Top Auto Insurance Provider for International Students in 2026 (Top 10 Companies)

Embark on the nuanced landscape of top car insurance provider for international students with State Farm, USAA, and Progressive. Discover the unmatched coverage, student discounts, and tailored policies these top companies offer for international students.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Chris Abrams

Updated March 2024

Company Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Discover the top car insurance provider for international students like Progressive, USAA, and State Farm. These companies offer tailored rates and safety-centric savings. This guide involves considering affordability and reliability.

Whether you are visiting the U.S. for a summer of study or living here long-term as a full-time student, you will often need a car to get around.

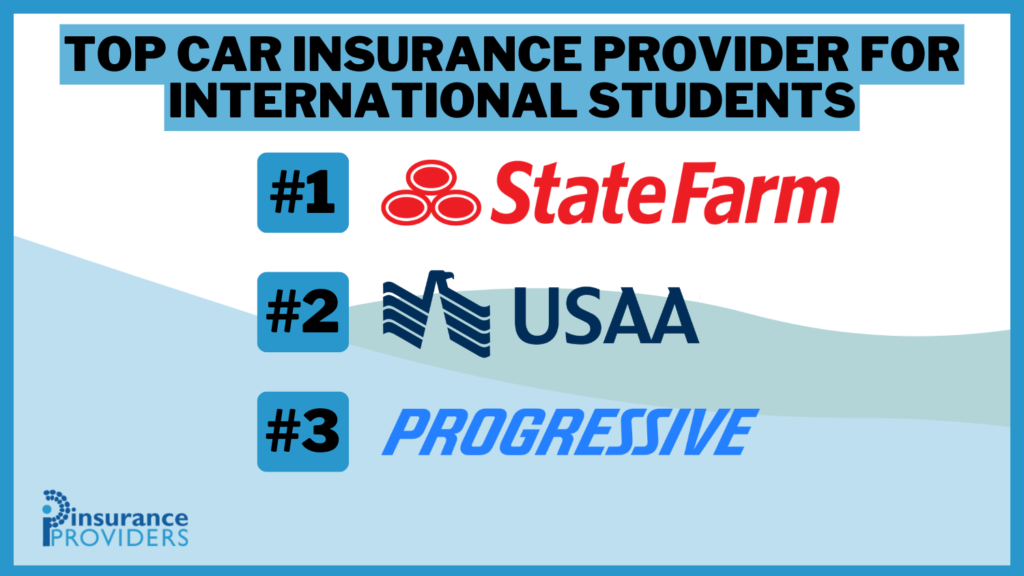

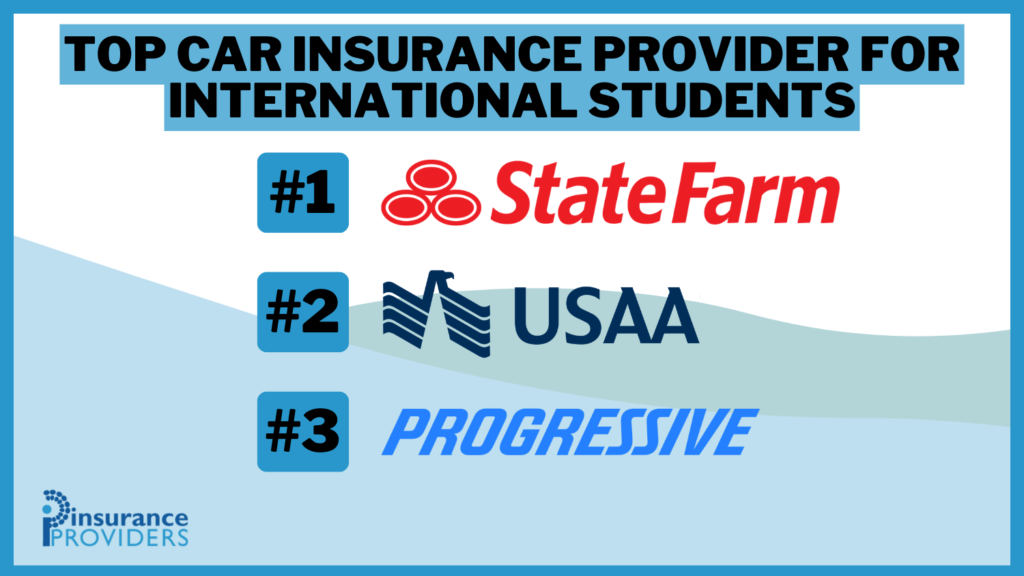

Our Top 10 Best Companies: Top Auto Insurance Provider for International Students

| Company | Rank | See Pros/Cons | Good Student Discount | Multi-Car Discount | Best for |

|---|---|---|---|---|---|

| #1 | State Farm | Up To 25% | Up To 20% | Vanishing Deductible | |

| #2 | USAA | Up To 15% | Up To 10% | Safe-Driving Discounts | |

| #3 | Progressive | Up To 20% | Up To 12% | Multi-Policy Discounts | |

| #4 | Allstate | Up To 20% | Up To 15% | Bundle Discounts | |

| #5 | Nationwide | Up To 15% | Up To 10% | Customizable Policies |

| #6 | Liberty Mutual | Up To 22% | Up To 13% | Comprehensive Coverage |

| #7 | Farmers | Up To 15% | Up To 10% | Local Agents | |

| #8 | AAA | Up To 10% | Up To 11% | Policy Options |

| #9 | Travelers | Up To 12% | Up To 9% | Online Convenience |

| #10 | Esurance | Up To 15% | Up To 10% | 24/7 Support |

Many colleges and universities are located in densely populated areas with easy access to mass transportation, but this is not always the case. Regardless, you will often find the ability to drive a car beneficial during your stay in the U.S.

If you plan to use a car while studying in America, you will need auto insurance. We’ll help you find the top auto insurance providers for international students. If you’re ready to shop for the best auto insurance rates in your area, enter your ZIP code here to get started.

