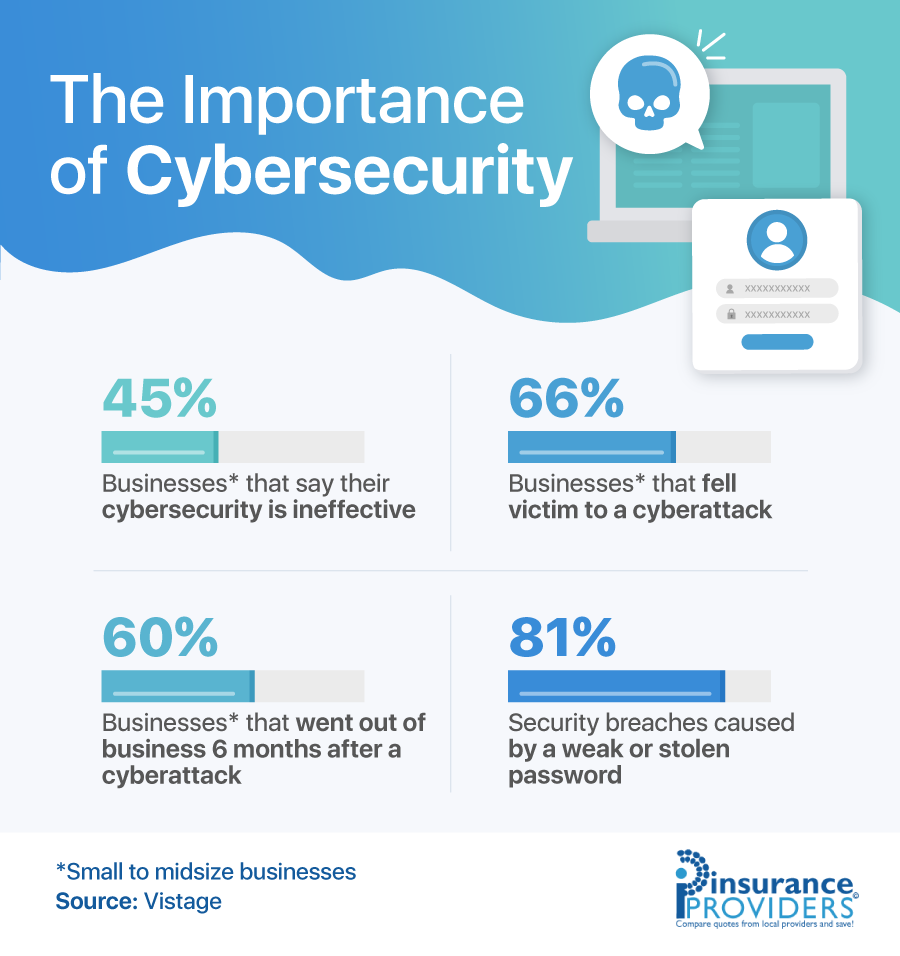

- As a result of a cyberattack on their company, 60% of small businesses went out of business

- The majority of attacks are caused by a stolen or weak password

Data is necessary for any company, but storing data always comes with security risks. Businesses have lost the trust of customers or gone under from leaked or hacked data. Unfortunately, cyberattacks are on the rise as more and more data is stored on electronic devices.

Therefore, the importance of cybersecurity and cyber insurance is not to be underestimated. Both of these factors are vital to determining companies’ success in the event of a cyberattack, and if cybersecurity fails, cyber insurance can prevent a company from going out of business in the case of a costly ransom payment.

Cyber insurance is an important type of business insurance that any company should consider, as hacking is on the rise. To learn more about the increase in cyberattacks and how to protect your business with cyber insurance, read on.

Why Cyber Insurance Is Important

Cyber insurance is just what it sounds like. It is insurance that covers the costs of data breaches, such as data recovery fees. What does cyber insurance actually cover? While it depends upon the policy, cyber insurance usually covers the majority of cybercrimes. Some of the costs associated with cybercrime include settlements, legal fees, pauses in business operations, and more.

Below, we will go into why getting cyber insurance to cover the cost of cybercrime is so important to businesses.

Cyber Crime Is Increasing

Why is cyber insurance so important? One of the most important reasons to invest in cyber insurance is that cybercrime is on the rise. AtlasVPN analyzed numbers from the Internet Crime Complaint Center and FBI and estimated that based on past numbers, the cost of damages from cybercrime will be $27 billion by 2025. Since the cost of cybercrime damages in 2019 was only $3.5 billion, that is a huge projected leap.

Take a look at the graphic below to see cybercrime cost increases in recent years.

Cybercrime can wrack up an expensive bill for companies. Numbers have been steadily increasing over the last decade. While the FBI recommends not paying ransom for hacked data, most companies have no choice but to pay to get their data or software back. Because of this, cybercrime has become a lucrative, albeit illegal, industry for hackers.

Ransomware is the most common type of cybercrime and has increased from $24 billion in 2015 to $170 billion in 2020.

Therefore, cybersecurity insurance for ransomware can save businesses from going under due to an expensive ransomware attack.

Max Turner, the CEO of CarDonationCenters.org, says, “Any company that has a website, stores sensitive customer information, or conducts business online should consider purchasing cyber insurance. The bigger your organization, the more you have to lose should your online security be compromised. Even small companies can suffer financial losses when their customers’ personal information is stolen.”

