Top Nebraska Auto Insurance Providers [2026]

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated February 2024

| Nebraska Statistics | Details |

|---|---|

| Road Miles | 94,481 |

| Registered Vehicles | 936,137 |

| Population | 1,929,268 |

| Most Popular Vehicle | Ford F-150 |

| Uninsured Motorists | 6.8% |

| Driving Related Deaths | Total: 230 Speeding: 29 Drunk Driving: 66 |

| Annual Premiums for State Minimum Coverage | Liability: $365 Collision: $237 Comprehensive: $229 |

| Cheapest Providers | American Family Mutual and USAA |

Nebraska law requires you to carry auto insurance, but finding a policy that meets your needs at a reasonable price can be a challenge. It doesn’t help that those auto insurers who tout user-friendly websites have not made it easy to quickly compare providers based on coverage and price.

We are here to give Nebraskans an easy solution to that challenge. Our site provides you with a one-stop-shop for finding the auto coverage you need at the best price. For good measure, we also rank providers and give you an overview of Nebraska’s rules of the road.

You can start by comparing rates between Nebraska auto insurance providers by entering your ZIP code here, or keep reading to get a more detailed rundown on Nebraska’s auto insurance market.

Nebraska Car Insurance Coverage and Rates

With the state mandating that each driver carries a minimum level of insurance, drivers who are caught without coverage may face penalties and even time in jail. Additionally, if you drive uninsured in Nebraska and cause an accident, you will be held financially liable for any damage.

Nebraskan drivers must carry at least $25,000 in bodily injury coverage with per-accident bodily injury coverage of $50,000 as well as $25,000 in property damage liability coverage.

Nebraska also requires drivers to carry uninsured and underinsured motorist coverage.

However, unlike some states, there is no requirement that drivers carry personal liability, collision insurance policies, or comprehensive insurance policies. That means that if you are on the road with only the state minimum coverage, you will be paying for repairs to your vehicle if you cause an accident or hit an animal, causing damage.

Nebraska’s lack of a comprehensive insurance requirement also means that you will be paying for any damage to your vehicle while it’s parked if your coverage only meets the minimum coverage requirements. That includes weather damage (often referred to as “Acts of God”).

What is Nebraska’s car culture?

Only a fraction of Nebraska’s population still works in agriculture. Residents have maintained the sensibilities of their pioneer forefathers and prize dependability and functionality when it comes to what they drive. That is one of the reasons the most popular vehicle is the Ford F-150 pickup truck.

However, Nebraskans still recognize the importance of automobiles in the state’s history, and they are racing fans. Lincoln is home to the Museum of American Speed, which focuses on auto racing. Also, Chevyland USA in Elm Creek and Pioneer Village in Minden feature historic vehicles.

Nebraska drivers also know the importance of a paper map and emergency supplies. Long distances between towns can mean spotty cell phone coverage on the roads and limited access to phone-based mapping services.

It also means you may not be able to call for a tow from your car.

How much coverage is required for Nebraska minimum coverage?

Nearly all states require drivers to carry insurance and Nebraska is no exception. The drivers of all vehicles registered in the state must carry automobile liability insurance (or other proof of financial responsibility) that meets or exceeds these minimum coverage amounts:

- $25,000 per person in bodily injury coverage

- $50,000 per accident in bodily injury coverage when multiple people are injured in a single accident

- $25,000 in property damage coverage

Even though Nebraska has one of the lowest levels of uninsured drivers in the country, the state still requires all auto insurance policies to include uninsured motorist (UM) and underinsured motorist (UIM) coverage in the following amounts:

- $25,000 per person in UM/UIM coverage

- $50,000 per accident in UM/UIM coverage for accidents where more than one individual is injured

For those drivers who are seeking additional UM/UIM coverage, Nebraska law mandates that insurers provide coverage of up to $100,000 per person and $300,000 per accident for those drivers who request and pay for the additional coverage.

Nebraska drivers must show proof of financial responsibility for all state-registered vehicles at the request of a law enforcement officer. However, most recreational and dealer vehicles are exempt from the requirement. Drivers may also show an electronic copy of their insurance card.

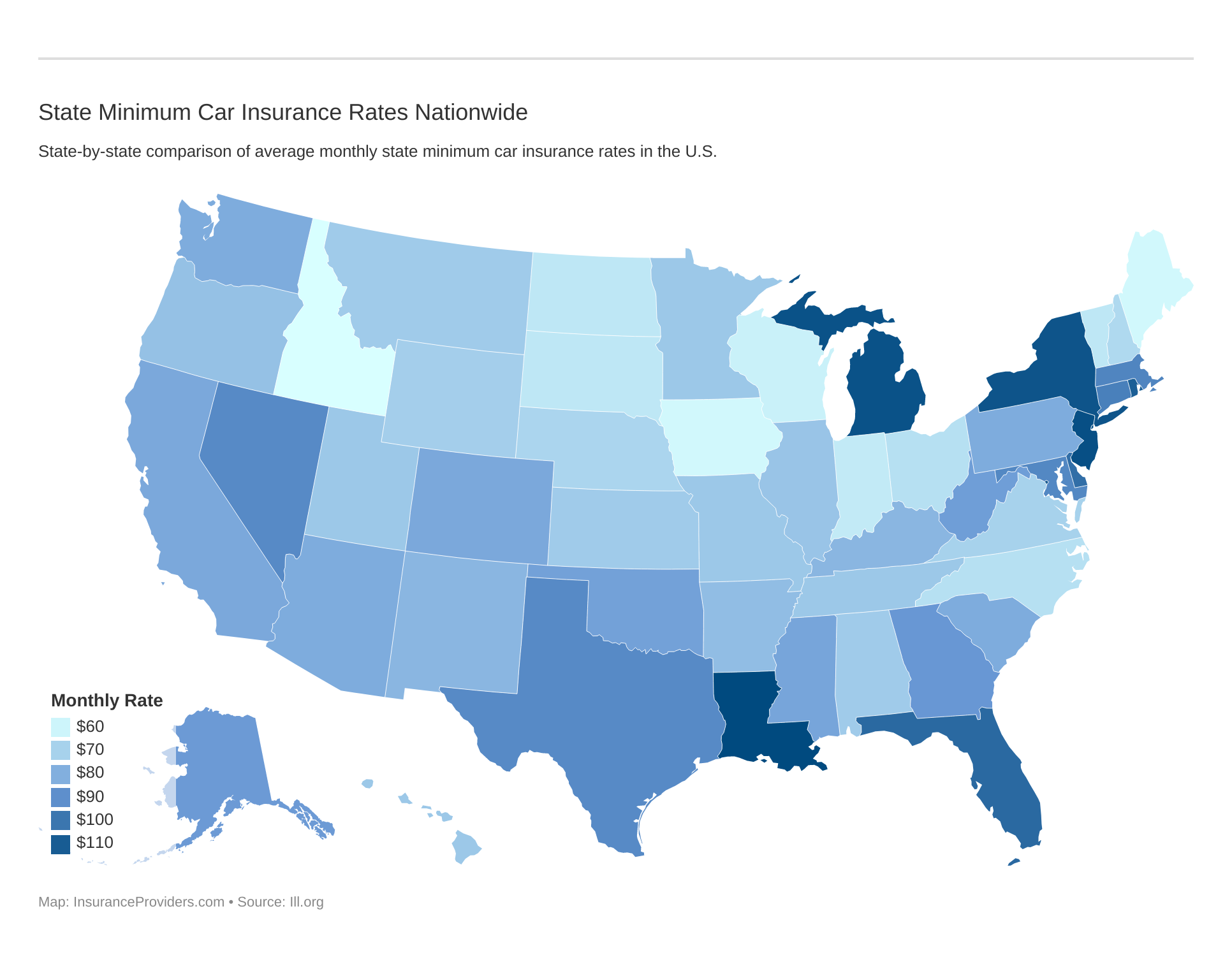

Minimum auto insurance coverage and rates vary from state to state. Compare state to state below:

What are forms of financial responsibility in Nebraska?

