Top Life Insurance Provider for Seniors in 2026 (Top 10 Companies)

The recommended top life insurance providers for seniors are New York Life, AIG, and Guardian. Explore why these companies secure their positions, providing peace of mind for seniors and their families.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life i...

Maria Hanson

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated February 2024

163 reviews

163 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

163 reviews

163 reviews 0 reviews

0 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviews

Leaving behind a legacy for your loved ones after you die is a very noble gesture, and purchasing cheap life insurance can help you make sure that those you leave behind have, at the very least, some financial support to fall back on after you’ve passed. But where can you find the best life insurance for seniors?

Our Top 10 Best Companies: Top Life Insurance Provider for Seniors

| Company | Rank | See Pros/Cons | Seniors-Focused Benefits | Additional Features | Best For |

|---|---|---|---|---|---|

| #1 | New York Life | Up To 10% | Up To 5% | Online Convenience |

| #2 | AIG | Up To 12% | Up To 6% | 24/7 Support | |

| #3 | Guardian Life | Up To 11% | Up To 4% | Vanishing Deductible | |

| #4 | Prudential | Up To 10% | Up To 5% | Safe-Driving Discounts | |

| #5 | Mutual of Omaha | Up To 9% | Up To 4% | Multi-Policy Discounts | |

| #6 | State Farm | Up To 9% | Up To 4% | Bundle Discounts | |

| #7 | Foresters Financial | Up To 8% | Up To 3% | Customizable Policies | |

| #8 | Lincoln Financial Group | Up To 10% | Up To 5% | Comprehensive Coverage | |

| #9 | MassMutual | Up To 8% | Up To 4% | Local Agents | |

| #10 | Globe Life | Up To 7% | Up To 3% | Policy Options |

Senior life insurance, as seen on TV, may sound like a dream come true. However, you should never purchase a life insurance policy simply because of a funny ad or clever slogan. Purchasing life insurance is a big financial step, and this task must be taken seriously.

Individuals who are interested in purchasing affordable life insurance for seniors should be sure to do a bit of research and read free reviews of different companies before buying a policy. This way, you can be certain that you’ve found the cheapest policy available to you that can also provide you with maximum coverage.

Keep reading to discover some of the best insurance companies on the market that provide cheap life insurance for seniors. If you want free quotes for life insurance for seniors, enter your ZIP code to start comparing rates right away.

#1 – New York Life: Online Convenience Leader

For seniors seeking reliable and comprehensive life insurance, New York Life emerges as the top choice, offering online convenience and peace of mind.Zach Fagiano Licensed Insurance Broker

Pros

- Up to 10% discount: Offers up to 10% discount on insurance policies.

- Up to 5% online discount: Provides a discount of up to 5% for purchasing policies online.

- Convenient online services: Offers online convenience for managing policies and making transactions.

Cons

- Limited discount percentages: Discounts offered may not be as high as some competitors.

- Lack of personalized support: Online services may lack the personalized assistance of in-person agents.

Read more: New York Life Insurance Company Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – AIG: 24/7 Support Specialist

Pros

- Up to 12% discount: Offers up to 12% discount on insurance policies.

- Up to 6% online discount: Provides a discount of up to 6% for purchasing policies online.

- Round-the-clock customer support: Offers 24/7 support for policyholders.

Cons

- Higher premium costs: Despite discounts, premiums might still be relatively higher compared to competitors.

- Limited customization options: Policies may lack flexibility in terms of coverage customization.

Read more: AIG Assurance Company Review

#3 – Guardian Life: Vanishing Deductible Pioneer

Pros

- Up to 11% discount: Offers up to 11% discount on insurance policies.

- Up to 4% online discount: Provides a discount of up to 4% for purchasing policies online.

- Vanishing deductible feature: Offers a vanishing deductible option for policyholders.

Cons

- Limited coverage options: May not offer as wide a range of coverage options compared to some competitors.

- Potential lack of online features: Online services may not be as comprehensive as those offered by other companies.

Read more: Guardian Life Insurance Company of America Review

#4 – Prudential: Safe-Driving Discount Innovator

Pros

- Up to 10% discount: Offers up to 10% discount on insurance policies.

- Up to 5% online discount: Provides a discount of up to 5% for purchasing policies online.