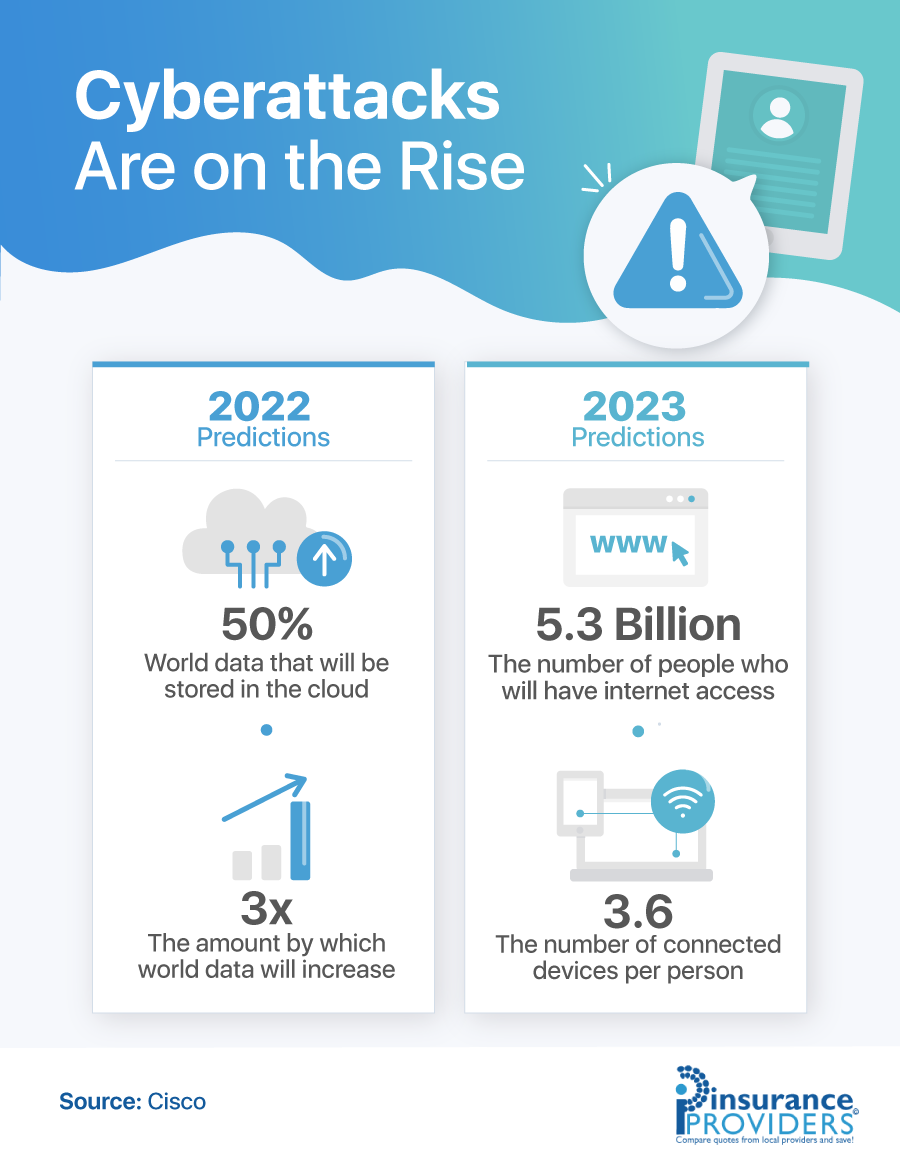

Why is cybercrime increasing? There are a number of reasons, from more Americans working from home during COVID-19 to more Americans having electronic devices. According to Cisco’s annual internet report, 70% of Americans worked from home in 2020, and 5 billion people had access to the internet, creating more opportunities for cybercriminals to hack into data. Cisco predicts that by 2031, there will be a cyberattack every two seconds.

Companies face threats from phishing, viruses, and more. These attacks are across a variety of devices, not just computers. Smartphones, tablets, cloud servers, and other technology are all at risk of cyberattacks.

Anyone can fall victim to fraudulent emails or phone calls, as hackers’ techniques are becoming more elaborate and convincing. Even those aware of common fraud scams may find themselves the victim of a cyberscam.

Businesses Are Unprepared for an Increase in Cyberattacks

The majority of businesses are unprepared for cyberattacks. Unfortunately, most of the common methods used for security, such as two-factor authentication or password management apps, are easily attacked by cybercriminals.

Security breaches due to a weak/stolen password made up 81% of security incidents in 2018. In 2019, the dark web had 15 billion stolen credentials for sale.

According to Vistage, 80% of IT managers believe their companies don’t have enough cybersecurity to prevent an attack. In addition, 77% of businesses lack an emergency plan for a cyber breach.

While most might assume that primarily large corporations are attacked, small and midsized companies are usually attacked first.

The cost of cyberattacks on these smaller businesses is astronomical and can result in a business failing. Taylor Murchison is the SEO growth director of OnTheMapMarketing.com and said that “While the importance of cyber insurance has grown in recent years, the repercussions of cybercrime can be just as severe as (if not more severe than) those of a physical crime such as theft or arson.”

Murchison continued, “Cyber insurance compensates your organization for specific financial damages incurred as a result of a cyber catastrophe. While it is particularly critical for businesses with digital presences, every organization with computers linked to the internet is susceptible to cyber hazards such as malware/viruses, distributed denial of service attacks, and data/privacy breaches.”

“For instance, you may have a website through which clients can make purchases or where you store client data. Such a digital presence invites the danger of being targeted by cyber thieves, and cyber insurance is intended to assist in mitigating the consequences of falling victim to cybercrime,” Murchison concluded.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Types of Cyber Insurance

There are a few different categories of cyber insurance that companies can purchase to protect their data. Coverage offerings can vary by company, but the two common types of insurance are first-party and liability insurance.

First-party cyber insurance covers common data breaches, such as data destruction, hacking, extortion, online theft, and more. All of these factors are usually outside of a victim’s control. In contrast, liability insurance covers incidents inside of the company’s or individual’s control. These coverages may also be called privacy liability, cyber liability, and more.

Dominic Harper is the founder of Debt Bombshell and says, “Regardless of your work, you should always get privacy liability as it is very important for any brand or network. Privacy liability coverages include consumer class action litigations and funds to a potential settlement, should a cyber incident or data breach occur.”

For example, a company employee may lose a laptop containing passwords that allow a hacker to steal information from a company. Sometimes first part and liability insurance will be bundled together and simply called a cyber liability insurance policy. It’s up to you to read the fine print of the coverages and cyber insurance requirements to ensure you are covered for factors outside of your control and employee mistakes.

Cost of Cyber Insurance

Cyber insurance can be expensive, although it varies from company to company. While you may not feel like adding cyber insurance to your list of business costs, keep in mind that the cost of a cyberattack without cyber insurance can devastate a company. Cyberattacks are difficult to prevent, especially ransomware, making cyber insurance a smart choice for most companies.

Just like car insurance or home insurance, the cost of your policy will depend upon your risk level. How cyber insurance works out your risk level includes factors like business type, amount of data stored, past cyber insurance claims, internet security, and more. You may be able to find varying prices among companies, so shopping around to find out who are the best insurance companies with the lowest rates can help you find savings.

Do you need cyber insurance?

If you aren’t sure if you need cyber insurance, Jibran Qazi, the CEO of My Canada Payday, recommends asking the following questions:

- What systems do your company use to protect this information?

- How often does your company train its employees on how to prevent cybercrimes and respond to breaches?

- Does your IT department monitor online activity within your company’s network?

- How often does your company change all of its passwords?

Qazi also says, “Once you have evaluated these factors, consider what would happen if a client was affected by a cybercrime that originated from your company. Would you be able to recover from this breach on your own, or would you need help paying for recovery measures? Do you need legal representation in addition to IT support?”

Is cybersecurity insurance necessary? Like any insurance, there are pros and cons to getting coverage. Cyber insurance covers most costs associated with recovering data, such as lawsuits or profit losses. What does cyber insurance not cover? It doesn’t cover physical property damage or leaked intellectual property. However, it is a necessary coverage to have as cyber insurance benefits generally outweigh the negatives.

If you are considering buying cyber insurance, you probably also want to know if it will cover any ransomware payments you might have to make. Ransomware claims are one of the most common claims, but insurance providers don’t always cover them. It’s important to check the coverage policy to see what damages your chosen provider covers.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cybersecurity and Cyber Insurance Tips

If you have questions about cyber insurance for your company and what types of threats you might face from cyberattacks, we’ve collected advice from multiple experts. From CEOs of cybersecurity help sites and services to insurance brokers, they answered the most important cybersecurity questions here.

Who should get cyber insurance?

“Any organization that harbors any degree of personal identifying information or records that would be considered sensitive in nature or related to finance. Small and medium-sized businesses (SMBs) are compromised by a cyberattack every 14 seconds. Additionally, 60% of companies that fall victim to a cyberattack go out of business within six months.

Cyber insurance can cover the legal aspects of a data breach, particularly the legal fees and costs of settlements, civil awards, or judgments resulting from a lawsuit. It will also cover liability costs centered on network security, privacy liability, and copyright infringement/domain name infringement (electronic media liability).”

What should a company look for when picking a cyber insurance protection plan for their company?

“The best policies cover costs associated with alerting customers, plus forensics, call center setups, consumer identity monitoring, legal fees, and a crisis management firm. But that may only dent the disaster. Policies don’t address loss in profits due to customers jumping ship. A policy can’t prevent a marred brand reputation.

Although a solid cyber insurance policy will cover notification, crisis management expenses, defense costs, damages, and the costs associated with regulatory action, it will not cover other, potentially much larger losses, such as reputational injury and loss of brand and market share.”

What are the main ways for companies to protect themselves from human error in addition to cyber insurance?

“Ongoing security awareness training. This involves a combination of micro e-learning, phishing simulation training, and live expert discussions. Beyond security awareness, training organizations must engage in vulnerability scanning initiated by the company CIO or CISO utilizing a managed security service provider.”

What are the biggest cybersecurity threats to companies?

“Insider threats due to malicious intent or simple mistakes, misconfigured systems, poor patch management, and poor password management all wrapped up in social engineering schemes.”

Robert Siciliano is the CEO of ProtectNowLLC.com.

Protect Now offers cybersecurity awareness training and certification.

What is Cyber Insurance?