Auto insurance is usually the easiest and least expensive way for drivers to prove they have taken financial responsibility for a vehicle, but Nebraska does allow other methods. Showing you have auto insurance is done by filing a certificate of insurance with the state department of motor vehicles (DMV) showing an authorized insurer has issued you a policy.

Nebraska drivers may also file a bond for the payment of $75,000 issued by an authorized surety company or by at least two individual sureties who own real estate in Nebraska that was approved by a court. Additionally, a driver may simply submit a $75,000 cash bond to the state.

Finally, Nebraska drivers may submit a certificate of self-insurance to the DMV as proof of financial responsibility.

How much percentage of income are premiums in Nebraska?

Nebraska residents took home an average of $43,277 in annual disposable income for 2014, which ranked as 15th in the country for that year. Disposable income is calculated as an individual’s income minus what was paid in taxes. In other words, how much that person actually had to spend. (For more information, read our “Are Auto Insurance premiums tax deductible?“).

One of the uses of disposable income is to calculate how much of the average individual’s take-home pay is spent on auto insurance. In Nebraska, the average annual payment was $806 for 2014, or 1.86 percent of disposable income.

The good news for Nebraskan is that, for 2014, their auto premiums as a percentage of income were tied with Maine for the country’s eighth-lowest for 2014. (For more information, read our “Maine Auto Insurance Guide [Providers + Coverage]“).

Among its midwestern neighbors, Nebraska residents pay about the average percentage of disposable income for auto insurance.

Nebraskans pay slightly more than their neighbors in Iowa and South Dakota but a little less than those in Kansas. The only midwestern state with significantly higher premiums as a percentage of income was Missouri, where residents paid 2.3 percent of their disposable income.

Premiums as a percentage of income also show that Nebraska’s rates have held pretty steady over the past few years. Rates did go up by more than $50 annually between 2012 and 2014, but the discretionary income of the average Nebraskan kept pace by increasing by $1,678 for those years.

CalculatorPro

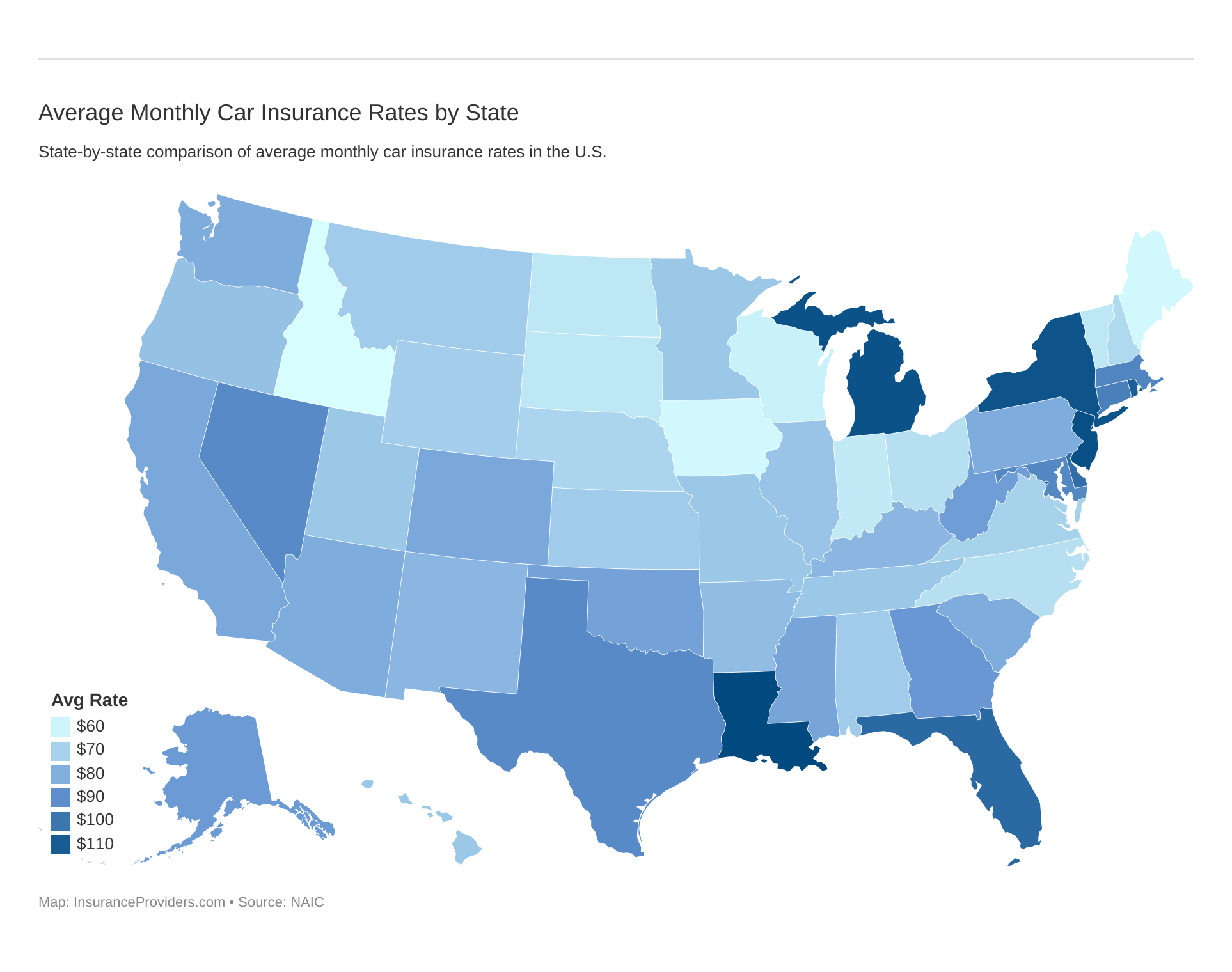

Average Monthly Car Insurance Rates in NE (Liability, Collision, Comprehensive)

The National Association of Insurance Commissioners (NAIC) tracks average auto insurance rates for each state and made the following findings for Nebraska in 2015, the most recent year for which data is available:

| Coverage Type | Annual Cost | Average (2011-2015) |

|---|---|---|

| Liability | $365 | $349 |

| Collision | $237 | $224 |

| Comprehensive | $229 | $206 |

| Combined | $831 | $779 |

While the NAIC’s numbers are based on coverage that only meets Nebraska’s minimum levels, they show that Nebraska’s average annual auto insurance rates for 2015 were lower than the national average of $1,311 annually.

Unfortunately, the NAIC’s numbers also show that Nebraska’s combined average annual rate increased from $732 in 2011 to $831 in 2015, a 13 percent increase over that period.

Your average monthly car insurance rates by coverage may be cheaper than expected for additional coverage like comprehensive. Review rates for car insurance coverage below:

What additional liability is available in Nebraska?

Knowing the financial health of your state’s auto insurance providers can help you figure out if significant rate increases are coming soon, or if insurers will soon be fleeing the state because they can’t turn a profit there.