- Safe-driving discounts: Offers discounts for policyholders with safe driving records.

Cons

- Limited accessibility: May not have as many local agents or branch offices compared to competitors.

- Complex policy options: Policies may be complex, making it difficult for some customers to understand their coverage.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Mutual of Omaha: Multi-Policy Discount Specialist

Pros

- Up to 9% discount: Offers up to 9% discount on insurance policies.

- Up to 4% online discount: Provides a discount of up to 4% for purchasing policies online.

- Multi-policy discounts: Offers discounts for bundling multiple insurance policies.

Cons

- Potential lack of coverage options: May not offer as many coverage options tailored to specific needs.

- Limited online services: Online features may not be as robust or user-friendly as those offered by competitors.

#6 – State Farm: Bundle Discounts Expert

Pros

- Up to 9% discount: Offers up to 9% discount on insurance policies.

- Up to 4% online discount: Provides a discount of up to 4% for purchasing policies online.

- Bundle discounts: Provides significant discounts for bundling multiple insurance policies.

Cons

- Limited multi-policy discount: The multi-policy discount may not be as high compared to some competitors.

- Potential premium costs: Despite discounts, premiums might still be relatively higher for certain coverage levels.

Read more: State Farm Life Insurance Review

#7 – Foresters Financial: Customizable Policies Leader

Pros

- Up to 8% discount: Offers up to 8% discount on insurance policies.

- Up to 3% online discount: Provides a discount of up to 3% for purchasing policies online.

- Customizable policies: Offers policies that can be tailored to individual needs and preferences.

Cons

- Potential lack of transparency: Policy options and pricing may not be as transparent compared to competitors.

- Limited accessibility: May not have as many local agents or offices for personalized assistance.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Lincoln Financial Group: Comprehensive Coverage Specialist

Pros

- Up to 10% discount: Offers up to 10% discount on insurance policies.

- Up to 5% online discount: Provides a discount of up to 5% for purchasing policies online.

- Comprehensive coverage: Offers a wide range of coverage options to meet various needs.

Cons

- Higher premium costs: Premiums might be relatively higher compared to competitors, even with discounts.

- Potential for complex policies: Policies may be complex, requiring thorough understanding before purchase.

#9 – MassMutual: Local Agents Focused

Pros

- Up to 8% discount: Offers up to 8% discount on insurance policies.

- Up to 4% online discount: Provides a discount of up to 4% for purchasing policies online.

- Local agents: Provides access to local agents for personalized assistance and support.

Cons

- Limited online services: Online features and services may not be as extensive or user-friendly as those offered by competitors.

- Potential for slower service: Local agent-focused approach may result in slower response times for certain inquiries or requests.

#10 – Globe Life: Policy Options Provider

Pros

- Up to 7% discount: Offers up to 7% discount on insurance policies.

- Up to 3% online discount: Provides a discount of up to 3% for purchasing policies online.

- Variety of policy options: Offers a range of policy options to cater to different needs and preferences.

Cons

- Limited coverage customization: Policy options may not be as customizable compared to some competitors.

- Potential for higher premium costs: Premiums might still be relatively higher for certain coverage levels, even with discounts.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

