Liberty Mutual Homeowners Insurance Review [2026]

Liberty Mutual is a solid company from a financial standpoint whose global reach only further solidifies its credit ranking status. As number three in the nation and fifth globally, Liberty Mutual’s size alone solidifies its rankings while also allowing the provider to maintain low monthly rates for policyholders. The company’s market share has remained essentially the same over three years, and the low loss ratio rate also is a sign of good measure that Liberty Mutual will be around for the long haul.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Schimri Yoyo

Licensed Real Estate Agent

Diego Anderson is a Real Estate Agent based in the Bay Area of California. Having received his Real Estate License at the age of 18, he wasted no time learning the ins and outs of the industry. With a focus on residential dual agency, he has a passion for supporting and educating families on their home buying and selling decisions. He is no stranger to new builds and new developments. He also r...

Diego Anderson

Updated March 2024

| Liberty Mutual Insurance Overview | Details |

|---|---|

| Year Founded | 1912 |

| Current Executives | Chairman, President & Chief Executive Officer - David H. Long |

| Numbers of Employees | 50,000 |

| Total Sales/Assets | $125,989,000,000.00 |

| HQ Address | 175 Berkeley Street, Boston, MA, 02116 |

| Phone Number | 1-617-357-9500 |

| Company Website | www.libertymutual.com |

| Premiums Written | $6,655,452,000 |

| Loss Ratio | 51.30% |

| Best For | Overall Home Insurance, Inclusive Policies, Claims Service, Cheap Rates |

Purchasing an insurance policy for your home, condo, or even just for the possessions in your rental can be a daunting challenge as your search takes you deep into an unknown territory of forms, insurance jargon, and fine-print exemptions. Don’t be too hard on yourself – a lot of people feel overwhelmed when they first begin this journey. There’s a lot of information to keep track of, but assuredly it’s all important.

The process of insurance shopping should seem easier, with most insurance providers embracing the internet and all its modern-day conveniences. The online options for bill pay, filing claims filing, and estimated quotes have taken great strides in making comparison shopping readily accessible to the public. However, for some people, this can be even more stressful, especially for those out there who are used to talking face to face with an agent.

Some level of unease is understandable, considering your home is one your biggest investments for your safety and well-being, both physically and financially. It is also important to keep in mind that a home investment, which includes the subsequent insurance policy, affects the status of your livelihood in the many years to come.

If these uncertainties are a major concern for you, then look no further than Liberty Mutual and its array of comprehensive insurance policies.

Liberty Mutual, the third-largest insurance provider in the nation and fifth globally, cuts straight through the confusion and allows policyholders to customize plans to meet their needs. This method of policy selection all but ensures you know exactly what is covered and how much coverage your policy entails.

On top of offering customizable plans, Liberty Mutual offers several discounts over a variety of conditions, from signing discounts to claims-free rewards programs. Many of the home discounts are offered to increase the safety of your home.

Below, you will find a detailed run-through of Liberty Mutual’s financial stability, credit ranking, and customer service approval rating. We have also provided sample rates for better estimated monthly costs as well as step-by-step guides for daily policyholder issues such as filing claims or receiving an online quote.

We have conveniently provided you a detailed snapshot of Liberty Mutual, so you can make a better decision when choosing a home insurance policy that meets your needs.

Our free online quote option is conveniently located below. Just enter your ZIP code, and we’ll take care of the rest.

What are Liberty Mutual’s ratings?

Aside from a car, purchasing a home is one of the biggest expenditures a person will undertake in their lifetime. Unlike an automobile, your home should not depreciate with each passing year of ownership.

Homeowners understand the need for safeguarding their home investment today, but how can you truly protect yourself and your loved ones in an unpredictable future? Your home should be made to last, and therefore, you need an insurance provider that will be there for the long haul.

Any financial institution does a thorough review of your credit history when offering you a loan or mortgage, and we feel you should do the same when placing the safeguarding of your home investment in the hands of an insurance provider. Only a creditworthy insurance provider will truly be there when an unexpected loss or damage occurs.

There are a series of rating agencies that act as watchdog organizations and report on the financial status of any given business along with the daily operations and standards of customer service.

We have gathered the information and put together a scorecard of what some top credit and customer support ranking agencies have to say about Liberty Mutual.

| Agency | Rating |

|---|---|

| A.M. Best | A |

| Better Business Bureau | A |

| Moody’s Rating | A2 |

| S&P Rating | A |

| NAIC Complaint Index | 0.4% |

| Fitch Ratings | A- |

| J.D. Power | 2/5 - 3/5 |

Liberty Mutual received a solid score on the financial front, and the customer response agencies are providing some of the highest marks.

Don’t just take our word for it. You will find an in-depth explanation below as to how each agency operates as well as what each of these ratings means for you as a potential policyholder at Liberty Mutual.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What goes into financial strength ranking, and who are they from?

A.M. Best

There are plenty of credit ranking agencies that regularly measure the financial stability of corporations around the globe. however, A.M. Best is one of the few credit ranking agencies to focus solely on the insurance industry. A.M. Best’s more detailed and in-depth analysis of the nation’s insurance providers puts it at the top of our list.

Since insurance is its wheelhouse, A.M. Best is uniquely better at measuring the ups, downs, and spikes that may occur in the insurance industry. The company knows the key indicators of an insurance provider on the rise or one that is skirting bankruptcy. (For more information, read our “Will a past bankruptcy keep me from getting approved for homeowners insurance?“).

According to its rating scale, which runs from A++ as the highest possible score and D as the lowest, Liberty Mutual earned an A credit ranking and has excellent financial standing in the insurance industry.

Liberty Mutual is currently viewed as being able to meet all of its financial obligations today and in the prospective near future.

The company is capable of handling payouts to policyholders making claims by offsetting any potential debt with enough new income in the form of incoming premiums. Overall, Liberty Mutual is poised for potential growth, so as a homeowner, choosing Liberty Mutual as an insurance provider looks to be a solid investment.

Better Business Bureau

The Better Business Bureau (BBB) is a nonprofit organization acting as a customer advocacy group measuring complaints and rating corporations from the corporate level down to the local. Nothing gets lost in the shuffle as the guardian of the consumer holds companies to higher standards and levels of accountability.

The BBB ranking system assigns ratings from A+ (highest) to F (lowest) based on a points-based system where an allotted 16 elements of a business are reviewed.

| Element | Range of Points That Can Be Earned or Deducted (Maximum to Minimum) |

|---|---|

| 1. Type of business | 0 to -41 |

| 2. Time in business | 8 to -10 |

| 3. Competency licensing | 0 or -41 |

| 4. Complaint volume | 20 to 2 |

| 5. Unanswered complaints | 20 to -21 |

| 6. Unresolved complaints | 10 to 1 |

| 7. Serious complaints | 15 to 0 |

| 8. Complaint analysis | 8 to -12 |

| 9. Complaint resolution delayed | 0 or -5 |

| 10. Failure to address complaint pattern | 0 or -5 |

| 11. Government action | 0 to -30 |

| 12. Advertising review | 0 to -41 |

| 13. Background information | 5 or 0 |

| 14. Clear understanding of business | 0 or -5 |

| 15. Mediation/arbitration | 0 to -41 |

| 16. Revocation | 0 or -10 |

Liberty Mutual scored an A rating from the BBB in the company’s hometown of Boston, MA. The top rating attests that Liberty Mutual has dependable customer service standards and efficiently resolves complaints.

Moody’s

As one of the oldest credit ranking agencies in the business, Moody’s provides reviews while managing accurate projections using informed analysis from experience and in-depth research.

Moody’s rated Liberty Mutual with an A2; the A ranking means that Liberty Mutual is a low-risk financial investment and able to meet their financial obligations. This ranking also attests that the insurance provider is capable of repaying debt quickly in the short term, which is an essential aspect for any insurance provider.

In short, Moody’s ranking suggests Liberty Mutual as a financially solvent company.

Standard & Poor’s (S&P)

Standard and Poor’s (S&P) is the second of the top three credit ranking agencies and another legacy institution. S&P acts as a watchdog organization of sorts and reviews the fiscal solvency of corporations. This allows all individuals to make educated decisions about their investments.

S&P primarily focuses on the stock market index, which is the listing that measures the fiscal performance status of 500 U.S. companies. The reports S&P puts out are representative of a company’s current financial status and allow investors to make more informed decisions.

Fortunately, this rating system can also be used to measure the financial stability of an insurance provider like Liberty Mutual.