One of the ways the insurance industry determines the financial health of a carrier is by monitoring its loss ratio, which is the ratio of insurance claims paid (plus adjustment expenses) divided by the total premiums collected. A high loss ratio is often a sign of financial distress and a ratio of more than 100 percent often shows that an insurer lost money in your state for that year.

As a general rule, a state is considered to have a healthy auto insurance market when its loss ratios are between 40 percent and 75 percent. A ratio of less than 40 percent usually shows an insurer is collecting more in premiums than needed to pay claims. A ratio topping 75 percent often shows that carriers are not collecting enough in premiums to cover their expenses.

High loss ratios are not necessarily a sign that a carrier is facing immediate bankruptcy. It is more likely that the insurer will be forced to increase policy premiums in the near future.

However, high loss ratios for several years running may show that an insurer is in financial distress.

Unfortunately, the loss ratios calculated by the NAIC for Nebraska from 2013 to 2015 (the latest years for which data is available) show that the auto insurance market has loss ratios for the state that are on the high side. That means Nebraska drivers could soon see rate increases.

| Nebraska Loss Ratios | 2015 | 2014 | 2013 |

|---|---|---|---|

| Medical Payments (MedPay) | 83.31 | 79.86 | 81.53 |

| Uninsured/Underinsured Motorists (UM/UIM) Coverage | 75.55 | 77.22 | 70.45 |

For 2015, Nebraska auto insurers had an average loss ratio of 83 percent for medical coverage and 76 percent for UM/UIM coverage. The NAIC did not provide loss ratios for personal injury protection in Nebraska for those years.

What add-ons, endorsements and riders are available in Nebraska?

Remember, Nebraska’s mandated minimum coverage levels will provide you with just that: minimum coverage. Most providers offer add-ons that provide for coverage to help shield you from out-of-pocket payments in a variety of situations that are not covered by basic auto policies.

These add-ons usually come at a price, but they can provide additional peace of mind for Nebraska drivers. Click on the links below to find out more about these common auto insurance add-ons:

- Guaranteed Auto Protection(GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Average Monthly Car Insurance Rates in NE (Liability, Collision, Comprehensive)

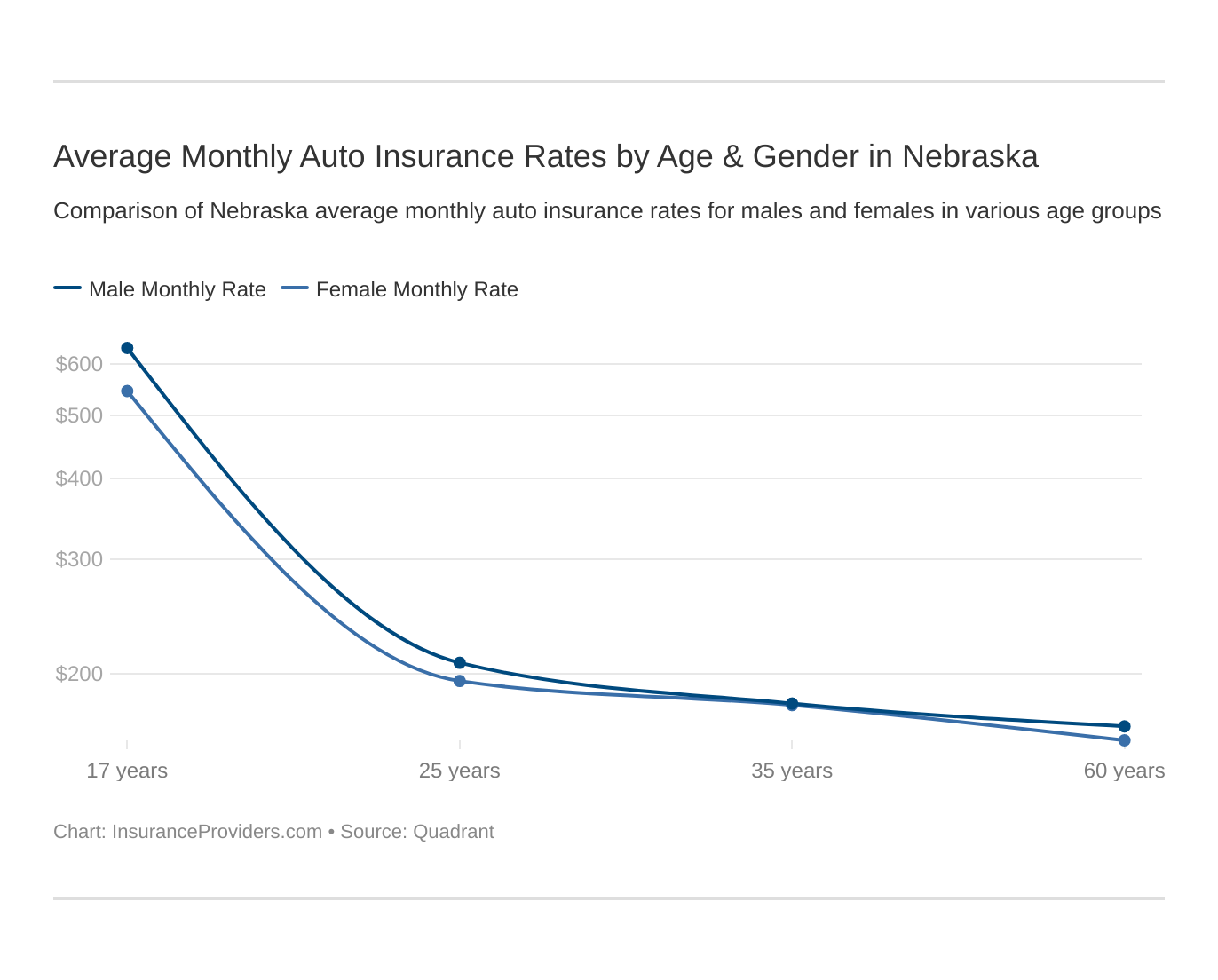

Auto insurers often consider factors like gender, marital status, and age when setting rates. While several states bar insurers from using gender in rate setting, Nebraska is not one of them. That means female drivers usually pay lower rates than male drivers, sometimes significantly lower.

| Company | Married 35-year-old female | Married 35-year-old male | Married 60-year-old female | Married 60-year-old male | Single 17-year-old female | Single 17-year-old male | Single 25-year-old female | Single 25-year-old male |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,181.35 | $2,077.34 | $1,938.05 | $1,954.86 | $6,080.95 | $6,397.53 | $2,455.30 | $2,507.30 |

| American Family Mutual | $1,770.79 | $1,770.79 | $1,612.52 | $1,612.52 | $2,966.53 | $4,367.34 | $1,732.11 | $1,874.67 |

| Mid-Century Ins Co | $2,294.53 | $2,283.40 | $2,057.06 | $2,167.27 | $8,770.83 | $9,042.05 | $2,594.48 | $2,713.90 |

| Geico General | $2,948.59 | $2,893.21 | $2,888.54 | $2,779.55 | $6,078.75 | $7,963.78 | $2,659.17 | $2,575.93 |

| Safeco Ins Co of IL | $3,285.67 | $3,565.82 | $2,594.19 | $3,158.12 | $14,111.65 | $15,859.09 | $3,448.52 | $3,821.47 |

| Allied P&C | $1,812.89 | $1,872.18 | $1,622.89 | $1,738.25 | $4,171.27 | $5,204.70 | $2,086.90 | $2,259.18 |

| Progressive Northern | $2,108.34 | $2,038.13 | $1,730.90 | $1,797.14 | $8,039.05 | $9,069.45 | $2,524.47 | $2,700.63 |

| State Farm Mutual Auto | $1,595.00 | $1,595.00 | $1,395.53 | $1,395.53 | $4,288.72 | $5,477.80 | $1,760.67 | $1,993.40 |

| USAA | $1,386.59 | $1,384.24 | $1,260.17 | $1,299.75 | $4,333.52 | $5,190.05 | $1,795.93 | $2,005.79 |

Read more:

- Mid-Century Insurance Company: Customer Ratings & Reviews

- State Farm Mutual Automobile Insurance Company Review

If you are young and unmarried, the above data may have you concerned about your auto insurance rates. However, you must remember the chart lists the average of Nebraska policies and includes high-risk drivers and those who have purchased more than state-minimum coverage.