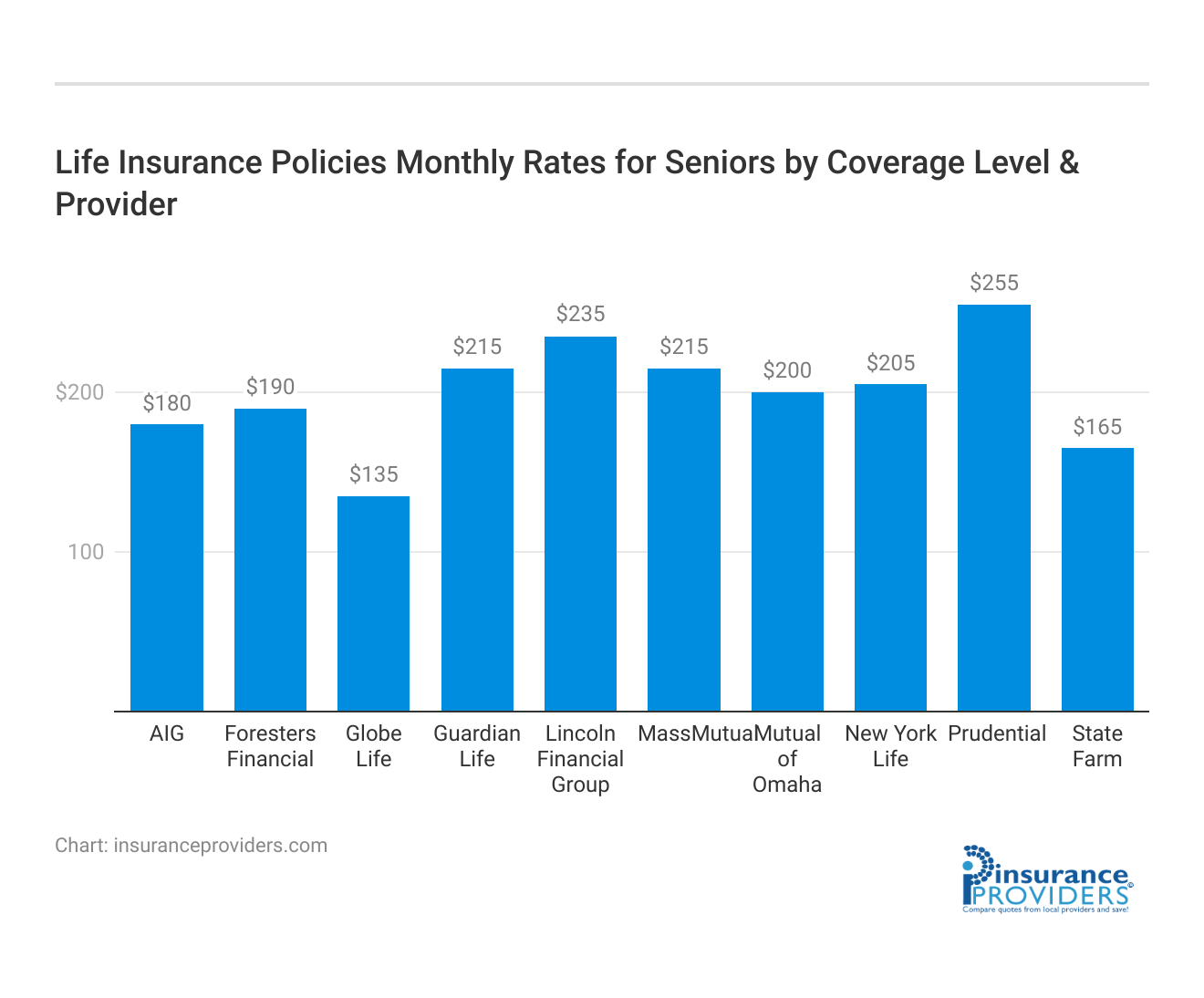

Understanding Life Insurance Rates for Seniors

When it comes to life insurance for seniors, the coverage rates can vary based on factors like age, health, and the chosen insurance provider. Let’s take a closer look at the average monthly rates for both full and minimum coverage offered by some prominent insurance companies.

Average Monthly Life Insurance Rates for Seniors

| Insurance Company | Full Coverage | Minimum Coverage |

|---|---|---|

| New York Life | $205 | $110 |

| AIG | $180 | $90 |

| Guardian Life | $215 | $108 |

| Prudential | $255 | $133 |

| Mutual of Omaha | $200 | $100 |

| State Farm | $165 | $80 |

| Foresters Financial | $190 | $80 |

| Lincoln Financial Group | $235 | $120 |

| MassMutual | $215 | $108 |

| Globe Life | $135 | $68 |

Who provides the best life insurance for seniors?

Many seniors are on a fixed income, and as such, must pay strict attention to their budget. That being said, you should buy life insurance for seniors from companies that can provide you with adequate coverage to accomplish your goals and also work with the needs of your budget.

Thankfully, you can find great life insurance policies at great rates with companies that have been in the business for years. Some of the best life insurance companies that offer low rates and the coverage you need can be seen here:

- Mutual of Omaha

- AIG

- Amica (read our “Amica Life Insurance Company Review” for more information)

- Globe Life Insurance

- Gerber Life

Now, which is considered to be the “best” company will, of course, vary depending upon the needs of the individual looking for insurance. However, you should always make sure that you do your research on any insurance company that you are interested in — even if it is well-known.