#1 – State Farm: Academic Excellence Discounts and Vanishing Deductibles

State Farm, with its focus on academic excellence discounts and vanishing deductibles, stands out as a top choice for international students seeking reliable and comprehensive auto insurance coverage.Zach Fagiano Licensed Insurance Broker

Pros

- Up to 25% good student discount: State Farm offers a substantial good student auto insurance discount of up to 25%, making it an attractive option for international students with excellent academic records.

- Up to 20% multi-car discount: State Farm provides a significant multi-car discount of up to 20%, allowing families or roommates to save on their auto insurance premiums.

- Vanishing deductible feature: State Farm stands out with its vanishing deductible feature, enabling policyholders to reduce their deductible over time if they maintain a clean driving record.

Cons

- Potentially higher rates: While State Farm offers various discounts, some customers may find that their base rates are relatively higher compared to other providers.

- Limited online convenience: State Farm’s online services might not be as extensive as some competitors, potentially impacting the convenience for tech-savvy customers.

Read more: State Farm Car Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Military Precision in Savings and Safe-Driving Rewards

Pros

- Up to 15% good student discount: USAA provides a good student discount of up to 15%, making it an attractive choice for students with strong academic performance.

- Up to 10% multi-car discount: The company offers a multi-car discount of up to 10%, providing additional savings for families or individuals insuring multiple vehicles.

- Safe-driving discounts: USAA focuses on safe-driving discounts, rewarding policyholders for maintaining a good driving record with potential premium reductions.

Cons

- Eligibility restrictions: USAA membership is limited to military members, veterans, and their families, making it inaccessible to the general public.

- Limited physical locations: USAA primarily operates online and through phone services, which may be a drawback for customers who prefer in-person interactions.