Additionally, if you are young with a good driving record, you are likely to pay less than the amounts listed in the chart (but you will still pay more than more experienced drivers with the same driving record).

Which gender and age pays more for car insurance? Drivers under 25 years old are often in the highest risk class. See if the gender stereotype (males vs female auto insurance rates) holds true in Nebraska.

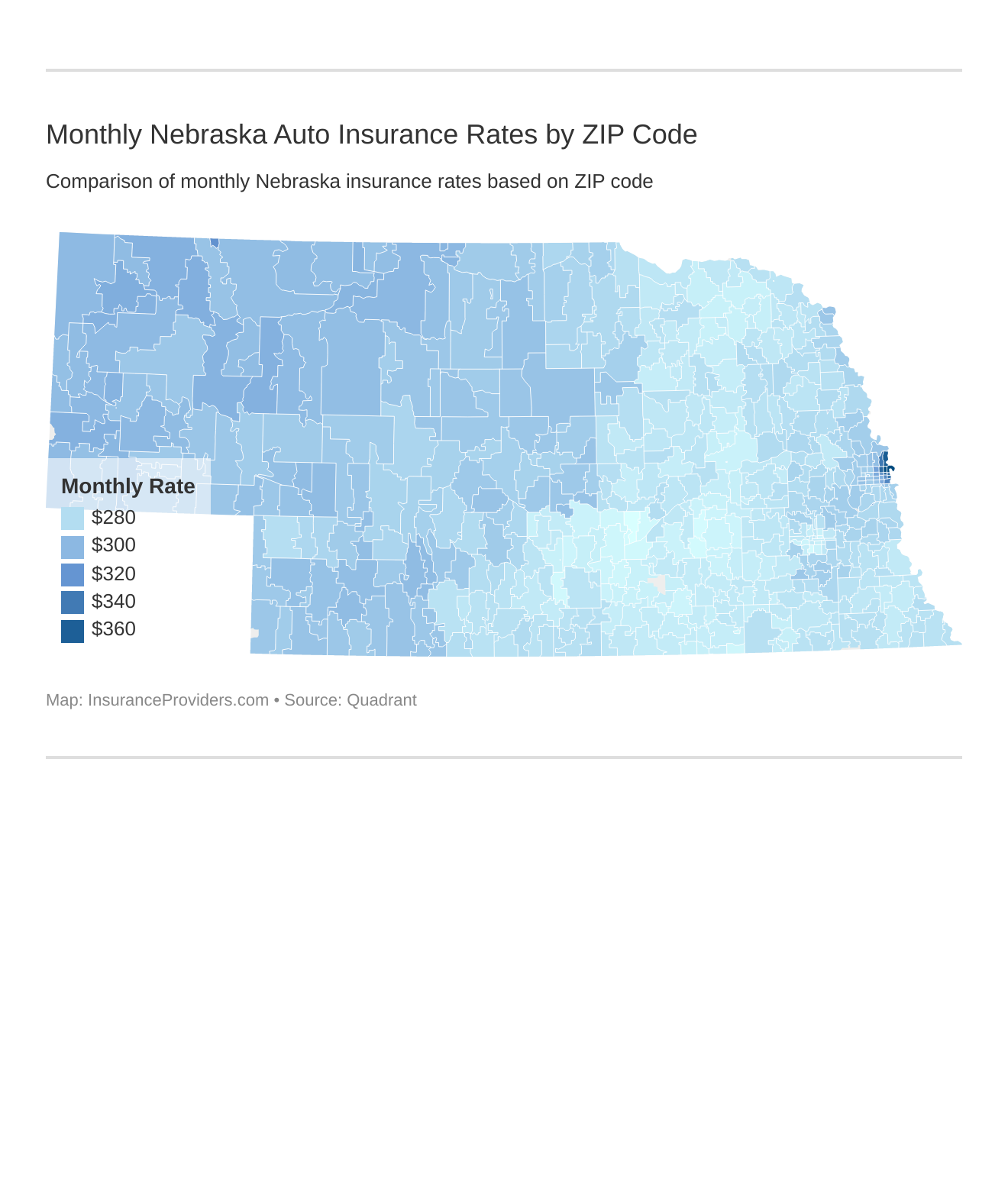

What are the cheapest rates by ZIP code in Nebraska?

In Nebraska, as in most states, where you live has a significant impact on your auto insurance rates. Below is a list of ZIP codes where drivers can expect to pay the least for auto insurance, broken down by company:

Nebraska's Cheapest ZIP Codes

| City | Zipcode | Average | Allstate F&C | American Family Mutual | Mid-Century Ins Co | Geico General | Safeco Ins Co of IL | Allied P&C | Progressive Northern | State Farm Mutual Auto | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Mc Cool Junction | 68401 | $3,216.69 | $3,069.47 | $2,155.82 | $3,790.30 | $3,804.61 | $5,983.46 | $2,412.35 | $3,396.99 | $2,140.69 | $2,196.53 |

| Columbus | 68601 | $3,215.66 | $2,962.43 | $2,190.28 | $3,638.80 | $3,804.61 | $6,222.77 | $2,447.91 | $3,101.10 | $2,193.71 | $2,379.35 |

| Holstein | 68950 | $3,215.34 | $2,673.16 | $2,148.32 | $3,828.42 | $3,804.61 | $5,859.38 | $2,539.59 | $3,546.99 | $2,224.06 | $2,313.54 |

| Deweese | 68934 | $3,210.55 | $3,069.47 | $2,172.01 | $3,596.50 | $3,804.61 | $5,827.38 | $2,356.29 | $3,531.07 | $2,224.06 | $2,313.54 |

| Edgar | 68935 | $3,209.28 | $3,069.47 | $2,172.01 | $3,679.41 | $3,804.61 | $5,827.38 | $2,356.29 | $3,391.18 | $2,269.63 | $2,313.54 |

| York | 68467 | $3,209.02 | $3,069.47 | $2,075.97 | $3,771.88 | $3,804.61 | $5,983.46 | $2,412.35 | $3,471.82 | $2,095.08 | $2,196.53 |

| Lincoln | 68522 | $3,208.14 | $2,825.91 | $2,222.31 | $3,932.98 | $2,767.88 | $6,328.83 | $2,704.77 | $3,497.24 | $2,436.94 | $2,156.44 |

| Lincoln | 68505 | $3,206.93 | $2,825.91 | $2,152.72 | $3,935.23 | $2,977.05 | $6,398.07 | $2,704.77 | $3,296.87 | $2,477.01 | $2,094.78 |