With a letter grade system that ranks from AAA as the highest to D as the lowest, S&P gave Liberty Mutual an A rating. Although not the top rating, Liberty Mutual’s A is still viewed as strong, with indicators that it is a low-risk investment.

S&P tends to be slightly more judicious in its reviews, which is partially why we like to use these rankings in determining the fiscal solvency of an insurance provider. The increased scrutiny provides a different perspective that seems to be more critical, and when it comes to homeownership, you want as much scrutiny as possible before paying out monthly rates for an insurance policy.

This statement may sound like a warning, but it is more of a disclaimer; Liberty Mutual’s “vulnerability” applies to any insurance provider given the unexpectedness of natural disasters and home damage in general. S&P likes to provide a little wiggle room before claiming any insurance provider is a sure thing since there are variables involved beyond anyone’s control.

NAIC Complaint Index

The NAIC, also known as the National Association of Insurance Commissioners, rates and measures companies, provides a national index comparing the number of complaints received by all insurance providers.

The NAIC takes into account the number of complaints along with the efficiency in response time and effectiveness in resolving said complaints from the insurance provider.

The score itself is determined by dividing the insurance provider’s number of complaints by the incoming amount of premiums. The general idea is that the complaint index gives a rough measure of an insurance provider’s performance on the consumer level as compared to the rest of the insurance industry.

The National Complaint Index average is always 1.00, and companies rank in comparison either above or below the national average.

Liberty Mutual scores well below the national average. On the customer level, Liberty Mutual excels by primarily meeting policyholders’ needs and effectively and efficiently responding to the complaints received.

Fitch Ratings

With offices in New York and London, Fitch provides reviews, ratings, and projections on the financial sector to improve investors’ knowledge of safe or unsafe investments. Fitch measures the up-to-date financial stability of any corporation by taking into consideration the company’s debt and ability to repay debts in the short and long term.

Somewhat on par with Moody’s and S&P, Fitch gives Liberty Mutual an A- ranking. Fitch’s ratings extend from AAA as the highest with D as the lowest. At an A-, Liberty Mutual is not at the top of investment opportunities but still receives top marks for its financial stability today and in years to come.

J.D. Power

J.D. Power has quickly become an authority on the viability of a company and its products primarily through a consumer review process. J.D. Power has a simple rating system out of five (highest) and has awarded Liberty Mutual two out of five overall and three out of five for policies offered.

According to J.D. Power, Liberty Mutual seems to have an average review for its consumer response team, but the outlook is much better when it comes to finding the exact policy that will fit your needs as a homeowner.

*Ratings are based on weighted averages of scores in several categories, including financial strength, consumer complaints and discounts.

What is the history of Liberty Mutual?

Liberty Mutual is a globally renowned insurance provider with over 100 years of service. Since 1912, Liberty Mutual has worked tirelessly on behalf of policyholders.

It all began when Massachusetts passed a law that required employers to protect employees with workers’ compensation insurance. From this law, Liberty Mutual was born, originally known as the Massachusetts Employees Insurance Association (MEIA).

Unlike the majority of insurance providers, Liberty Mutual did not have its beginnings in the automotive industry. The insurance provider predates the automobile insurance rush, having been established to protect the well-being of workers, particularly those who operated in unsafe working environments.

The first auto policy would not come around until 1918, which is, in fact, the very same year the company took on the official name of Liberty Mutual Insurance Company. The first auto policy led to fire and casualty insurance (read our “Liberty Mutual Fire Insurance Company Review” for more information). Today, the insurance provider is the fifth-largest insurer of property and casualty globally with operations in thirty countries.

Just as it began about the people, Liberty Mutual remains ultimately about and for the people it insures. Liberty Mutual has actively promoted this mission throughout its 100 years of providing insurance. Some examples include spearheading the development of emergency stop buttons on escalators in the 1940s as well as designing the first safety car in the following decade.

Liberty Mutual’s more recent acquisitions include Safeco in 2008 and Solaris Labs in 2016, both of which continue the insurance provider’s mission of promoting consumer safety through expansion and innovation. Solaris, in particular, reinforces Liberty Mutual as a champion of consumer safety, as the lab itself was created just for this purpose.

Liberty Mutual is paving the way for consumer safety and garnering a reputation for paving the way for employee satisfaction and equal rights.

In January 2019, Forbes magazine recognized Liberty Mutual in a list of the best employers for diversity hires, and in the same year, the insurance provider was recognized with the Great Place to Work award by independent analyst Great Place to Work. Financially, Liberty Mutual has ranked for the second time at #75 in the Fortune Ranking based on 2018 revenues.

Read more: LM Insurance Corporation: Customer Ratings & Reviews

What does Liberty Mutual’s market share look like?

So, how exactly do those top credit ranking agencies compile their scores? One important aspect they measure in determining rankings is the total share or percentage of the market that any given company controls, or more simply, the market share. Market share is a great way to see how a company performs on par with the rest of the industry.

The yearly percentage in comparison to other companies in the same industry gives consumers a better impression of the operations, size, and scope of a company. This figure lets you know how big the company is along with how well they function.

While a single year grants consumers a snapshot of a company’s control of the market, a three-year analysis grants consumers close to a full picture collage of any given corporation’s projection for the future.

| Market | 2016 | 2017 | 2018 |

|---|---|---|---|

| % Market Share | 6.74% | 6.86% | 6.74% |

| Premiums Written | $6,164,379,000 | $6,471,114,000 | $6,655,452,000 |

The table above shows Liberty Mutual holding steady on its market share. Roughly averaging around 6.74 percent with a spike in 2017, Liberty Mutual shows no signs of slowing down as the premiums being written continue to rise.

It is also important to note that each of the top insurance providers saw a dip between 2017-2018, which suggests an industry-wide slump and not a personal failing of Liberty Mutual.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Liberty Mutual’s plans for the future?

As the third-largest insurance provider in the nation, Liberty Mutual shows no signs of relinquishing its top spot.

The premiums continue to rise, and the company’s hold over the market has remained around 6.74 percent for going on three years now. Liberty Mutual’s global expansion and recent acquisitions of AmTrust in 2019 and Safeco back in 2008 further prove that this company is a safe bet as your home insurance provider for today and in the future.

Do they have an online presence?

Liberty Mutual has a fully functional website offering key information on various topics including corporate structure, careers, and the company’s charitable contributions. The design is minimalist with each page featured in the company’s signature yellow with blue accents.

As far as the functionality, the website offers an agent finder and online quote search options as well as the ability to manage claims and view your policy.

Liberty Mutual also hosts an online learning center called MasterThis™ in partnership with its other learning center resource, HowStuffWorks®. MasterThis™ covers a variety of topics, including tips on moving with ease, cars, antique searching, and increasing your home value.

The articles make for nice reading and serve well as a rudimentary guide. The interface is sleek and intuitive, yet the range of topics does seem limited. It makes for an easier, almost seamless transition from going into a store to getting more information. A smooth, simple design is a great way to connect with a broad range of prospective clients.

Does Liberty Mutual have any commercials?

Liberty Mutual’s recent foray into commercials takes the absurdist humor approach that so many other insurance providers have. These commercials provide mixed results in the comedy department, but we feel they leave an impression.

Recent commercials feature an emu named LiMu and a man named Doug.

The main message from these commercials seems to emphasize Liberty Mutual’s customizable policy plans.

They have another commercial, one that takes repetition to another level with a karaoke themed singing of the insurance provider’s name. To be fair, the repetition is a variation on the company jingle, and it does get the name stuck in your head. In terms of marketing strategies are concerned, coming up with an earworm is a surefire way to get people to remember you.

https://youtu.be/3qWHMVghx0U

Liberty Mutual keeps it short, sweet, and repetitive when it comes to their commercial branding. Although we feel the commercials are not as humorous as some of their competitors, the insurance provider still manages to get their company name and the pay what you want deal across to their customer base.

It’s already stuck in our heads.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What does Liberty Mutual look like in the community?

Liberty Mutual provides charitable assistance to the communities of its policyholders. A quick fact on the giving-back section of the company site reveals that the company has donated over $52 million to charity.

Liberty Mutual funnels charitable donations and time toward three main categories: homelessness, education, and accessibility (disability work).

One arm of the giving-back program is the Liberty Mutual Foundation, which just celebrated its 16th anniversary in 2019. The foundation was set up to assist nonprofits through monetary donations and volunteer time to improve communities at the local level. This mission is accomplished through awarding grants to help nonprofits meet goals.