Read more: USAA Car Insurance Review

#3 – Progressive: Innovative Policies With Varied Discounts

Pros

- Up to 20% good student discount: Progressive offers a generous good student discount of up to 20%, making it an appealing option for academically successful international students.

- Up to 12% multi-policy discounts: Progressive provides multi-policy discounts of up to 12%, encouraging customers to bundle auto insurance with other policies for additional savings.

- Varied coverage options: Progressive stands out for offering diverse coverage options, allowing customers to customize their policies according to their specific needs.

Cons

- Slightly higher rates: Progressive’s rates may be slightly higher for certain customer profiles, potentially making it less competitive in terms of pricing.

- Customer service feedback: Some customer reviews suggest varied opinions on Progressive’s customer service, with occasional concerns raised about responsiveness and claim handling.

Read more: Progressive Car Insurance Review

#4 – Allstate: Bundled Savings and Generous Good Student Discounts

Pros

- Up to 20% good student discount: Allstate offers a good student discount of up to 20%, providing cost savings for students with good academic standing.

- Up to 15% multi-car discount: Allstate provides a multi-car discount of up to 15%, making it an appealing choice for families or individuals insuring multiple vehicles.

- Bundle discounts: Allstate offers bundle discounts, allowing customers to save by combining multiple insurance policies such as auto and home insurance.

Cons

- Potentially higher premiums: Some customers may find Allstate’s base premiums to be relatively higher compared to other providers, affecting the overall cost of coverage.

- Mixed customer service reviews: Customer reviews suggest varied opinions on Allstate’s customer service, with both positive and negative feedback, indicating inconsistent experiences.

Read more: Allstate Car Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Customizable Coverage Tailored to Individual Needs

Pros

- Up to 15% good student discount: Nationwide provides a good student discount of up to 15%, making it an attractive option for students excelling academically.

- Up to 10% multi-car discount: The company offers a multi-car discount of up to 10%, providing additional savings for households with multiple vehicles.

- Customizable policies: Nationwide allows customers to customize their policies, tailoring coverage to meet individual needs and preferences.

Cons

- Average customer satisfaction: While Nationwide maintains a solid reputation, some customer reviews suggest average satisfaction levels, indicating room for improvement in customer service.

- Limited local agents: Nationwide may have fewer local agents compared to some competitors, potentially affecting accessibility for customers who prefer face-to-face interactions.

#6 – Liberty Mutual: Substantial Good Student Discounts and Comprehensive Coverage

Pros

- Up to 22% good student discount: Liberty Mutual offers a substantial-good student discount of up to 22%, making it an appealing choice for students with strong academic performance.

- Up to 13% multi-car discount: The company provides a multi-car discount of up to 13%, offering savings for households with multiple vehicles.

- Comprehensive coverage options: Liberty Mutual stands out for providing comprehensive coverage options, allowing customers to tailor their policies to specific needs.

Cons

- Potentially higher rates for some: Liberty Mutual’s rates may be higher for certain customer profiles, potentially making it less competitive in terms of pricing.

- Mixed customer reviews: Some customers have expressed mixed opinions about Liberty Mutual’s customer service and claims handling, suggesting variability in experiences.

Read more: Liberty Mutual Car Insurance Review

#7 – Farmers: Local Presence, Student Savings, and Personalized Service

Pros

- Up to 15% good student discount: Farmers provide a good student discount of up to 15%, making it an attractive option for students with strong academic performance.

- Up to 10% multi-car discount: The company offers a multi-car discount of up to 10%, providing additional savings for households insuring multiple vehicles.

- Local agents: Farmers stands out for its network of local agents, offering personalized assistance and in-person support for customers who prefer face-to-face interactions.

Cons

- Potentially higher premiums: Some customers may find Farmers’ base premiums to be relatively higher compared to other providers, impacting overall affordability.

- Mixed reviews on claims process: Customer reviews suggest mixed opinions about the claims process, with some expressing satisfaction and others facing challenges, indicating variability in experiences.