Let’s take a closer look at each one of these companies so you can learn a little more about them and discover which one is the best fit for you and your insurance needs.

Mutual of Omaha

If you are over 70 years old, you can still purchase a life insurance policy with Mutual of Omaha, a titan of the insurance industry. This company first opened its doors for business in 1909 and advertises that you could purchase a whole life insurance policy starting at just $8.84 per month. There’s no need to worry about the financial strength of this company either, as it earned an A+ rating from A.M. Best.

AIG

AIG is another company that has been providing insurance for quite some time — since 1919, in fact.

If you were to do business with AIG, you could, as the company advertises, purchase a guaranteed approval policy starting at age 50. This means that you won’t have to bother with a medical exam in order to obtain coverage.

While the maximum age for this policy is 80 years old, you could potentially get coverage for as low as $21 per month. You can rest assured that your beneficiaries will be able to receive the death benefit provided by the policy because AIG has an A rating from A.M. Best.

Even better, if you want to get some life insurance quotes about life insurance for seniors, you can apply directly via AIG’s company website.

Read more:

- Senior Life Insurance Company: Customer Ratings & Reviews

- Top Guaranteed Issue Life Insurance Provider

Amica

If you are determined to purchase insurance from a financially strong company, you may want to add Amica auto insurance, an A.M. Best A+ rated company, to your list for consideration. This life insurance institution advertises that you could potentially buy $50,000 in coverage for as little as $12.95 per month. You could even purchase a whole life 20 policy up until you reach your 80th birthday.

Amica is no fly-by-night insurance company either. It has been serving clients since 1907.

Globe Life Insurance

Founded in 1957, Globe Life Insurance may be a little younger than its competitors; however, This company advertises that you could purchase $100,000 in coverage starting at $3.49 per month, which is nothing to sneeze at. With an A rating from A.M. Best, Globe Life Insurance could be a great choice for you if you want to get a lot of coverage for a low rate.

Gerber Life

Gerber Life doesn’t only provide insurance for babies or kids. Seniors are also invited to take advantage of some of the great plans offered by this company, which earned an A rating from A.M.Best. Applicants for final expense coverage could potentially buy $50,000 in coverage for only $3.49 per month.

Read more: Gerber Life Insurance Company Review

Case Studies: Top Life Insurance Provider for Seniors

Case Study 1: Mutual of Omaha

Mutual of Omaha, a titan in the insurance industry, has been providing life insurance policies since 1909. Even if you’re over 70 years old, you can still purchase a policy from them.

With a starting price of just $8.84 per month for a whole life insurance policy, Mutual of Omaha offers affordable options. The company has also earned an A+ rating from A.M. Best, assuring its financial strength.

Case Study 2: AIG

AIG has been in the insurance business since 1919 and is another trusted provider. They offer a guaranteed approval policy starting at age 50, eliminating the need for a medical exam.

While the maximum age for this policy is 80, you can potentially secure coverage for as low as $21 per month. AIG holds an A rating from A.M. Best, ensuring the reliability of their death benefit payouts.

Case Study 3: Amica

For those seeking insurance from financially strong companies, Amica is an excellent choice. This A.M. Best A+ rated company has been serving clients since 1907.

With Amica, you could potentially purchase $50,000 in coverage for as little as $12.95 per month. They even offer a whole life 20 policy that you can acquire until your 80th birthday.

Case Study 4: Globe Life Insurance

Although Globe Life Insurance is relatively younger compared to its competitors, having been founded in 1957, it offers attractive coverage options.

They advertise the ability to purchase $100,000 in coverage for as low as $3.49 per month. With an A rating from A.M. Best, Globe Life Insurance provides a great choice for seniors who want extensive coverage at an affordable rate.

Case Study 1: Gerber Life

Gerber Life, known for its insurance plans for babies and kids, also offers options for seniors. They have received an A rating from A.M. Best, indicating their reliability. Seniors looking for final expense coverage can potentially buy $50,000 in coverage for just $3.49 per month through Gerber Life.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheap Life Insurance for Seniors: The Bottom Line

Life insurance for elderly people is an incredible tool that can help you provide for your loved ones even after you’ve gone. Individuals on a fixed income may think that life insurance isn’t a viable option, but there are several reputable insurance companies doing business today that can help you get the coverage you need at a reasonable rate.