“Cyber insurance is a type of insurance that covers risks and costs associated with cyber attacks, data breaches, and other cyber-related incidents. Cyber insurance can help businesses protect themselves from costly losses that could result from a cyber attack.

Cyber insurance can help businesses mitigate the risk of a cyber attack by covering costs such as data theft, loss of customer data, business interruption, damage to intellectual property, and more.

Businesses should consider obtaining cyber insurance if they are vulnerable to a cyber attack and potentially affected by the aftermath of a cyber attack. Cyber insurance can help businesses recover financially from an incident and ensure they can continue operations during a crisis.”

Do you need Cyber Insurance?

“When it comes to cyber insurance, the first thing businesses need to do is calculate their needs. This can be difficult, as cyber risk can be unpredictable and vary greatly from business to business.

However, some general guidelines can help businesses get a start. For example, a business with less than $5 million in annual revenue should consider starting with basic cyber insurance protections such as property damage and loss of data. A business with more than $5 million in annual revenue may consider additional coverages such as breach notification and data encryption.

Once businesses understand their needs better, they can search for the best possible cyber insurance coverage. Many options are available, so it is important to compare rates and reviews before making a decision.”

Some of the Important Risks in a Cyber Policy

“Cyber insurance is a growing industry, and businesses need coverage in case of a cyberattack. Some of the risks that companies face include the following:

- Loss of customer data: Cyberattacks can steal valuable customer data, which can lead to significant losses for businesses.

- Damage to business systems: Cyberattacks can destroy or disable business systems, leading to a loss of productivity and revenue.

- Insurance costs: Cyberattacks can also increase insurance premiums for businesses.

Cyber attacks can cause extensive damage to businesses if they don’t take the necessary steps to protect themselves.”

Noah Cammann is the CEO of Cofes.com.

Cofes provides security, VPN, and other business program reviews.

What does cyber insurance cover?

“Cyber insurance can protect businesses from a variety of cyber risks, including data breaches, malware infections, and online attacks. Coverage may include financial compensation for costs associated with the incident, such as damage to reputation or lost business.

Cyber insurance can also provide peace of mind knowing that the business is protected should an incident occur.”

How much does cyber insurance cost?

“Cyber insurance is important for businesses of all sizes, as cybercrime is rising.

The cost of cyber insurance varies depending on the policy, but a good estimate would be around $2 million per claim. It’s important to have coverage in case of an attack or data breach, as these can lead to costly consequences. Cyber insurance can also help businesses protect themselves from potential litigation.”

How to get cyber insurance?

“There are a few ways to get cyber insurance for businesses. Some insurers offer special rates for businesses, and some provide cyber coverage as part of their general liability insurance. Businesses can also self-insure by purchasing cyber insurance policies that cover them for damages caused by cyberattacks.”

Why is cyber insurance so expensive?

“Cyber insurance is expensive for a few reasons. First, the cost of cyber insurance coverage can be quite high compared to traditional insurance options. Cyber insurance policies typically include a higher deductible and a more comprehensive coverage than standard policies.

Second, there is often a lengthy waiting period before an insurer will approve a claim filed due to a cyberattack. This waiting period can extend for months or even years in some cases.

Lastly, many cyberattacks are not covered by traditional insurance policies. This means that individuals who are victims of such attacks may have to pay out-of-pocket for damages incurred.”

André Disselkamp is the CEO of Finsurancy.com.

His company consults businesses on insurance and finance matters.

“Cyber insurance is a growing field and is becoming more critical to companies as they become increasingly dependent on digital systems.

In recent years, hackers have turned their attention to stealing information and data from companies. This can be detrimental to the company’s reputation, financial standing, and customer loyalty. Cyber insurance helps protect businesses by providing a monetary amount that can be used to help recover from damages caused by a cyberattack.

However, cyber insurance does not provide full protection for your business. It is also important for businesses to invest in secure networks and software updates when possible and to train employees on safe practices for handling customer information and data.

Cybersecurity issues are a major concern for all businesses today, especially those that store sensitive customer information like credit card numbers or social security numbers.

Even if you don’t store this type of data on your servers, there are still ways hackers can get into your system through unprotected networks or by finding weak spots in your software updates (which happens more often than you’d think).

Cyber insurance, or cyber liability insurance coverage (CLIC), protects businesses from internet-based risks and, more generally, from risks relating to information technology infrastructure and activities.

Depending on the policy, cyber insurance may cover some or all of the following:

- Loss of data

- Noncompliance with privacy regulations

- Theft of funds or assets

- Multimedia content liability

- Transmission of malicious code or viruses

- Denial of service attacks

- Cyber extortion

Cyber insurance policies may be designed to insure against a variety of cyber-risks, including first-party costs such as data restoration, extortion, and theft; liability costs such as defense and damages in the event of a security breach; and business interruption costs.”

Patrick Dever is the owner of CouponNinja.com.

He works diligently to maintain cybersecurity for his website.

Who should get cyber insurance?

“A company, business, or individual should consider cyber insurance if they have a computer system that is connected to the internet or other type of network.

Alternatively, a business should consider cyber insurance if it processes, stores, or transmits credit card data (PCI DSS). For example, shops that process credit card payments via their website are required to have this type of coverage.”

What should a company look for when picking a cyber insurance protection plan for their company?

“To choose the right policy, consider the following:

- How good is your cyber insurance coverage?

- Will you have a deductible?

- Is there coverage for third-party losses in the event of a cyberattack or cybercrime?

- How much coverage do you need?

- What do you get for your premium?

Asking these questions will help you get the best coverage.”

What are the main ways for companies to protect themselves from human error in addition to cyber insurance?

“There are many ways to reduce the chances of human error. They include:

- Password management

- Software security upgrades

- Business continuity planning

Utilizing these strategies reduces the risk of human error.”

What are the biggest cybersecurity threats to companies?

“Here are some of the most common cybersecurity threats companies face.

A Trojan horse is software that allows a hacker to take over your computer. A virus is a piece of malicious code that can be spread directly or through a link to a website. Malware or spyware is software that acts as an electronic spy. It collects information and sends it to its creator.

Email phishing scams and social engineering scams (grandparent scams) involve hackers faking their identity and attempting to trick someone into revealing their information or clicking on a link from an email.”

Do you have any personal experiences with your cybersecurity failing?

“Yes, in a recent cyber breach, a company’s database of credit card information was stolen. This happened because the company did not have cyber insurance and did not perform any kind of security testing. The workforce, who should know better, had been emailing each other password-protected documents.”

Lynda Fairly is the co-founder of NumLooker.

Her site has a search tool for public records and background checks.

Who should get cyber insurance?

“Companies that have taken the full guarantee of their IT companies that their confidential information is safe with their systems should get cyber insurance. In cases of a cyber breach, the cyber insurance company has to pay the expenses of the amount of data leaked from their systems.”

What should a company look for when picking a cyber insurance protection plan for their company?

“They should go for a company that is very well reputed in the business as this cyber company will take care of their most crucial documents. So while selecting, they should select the company with the highest rating in this industry.

Also, before selecting a company, try to check the latest technology being used in cybersecurity and check whether the company you are selecting is equipped with the latest technology or not.”

What are the main ways for companies to protect themselves from human error in addition to cyber insurance?

“Companies can protect themselves from human error by not giving many people access to their company’s information. Also, the owner can add an eye or thumbprint scanner as a security measure to their cybersecurity systems.”

What are the biggest cybersecurity threats to companies?

“The biggest cyberthreat to breached companies is not losing money, but losing their confidential files and information. If anyone gets access to them, they can blackmail them or destroy the whole company. Nowadays, the biggest threat to companies is cyberthreats.”

Did you have cyber insurance to help cover some of the recovery costs?

“Cyber insurance would cover some recovery costs if the files get leaked from their systems by human error or system failure.”

Steven Walker is the CEO of Spylix.com.

Spylix facilitates legal parental and employee monitoring services.

Who should get cyber insurance?