Read more: Farmers Car Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – AAA: Membership Benefits, Multi-Car Discounts, and Diverse Policy Options

Pros

- Up to 10% good student discount: AAA offers a good student discount of up to 10%, providing cost savings for students excelling academically.

- Up to 11% multi-car discount: The company provides a multi-car discount of up to 11%, allowing households with multiple vehicles to save on their premiums.

- Policy options: AAA stands out for offering various policy options, allowing customers to choose coverage that aligns with their specific needs.

Cons

- Membership requirements: AAA requires membership for access to its insurance services, limiting availability to individuals who are part of the AAA club.

- Potentially higher rates for some: AAA’s rates may be higher for certain customer profiles, potentially making it less competitive in terms of pricing.

Read more: AAA Auto Insurance Review

#9 – Travelers: Online Convenience, Academic Rewards, and Multi-Vehicle Savings

Pros

- Up to 12% good student discount: Travelers offers a good student discount of up to 12%, making it an attractive option for academically successful international students.

- Up to 9% multi-car discount: The company provides a multi-car discount of up to 9%, allowing households with multiple vehicles to save on their auto insurance premiums.

- Online convenience: Travelers emphasize online convenience, making it easy for customers to manage policies, make payments, and access information through digital platforms.

Cons

- Mixed customer reviews: Customer reviews suggest varied opinions about Travelers’ customer service, with both positive and negative feedback, indicating inconsistent experiences.

- Limited local presence: Travelers may have a limited local presence compared to some competitors, potentially affecting accessibility for customers who prefer in-person interactions.

Read more: Travelers Car Insurance Review

#10 – Esurance: 24/7 Support, Good Student Discounts, and Multi-Car Savings

Pros

- Up to 15% good student discount: Esurance provides a good student discount of up to 15%, making it an appealing choice for academically successful international students.

- Up to 10% multi-car discount: The company offers a multi-car discount of up to 10%, providing savings for households with multiple vehicles.

- 24/7 support: Esurance stands out for offering 24/7 support, ensuring that customers can access assistance at any time, day or night.

Cons

- Mixed customer reviews: Customer reviews suggest varying opinions about Esurance’s customer service, with both positive and negative feedback, indicating variability in experiences.

- Potential higher rates for some: Esurance’s rates may be higher for certain customer profiles, potentially impacting overall affordability.