Now, you must bear in mind that when it comes to life insurance rates, life insurance for seniors can fluctuate based upon the company’s rules and other criteria, so you should always get a few different quotes to see which company is right for you.

If you’re ready to start looking for a life insurance company offering life insurance for seniors, you don’t have to wait.

Read more: Cheap Life Insurance Policies

Enter your ZIP code to get free quotes about life insurance for seniors today.

Frequently Asked Questions

Why is life insurance important for seniors?

Life insurance is important for seniors because it provides financial protection and peace of mind for themselves and their loved ones. It can help cover final expenses, outstanding debts, estate taxes, and leave a financial legacy for beneficiaries. Life insurance can also be used as a tool for estate planning and transferring wealth to future generations.

What factors should seniors consider when choosing a life insurance provider?

When choosing a life insurance provider as a senior, consider the following factors:

- Financial strength and reputation: Look for insurance companies with strong financial ratings and a reputation for stability and reliability.

- Policy options: Assess the range of policy options available, such as term life insurance, whole life insurance, or guaranteed universal life insurance, and determine which best fits your needs.

- Underwriting process: Understand the underwriting process of each provider, as some may have more lenient requirements or offer policies with no medical exams.

- Coverage amount and premiums: Consider the coverage amount you need and compare premiums from different providers to find an affordable option.

- Customer service and claims handling: Research customer reviews and ratings to assess the provider’s customer service and claims experience.

- Additional benefits or riders: Some insurers offer optional riders or benefits that may be relevant to seniors, such as long-term care riders or living benefits for critical illness or chronic conditions.

Which life insurance provider is considered a top choice for seniors?

There are several reputable life insurance providers that are often recommended for seniors. Some top choices include:

- New York Life: With a long-standing history and excellent financial ratings, New York Life offers various life insurance options and has experience serving the senior market.

- Mutual of Omaha: This provider offers a range of life insurance policies, including guaranteed universal life insurance, which can provide coverage without a medical exam.

- AIG (American International Group): AIG offers life insurance options specifically designed for seniors, with policies that may have simplified underwriting or no medical exams.

- Transamerica: Transamerica provides a variety of life insurance products and has a strong presence in the senior market, offering options like final expense insurance.

- Protective Life: Protective Life offers term life and whole life insurance options for seniors, with flexible coverage and customization options.

Are there life insurance options for seniors with pre-existing health conditions?

Yes, there are life insurance options available for seniors with pre-existing health conditions. Some insurance providers specialize in offering coverage to individuals with health issues or offer policies with simplified underwriting that may not require a medical exam. However, the availability and cost of coverage may vary depending on the specific condition and its severity. Consulting with an insurance professional or working with a broker who specializes in high-risk cases can help you navigate the options and find suitable coverage.

Can seniors purchase life insurance without a medical exam?

Yes, some life insurance providers offer policies without a medical exam, or with simplified underwriting processes that require less extensive medical information. These policies may be a good option for seniors who prefer to avoid medical exams or have health conditions that may affect their insurability. However, it’s important to note that policies without medical exams may have certain limitations, such as lower coverage amounts or higher premiums compared to policies that require a medical exam.

Are there any specific considerations for seniors when applying for life insurance?

Seniors may need to consider a few additional factors when applying for life insurance, such as:

- Health conditions: Be prepared to provide detailed information about any pre-existing health conditions or undergo medical underwriting, which may include a medical questionnaire or examination.

- Policy duration: Consider the desired length of coverage. Term life insurance may provide coverage for a specific period, while permanent life insurance offers lifetime coverage.

- Coverage amount: Evaluate the amount of coverage needed to meet financial obligations, such as final expenses, outstanding debts, or providing for dependents.

- Beneficiary designations: Ensure that beneficiary designations are up to date and reflect your current wishes.

- Premium affordability: Assess the premiums in relation to your budget, considering that premiums may increase with age.

What is the best age to buy life insurance as a senior?

There is no specific age that is considered the best age to buy life insurance as a senior, as it depends on individual circumstances and needs. However, it’s generally recommended to consider purchasing life insurance sooner rather than later. Premiums tend to increase with age, and the risk of developing health conditions also rises.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.