“Cyber insurance is a must-have for any business that stores sensitive data on electronic devices or the cloud, regardless of the industry they operate in.”

What should a company look for when picking a cyber insurance protection plan for their company?

“Here are some factors to keep in mind when choosing cyber insurance:

- Total coverage

- Legal expenses

- Regulatory fines and penalties

- Credit monitoring

Companies should always look for these when picking a cyber protection plan.”

What are the main ways for companies to protect themselves from human error in addition to cyber insurance?

“The best way to protect yourself from human error is by conducting extra training sessions for employees. These training sessions should encompass factors that could help enhance your cybersecurity protection, the types of risks associated, and everything in between.”

What are the biggest cybersecurity threats to companies?

“Some of the biggest cybersecurity threats faced by companies include the following:

- Phishing

- Ransomware

- IoT vulnerabilities

- Cloud vulnerabilities

- Denial-of-service Attack (DoS)

Companies should be aware of these threats.”

Do you have any personal experiences with your cybersecurity failing?

“The biggest cybersecurity failure incident that I have witnessed was related to phishing. A couple of years ago, one of my employees received a message from one of our suppliers requesting additional information regarding one of our orders. There was a link provided to gain more information regarding the issue.

However, it turned out that the message was not from one of our suppliers after all; it was a phishing link. The employee clicked on that link, which led to the theft of sensitive company data. This was an example of human error causing a cybersecurity failure.”

Did you have cyber insurance to help cover some of the recovery costs?

“We did have cyber insurance. Luckily for us, our cyber insurance helped us recover almost 80% of the total recovery costs.”

Patrick Smith is the Editor-in-Chief of FireStickTricks.com.

Fire Stick Tricks uses VPN services to provide online security.

“Businesses that store important information digitally, whether that be their own sensitive information or that of their clients/customers, should definitely consider getting cyber insurance. And with the way that the business world operates these days, that includes most businesses.

Almost every business is vulnerable to a cyberattack, and cyberattacks can cause massive financial loss. When a data breach or some other kind of cyberattack occurs, there are a variety of different financial losses your business can incur. Rarely will you only deal with just one type of financial loss — usually, there is a handful of them that results in quickly added up costs.

Some of the main ways your company may be forced to spend money are through legal fees, general business disruption, loss of revenue, forensic analysis, software/equipment damages, public relations expenses, and more. Cyber insurance helps cover that financial loss, allowing your company to focus on rebuilding your cybersecurity and your reputation.

While every business, regardless of size, should seriously consider getting cyber insurance, I would say that small businesses should consider it even more. This may seem backward since large businesses have more customers and sensitive data and are thus seemingly bigger targets for attacks, but small businesses are essentially equal targets — they just have fewer means to recover from an attack.

Large businesses have much more financial security and resources to bounce back and take the necessary actions. They have greater support from investors, stakeholders, and staff.

Small businesses don’t have that kind of monetary or personnel support, so falling victim to a cyberattack without cyber insurance is much more likely to be the end of their business altogether.”

Kristen Bolig is the CEO of SecurityNerd.com.

Her site provides detailed reviews on various security systems.

“In recent years, cyber insurance has been a hot topic. With the growing number of cyberattacks, the increased demand for cyber insurance is inevitable. But what kind of insurance policies are available, and who should get them?

The main idea behind cyber insurance is to provide financial protection to businesses in the event of a data breach or other cyber-related attack. Such attacks may lead to significant lawsuits, fines, and recovery expenses.

Who should get cyber insurance? Most companies should consider getting some kind of cybersecurity policy. It is especially important for companies with a wide customer base and sensitive information. For example, healthcare organizations should take extra measures to protect their patients’ health records.

A single security breach can cost hundreds of thousands of dollars in recovery expenses and lost sales. In addition, it can damage your reputation, which is often hard to recover.

It is important to note that there are still many common misconceptions about cybersecurity insurance. For example, many people believe that such coverage will protect them from data breaches involving user passwords or credit card numbers.

However, most policies only cover scandals caused by hackers or viruses, not internal problems like employee negligence or improper password management.

Cyber insurance is a specific type of insurance policy that covers your company from the costs associated with recovering from a data breach.

In today’s business world, almost all companies rely on computers and technology to run their businesses. This means that almost every company risks losing their critical data to hackers or human error — such as accidentally deleting key files.

Cyber insurance is designed to cover the costs of recovering from these types of data loss events. For example, suppose you are holding on to customer credit card numbers that are stolen in a data breach. In that case, cyber insurance will cover the cost of replacing those credit cards and hiring forensic investigators to determine how the breach happened.

Cyber insurance can also cover the cost of restoring your IT systems after a virus infection or equipment failure. Cyber insurance can even cover the cost of crisis management services in the event that you need to hire a public relations firm to help restore your company’s reputation following a cyberattack.

Since cyberattacks are so affordable for criminal groups, there has been an explosion in cybercrime over the past few years. Now, small businesses are being targeted by hackers more aggressively than large companies. One of the reasons for this is because small companies tend to have less cybersecurity than large ones.”

Chad Price is the founder and CEO of ChadPrice.com.

As a business owner, he puts a high price tag on cybersecurity.

Who should get cyber insurance?

“Businesses that work digitally or want to store their information online should get cyber insurance.

Companies should invest in cyber insurance for protection against hackers and malware and to protect against any damage caused by human prone mistakes. Companies that rely on technology and have a relatively new crop of employees should also look into getting cyber insurance. It helps with saving business costs.”

What should a company look for when picking a cyber insurance protection plan for their company?

“A company should actively look for public relation expenses and liability/defense costs when selecting a cyber insurance protection plan for their company. This helps protect the company image in time of need, and any damages done can be paid off in time.”

What are the main ways for companies to protect themselves from human error in addition to cyber insurance?

“The main way for companies to protect themselves from human error is to change passwords every few months. This may look like a minor safety practice, but it can help protect from hackers and malware.”

What are the biggest cybersecurity threats to companies?

“The biggest threat to cybersecurity companies is hacked passwords, phishing, and ransomware. It may also include malware and heavy data breaches concerning sensitive information.”

Do you have any personal experiences with your cybersecurity failing?

“Yes, I have been hacked in the past, and it led to my company losing an excess of important information in the process. It took a whole year to set up a viable database again.”

Did you have cyber insurance to help cover some of the recovery costs?

“Yes, I did have cyber insurance at that time, and it helped me manage more than 70% of the damage. It proved to be a lifesaver during a tough time for my business. Getting cyber insurance has been my most fortunate decision since COVID-19, protecting me and my finances from any big mishap.”

Eduarda dePaula is the CEO of FindByPlate.com.

On her site, you can find suspicious activity reports by license plate.

Who should get cyber insurance?

“Any company that gathers clients’ personal data should get cyber insurance. Nowadays, data is regarded as a powerful resource. It has the power to make or break a company; thus, protecting it is crucial. Cybercrime is on the rise, and both big and small businesses are equally at risk.

Personal data, including phone numbers, credit card numbers, or social security numbers stored on premise or in the cloud, are vulnerable to these highly organized groups of digital criminals.

Many small business owners mistakenly think that they will not be targeted by such threats. If a business owner doesn’t protect its database, a cyberattack may cost the company a large sum of ransom money to get its data back.

Even a small business can be subjected to different types of cyberattacks such as ransomware, invoice manipulation, and customer credit card and record hacking, among others. On top of that, the damage to a company’s reputation may pose negative effects in the long run.

Firewalls and antivirus software are not enough to protect a business from the potency of rampant data hacking. Cyber insurance is a more comprehensive strategy to fortify a company’s digital defenses.

Cyber liability insurance has a wide range of coverage for data compromise protection, identity recovery, and cyber protection. Policies differ, but in general, cyber insurance is a safety net if ever a business encounters related problems.

As a CEO of a design agency with a huge customer database, I am less worried about my company’s overall health, thanks to cyber insurance. I believe that taking this proactive step will help secure the future of my company.”