Read more: Esurance Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

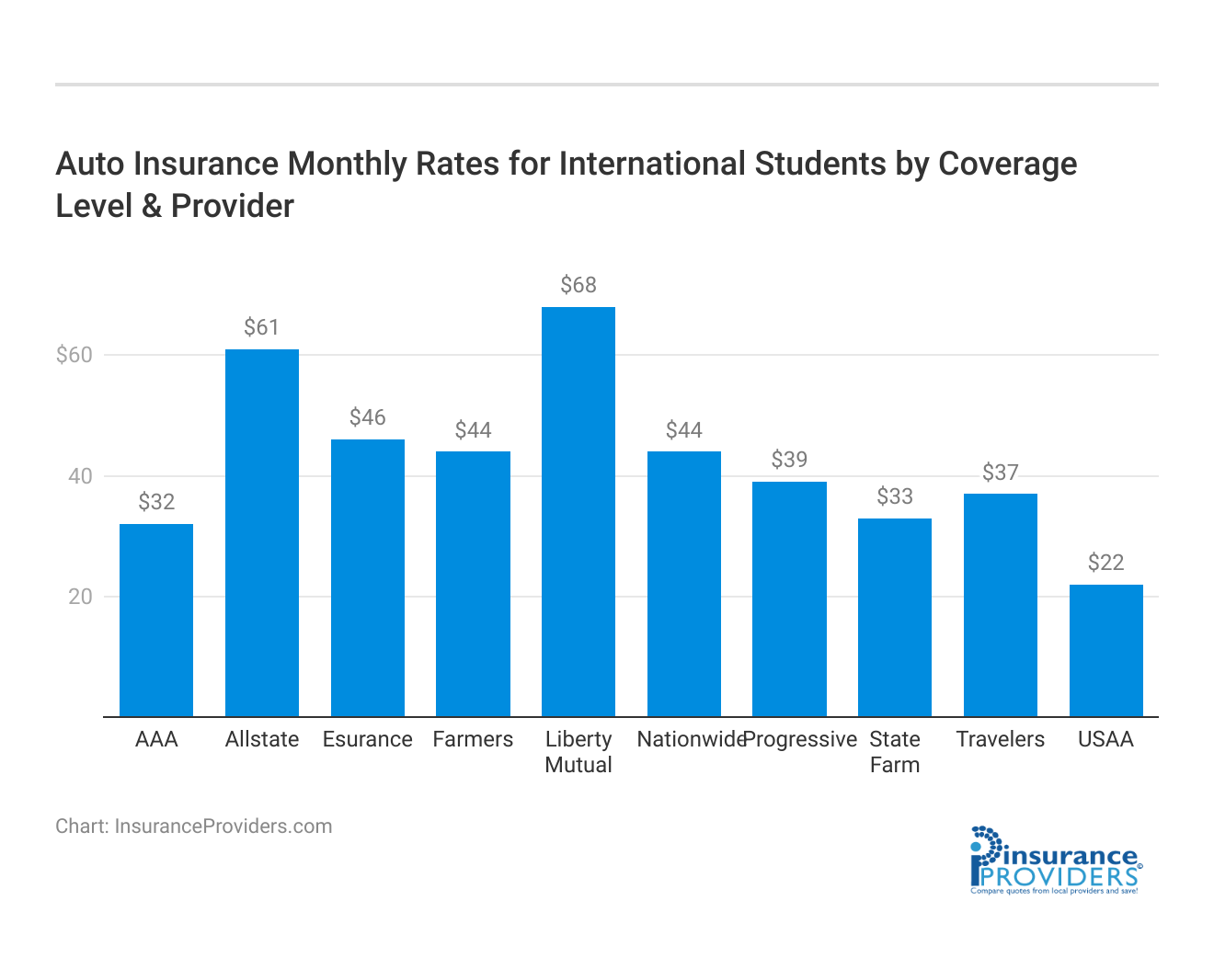

Illustrating Top 10 Auto Insurance Providers for International Students

When considering auto insurance options for international students, examining the rates of the top 10 providers becomes crucial. State Farm and USAA offer affordability with full coverage rates at $86 and $59 per month, respectively. For those seeking a balance between cost and coverage, these options present themselves as prudent choices, especially for students on a budget.

Average Monthly Auto Insurance Rates for International Students

| Insurance Company | Full Coverage | Minimum Coverage |

|---|---|---|

| State Farm | $86 | $33 |

| USAA | $59 | $22 |

| Progressive | $105 | $39 |

| Allstate | $160 | $61 |

| Nationwide | $115 | $44 |

| Liberty Mutual | $174 | $68 |

| Farmers | $139 | $44 |

| AAA | $86 | $32 |

| Travelers | $99 | $37 |

| Esurance | $114 | $46 |

On the higher end, Liberty Mutual stands out with a premium offering at $174 per month for full coverage, providing potential additional benefits that may cater to specific needs. Examining the middle ground, AAA and State Farm share similar full coverage plans at $86 per month, but with different minimum coverage costs of $32 and $33, respectively.

Travelers and Esurance also bring competitive options to the table, with Travelers offering full coverage at $99 and Esurance at $114 per month. Farmers, Progressive, Nationwide, and Allstate complete the list with varying rates, giving international students a range of choices to consider based on their financial capacity and coverage requirements.