| Waco | 68460 | $3,202.39 | $3,069.47 | $2,075.97 | $3,693.51 | $3,804.61 | $5,983.46 | $2,412.35 | $3,280.42 | $2,122.41 | $2,379.35 |

| Kearney | 68847 | $3,201.56 | $3,008.63 | $2,088.52 | $3,555.61 | $3,804.61 | $6,102.30 | $2,336.82 | $3,630.57 | $2,118.29 | $2,168.68 |

| Kenesaw | 68956 | $3,198.60 | $2,673.16 | $2,088.52 | $3,703.40 | $3,804.61 | $5,859.38 | $2,539.59 | $3,591.21 | $2,214.02 | $2,313.54 |

| Benedict | 68316 | $3,198.41 | $3,069.47 | $2,075.97 | $3,732.52 | $3,804.61 | $5,983.46 | $2,412.35 | $3,103.94 | $2,224.06 | $2,379.35 |

| Juniata | 68955 | $3,197.47 | $2,673.16 | $2,088.52 | $3,515.90 | $3,804.61 | $5,859.38 | $2,539.59 | $3,770.07 | $2,212.44 | $2,313.54 |

| Wood River | 68883 | $3,196.12 | $2,673.16 | $2,088.52 | $3,771.25 | $3,804.61 | $5,687.29 | $2,526.11 | $3,650.55 | $2,184.64 | $2,378.97 |

| Gilead | 68362 | $3,193.92 | $3,069.47 | $2,155.82 | $3,711.60 | $3,804.61 | $5,827.38 | $2,356.29 | $3,218.96 | $2,224.06 | $2,377.11 |

| Hubbel | 68375 | $3,186.96 | $3,069.47 | $2,172.01 | $3,609.03 | $3,804.61 | $5,827.38 | $2,356.29 | $3,242.66 | $2,224.06 | $2,377.11 |

| Cairo | 68824 | $3,186.01 | $2,673.16 | $2,073.09 | $3,891.05 | $3,804.61 | $5,687.29 | $2,526.11 | $3,398.59 | $2,241.26 | $2,378.97 |

| Axtell | 68924 | $3,185.90 | $3,008.63 | $2,073.09 | $3,561.45 | $3,804.61 | $6,102.30 | $2,488.84 | $3,148.69 | $2,106.56 | $2,378.97 |

| Doniphan | 68832 | $3,185.76 | $2,673.16 | $2,073.09 | $3,770.93 | $3,804.61 | $5,687.29 | $2,526.11 | $3,518.97 | $2,238.68 | $2,378.97 |

| Grand Island | 68801 | $3,175.70 | $2,673.16 | $2,009.93 | $3,876.83 | $3,804.61 | $5,687.29 | $2,526.11 | $3,346.69 | $2,277.68 | $2,378.97 |

| Alda | 68810 | $3,173.24 | $2,673.16 | $2,024.81 | $3,825.14 | $3,804.61 | $5,687.29 | $2,526.11 | $3,435.16 | $2,203.89 | $2,378.97 |

| Henderson | 68371 | $3,169.25 | $3,069.47 | $2,075.97 | $3,517.43 | $3,804.61 | $5,983.46 | $2,412.35 | $3,280.87 | $2,182.52 | $2,196.53 |

| Lincoln | 68512 | $3,162.55 | $2,825.91 | $2,104.59 | $3,872.42 | $2,767.88 | $6,398.07 | $2,744.26 | $3,162.49 | $2,477.90 | $2,109.42 |

| Bradshaw | 68319 | $3,157.27 | $3,069.47 | $2,075.97 | $3,484.44 | $3,804.61 | $5,983.46 | $2,412.35 | $3,266.46 | $2,122.18 | $2,196.53 |

| Grand Island | 68803 | $3,133.81 | $2,673.16 | $2,009.93 | $3,699.22 | $3,804.61 | $5,687.29 | $2,526.11 | $3,247.40 | $2,203.87 | $2,352.72 |

While we’re at it, here are the most expensive Nebraska ZIP codes for buying auto insurance:

Nebraska's Most Expensive ZIP Codes

| City | Zipcode | Average | Allstate F&C | American Family Mutual | Mid-Century Ins Co | Geico General | Safeco Ins Co of IL | Allied P&C | Progressive Northern | State Farm Mutual Auto | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Omaha | 68111 | $4,516.91 | $3,696.37 | $2,848.98 | $5,835.26 | $4,915.22 | $8,012.92 | $4,007.58 | $5,028.31 | $3,343.24 | $2,964.35 |

| Omaha | 68110 | $4,497.63 | $3,696.37 | $2,837.43 | $5,558.40 | $4,915.22 | $8,012.92 | $4,223.41 | $5,210.15 | $3,343.74 | $2,681.07 |

| Omaha | 68112 | $4,344.39 | $3,696.37 | $2,674.48 | $5,287.85 | $4,915.22 | $8,012.92 | $4,007.58 | $4,561.28 | $3,262.78 | $2,681.07 |

| Omaha | 68131 | $4,264.14 | $3,936.98 | $2,837.43 | $5,345.45 | $3,946.15 | $7,296.02 | $4,223.41 | $4,730.01 | $3,380.76 | $2,681.07 |

| Omaha | 68104 | $4,209.21 | $3,696.37 | $2,621.32 | $5,299.50 | $4,304.24 | $7,729.84 | $3,793.81 | $4,637.48 | $3,384.19 | $2,416.12 |

| Omaha | 68108 | $4,201.70 | $3,696.37 | $2,674.48 | $5,481.70 | $3,946.15 | $7,604.48 | $4,223.41 | $4,485.55 | $3,265.81 | $2,437.34 |

| Omaha | 68102 | $4,192.38 | $3,696.37 | $2,594.65 | $5,397.70 | $3,946.15 | $7,604.48 | $4,223.41 | $4,345.37 | $3,308.19 | $2,615.07 |

| Omaha | 68152 | $4,092.93 | $3,120.25 | $2,621.32 | $5,261.63 | $4,304.24 | $7,729.84 | $3,793.81 | $4,274.62 | $3,426.48 | $2,304.15 |

| Omaha | 68178 | $4,014.67 | $3,936.98 | $2,837.43 | $4,857.30 | $3,460.52 | $7,604.48 | $3,107.50 | $4,343.07 | $3,369.70 | $2,615.07 |

| Omaha | 68198 | $4,007.06 | $3,936.98 | $2,594.65 | $5,384.31 | $3,460.52 | $7,012.93 | $3,224.56 | $4,579.54 | $3,254.96 | $2,615.07 |

| Omaha | 68132 | $3,991.15 | $3,936.98 | $2,621.32 | $5,252.67 | $3,460.52 | $6,980.02 | $3,793.81 | $4,172.62 | $3,286.34 | $2,416.12 |

| Omaha | 68107 | $3,974.93 | $3,936.98 | $2,569.72 | $5,092.82 | $3,946.15 | $7,044.94 | $3,224.56 | $4,370.77 | $3,211.45 | $2,376.97 |

| Omaha | 68182 | $3,958.14 | $3,936.98 | $2,400.27 | $5,109.38 | $3,460.52 | $6,980.02 | $3,793.81 | $4,106.91 | $3,220.33 | $2,615.07 |

| Omaha | 68105 | $3,956.07 | $3,936.98 | $2,594.65 | $4,760.64 | $3,946.15 | $7,044.94 | $3,224.56 | $4,412.86 | $3,306.91 | $2,376.97 |