Seeking nonprofits that will have a local impact, the foundation looks for organizations that empower struggling families and individuals to thrive. Liberty Mutual also awards grants through the Safeco Insurance Fund.

Liberty Torch Bearers is the volunteer portion of the give-back program. According to Liberty Mutual, it has amassed over 80,000 hours served and over 2,000 projects completed.

Liberty Mutual also runs a donation match program where the insurance provider matches $0.50 for every dollar an employee donates. Those donations amount to roughly $18 million.

Serve with Liberty, the insurance provider’s annual day of community service, is held during the first two weeks of May every year, and this year 24,143 employees participated.

What can be said about Liberty Mutual’s employees?

We are firm believers that a policy is only as good as the employees who uphold them. Liberty Mutual’s current slogan revolves around paying only for what you want in a policy, which ultimately sounds like a great deal.

Your plan can be as inclusive or minimal to meet your needs, but none of that matters if you are given the runaround when it comes to processing your claim or even troubleshooting your monthly rates.

A happy employee generally equals better and more productive work, which then entails a more satisfied customer. No matter the mission or good intentions of an insurance provider, it will always come down to the core group of employees and how they interact with policyholders that makes or breaks a company. No one wants to call into customer service and be on the line with someone who clearly doesn’t want to be helpful, or doesn’t believe in the cause.

Their efforts are essential to the success of any company, and that is why we have taken a closer look at the employees that are making Liberty Mutual the third-largest insurance provider in the nation and fifth around the globe.

Age of Employees and Tenure

According to Payscale, the median age of Liberty Mutual employees is 34 and the average tenure is a little under four years. Perhaps not as much longevity as one would like to see, but four years is still enough time to gain traction and veteran experience.

The percentage of mid – career and experienced workers is at a comfortable level, around 20 percent, where as a policyholder, you can rest assured that your home investment is not in the inexperienced hands of a young adult.

Employee Experience

Overall, Liberty Mutual’s employees responded favorably to their experiences while on the job. In a random survey of 244 employees, Payscale reports a three-out-of-five rating in favor of employee satisfaction.

According to Great Place to Work, 83 percent of employees recommend the company as a positive employer.

Awards and Accolades

Through 100 years of providing insurance, Liberty Mutual has amassed quite a tally of awards, so we will name a few from recent years. Liberty Mutual was awarded the 2018 Digital Workplace of the Year Award for its digital assistant and was recognized for having the most satisfied commercial insurance agents by the J.D. Power 2018 Independent Insurance Agent Satisfaction Study.

They ranked number 80 and number 73 on the 2017 and 2019 100 Best Workplaces for Diversity list published by Great Place to Work and Fortune magazine and are currently number 37 on PEOPLE’s 2019 Companies that Care list.

For the second year in a row, the Human Rights Campaign has awarded Liberty Mutual a perfect score of 100 for LGBTQ workplace equality, and Liberty Mutual also ranks number 62 on Forbes’ inaugural Best Employers for New Graduates 2018 list. The insurance provider has also been selected by Forbes Magazine as a 2018 Best Employer for Women.

Does Liberty Mutual offer cheap home insurance rates?

There are plenty of apps and review lists for cheap eats, and yet we just cannot find the same cheap list when it comes to home insurance rates. Since there is an apparent lack of direct cheap insurance lists, we have compiled some sample rates by area for Liberty Mutual to give you a better idea of how they stack up against competitors in the insurance market.

In this section, we get down to the nitty-gritty details with some actual quoted figures to help you find the most affordable home insurance policy that still meets all your needs.

We will run through available options and actual sample rates to give you a better idea of what your monthly rate may cost and, more importantly, if you can afford the monthly rates that Liberty Mutual offers for home insurance policies.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is their availability like?

Liberty Mutual Insurance is licensed in all 50 states and the District of Columbia. You can click here to find an agent near you.

How does Liberty Mutual stack within the top-10 by market share?

Liberty Mutual is currently third in the nation for homeowner insurance policies for multiple perils and has held that spot steadily for the past three years.

| Rank | Company | Direct Premiums Written ($) | % Market Share | Loss Ratio |

|---|---|---|---|---|

| 1 | State Farm | $18,177,462,000 | 18.50% | 61.87% |

| 2 | Allstate | $8,262,445,000 | 8.36% | 65.55% |

| 3 | Liberty Mutual | $6,655,452,000 | 6.74% | 52.60% |

| 4 | USAA | $6,170,558,000 | 6.24% | 79.77% |

| 5 | Farmers Insurance Group | $5,795,044,000 | 5.86% | 78.80% |

| 6 | Travelers | $3,766,277,000 | 3.81% | 69.34% |

| 7 | American Family Insurance | $3,276,280,000 | 3.32% | 63.74% |

| 8 | Nationwide | $3,184,627,000 | 3.22% | 77.83% |

| 9 | Chubb Ltd Group | $2,832,082,000 | 2.87% | 91.87% |

| 10 | Erie Insurance Group | $1,675,976,000 | 1.70% | 66.03% |

Liberty Mutual continues to grow as the number of premiums written rises steadily. As noted in the previous market share section, its three-year figures remain steady, which is a good sign for any investor.

Another interesting note is the insurance provider’s low loss ratio rate. The loss ratio is the comparison of incoming payments versus outgoing payouts. Some may worry that Liberty Mutual may not be quick to pay out, but we think the low percentage loss ratio indicates the company manages financial obligations and debt at a better rate than competitors.

Are there any sample rates for Liberty Mutual available?

We gathered some sample rates in the Pasadena and Los Angeles areas to give you a better idea of what you may pay on a month-to-month basis. We selected ranges of coverage for lower $200,000 up to $500,000 and offered up a quick comparison study with the other top 10 insurance providers.

| Dwelling Coverage: Pasadena, Los Angeles County, CA | $200,000 | $350,000 | $500,000 |

|---|---|---|---|

| State Farm | $427 | $690 | $972 |

| Allstate | $421 | $734 | $1,047 |

| Liberty Mutual (as Liberty Ins Corp) | $656 | $866 | $1,076 |

| USAA | $448 | $811 | $1,154 |

| Farmers Insurance Group | $899 | $1,386 | $1,869 |

| Travelers | $408 | $585 | $795 |

| Nationwide | $439 | $668 | $961 |

*CA rates based on home age of one to three years old, $1,000 deductible

*SOURCE: California Department of Insurance

Liberty Mutual holds its own through each category of coverage and offers competitive rates — some of the lowest in the top five. The extremely low rates offered by Travelers and Nationwide seem too good to be true, and offerings of coverage are probably not as inclusive as the top five.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What sort of coverage do they offer?

Liberty Mutual offers a variety of policy options over several different lines of insurance types, though the company focuses primarily on auto and home insurance. Condo, home, auto, and renters are the top categories featured on the home page, but additional insurance options are available including pet, life, and accident insurance.

Do they have policy types?

Liberty Mutual’s home insurance coverage comprises the typical variety including standard homeowners, renters, condo, and landlord. The company is well-known for compartmentalizing policy options and offering consumers the opportunity to pay only for what they need.

Homeowners

Liberty Mutual provides a standard homeowner’s policy, or HO-3, that comprises coverage for the physical dwelling, personal possessions, liability, and additional living expenses.

Condo

The condo insurance policy, otherwise known as an HO-6, has policyholders covered for everything but the physical structure. This will cover your possessions, liability, and any repairs inside the unit (appliances or alterations to the insides of your condo structure). Additional coverage is also offered for valuable possessions like cell phones, computers, and jewelry.

Renters

Renters insurance, or an HO-4, covers personal property, liability, additional living expenses, and potential medical payments. Like condo insurance, a renter policy also offers coverage for valuable possessions like electronics and jewelry.

One interesting addition is the option for earthquake insurance, which many providers have taken off the table recently; This option may be enticing to those living in earthquake-prone areas.

Read more:

- HO-6 vs. Renters Insurance: What You Need to Know

- Liberty Renters Insurance Review

- Liberty Mutual Personal Insurance Company Review

Mobile Home

Liberty Mutual does not currently offer mobile home insurance but will assist you in gaining coverage through Assurant.

Rental Property

The rental property policies offered by Liberty Mutual, better known as landlord or DP insurance, provide liability and physical structure coverage. The additional or add-on categories are more inclusive, but, of course, they come with a price tag; they include covering personal property, fair rental value, inflation protection, and umbrella coverage.