Students need to conduct a thorough assessment of their needs and budget while taking into account the specifics of each provider’s coverage. By doing so, international students can make informed decisions that align with their unique circumstances, ensuring they have reliable and affordable auto insurance during their time in the United States.

Before International Students Can Get Insurance, They Need a License

You need insurance to drive legally in the U.S., but that’s not all you need. Before you can get insurance coverage, you must be licensed to drive in America. There are a couple of ways to accomplish this.

Can you drive in the U.S. if you have a foreign driver’s license?

Generally, the answer is yes, but it comes with conditions. Most states will allow you to use your home country’s driver’s license for a short period, provided you also carry an International Driving Permit or IDP. This document translates the data on your current license into a form acceptable in America. You will not be able to drive until you have this document.

If you are a student traveling from the U.S. to a foreign country, you can have your home country driver’s license converted into an International Driver’s Permit at the American Automobile Association (AAA) or the American Automobile Touring Alliance (AATA).

If, however, you are an international student coming to America, you will need to obtain your IDP in your home country if you want to continue to use your home driver’s license.

While you can use your driver’s license and IDP for some time, eventually you will need to get a U.S. driver’s license in order to drive in America. This will allow you to continue to drive legally. In addition, this will enable you to obtain auto insurance coverage so that you can rent or purchase a vehicle to use while studying in America. Before your temporary grace period expires, you will want to follow these steps to get a new license in the U.S. This will allow you to continue to drive legally.

Read more:

- Best Auto Insurance for Foreign Drivers

- Do you have to have a driver’s license to buy auto insurance?

- Do you need Auto Insurance for a driver who only has a permit?

- How do you get auto insurance for a foreign exchange student?

How to Get a U.S. Driver’s License

This process is somewhat more difficult for an international student, so it is wise to do your research and get your paperwork in order. Use this information as a guide to help you obtain your U.S. driver’s license.

There Will Be a Lot of Paperwork

First, you will want to determine if you are eligible for a U.S. driver’s license. Check the U.S. Immigration and Customs Enforcement policies to determine your lawful status before you apply.

The state you want to drive in will have its own rules and regulations as well, so ensure that you are informed of the specifications. Your school will usually have a Designated School Official (DSO) who can help you with this step.

You will have to activate a Student and Exchange Visitor Information System record and be located in the U.S. for a minimum of 10 days before you can apply for your American driver’s license. There are also several documents that may be required from your local Department of Motor Vehicles. Each of these documents will need to be completed and in good standing, before you can request a driver’s license.

Stay in touch with your DSO, so that you don’t miss any filing deadlines. Verify that your personal information is correct and corresponds with all of your paperwork. Keeping track of these details will go a long way toward ensuring you get your license when you need it.

You Will Have to Pass the Tests

Once you have all the necessary forms and documents submitted, it will be time to get tested. There are a series of exams you must pass before you can be licensed to drive in the U.S. Specific details and requirements vary by state, but generally, you will be tested in three key areas.

You will need to pass a vision test to establish that you can see well enough to drive. Each state has its own set of qualifications to pass this test.

Next comes the written test. You will want to study, as these tests can be tricky. You will need to learn the specific rules of the road in your area, so use the resources that the local Department of Motor Vehicles will provide. You should also be able to request that the test be given in your native language or administered through a translator.

Finally, the big test is the driving test. You will be required to demonstrate various driving skills and an understanding of how to navigate the roads safely and proficiently. Again, each state has its own requirements. You should be prepared to cover the basics and a few specialty situations like parallel parking.

After receiving your license, you have the legal right to drive in the United States and are almost ready to buy or lease a vehicle on your own. However, keep in mind that in order to drive, you must have auto insurance. There are several methods to meet this requirement, one of which is to choose from among the top auto insurance providers by state.

How to Get Auto Insurance Coverage as an International Student

With a few very specific exceptions, before anyone can drive a car in America, that car must be covered by auto insurance. There are several ways to obtain coverage as an international student, so let’s have a look.