| Melbeta | 69355 | $3,886.61 | $3,390.67 | $2,147.81 | $3,936.76 | $4,875.76 | $6,654.50 | $2,514.58 | $6,594.26 | $2,366.38 | $2,498.74 |

| Whiteclay | 69365 | $3,861.11 | $3,390.67 | $2,073.09 | $3,948.22 | $4,875.76 | $6,625.23 | $2,523.00 | $6,594.26 | $2,366.38 | $2,353.35 |

| McGrew | 69353 | $3,848.93 | $3,390.67 | $2,170.84 | $3,936.76 | $4,875.76 | $6,292.42 | $2,514.58 | $6,594.26 | $2,366.38 | $2,498.74 |

| Manley | 68403 | $3,751.17 | $3,212.83 | $2,319.94 | $4,123.61 | $3,590.82 | $6,328.83 | $2,625.85 | $6,594.26 | $2,521.20 | $2,443.16 |

| Omaha | 68134 | $3,750.51 | $3,696.37 | $2,400.27 | $4,689.88 | $3,460.52 | $6,928.75 | $3,327.05 | $4,091.76 | $2,828.84 | $2,331.17 |

| Panama | 68419 | $3,741.84 | $3,187.83 | $2,294.57 | $4,189.12 | $3,590.82 | $6,328.83 | $2,808.57 | $6,594.26 | $2,521.20 | $2,161.40 |

| Snyder | 68664 | $3,733.70 | $3,212.83 | $2,312.43 | $4,147.45 | $3,590.82 | $6,308.53 | $2,654.95 | $6,594.26 | $2,521.20 | $2,260.85 |

| Cedar Creek | 68016 | $3,731.42 | $3,212.83 | $2,319.94 | $3,945.91 | $3,590.82 | $6,328.83 | $2,625.85 | $6,594.26 | $2,521.20 | $2,443.16 |

| Ueling | 68063 | $3,727.61 | $3,212.83 | $2,312.43 | $4,092.61 | $3,590.82 | $6,308.53 | $2,654.95 | $6,594.26 | $2,521.20 | $2,260.85 |

| Winslow | 68072 | $3,727.61 | $3,212.83 | $2,312.43 | $4,092.61 | $3,590.82 | $6,308.53 | $2,654.95 | $6,594.26 | $2,521.20 | $2,260.85 |

| Omaha | 68117 | $3,712.37 | $3,936.98 | $2,400.27 | $4,533.92 | $3,214.67 | $6,803.39 | $3,231.67 | $4,264.38 | $2,649.04 | $2,376.97 |

As you can see above, 16 of the 25 most expensive Nebraska ZIP codes for buying auto insurance are in Omaha.

How does ZIP code affect auto insurance? Factors like traffic, crime, and claim frequency in your area all matter. Find out how your ZIP code compares against other zips in NE.

What are the cheapest rates by city in Nebraska?

Since some cities can have multiple ZIP codes and most Nebraskans identify with their city or town more than they do with their ZIP code, we have broken out the 10 least and most expensive annual average auto insurance rates by city.

| Least Expensive Cities | Average Annual Rate | Most Expensive Cities | Average Annual Rate |

|---|---|---|---|

| Albion | $3,282.91 | MELBETA | $3,886.60 |

| Bellwood | $3,283.20 | WHITECLAY | $3,861.11 |

| Tecumseh | $3,283.52 | MCGREW | $3,848.93 |

| Saronville | $3,283.91 | OMAHA | $3,803.42 |

| Du Bois | $3,284.07 | MANLEY | $3,751.17 |

| Marquette | $3,284.65 | PANAMA | $3,741.84 |

| Brock | $3,284.76 | SNYDER | $3,733.70 |

| Cordova | $3,285.35 | CEDAR CREEK | $3,731.42 |

| Beatrice | $3,286.11 | UEHLING | $3,727.61 |

| Atlanta | $3,286.33 | WINSLOW | $3,727.61 |

Surprisingly, most of the 10 most expensive cities for auto insurance in Nebraska are in relatively small towns.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Nebraska Car Insurance Companies

Let’s face it, no matter where you live in Nebraska, if you drive, you will be sending a chunk of your hard-earned cash to your auto insurance carrier. While there are many factors to consider when determining which insurer is “the best,” we believe there are three major factors to consider:

- How the carrier is performing financially

- Where the carrier is ranked among its competitors

- Does the carrier provide good customer service and how well does it handle complaints

We will be taking a look at each of these performance factors for Nebraska insurers in more detail below.

What are the financial ratings of the largest car insurance companies in Nebraska?

With dozens of auto insurers writing policies in Nebraska it can be hard to judge which you ones can trust to stick around. Fortunately, there is a company that grades insurers based on their financial stability. A.M. Best is an industry leader in ranking the financial stability of insurers.

A.M. Best gives insurers grades from A++ for those considered the most stable to E for the least. When it comes to ranking Nebraska’s 10 largest insurers three received an A++ rating, and none were rated worse than A.

Here is a list of how the largest insurers in the state fared in A.M. Best’s ratings:

| INSURER | AM Best Rating |

|---|---|

| State Farm Group | A++ |

| Progressive Group | A+ |

| Kentucky Farm Bureau Group | A |

| American Family Insurers Group | A |

| Iowa Farm Bureau Group | A |

| Geico | A++ |

| Nationwide Corp Group | A+ |

| Allstate Insurance Group | A+ |

| USAA Group | A++ |

| Farmers Insurance Group | A |

As shown above, the three ranked A++ were State Farm Group, Geico, and USAA Group. The Progressive Group, Nationwide Corp. Group, and Allstate Insurance Group were not far behind, with A.M. Best ratings of A+.

Which car insurance companies have the best ratings in Nebraska?

J.D. Power, widely considered the gold standard when it comes to measuring customer satisfaction, releases an annual study ranking customer satisfaction with their auto insurance carrier. The study does not separately address Nebraska’s insurance market, but it does look at the satisfaction of customers located in the Central Region, which includes Nebraska.

The average J.D. Power rating for all auto insurers operating in the Central Region, based on a 1,000-point scale, was 832. You can see the ratings for the major auto insurers operating in the Central Region here (not all of these carriers write policies in Nebraska):

| Company | Rating (Based on 1,000 Point Scale) | J.D. Power Power Circle Rating (Maximum of Five) |

|---|---|---|

| Shelter | 858 | 5 |

| Auto-Owners Insurance | 856 | 5 |

| Allstate | 844 | 4 |

| Geico | 838 | 4 |

| Auto Club of Southern California | 837 | 3 |

| Travelers | 832 | 3 |

| State Farm | 828 | 3 |

| American Family | 823 | 3 |

| Progressive | 823 | 3 |

| Farm Bureau Mutual | 822 | 3 |

| Safeco | 819 | 2 |

| Farmers | 817 | 2 |

| Liberty Mutual | 811 | 2 |

| Nationwide | 807 | 2 |

So, when it comes to J.D. Power ratings, bigger is not better when it comes to customer satisfaction among Nebraska’s auto insurance providers. The two highest-rated, Shelter and Auto-Owners Insurance, are not among the 10 largest insurers in the state.

Read more: Shelter Auto Insurance Review

Who is the cheapest car insurance company in NE? Review the average auto insurance rates by company below:

Which car insurance companies have the most complaints in Nebraska?

The Nebraska Department of Insurance has procedures in place to ensure insurer complaints receive a proper hearing. Residents may file complaints against their insurer online or by filing a paper form with the department.

Once a complaint is filed, a consumer affairs investigator will reach out to the company for a response. Companies then have 15 business days to respond to the complaint. After hearing from the insurer, the investigator will review all the information and issue a ruling.