Additional Policies

Liberty Mutual is not one for excess and seems direct in its insurance coverage options. Two additional policies included under home insurance are flood and umbrella coverage. The flood coverage is operated through the WYO (Write Your Own) Program under the Federal Emergency Management Agency (FEMA) in all 50 states; Liberty Mutual’s participation allows it to service NFIP policies.

Umbrella insurance ensures that you have enough coverage for the entirety of your assets. If your homeowners policy only pays out a certain amount, but your property damaged is worth more than that amount, then umbrella coverage is what you need to match your property dollar for dollar.

Do they have a standard homeowners policy?

The standard homeowners policy offered by Liberty Mutual covers protection for the physical dwelling, personal possessions, liability, and additional living expenses.

The physical dwelling offering is typical and will cover the cost of damage to your home or property. This can include additions to the property not attached for an extra charge, whereas structures that are attached to the property are generally included in the overall coverage.

Personal liability coverage comes in handy for any injuries that occur to third parties while on your property and saves you from expensive medical bills and lawsuits, while the additional living expense comes in handy if you need to stay elsewhere due to repairs or even fumigation of your home residence.

A few additional coverage options to add to those listed above include offerings of coverage for valuables (as we included with the mention of umbrella coverage), water backup and sump pump overflow, and inflation protection.

Inflation protection is of particular interest in long-term homeownership, ensuring that the value of your home policy remains at a relative cost to the rate of inflation over time.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Do they offer any bundling options?

Liberty Mutual offers bundling options for combining any variety of policy options. As offerings for coverage are specified primarily for homes and autos, this is the primary bundling insurance option that is afforded to policyholders.

The company site provides an online quote option for bundling home and car and will give you a discounted rate rather quickly once all informational forms are filled out.

Does Liberty Mutual offer any discounts?

As is the case with most home insurance discounts, the amount saved depends on several variables, so it is no wonder Liberty Mutual is cautious about providing even a base percentage of savings upfront. The online quote option on the site calculates your discount automatically, and any further questions can be relayed to an agent or a customer service representative.

Here is a sampling of the types of discounts Liberty Mutual offers.

- Bundle and Save — Multi-Policy Discount

- Multi-Policy Discount — Comprehensive Protection and Additional Savings

- Claims-Free Discount — Homeowners are Rewarded for not Filing a Claim Over 5 Year Period

- Protective Devices Discount — Save by Outfitting Your Home with Protective Devices

- Newly Purchased Home Discount

- Safe Homeowner Program — Save on Premium by Being Claims-Free for Three Years

- Early Shopper Discount — Save When You Request a Quote Before Your Policy with Another Carrier Expires

- Insured to Value Discount — Save When You Insure up to 100% for the Cost of Home Replacement

- New/Renovated Home Discount — Save if Your Home Was Built or Recently Renovated

- Military Discount — Discounts for Veterans and Those Currently Serving in the Military

- Preferred Payment Discount — Save When You Pay Premiums with Electronic Funds Transfer (EFT) Plan

- New Roof Discount — Save if You Have a Brand-New Roof, or Replaced Old Roof

- Paperless Discount — Save When You Sign Up for Paperless Billing

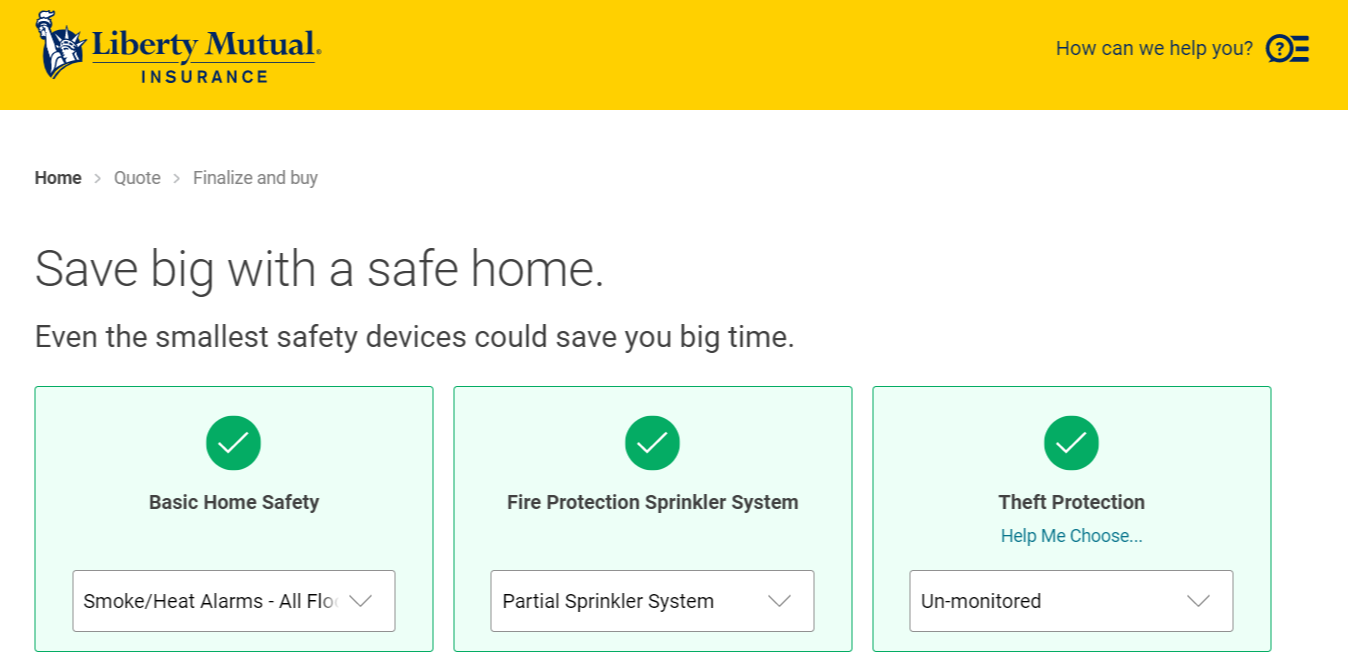

Security Discounts

Like most homeowners policies, Liberty Mutual promotes the safety and well-being of its policyholders by offering savings on policy rates when homeowners safeguard their homes.

Installing protective and/or security upgrades to your home like smart home devices, deadbolts, fire extinguishers, smoke and fire alarms, sprinklers, or burglar alarms will save you on your homeowners insurance policy, as well as provide some much-needed security and peace of mind.

Although not necessarily a security discount, we feel the claims-free discount loosely fits in this category, as homeowners are rewarded for not filing claims and essentially maintaining a safe, accident-free, and secure home.

This discount generally applies to those switching from another insurance provider and acts as an incentive for those who have not filed a claim in five years with their previous insurance provider.

Bundling Discounts

Liberty Mutual offers discounts for taking out multiple policies; these would mainly include home, auto, and life. The exact percentage of the discount would need to be determined by area during an agent meeting.

Other Discounts

- Early Shopper Discount

- Insured to Value Discount

- New/Renovated Home Discount

- Military Discount

- Preferred Payment Discount

- New Roof Discount

- Paperless Discount

What sort of programs do they offer?

To assist potential policyholders in this confusing selection process, Liberty Mutual has two versions of a learning center linked to the company website.

The HowItWorks and MasterThis sections offer knowledge about insurance and home-related issues through a convenient topic-based search on each learning section’s front page. For homeowners, the topics include everything from home repair to increasing the value of your home and moving advice.

Other than the learning center, there are convenient and quick search engines for agents and quotes as well as rate calculators that give a basic cost by area before directing you to fill out the more inclusive quote option.

The site could use more case-specific numbers on discount percentages for homeowners insurance, but considering that these percentages will almost always fluctuate on a case-by-case scenario, we understand the vagueness.

Liberty Mutual’s online options for policyholders include bill pay and claims filing. The options are front and center on the navigation bar.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Can you cancel your policy?

Unlike the majority of insurance providers, Liberty Mutual has a full web page devoted to the canceling of your policy.

Cancellation Fee

Liberty Mutual may address cancellation online but fails to offer direct information about possible processing and cancellation fees. We would recommend looking over your length of service for your contract before signing up or canceling. Liberty Mutual sometimes sells 12-month policies and terminating service earlier than the contracted end date, which may result in fees.

Is there a refund?

There is no mention of a refund when canceling your service. Processing and cancellation fees may apply, but at that point, you would no longer have to fulfill the total premium as stipulated in your contract.