Christiaan Huynen is the CEO and founder of DesignBro.com.

DesignBro is a global platform connecting clients to designers.

Who should get cyber insurance?

“Businesses that rely on the networks available online for creating, circulating, and storing data that includes the credit card details of the customers, as well as that of the company, should have cyber insurance. It will ensure their safety while working online and also cover the retrieval of data in the event of a cyberattack.”

What should a company look for when picking a cyber insurance protection plan for their company?

“The companies that are looking to select a cyber insurance protection plan for their needs should be careful of some expenses like forensic expenses, legal expenses, notification expenses, public relations expenses, credit monitoring, liabilities, and defense costs.”

What are the main ways for companies to protect themselves from human error in addition to cyber insurance?

“One of the best methods that companies can use to get rid of human error is to educate the whole mass of the employees by giving them as much training as one can. It would not only improve their knowledge but would also challenge their problem-solving skills.”

What are the biggest cybersecurity threats to companies?

“The most common cyberattack that has affected companies is phishing. Other than this, the other biggest issues affecting many companies’ cybersecurity are ransomware, social engineering scams, DDoS attacks, viruses from third-party software, cloud computing vulnerabilities, and other such corporate security challenges.”

Do you have any personal experiences with your cybersecurity failing?

“Yes, once my company was attacked, and the cybersecurity system failed to prevent the security breach. But thankfully, we somehow retrieved the data at the earliest time possible without any loss.

After the security breach, I immediately urged my team to remember what type of data was lost by going through the list and sorting out the issues and reporting them to the cybersecurity experts.”

Did you have cyber insurance to help cover some of the recovery costs?

“Yes, we have two cyber insurance policies to cover up some costs in an emergency. This helps us plan our budget without needing many changes to accommodate this security concern, and hence, the pressure surrounding our security system is reduced.”

David Reid is the Sales Director at VEMTooling.com.

VEM tooling is a plastic manufacturing and tooling company.

“Any business that stores data on a network is at risk for a cyberattack. Without cyber insurance, you could be on the hook for state and federal fines and penalties, a forensic investigation, breach notification costs, and even a class action or third-party lawsuit down the road — all hits on your balance sheet.

In addition, the COVID-19 pandemic emphasized a model where the essential point of contact between a business and its consumers is online, forcing companies into somewhat of a digital transformation. However, as organizations have relied much heavier on digital platforms to conduct their business, their exposures to cybercrime have also increased.

Cyber insurance covers first-party and post-breach expenses, such as legal fees, IT forensic investigation, compliance with state notification laws, credit monitoring for breached individuals, public relations and crisis management, regulatory fines, and more.

There is no standard cyber insurance policy that can be applied to every business, so having an experienced broker will be key to making sure you are adequately insured.

The biggest mistake companies make in determining how much cyber insurance they need is not factoring in the added exposure that vendors create. Many of the largest cybersecurity breaches were caused by a vendor, and quality cyber insurance policies would cover these losses.

It is important to work with your insurance broker proactively, who will assist by partnering with vendors and insurance carriers to address this through risk management solutions, including improved network defenses, multi-factor authentication, employee training, and third-party vendor security audits.”

Michael Zeldes is the Senior Vice President of HUBInternational.com.

HUB International is a leading global insurance brokerage.

“Cyber insurance is one of the more undersold types of coverage but emerging to be one of the most important.”

Who should get cyber insurance?

“Cyber insurance is a coverage that every business using a computer should consider purchasing. Hackers can target businesses’ computers in specific ways to maximize a payoff. Even if the business does not have any personally identifiable information of the owners, staff, or clientele, hackers can still find a way to cause harm and make money.”

What should a company look for when picking a cyber insurance protection plan for their company?

“When picking a cyber insurance policy, it is always best to have an independent agent help you so that you can utilize their experience to create a policy addressing your risks specifically. In a general sense, the best course of action is to purchase a standalone policy from an excess and surplus lines carrier.

Adding a cyber endorsement to a standard business owner’s policy will grant little coverage and not be sufficient. Key components to look for in the policy are cyber extortion, breach response, digital asset restoration, business income, reputational harm, technology liability, and compliance coverage.”

What are the main ways for companies to protect themselves from human error in addition to cyber insurance?

“Hackers enter systems through emailed links to personnel that doesn’t consider that it may be a phishing scam. Companies are now sending fake phishing emails to their employees to evaluate their knowledge and make sure they receive proper training if they fall victim to the controlled emails.

Buying the services of a company to set up and manage your cyber defenses is a great technique, as well as having data backups. Even though data backups are usually the first compromised system, they are still a good countermeasure for inexperienced hackers.”

What are the biggest cybersecurity threats to companies?

“One of the biggest threats is ransomware. When a hacker gets into the system, they lock down all the computers, destroy the backups, and demand a ransom before releasing the computers back to the company.

The reason I consider this the biggest threat is because the ransom can be astronomical. Cyber insurance carriers are paying up to the policy limit for many of the losses, driving up the cost of cyber insurance. This turns businesses away from buying cyber insurance because premiums are too high and leave them without coverage.”

Do you have any personal experiences with your cybersecurity failing?

“Personally, our agency has never had a cyber breach. However, in 2016, I worked as a consultant for MedStar Health on their real estate team when they were hacked. A ransomware attack shut down computers across ten hospitals in the Washington, D.C. area. Cyber insurance was groundbreaking back then, and it was rare for companies to have it.

The FBI got involved and was able to restore the system, but for approximately a week, everyone was fearful of how deeply the hackers penetrated the system. Our greatest concern was if the hackers had the capability to hold patients with life-supporting equipment hostage to get their payment.

Thankfully, there was no loss of life due to the incident, but it was a clear sign that cyberthreats are a huge risk.

I have also heard from other agencies about their experiences with being hacked. One was a phishing scam in which a hacker was in the agency’s system for months watching how the person in charge of finance distributed funds.

The hacker spoofed an email address to send an email requesting payment to that individual. The agency paid the hacker and then realized what happened a day or so later.”

Did you have cyber insurance to help cover some of the recovery costs?

“The agency’s cyber insurance policy helped them in the recovery of the funds, which were not an exorbitant amount. The policy helped the agency comply with New York State’s regulations for insurance agencies that get breached. Typically, the costs to comply with the regulation are higher than the initial loss to the actual hacker.

New York requires that the breached agency reports to the state and complies with an investigation by the state. Then, the agency needs to notify all clients of the incident and that they may have been affected.

The cyber insurance paid all those costs for the agency and paid to help rebuild the agency’s reputation. Those fees and costs were greater than the original repayment of the scammed amount. The cyber coverage was key to keeping the agency in business and retaining a great portion of its client base.”

Peter G. Conte is an insurance broker at HonigConte.com.

HCP provides business and personal insurance coverage in New York.

“Cyber security is a top priority for businesses of all sizes. The threats to businesses continue to increase, and cyber crime is now the number one criminal activity.

What is cyber security?

Cyber security refers to the protection of a business’s information and systems from cyber attacks. Cyber attacks can happen in a number of different ways, including through email, social media, and website attacks.”

What are the types of cyber attacks?

“There are two main types of cyber attacks: Spear phishing and hacking. Spear phishing is when a hacker tries to trick you into revealing your personal information. Hacking is when a hacker breaks into your computer network and accesses your information.”

What are the signs that my business is at risk?

“There are a number of signs that your business is at risk, and you should always be on the lookout for them. Some signs that your business is at risk include increased malware activity, unauthorized access to your systems, and a sudden increase in online traffic.”

What is cyber insurance?

“Cyber insurance is insurance that businesses use to protect themselves from cyber attacks. Cyber insurance can cover a variety of risks, including attacks that occur through email, social media, and website attacks.”

Is cyber insurance necessary?

“Most experts believe that cyber insurance is essential for businesses of all sizes. Without cyber insurance, businesses could face significant financial losses if they are hacked.