While the Department of Insurance will issue rulings on complaints, it does not have the power to force an insurer to pay a claim or refund premiums that have been paid.

Sadly, Nebraska does not provide information on the number of complaints filed against each insurer as some other states do. That leaves us to check a national database for an idea of the number of complaints filed against the state’s largest auto insurers.

The NAIC tracks the number of complaints filed against the country’s largest insurance providers and uses that data to establish a “complaint ratio” measuring the number of complaints relative to its market share. The ratio allows for a direct comparison of large and small insurers.

| Provider | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|

| State Farm Group | 0.44 | 1482 |

| Progressive | 0.75 | 120 |

| Kentucky Farm Bureau Group | 0.02 | 1 |

| American Family Insurers Group | 0.79 | 73 |

| Iowa Farm Bureau Group | 0.77 | 32 |

| Geico | 0.68 | 333 |

| Nationwide Corp. Group | 0.28 | 25 |

| Allstate Insurance Group | 0.5 | 163 |

| USAA Group | 0.74 | 296 |

| Farmers Insurance Group | 0.59 | 7 |

The auto insurer with the highest number of complaints against it, State Farm Group, has a relatively low complaint ratio of 0.44. Insurers two some of the highest complaint ratios, the American Family Insurers Group and Iowa Farm Bureau Group, had a small fraction of the complaints filed against them relative to State Farm.

What are the cheapest car insurance companies in Nebraska?

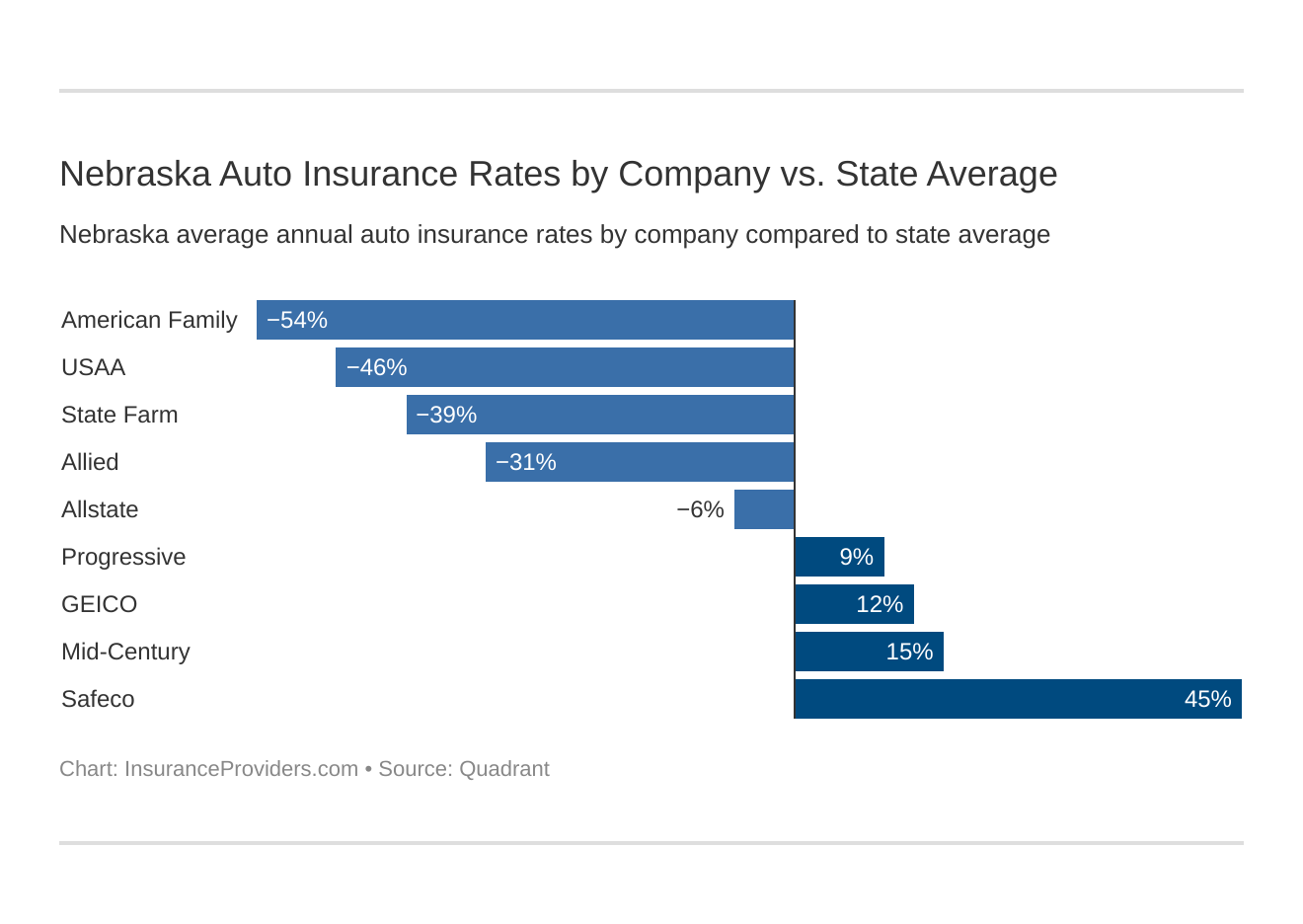

We have compiled data that allows you to compare the average annual premiums of some of Nebraska’s largest auto insurance providers. It also allows you to compare company premiums against the state average of $3,399.85.

| Company | Average | Compared to State Average (+/-) | Percentage above or below state average (+/-) |

|---|---|---|---|

| Allstate F&C | $3,199.08 | -$200.77 | -6.28% |

| American Family Mutual | $2,213.41 | -$1,186.45 | -53.60% |

| Mid-Century Ins Co | $3,990.44 | $590.58 | 14.80% |

| Geico General | $3,848.44 | $448.58 | 11.66% |

| Safeco Ins Co of IL | $6,230.57 | $2,830.71 | 45.43% |

| Allied P&C | $2,596.03 | -$803.82 | -30.96% |

| Progressive Northern | $3,751.01 | $351.16 | 9.36% |

| State Farm Mutual Auto | $2,437.71 | -$962.15 | -39.47% |

| USAA | $2,332.01 | -$1,067.85 | -45.79% |

As you can see, Safeco Insurance Co. of Illinois charges premiums averaging more than $2,800 (or 45 percent) above the Nebraska state average. On the other hand, American Family Mutual and USAA charge premiums that are 54 percent and 46 percent, respectively, below the state average.