How to Cancel

Liberty Mutual remains old school in this aspect and will have you give the customer service department a call to cancel. The number is 1-800-658-9857, and representatives are available at all times. We feel a talk with your local agent would be just as effective, but the Liberty Mutual site recommends policyholders call first.

When can I cancel?

You can cancel your homeowners policy at any time by calling a Liberty Mutual customer service representative, but as mentioned previously, early cancellation may result in fees.

Generally, Liberty Mutual sells policies over a particular amount of time, say 12 months, and although you will not be held accountable for the remainder of your premium, there will probably be an early cancellation fee.

When canceling by phone, your cancellation can be made effective immediately or can take effect at a later proposed date.

How can you make a claim?

If we are being honest, claims are the whole reason homeowners search for the right insurance policy. Finding great rates, affordable premiums, and excellent customer service are all important factors, but the big kahuna is the claims process.

Accidents happen and damage or loss to property is so much of a guarantee you might as well call them eventualities rather than accidents. So what you need is an insurance provider that makes the entire claims process policyholder-friendly so you can repair your loss, repair your life, and get on with living it.

Liberty Mutual provides plenty of alternatives when picking your plan. Remember to pay for only what you need, and they also provide several options when it comes to making your claim.

Ease of Making a Claim

Filing a claim with Liberty Mutual has never been easier. Policyholders can call the customer service line at 1-800-658-9857 or file their claim online; both are viable options that truly allow Liberty Mutual home insurance policyholders to take advantage of the conveniences of the modern age.

What you will need to file a claim online is a Liberty Mutual online account (this will consist of a username and password) that you will log in or sign up for, the date of the incident, and the details of said incident.

Once you’ve filed your claim, a representative from the claims department will contact you within one to two business days with further information and details on how you should proceed.

Premiums Written

We spoke of market share performance earlier, and much of that is decided by the number of premiums an insurance provider writes in any given year. For any other business, premiums written would be comparable to a product sold for a potential profit; in the case of insurance providers, these companies are selling a promise or contractual agreement as a form of income.

The basic rules of capitalism still apply in this analogy even if the product sold is not a tangible object, so the more premiums sold, the more potential for an insurance provider to turn a profit. The table below shows Liberty Mutual’s three-year totals for premiums written as supplied by the NAIC.

| Company | 2016 - % Market Share | 2016 - Premiums Written | 2016 Loss Ratio | 2017 - % Market Share | 2017- Premiums Written | 2017 Loss Ratio | 2018 - % Market Share | 2018 - Premiums Written | 2018 Loss Ratio |

|---|---|---|---|---|---|---|---|---|---|

| State Farm | 19.26% | $17,613,109,000 | 54.25% | 18.63% | $17,556,871,000 | 80.93% | 18.40% | $18,177,462,000 | 61.87% |

| Allstate | 8.64% | $7,903,530,000 | 49.98% | 8.44% | $7,957,403,000 | 55.60% | 8.36% | $8,262,445,000 | 65.55% |

| Liberty Mutual | 6.74% | $6,164,379,000 | 51.58% | 6.86% | $6,471,114,000 | 65.09% | 6.74% | $6,655,452,000 | 51.30% |

Liberty Mutual has shown growth each year in the number of premiums written, meaning the company continues to attract new customers while maintaining loyalty among veteran policyholders.

We included the other two top competitors in the insurance field to address the slight dip in the rise of premiums written that occurred around 2017 with the year’s aftereffects being represented in 2018 figures.

The premiums still rose in 2018 by about $200 million, but not nearly as much in gains from 2016-2017. The apparent drop or loss of momentum was seemingly due to a 2017 year with an unusual number of natural disasters.

This dip from 2017 weather conditions can be readily viewed in both the top contenders in lower performance gains between 2017 and 2018. The reason for bringing the slight dip up is to point out that even after a rough year, Liberty Mutual was still able to increase the number of premiums written while maintaining a lower loss ratio rate than either Allstate or State Farm.

Since insurance providers sell a promise to be redeemed at a later date to payout repair costs, business models and profit margins are dependent on consistent increases in the number of premiums written to cover the payouts for filed claims.

What is the loss ratio?

In a volatile market suspect to uncontrollable whims of chance and inclement weather conditions, insurance providers look to maintain the delicate balance between incoming premiums versus payouts for filed claims, which brings us to our segue into the topic of loss ratio.

An insurance provider sells a promise to repair damages at a future point in time in return for a monthly fee or rate, and in the majority of cases, the money a policyholder pays monthly could in no way cover the cost of the eventual home repairs needed.

So the money comes from a pooled fund of homeowners policies that the provider manages. But how can an insurance provider stay in business much less profitable if they are constantly paying claims to policyholders? And more importantly, how can you determine if an insurance provider is paying out more than they are taking in?

And that is exactly what the loss ratio percentage tells your average consumer. It is calculated by dividing the number of premiums written by the number of filed claims paid over a selected period.

A loss ratio that is under 40 percent is probably too low (this in effect suggests the provider is stingy in paying out claims), while one that is over 75 percent, is probably too high (a number which hints at a company’s lack of financial stability).

More money going out than in or vice versa is a basic equation for bad business and eventual bankruptcy. However, a single low or high year does not immediately signal bankruptcy, but a series of low or high years should be a clear warning sign; that is why in determining Liberty Mutual’s financial stability, we have compared loss ratio percentages over three years.

Liberty Mutual’s loss ratio percentage is both steady and low at around just under 52 percent for both 2016 and 2018, an impressive feat for an insurance provider of its size.

There was a peak in 2017 to around mid 60 percent, but as mentioned previously, that year had an unusual number of natural disasters so a spike in their loss ratio (signaling an increase in payouts) is to be expected and comforting from a policyholders point of view.

The loss ratio increase shows that when disaster struck for many of their policyholders, Liberty Mutual came to their aid by processing claims and willfully paying out for repairs.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Can you get a quote online?

Liberty Mutual has taken full advantage of the marketing potential in using the internet to not only maintain positive relations with existing policyholders but also to gain potential new clients. And as in any industry, the best way to entice new customers is to talk money.

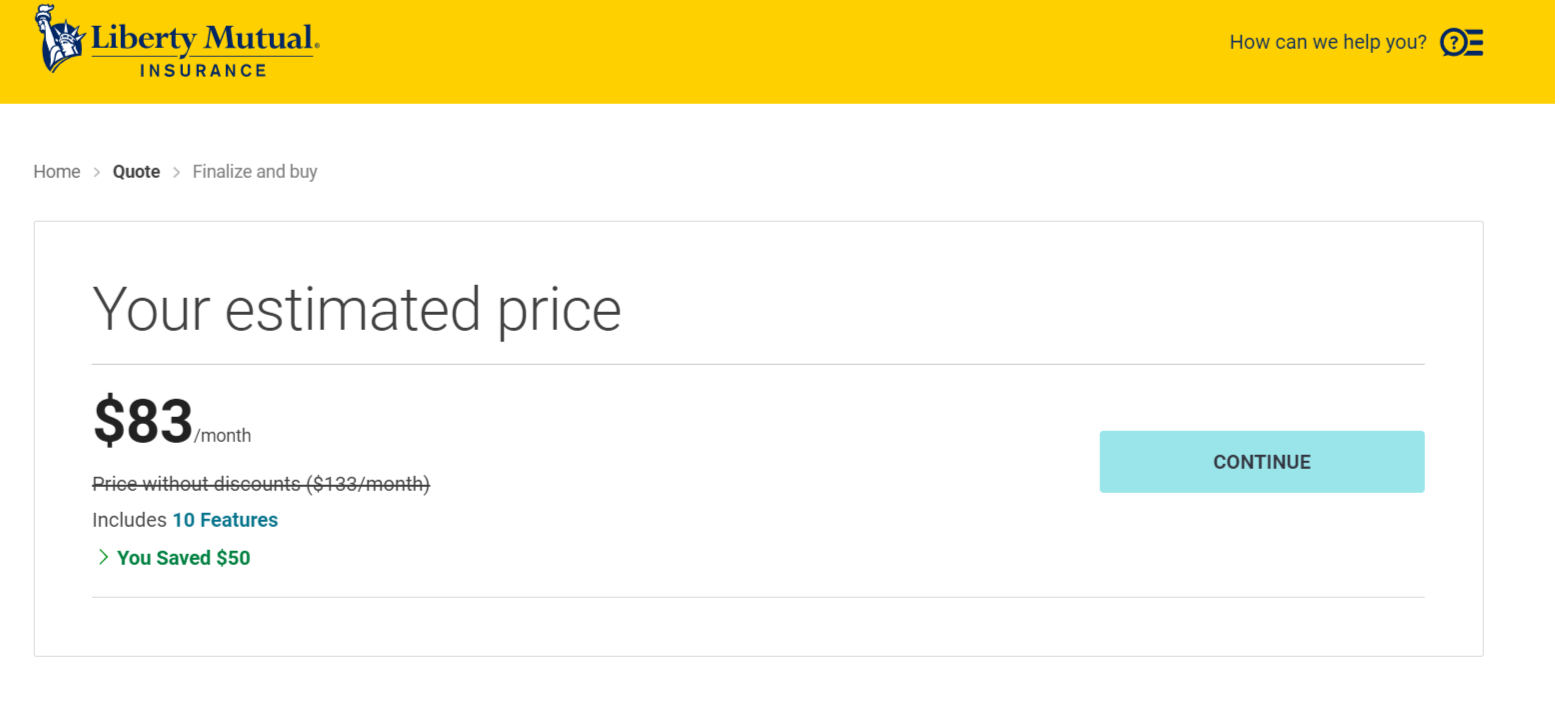

Liberty Mutual offers a free online quote option that is both quick and easy to fill out while providing a rough estimate of your monthly rate, coverage, and premium.