Non-owners Insurance is Good for Renters

International students often borrow cars from friends or host families. In those situations, the car is usually covered by the owner’s insurance policy, which allows for other drivers of the vehicle. It is legal for you to drive it as long as you have your Independent Driving Permit and any driver’s license.

In some cases, the owner of the car you are borrowing may not be carrying insurance that will cover you. In these situations, you can insure someone else’s vehicle through what is known as non-owners insurance. These policies are typically more affordable than traditional auto insurance coverage, as they are designed for drivers who don’t operate vehicles on a daily basis or are only using a car for a short period of time. This may apply to you as an international student.

Some international students rent cars frequently while in the U.S. You are not legally required to pay for the auto insurance the rental company offers, so legally speaking, you don’t need insurance to rent a car. However, if you decline the supplemental insurance, you put yourself at risk in the event of an accident. If you are at fault, you will be paying out of your own pocket.

Of course, the car insurance offered by the rental company is expensive. In this situation, carrying a non-owner policy may be the most affordable insurance solution for international students. Another option that fits students living seasonally in the U.S. is called short-term insurance.

Read more: Top Non-Owners Car Insurance Coverage: What You Need to Know

Short-Term Insurance Works Well When You Borrow a Car

When attending school in the U.S. as an international student, you may find yourself traveling back and forth from your home country on a regular basis. If so, you will not want to be committed to an auto insurance policy over a long period of time. In this circumstance, a short-term policy can be the best car insurance for international students in the USA.

Rather than the standard six- to twelve-month terms usually offered by auto insurance providers, short-term car insurance policies cover much briefer periods. You can get short-term car insurance coverage for daily use, and up to six months at a time. If you plan to use the host family’s vehicle during your stay, they can purchase a short-term policy to keep you covered while you drive. (For more information, read our “What is short-term Auto Insurance?“).

If You Want to Buy Your Own Vehicle, You Need a Traditional Policy

If you are committed to your international studies for the long haul and are planning to remain in America for a significant amount of time, you may be thinking of purchasing your own car. Once you have endured the procedure of obtaining your U.S. driver’s license, you will be eligible to buy a car. In order to do that, you will need to obtain a standard auto insurance policy.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Best Car Insurance for International Students in the U.S.A.

Each auto insurance provider has its own specialties and reputation. For international students, affordable and quality car insurance is within reach if you know where to look. Fortunately, you have some resources in your search for the best insurance companies for international students.

Your school’s International Student Affairs office can assist you, as can your Designated School Official. If you are living with friends or a host family, reach out to them for their advice on the best insurance for international students. Shopping around and comparing rates will be useful, as will knowing the type and amount of coverage you need.

The Insurance Information Institute explains that you are usually required to carry liability coverage and can choose to upgrade to full coverage should you wish. Comprehensive insurance is the more expensive option, but it does provide you with greater coverage. As an international student, you will often be on a budget; therefore, finding affordable car insurance is beneficial.

The Best Auto Insurance Companies for You

Determining the best insurance companies for international students depends on several factors. Depending on the state you live in, you may be able to find inexpensive or substandard insurance providers, but the coverage may not be what you need. Often, choosing a well-established car insurance company seems expensive, but it can save you money in the end.

Well-known providers like Geico, State Farm, and AAA offer discounted rates to students who maintain a certain grade standard. Encouraging a focus on schoolwork and catering to student drivers sets these companies apart from the rest.

These companies offer low rates for non-owner insurance policies, which may be the best solution for you as a visiting student. They each have reputations for providing quality customer service which can be extremely valuable when purchasing your first auto insurance policy.

Pay attention to your local insurance options as well. There are several high-quality regional insurance providers that may suit you well as an international student. Erie Insurance, operating in parts of the Midwest and Northeast, offers safe driving discounts. They also provide lower rates to drivers with reduced usage. If you plan to return home for the summer and leave your car behind, Erie will factor that into your rates.