Cyber security is a top priority for businesses of all sizes. Cyber insurance is one way that businesses can protect themselves from cyber attacks. Cyber insurance can cover a variety of risks and is essential for businesses of all sizes.

A cyber insurance policy can also provide coverage for legal costs and other expenses related to a cyber attack, such as investigating the attack and filing a lawsuit.”

Lianzhen Yang is the CEO of Pala Leather.

His company sells custom-made clothing.

“Cybersecurity is on the minds of more and more companies and businesses. As more business goes online, so does more risk.

There is no ‘set’ cyber insurance policy. When taking out a cyber insurance policy, companies have to understand this policy is set to change month by month. Because of the ever-changing nature of cybersecurity, these insurance companies must continue changing.

Businesses of all sizes that do business online should have cyber insurance. Even small businesses are just as susceptible to being hacked and having data stolen. In fact, small businesses are becoming more and more likely to experience cyberattacks.

Choose cyber insurance that covers ransomware. Good cybersecurity should cover financial losses caused by a cyberattack. Understand every element of the cyber insurance you’re paying for and what it protects against.

Cyber insurance can help businesses stay productive. In the event of a cyberattack, business can slow or even come to a halt while the situation is being resolved. Insurance can help mitigate attacks, resolve them quickly if they arise, and help keep production on track.

Cyber insurance companies won’t just offer you protection — they want to know you’re taking steps to protect against risk too. Expect periodic risk assessments throughout the duration of your insurance period. There will also be negotiations and renewals.

There is a great reward for businesses that are moving online. With every reward comes risk, and cyber insurance is built to help protect against that risk. A data breach or security attack that takes down your website can make consumers lose trust in your website.”

Anthony Martin is the CEO of ChoiceMutual.com.

Choice Mutual offers final expense insurance policies.

“Cyber insurance is a type of insurance that protects against cyberthreats. Its primary purpose is to mitigate the negative consequences of cybersecurity incidents (like a data breach, ID theft, or a cyberattack). It also covers the expense of recovery from such incidents and assists a company in dealing with lawsuits.

Cybersecurity insurance, cyber-risk insurance, data breach insurance, and cyber liability insurance are all terms used to describe cyber insurance.

Small businesses are frequently extremely cost-effective since they invest in their organization, their staff, and their products. While they are focused on expanding their business and increasing revenue, they may ignore a vital component of long-term success: cybersecurity.

Cyber insurance should be purchased by businesses that store client information, accept online payments, or use cloud services. However, most (if not all) businesses today have an online presence and are routinely vulnerable to cyberthreats. Do not assume that you do not require cyber insurance because your firm is small.

Attacks are quite common. Many of the affected businesses have never reopened after being attacked by a cyberattack.

Cyberattacks cost hundreds of thousands of dollars on average for each organization. The most commonly reported data breach involves personally identifiable information, with credit and payment card information being one of the most frequently stolen kinds of data.

Maintaining cyber liability insurance will assist businesses in remaining functioning following an attack. Cyber liability insurance is critical. At the very least, cyber liability insurance assists businesses in complying with state rules requiring them to notify customers of a data breach containing personally identifiable information.

While you can never be certain that your cybersecurity will not be penetrated, you can insure against the expenditures that frequently emerge in such a circumstance.

A cyber insurance policy can cover the following expenses: business interruption, the cost of hiring negotiators and paying a ransom, recovery or replacement of records or data, liability, and loss of third-party data, defense of legal claims, copyright infringement, online misappropriation of intellectual property, crisis management and monitoring, and prevention of further attacks.

Cyber insurance will not protect a company from cyberattacks or expose it to cyber-risks, but it will help to limit the harm caused by a cybersecurity catastrophe. Cyber insurance is a critical safety net that ensures your organization can continue to prosper with minimal disruption following a security event.

Cyber insurance is becoming an essential component of firms’ cybersecurity plans. Noncompliance with necessary standards and laws, such as PCI DSS and HIPAA, may result in significant penalties and fines. Noncompliance fines may be covered by your cyber insurance policy.”

Matthew Paxton is the founder and owner of Hypernia.com.

Matthew reviews the best gaming servers and provides tech guides.

What are the biggest cybersecurity threats to companies?

“Phishing attempts are growing more complex. Phishing involves precisely targeted digital communications that are sent to trick individuals into clicking on a link that can then install malware or reveal personal data.

Now that most employees are more aware of the dangers of email phishing or clicking on suspicious-looking links, hackers are upping the ante by using machine learning to quickly craft and distribute convincing fake messages in the hopes that recipients will unwittingly compromise their organization’s networks and systems.

Hackers can steal user logins, credit card passwords, and other sorts of personal financial data, as well as obtain access to private databases using such assaults.

Ransomware strategies evolve. Every year, ransomware attacks are estimated to cost victims billions of dollars, as hackers use technology to essentially kidnap a person’s or organization’s databases and hold all of the data for ransom.

The development of cryptocurrencies like Bitcoin, which allow ransom demands to be paid anonymously, is attributed to helping to fuel ransomware attacks. As businesses focus on strengthening their defenses against ransomware attacks, some experts fear that hackers will increasingly target other potentially lucrative ransomware victims like high-net-worth individuals.

Other aspects of the cryptocurrency movement have an impact on cybersecurity. Cryptojacking, for example, is a practice in which cyber thieves use third-party computers at home or at work to ‘mine’ for bitcoin.

Because cryptocurrency mining (for example, Bitcoin) necessitates massive quantities of computer processing power, hackers can profit by discreetly piggybacking on other people’s systems. Cryptojacked systems can cause major performance difficulties and costly downtime for firms as IT traces down and remedies the problem.

Aside from hackers wanting to gain money by stealing personal and corporate data, entire nation-states are now utilizing their cyber capabilities to penetrate other governments and launch assaults on key infrastructure.

Cybercrime is a huge threat today, not just to the business sector and people but also to the government and the entire country. State-sponsored attacks are predicted to rise as we approach 2023, with strikes on key infrastructure being of particular concern.

Many of these attacks target government-run systems and infrastructure, but private companies are also vulnerable.

The Internet of Things (IoT) is becoming more common by the day. By 2025, the number of linked devices is estimated to reach 75 billion. Laptops and tablets, of course, are included, but so are routers, webcams, home appliances, smartwatches, medical gadgets, manufacturing equipment, autos, and even home security systems.

Consumers benefit from connected gadgets, and many organizations are increasingly using them to save money by collecting massive volumes of useful data and improving corporate operations. However, as more devices become connected, the potential of cyberattacks and infections increases, making IoT networks increasingly vulnerable.

IoT devices can be exploited to cause havoc, overload networks, or shut down crucial equipment for financial gain once they are in the hands of hackers.”

Daniel F. Carter is an SEO Manager at ManhattanTechSupport.com.

Manhattan Tech Support provides IT support and service packages.

Who should get cyber insurance?

“Cyber insurance is an important tool for any business, but it is especially important for businesses that deal with sensitive data, such as credit card information or social security numbers. Hackers are becoming more and more sophisticated, so it is important to have a plan in place in case your business is hacked.

A good cyber insurance policy will help you recover from a data breach, and it will also help you protect your business from future attacks. So if you are not already insured, it is time to consider cyber insurance.”

What should a company look for when picking a cyber insurance protection plan for their company?

“Here are some things to look for when choosing a plan:

- Is the insurance provider reputable and reliable?

- What kind of coverage do they offer?

- Make sure they have a comprehensive plan that covers all aspects of your business.

- How much does the policy cost?

- Make sure you get quotes from several providers and compare prices before making a decision.

- How long has the insurer been in business?

- The longer they’ve been in business, the more experience they’ll have in dealing with cyber incidents.

- Does the company have a good track record when it comes to claims?

When picking a cyber insurance protection plan, it’s important to work with an experienced broker who can help you find the right coverage for your company.”

What are the main ways for companies to protect themselves from human error in addition to cyber insurance?