By no means is this set in stone (discounts are applied after actually signing up for a policy), but it helps to put you in the ballpark range of what a home insurance policy with Liberty Mutual would cost.

The online quote is just another “the more you know” inspired PSA of an option provided free of charge that will help you make the most informed decision when choosing the insurance provider and policy that meets your needs as a homeowner.

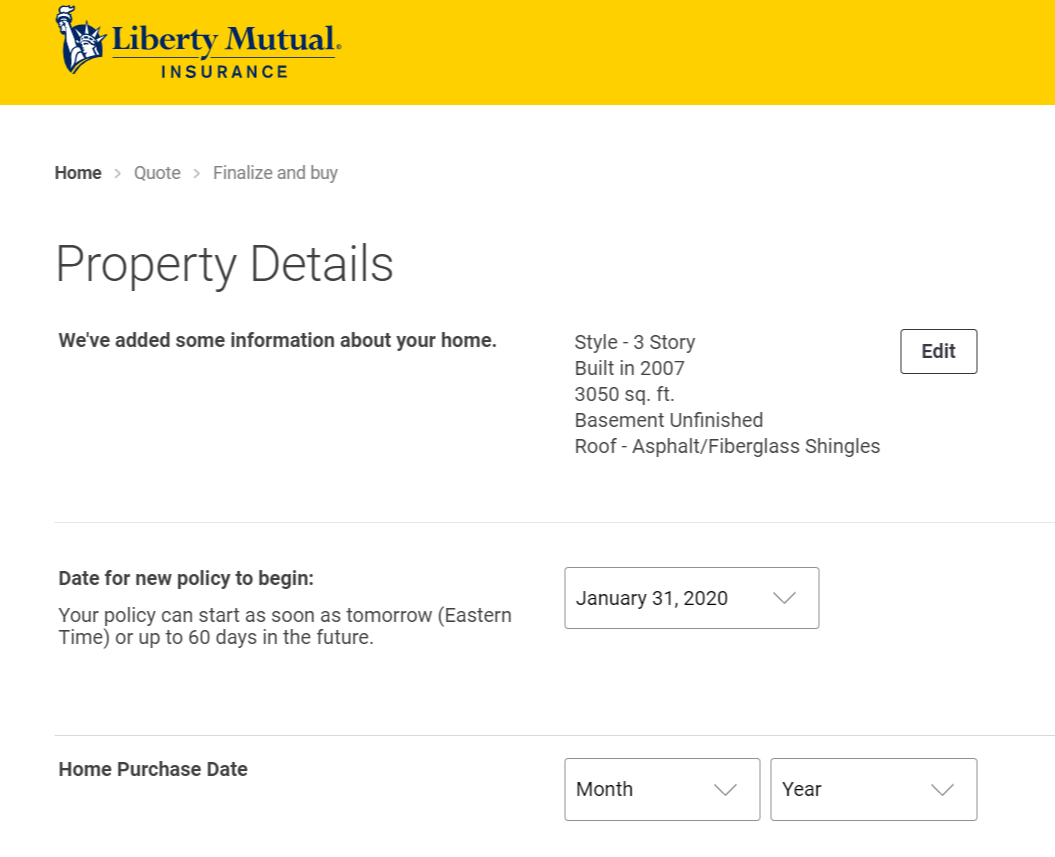

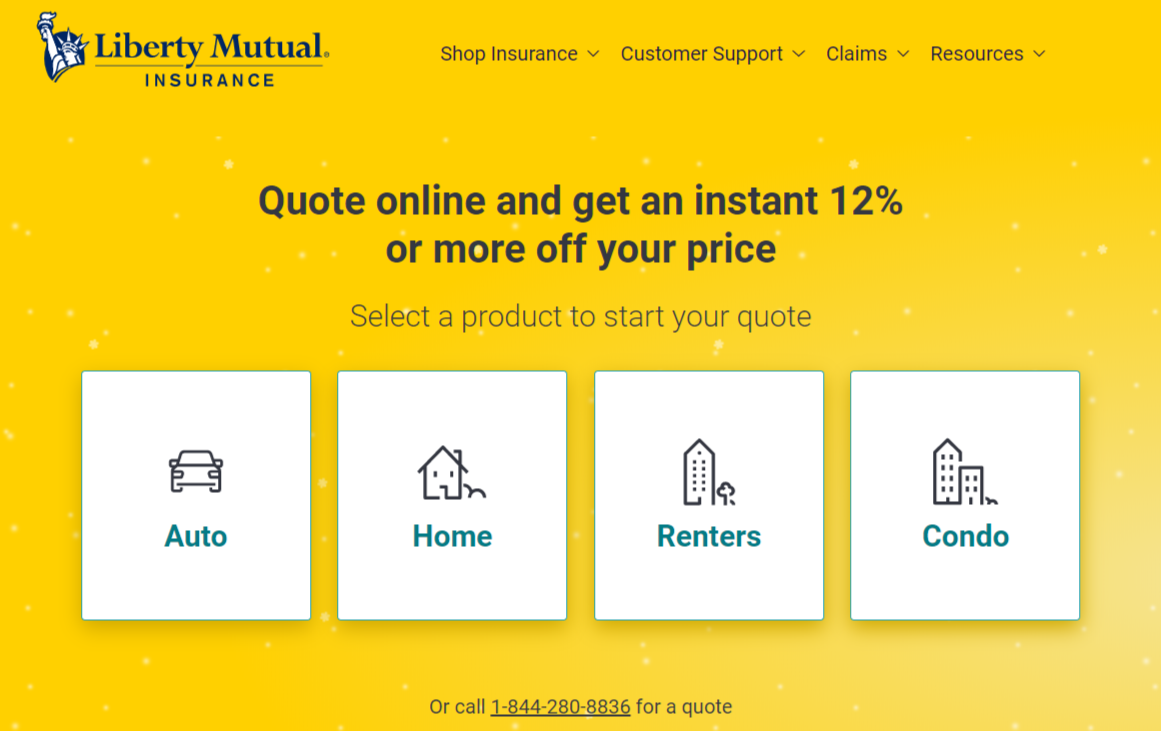

Step One

Acquiring an online quote from Liberty Mutual is a quick process that is offered front and center on the insurance provider’s front page. Beneath the header is first an enticing offer to save 12 percent for using the online quote option, and then a row of icons featuring Liberty Mutual’s different lines of insurance are lined up in a row.