Because car insurance rates depend on numerous variables, it is difficult to know who will provide the cheapest insurance for international students. Your age, lack of driving record, and credit history all work against you in this regard. For these reasons, it may be wise to select a major brand as your first car insurance carrier. The student discounts and alternate policy offerings from Geico, State Farm, and AAA make quality car insurance affordable.

Again, there is no one company that offers the cheapest student car insurance. Comparing rates for Geico international student car insurance and State Farm international student car insurance will help you find the best deal.

The Bottom Line on Auto Insurance for International Students

When you are living in a new country, many things seem complicated and unfamiliar. Car insurance is no different, but you can navigate this world with a little patience and attention to detail. Whether you are borrowing, renting, or buying a car, once you have decided on the type of policy that best fits your situation you are well on your way.

The best car insurance for international students offers student discounts and non-traditional policy types and terms. These companies can be found nationwide. To begin your search for the best insurance companies for international students, enter your ZIP code below.

Case Studies: Top Auto Insurance Provider for International Students

Case Study 1: Global Auto Insurance Agency

Mike, an international student studying in Australia, sought auto insurance coverage that would cater to his specific needs. He discovered Global Auto Insurance Agency, a reputable provider that specialized in serving international students.

Global Auto Insurance Agency offered coverage options with features like coverage for international driver’s licenses, affordable rates for students, and the ability to adjust coverage based on the student’s study duration. Mike found the policies offered by Global Auto Insurance Agency to be flexible and accommodating for his situation.

Case Study 2: International Student Insurance Corporation

Emily, an international student pursuing her studies in the United Kingdom, needed auto insurance coverage. She came across International Student Insurance Corporation, a well-established provider known for its expertise in serving the insurance needs of international students.

The corporation offered specialized auto insurance policies that included coverage for international driver’s licenses, medical expense coverage in case of accidents, and multilingual customer support. Emily chose International Student Insurance Corporation for its comprehensive coverage options and dedicated support for international student.

Case Study 3: Global Student Coverage

Maria, an international student from Brazil, discovered Global Student Coverage, a specialized insurance agency catering to the unique needs of students like her. Seeking comprehensive auto insurance for her studies in the United States, Maria was impressed by the agency’s tailored policies.

With a focus on affordability, coverage for foreign driver’s licenses, and flexibility based on study duration, Global Student Coverage provided Maria with a sense of security. When faced with a minor accident involving her rented car, Maria experienced the agency’s dedicated multilingual customer service, which guided her through a smooth claims process.

Overall, Global Student Coverage not only met Maria’s auto insurance needs but also offered valuable support and peace of mind during her international student journey.

Frequently Asked Questions

Can international students drive in the U.S. with their foreign driver’s license?

Yes, most states allow international students to use their foreign driver’s license for a limited period with an International Driving Permit (IDP).

How can international students get a U.S. driver’s license?

International students can obtain a U.S. driver’s license by following these steps:

- Check eligibility based on lawful status and state regulations.

- Gather required documents and complete necessary paperwork.

- Pass vision, written, and driving tests specific to the state.

What are the options for auto insurance coverage for international students?

- Non-owners Insurance: Suitable for students borrowing cars, as it covers vehicles not owned by the student.

- Short-Term Insurance: Ideal for students who travel frequently or use a host family’s vehicle temporarily.

- Traditional Policy: Required if the student intends to buy their own car.

Which are the best auto insurance companies for international students?

Some reputable insurance providers for international students include Geico, State Farm, AAA, and regional companies like Erie Insurance. These companies often offer student discounts and various policy options.

How can international students find affordable car insurance?

To find affordable car insurance, international students can:

- Compare rates from different providers.

- Take advantage of student discounts.

- Consider non-owner policies or shorter-term policies.

- Opt for well-established insurance companies.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.