“There are several ways companies can protect themselves from human error. One key way is through cyber insurance and cybersecurity. Cyber insurance can help protect companies against losses that may occur as a result of a data breach or other cyberattack. And cybersecurity can help protect companies against hacks, malware, and other online threats.

Other ways companies can protect themselves from human error include implementing policies and procedures that reduce the risk of mistakes and training employees on how to safely and securely handle company data.”

What are the biggest cybersecurity threats to companies?

“There are a few key areas that companies should focus on to protect themselves from cybersecurity threats.

One of the most important is ensuring that your company has strong cyber insurance. Cyber insurance can help protect your business from financial losses in the event of a data breach or other cyberattack.

Another key is to make sure that your company has strong security measures in place, including firewalls, antivirus software, and employee training on how to spot phishing attacks.

Finally, it’s important to stay up-to-date on the latest cybersecurity threats and how to protect against them. This can be done through industry publications, conferences, and networking with other experts in the field.”

John Espenschied is the owner of InsuranceBrokersGroup.com.

He has over 20 years of experience in personal and commercial insurance.

“Cyber insurance is a ‘must-have’ for any business that deals with the internet or wants to protect its customers. A lot of businesses are feeling the pain of cyberattacks because they are not taking the necessary precautions. Consumers are also at risk when they are using their devices to do business on the internet.

Some of the things a company should look for when picking their plan include how much coverage they want, how quickly they want to receive a payout, and whether or not they’re willing to use a deductible.

In order to protect themselves from human error in addition to cyber insurance, companies can use a mixture of managerial, technological, and operational tools. Managers should implement a protocol for the employees in order to handle potential issues that might arise.

In terms of technology, managers can install software to monitor networks and identify potential threats or weaknesses. Operational procedures are also helpful because they can provide a streamlined process that ensures the safety of the company’s important data.

The biggest threat is the insider threat. This is because employees are not aware of the risks and threats and are more likely to click on suspicious links, give away personal information, or share files without thinking.

Recently, an employee at our company got a phishing email in his inbox that looked like it came from a company he had just received a lot of correspondence from, but in actuality, the email was from an unfamiliar website.

The employee clicked on the link and entered his login information, which allowed the site to have access to the employee’s account and email. The site then sent messages, ostensibly from the employee to all of the other employees.

Yes, we had cyber insurance to help cover some of the recovery costs. My cyber insurance policy covered 75% of the recovery cost, and my deductible was $10,000. The policy has been helpful in recovering from last year’s attack.”

Stephen Curry is the CEO of CocoSign.com.

CocoSign is a secure E-Sign service provider.

Who should get cyber insurance?

“Businesses of all sizes and some individuals should consider getting cyber insurance to protect against financial loss from a data breach or other cybersecurity incident.

Multiple things need to be considered before you decide to get insurance. First, you need to think about your type of business because some industries face a greater risk than others. If you store or process any sensitive data, such as credit card information or health records, you may want to look into cyber insurance.

You also need to consider your business size. Larger businesses can afford more expensive policies with higher limits, but smaller organizations can still benefit from lower-limit policies at relatively low prices. Some individuals should also think about personal cyber insurance, depending on how much sensitive data they are responsible for.

This usually applies to freelance workers that aren’t represented by a corporation that already provides them coverage.

What should a company look for when picking a cyber insurance protection plan for their company?

“There are a lot of things to consider when it comes to picking the best cyber insurance plan for your company. Here are a few very important questions to ask:

How well does the provider understand your business model?

Your provider should understand your business model almost as well as you do to ensure your security needs are being held up. They need to know what you do, the industry you’re in, and what type of information you are trying to protect.

What cyber events are covered by the policy?

There are many different types of breaches that could occur online, and you need to ensure that your coverage will protect you in those circumstances. Whether it’s a data breach, malware infection, ransomware situation, hacker extortion, or simply a business email compromise, you need to know that your provider knows the coverage you want.

What is the cost of premiums?

This is important to ask to ensure that the premiums are as expected, and you know what this policy will cost your company.

How does it all compare to other companies?

Finally, do your research and get multiple quotes. Make sure you’re working with a well-known and trusted provider that will provide you with a good price for good quality service.”

What are the main ways for companies to protect themselves from human error in addition to cyber insurance?

“The best way for companies to protect themselves from human error when it comes to cybersecurity is to build a culture of cybersecurity at work. A culture of cybersecurity is one where every employee knows the risks that exist online and knows how to avoid potentially dangerous online locations.

It also extends to the customers; a culture of cybersecurity is one where each customer feels safe in their shopping and interactions with employees. The first and most important step to this is clarity. Being open with your employees and organization members about risks and avoidance is key.

It’s important to not sugarcoat information, rather than just be clear about your expectations for staff and explain why. This should be a top to bottom approach; upper-level company members should begin practicing safe internet usage and explain why this is essential to lower-down staff.

If the management does it first, others will tend to follow. Another active step is setting goals for the organization about cybersecurity. What do you hope to achieve, how can cybersecurity help you with that, and how would a breach affect your goals? An aura of competition and active attention is always beneficial to preventing cybersecurity threats.”

What are the biggest cybersecurity threats to companies?

“The most common cybersecurity threat we see is in relation to malware and ransomware installations. By surfing the internet and going to unprotected sites, employees can unwittingly download malware on their computer, or even ransomware, which is malware that encrypts your computer systems and prevents you from accessing files and password-protected programs.

These situations are known to occur in offices, simply due to the number of people online and the lack of protection they use while surfing the web.”

Patricia Vercillo is the VP of Operations at SmithInvestigationAgency.com.

For over 15 years, she has helped clients with security investigations.

“One of the points I routinely address in my articles is the need for insurance by new businesses, and the idea of ‘cyber insurance’ is something I am just beginning to hear more about.

First, ask yourself whether you really need a separate policy for cyberattacks. A name like ‘cyber insurance’ sounds modern and important, but your property, liability, and exclusion/omission insurance policies may already cover most or all of the losses you are concerned about. In that case, cyber insurance is just a solution in search of a problem.

Most new businesses, however, are not going to need a cyber insurance policy.

Some businesses that are more technology-focused, on the other hand, may benefit from a particularized cyber insurance policy. If your company provides servers or email services to other companies, for example, making sure that you are adequately insured against cyberattacks not only makes sense, it’s critical.

A potential benefit of cyber insurance may be that it provides insurance against the financial damage caused by ransomware attacks, which will likely not be covered in a standard property insurance policy. In other words, if a company has to pay several thousands of dollars to unlock their system, there may be an insurance policy that would pay for that.

Because so many ransomware attacks happen due to operator error (i.e., opening a suspicious email), you might have trouble finding an insurer to cover this.

Like other forms of insurance, the bottom line with cyber insurance is to read the policy and know exactly what you are buying.”

Matthew Carter is an attorney at IncandGo.com.

Inc and Go guides businesses through initial formation and setup.

Who should get cyber insurance?

“Businesses that keep sensitive data in the cloud or electronic devices should consider purchasing cyber liability insurance to protect themselves against data breaches.

Data breaches, system hacks, ransomware extortion payments, and denial-of-service attacks may lead to financial losses for firms without adequate cybersecurity insurance. If your small company keeps confidential data on the internet or a computer, this insurance may benefit you.”

What should a company look for when picking a cyber insurance protection plan for their company?

“Your company’s requirements should be taken into consideration.

Various kinds of coverage are offered, including fraudulent transactions, employee and customer information leakage, third-party litigation, business disruption and extortion, and many more. You may not need all of them, so it’s crucial to analyze what each one provides and what features you need to safeguard yourself in the event of a cyberattack.

Look for a service provider with experience working with small and medium-sized businesses. The demands and exclusions of large companies will vary from those of small businesses, so don’t be hesitant to inquire about the variations in coverage across plans and carriers.”

What are the main ways for companies to protect themselves from human error in addition to cyber insurance?