Step Two

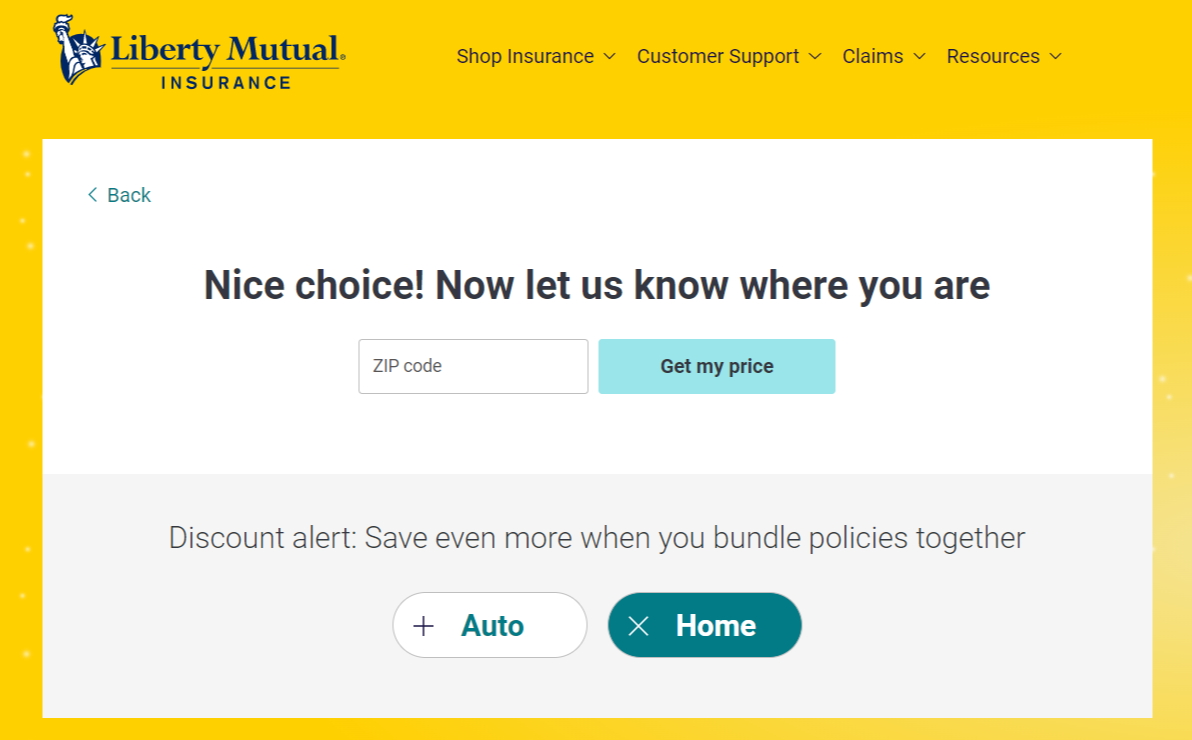

After clicking on the Home icon, you are then prompted to consider bundling options as you type in the ZIP code for the home you are looking to insure.

Step Three

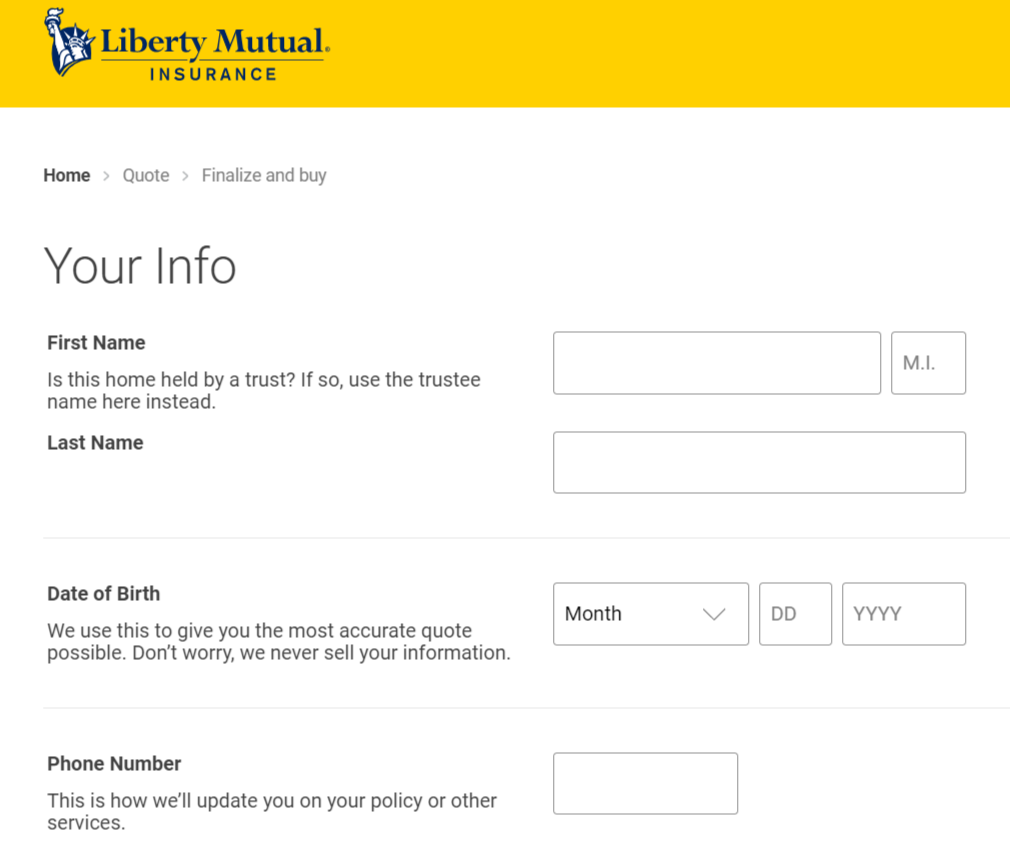

After inputting the address of the home you want to insure, you will be redirected to a new page and prompted to provide basic personal information like name, date of birth, and contact information.

Step Four

Step Four

After completing the personal information, the next two pages you will be redirected to cover the property details, current insurance policy information, and the status of your mortgage or lack thereof for your home.

Step Five

The property details section goes on for about three pages and when completed, the discount page is next in line. You can check all the boxes that apply and then click on the save and continue button at the bottom left of your screen.

Step Six

You answer two more questions of the yes or no variety concerning reviewing both the flood and additional insurance statement forms, and that is it. Liberty Mutual begins assessing your information and provides you with an online quote within less than a minute.

Step Seven

Aside from the relative quickness and limited amount of information necessary to apply, Liberty Mutual’s online quote service stands out from the competitors because it offers a final step most competitors would not dare offer.

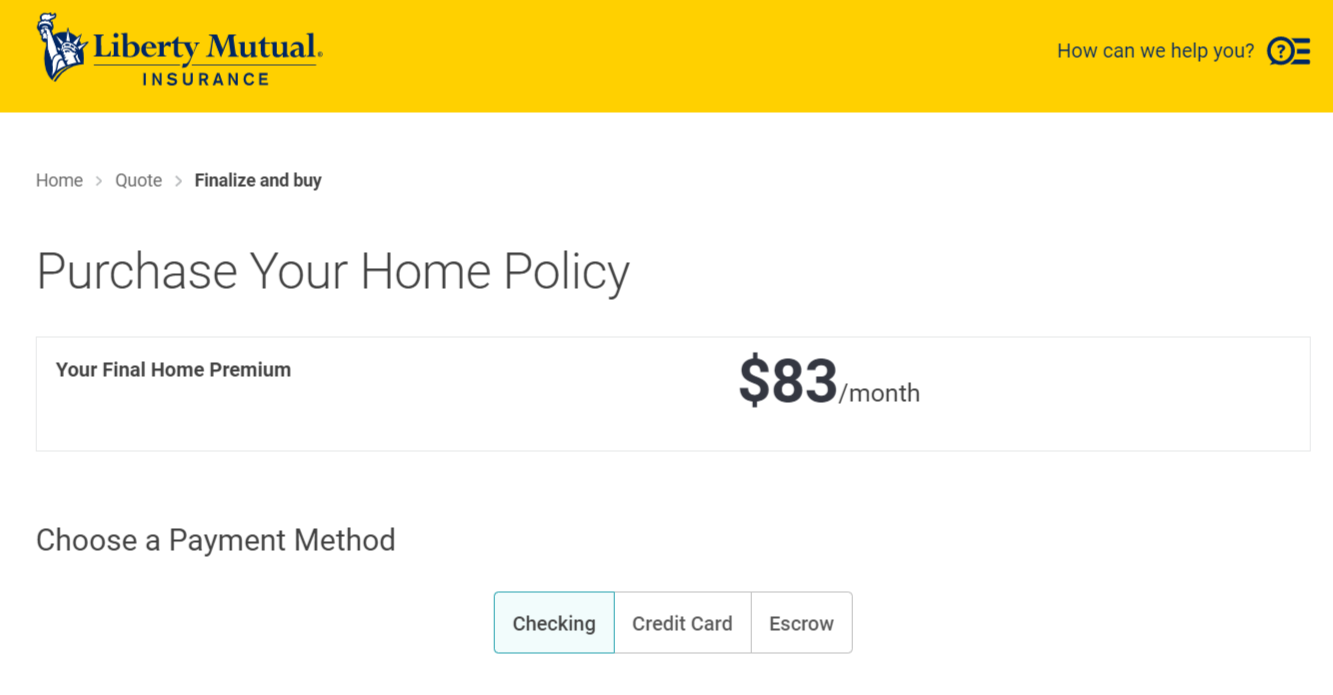

The final step is the offer to purchase that quoted policy online in the here and now. After reviewing your information, Liberty Mutual will sell you a policy online off their estimated quote. It just goes to show the trust that Liberty Mutual has in the accuracy quote service.

What are some details regarding their website or app?

Liberty Mutual’s website sticks to the basics of the personal insurance side of its business with an emphasis on providing an online quote for different lines of insurance.

It’s no wonder such a focus is placed on the quote option; aside from providing potential policyholders with accurate estimates for premiums and monthly rates, Liberty Mutual also sells these quoted estimates straight from their website.

You can purchase your home insurance from the comfort of your home with no immediate verification of the housing or personal information you provided to get your quote. Liberty Mutual will sell you an insurance plan on the spot after the quote service option they offer potential customers.

The site design features the company’s trademark yellow and blue. After spending a decent amount of time researching the site, we were surprised by how unobtrusive the yellow ended up being. Though the colors do little but create uniformity, they don’t distract over time.

The navigation is intuitive and simple with clearly marked links to important headers for each of the top sections. Since Liberty Mutual conducts business under a variety of surnames as well as the business conducted for their international operations, the front page for the site is a bit crowded, which can be overwhelming.

However, even with overcrowding on some pages, the site should not cause any problems as far as navigating to the correct page for the information for which you are searching.

Overall, the site provided all the necessary information we searched for under insurance policies; the inclusion of only basic details for each section was also beneficial for a better understanding on the go. The simpler, streamlined messages seem ideal for mobile and tablet devices.

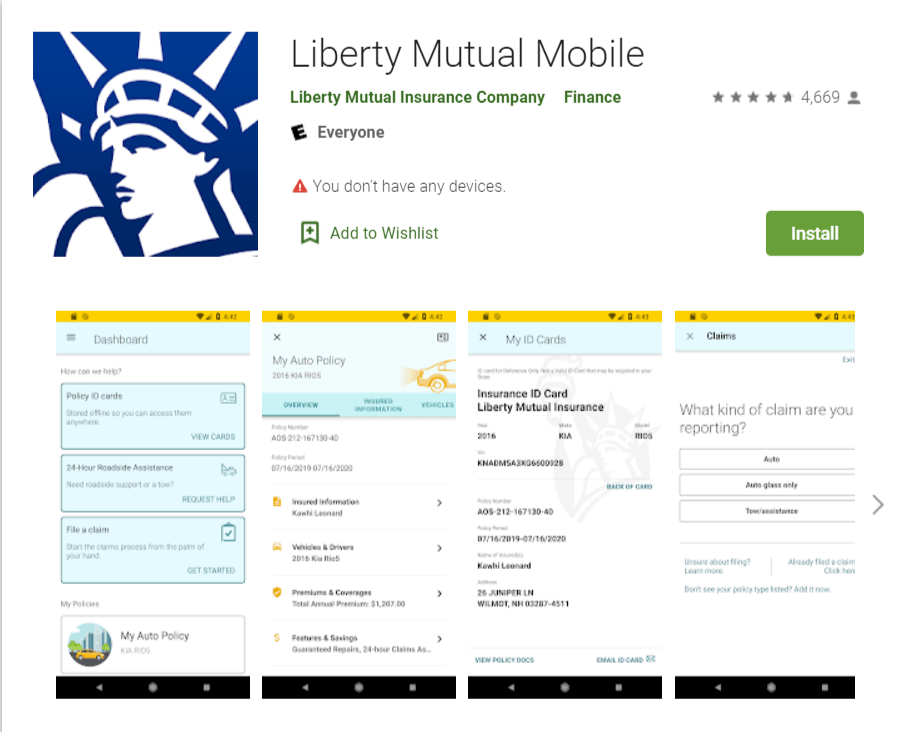

As far as mobile options, Liberty Mutual has its very own app that offers the same bill pay, policy review, and claims filing options as their website. The app is appropriately titled Liberty Mutual Mobile and is a rousing success according to recent Google Play reviews.

The 4.7 review out of 5 leaves little to no room for interpretation when it comes to the success of Liberty Mutual’s mobile app. And if the high score labeled on the graph failed to offer enough proof, the comments section is littered with praise for the app’s ease of use and functionality.

Our only slight grievance is that, like most insurance apps, it tends to focus primarily on auto insurance rather than providing a more inclusive description and in-app options for the many other lines of insurance that Liberty Mutual carries.

These gripes are minimal considering the app functions amazingly well and can still be used for home insurance policies even if it is not featured in the description.

As shown above, the layout is clean and the navigation intuitive for cell phone use. It makes a perfect addition to their already inclusive online presence. With the mobile app and the website, you can practically handle all of your Liberty Mutual insurance needs online now.

Are there pros and cons with Liberty Mutual?

Here is a quick summary of the pros and cons of being a Liberty Mutual home insurance policyholder.

| Pros | Cons |

|---|---|

| As the number 3 insurance provider in the nation and 5th globally, Liberty Mutual has the size to promote strength in fiscal stability while maintaining steady low rates for policyholders | The large size of Liberty Mutual as an insurance provider can lead policyholders to feel a lack of intimacy as if they are just another cog in the insurance machine |

| Liberty Mutual offers customizable policies touting a pay only what you need standard | Canceling your policy can result in fees as the majority of Liberty Mutual's policies are offered over a 12 month period |

| Liberty Mutual's mobile app and website provide on the go options for billpay, filing claims, and policy information. You can also purchase homeowners insurance directly online | An increased online presence, although convenient, lacks the intimacy and security of a more personable agent interaction |

Liberty Mutual really wins us over with its customized plans and mobile app access. In our book, the pros seem to outweigh the cons, but now that you have all the necessary information, we’ll let you decide that one for yourself.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the bottom line when it comes to Liberty Mutual?

Liberty Mutual is a solid company from a financial standpoint whose global reach only further solidifies its credit ranking status. As number three in the nation and fifth globally, Liberty Mutual’s size alone solidifies its rankings while also allowing the provider to maintain low monthly rates for policyholders.

The company’s market share has remained essentially the same over three years, and the low loss ratio rate also is a sign of good measure that Liberty Mutual will be around for the long haul.

We would prefer a true cancel anytime policy, but overall, Liberty Mutual is a solid company geared for the modern policyholder.

Hopefully, if we have done our job, you now have a better idea of what Liberty Mutual has to offer in the way of homeowners insurance. To get a more detailed estimate on what a Liberty Mutual policy rate would cost you every month, check out our free online quote option below. Just add your ZIP code, and we will guide you through the rest of the process. It’s that easy.

Frequently Asked Questions

What is Liberty Mutual homeowners insurance?

Liberty Mutual homeowners insurance is a type of insurance coverage designed to protect homeowners from financial losses due to damage or loss of their property. It provides coverage for the structure of the home, personal belongings, liability protection, and additional living expenses in case of a covered loss.

What does Liberty Mutual homeowners insurance typically cover?

Liberty Mutual homeowners insurance typically covers the dwelling (structure of the home), personal property, liability protection (including bodily injury and property damage to others), and additional living expenses if you’re unable to stay in your home due to a covered loss. It may also include coverage for specific perils, such as fire, theft, windstorm, and more.

Can I customize my Liberty Mutual homeowners insurance policy?

Yes, Liberty Mutual offers options to customize your homeowners insurance policy based on your specific needs. You can add optional coverages like identity theft protection, valuable items coverage, water backup, and more. It’s important to discuss your coverage needs with a Liberty Mutual representative to ensure you have the appropriate coverage in place.

How much does Liberty Mutual homeowners insurance cost?

The cost of Liberty Mutual homeowners insurance varies based on several factors, including the location of your home, the value of your property, the level of coverage you choose, your deductible, and any additional coverages you select. To get an accurate quote, it’s best to contact Liberty Mutual directly or visit their website and provide the necessary information for a personalized quote.

How do I file a homeowners insurance claim with Liberty Mutual?

To file a homeowners insurance claim with Liberty Mutual, you can do so online through their website, by phone, or through their mobile app. Be prepared to provide detailed information about the loss, including the date and cause of the damage, a description of the items affected, and any supporting documentation or photographs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.

Step Four

Step Four