“The first step is to give substantial and regular training while raising public awareness of security problems and concerns. From a single unintentional remark on Facebook and using the same passcode for a personal and professional account to installing an app on a personal device, anything might give cybercriminals access to a system that has been compromised.”

What are the biggest cybersecurity threats to companies?

“Thousands of organizations are targeted each year by ransomware, which is one of the most popular and crucial cyberattacks. Because they are among the most profitable types of assaults, these attacks have only grown in frequency over time.

Once the data has been encrypted not to be used or accessed, ransomware demands that the firm pay the ransom to get it back. The result is that organizations are forced to make a difficult decision: either pay the ransom and risk losing large quantities of money or impair their operations due to data loss.”

Jeff Mains is the CEO of ChampionLeadership.com.

He is an entrepreneur with five successful startups.

“When picking a cyber insurance protection plan for your company, there are a few factors that you will want to consider. One of these factors involves the suitability of the coverage for your company. In other words, if the coverage does not fit your company, then it is not worth buying.

Make sure that you review the entire policy and do not just skim over it. You will also want to consider deductible amounts, policy limits, and coverage options.

If you are not familiar with the most significant threats, then you will not know where to look for cyber insurance protection plans. Threats like online fraud and scams, malicious software, data breaches, credit card theft, and identity theft are just a few of the many threats that you should know about.

If you are a business owner, you want to know that you have adequate coverage and protection because if your company comes under cyberattack, it could put your business in jeopardy and your reputation in the toilet.

You want to make sure that your company is protected from these threats, but you also want to ensure that you have adequate protection and coverage. So knowing what to look for is key.

Our company specializes in car insurance, and we see the need to protect our clients from the theft of their personal information, identity theft, and other related cybercrimes. We are always finding new technology and ways to give our clients the best possible protection.”

My Choice provides online insurance policy price comparisons.

Who should get cyber insurance?

“People who are in high-risk industries such as healthcare, finance, and manufacturing; people with high-risk jobs such as IT professionals, lawyers, bankers, and engineers; and businesses that handle or store sensitive data or information should all get cyber insurance.”

What should a company look for when picking a cyber insurance protection plan for their company?

“When it comes to cyber insurance protection, a company should look for a plan that best fits their needs. There are many factors to consider when picking the right plan. Companies should not just focus on the cost of protection but also their own risk profile and their industry’s risk profile.

A company should also consider whether they want to be covered by one insurance provider or multiple providers.”

What are the main ways for companies to protect themselves from human error in addition to cyber insurance?

“There are different ways for companies to protect themselves from human error in addition to cyber insurance. These include the following:

- Security awareness training: this is a mandatory training program where company employees are trained on how to stay safe online and avoid being hacked or falling victim to phishing scams.

- Cybersecurity software: this is software that can be installed on company computers and mobile devices for protection against hackers and viruses.

- Data backup: this ensures that all data stored on company computers, mobile devices, servers, etc., are backed up in case the device gets lost or stolen.

It is extremely important to protect against human error.”

What are the biggest cybersecurity threats to companies?

“The most common threats that companies face are phishing and malware. These two threats are often used together in a single attack called spear-phishing or whaling.

Spear-phishing is when the cybercriminal sends an email with malicious content designed to trick the user into clicking on a link or downloading an attachment that will allow the attacker access to their computer system or network.”

Michael J. Baldicana is an SEO specialist with DreamChasers.xyz.

Dream Chasers is a global digital marketing agency.

What is covered by cyber insurance?

“Cyber security is one of the most important issues facing businesses today. The risk of a cyber attack is constantly growing, and it’s vital that businesses take steps to protect themselves. Cyber insurance can help protect businesses from a wide range of cyber-attacks.

Cyber insurance can protect businesses from damages that could occur as a result of cyberattacks, such as identity theft, loss of revenue, and data breaches. Cyber insurance typically covers losses that result from unauthorized access to computer systems or the distribution of malware.

There are a number of different types of cyber coverage available, and each may have different requirements. Businesses should consult an insurance agent or review their policy to determine what type of coverage is best for them.”

How much does cyber insurance cost?

“Cyber insurance has become increasingly important for businesses in the age of technology. With so much information and communication being handled electronically, cybercrime has become a pressing concern for business owners.

The cost of cyber insurance can be prohibitive for some small businesses, but it is an important investment to protect your business from potential damage.”

How to get cyber insurance?

Cyber security is an ever-growing concern for businesses of all sizes. Cyber insurance can help mitigate the risk of digital incidents and protect your business from potential financial losses. There are a number of ways to get cyber insurance, and it’s important to find an insurer that has the right coverage for your business.

It is important to talk to your insurance provider about whether they offer specific cyber insurance policies for businesses. Some insurers offer special discounts or bundling opportunities for customers who purchase cyber insurance together with other types of coverage, such as property or liability protection.

It’s also important to ask about any exclusions or limitations that may apply to your policy.

Cyber insurance is a vital tool for businesses of all sizes. It can protect businesses from a wide range of cyberattacks and help protect your data and systems.”

Vlad Mishkin is the founder of WebScraping.Ai.

His company solves web scraping issues at scale.

What are the risks covered by cyber insurance?

“Businesses of all sizes need to protect their data and their intellectual property. Cyber insurance is a way to do just that. It provides coverage for a range of cyber-related risks, including data theft, data loss, computer viruses, and other attacks.

Some common cyber insurance coverage includes:

- Data breaches: If your business suffers a data breach that exposes the personal information of customers or employees, cyber insurance may help cover the costs of restoring trust with affected individuals and repairing damage to your reputation.

- Cyber scams: Cyber scammers target businesses every day, hoping to steal sensitive information or gain access to company resources. If your business falls victim to a cyber scam, cyber insurance can help cover the cost of catching and prosecuting the perpetrators.

- Online attacks: An online attack is basically any attempt made by an unauthorized person to access or damage property or networks connected to the internet. Cyber insurance can help cover the cost of repairing damage caused by such an attack, as well as any legal fees incurred in defending against it.

Cyber insurance is a vital part of any business’s defensive strategy. Cyber risks can include data breaches, cyber scams, online attacks, and more. A cyber insurance policy can help your business cover the costs of damages caused by any of these events.”

How much does cyber insurance cost?

“The importance of cyber insurance for businesses cannot be overstated. Cybercrime continues to grow in popularity, costing businesses an estimated $450 billion globally in 2017. In the United States, cybercrime is the fastest growing crime category, with reported losses increasing by 167% over the past five years.

Given the severity of these costs and the ever-growing threat of cyberattacks, it’s no surprise that cyber insurance is quickly becoming one of the most important investments a business can make.

Cyber insurance is a vital tool for businesses of all sizes. It provides coverage for a range of cyber-related risks. It is important to find the right policy for your business and to understand what is covered.”

Ryan Brown is the founder of Art of Lock Picking.

His site provides valuable insight on theft and security.

What is cyber insurance?

“Cyber insurance is a type of insurance that provides coverage for cyber attacks. It is important for businesses to have cyber insurance because cyber attacks can cause extensive damage to businesses.

Cyber insurance is a type of insurance that covers losses due to cybercrime. Cybercrime includes activities such as hacking, phishing, and spamming. Cyber insurance can help businesses protect themselves from financial losses caused by cyber-attacks.

Cyber insurance can also help businesses cover the costs associated with responding to a cyber attack, such as damage to computer systems or data.”

What is covered by cyber insurance?

“Cyber insurance is a type of insurance that provides coverage for damages caused by cyber-attacks. Cyber insurance can cover a wide range of activities, including data breaches, computer theft, and online fraud. Cyber insurance can also protect businesses against lawsuits related to cyber incidents.

How much does cyber insurance cost?

“Cyber insurance can be a costly investment for businesses, but it’s important to consider the importance of cyber security before making a decision. Cyber security experts have warned for years that cyber attacks are becoming increasingly common and more sophisticated.