Read more: Safeco Insurance Company of Illinois Review

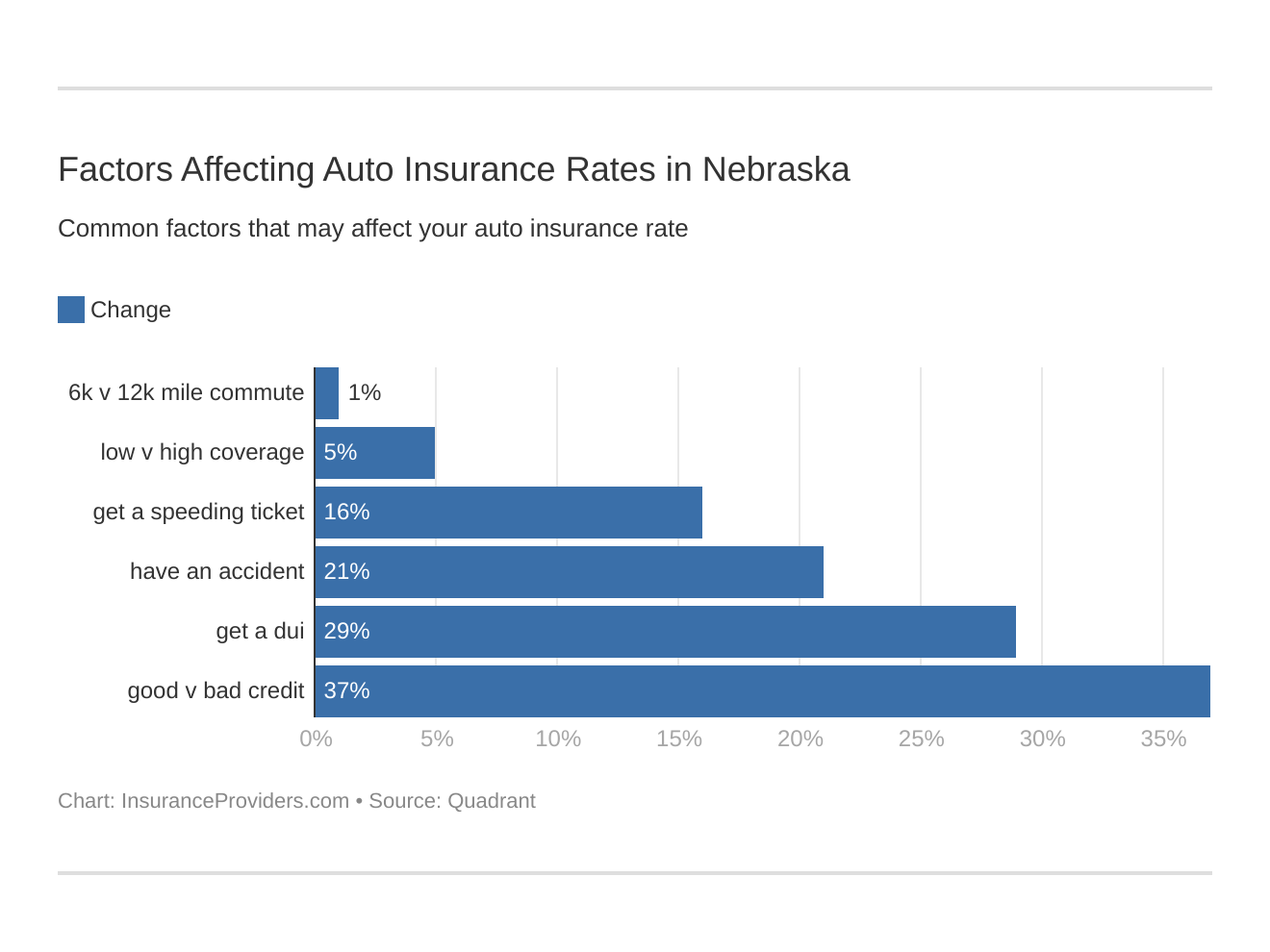

Does my commute affect my car insurance rate in Nebraska?

In Nebraska, the drive between cities and towns can be quite long, which means long commutes if you live in one town and work in another or your town is without a major retailer. That means a lot of drivers rack up substantial miles just going about their daily business.

Unfortunately, some auto insurers take your commute into account when determining your rates. Luckily, in Nebraska, a longer commute to work doesn’t often lead to too significant an increase in rates, or any increase at all for some auto insurers, as shown in the table below:

| Company | 10 Mile Commute/6,000 Annual Mileage | 25 Mile Commute/12,000 Annual Mileage |

|---|---|---|

| Allstate | $3,199.09 | $3,199.09 |

| American Family | $2,195.50 | $2,231.31 |

| Farmers | $3,990.44 | $3,990.44 |

| Geico | $3,788.76 | $3,908.12 |

| Liberty Mutual | $6,230.57 | $6,230.57 |

| Nationwide | $2,596.03 | $2,596.03 |

| Progressive | $3,751.01 | $3,751.01 |

| State Farm | $2,375.18 | $2,500.23 |

| USAA | $2,304.90 | $2,359.11 |

So, in Nebraska at least, you won’t be penalized too much for your long commute to work by most of the large auto insurers, with only four of the nine largest insurers increasing their rates based on long commutes and none increasing rates by more than $130 annually.

Six major factors affect auto insurance rates in NE. Which car insurance factors will affect your rates the most? Find out below:

Can coverage level change my care insurance rate with companies in Nebraska?

As with most things in life, when you want more auto insurance coverage you usually pay more. Luckily, in Nebraska, the average annual price difference between the lowest and highest level of coverage is pretty reasonable for most companies, as you can see from the chart below:

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $3,121.13 | $3,193.28 | $3,282.84 |

| American Family | $2,196.25 | $2,279.32 | $2,164.66 |

| Farmers | $3,823.80 | $3,933.99 | $4,213.54 |

| Geico | $3,760.03 | $3,844.99 | $3,940.29 |

| Liberty Mutual | $6,057.90 | $6,197.21 | $6,436.58 |

| Nationwide | $2,637.85 | $2,585.77 | $2,564.48 |

| Progressive | $3,580.81 | $3,741.58 | $3,930.65 |

| State Farm | $2,342.89 | $2,433.89 | $2,536.33 |

| USAA | $2,256.68 | $2,328.68 | $2,410.66 |

The chart shows that in Nebraska, for the average driver, that the monthly price difference for low- vs. high-coverage plan is at most $32 a month. That number is based on Liberty Mutual’s $379 price difference (the highest on our table) broken down over 12 months.

How does my credit history affect my car insurance rate with companies in Nebraska?

A lot of drivers are surprised (and angered) when they learn that auto insurance carriers can use a driver’s credit history when setting your auto insurance rates. However, it is perfectly legal in most states, including in Nebraska.

There has been a recent push to outlaw the practice in some states (and even organizations fighting to do so), but only California, Hawaii, and Massachusetts have done so. For Nebraska drivers, credit scoring is a fact of life.

If you have bad credit, the good news is that not all insurers use a driver’s credit history the same way, which means some companies’ penalize will not rely on your credit history as much as others. This chart shows how credit impacts the rates charged by Nebraska’s major insurers.

| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $2,607.28 | $3,020.24 | $3,969.74 |

| American Family | $1,648.32 | $2,026.00 | $2,965.91 |

| Farmers | $3,608.23 | $3,790.48 | $4,572.61 |

| Geico | $3,326.47 | $3,818.47 | $4,400.38 |

| Liberty Mutual | $4,266.87 | $5,429.16 | $8,995.67 |

| Nationwide | $2,183.71 | $2,483.58 | $3,120.82 |

| Progressive | $3,333.16 | $3,612.67 | $4,307.21 |

| State Farm | $1,648.11 | $2,123.22 | $3,541.78 |

| USAA | $1,784.78 | $2,103.06 | $3,108.18 |

As you can see, for most insurers, the difference between good and fair credit can cost you hundreds of dollars a year in auto insurance in Nebraska. Drivers with poor credit ratings pay more than $1,000 a year more for their auto insurance than those with good credit, with Liberty Mutual more than doubling it’s already high rates for drivers with poor credit (from $4,267 to $8,996).

How does my driving record affect my rates with car insurance companies in Nebraska?

You’ve probably been hearing this since you were in driver’s ed, but it bears repeating: your driving record matters when it comes to your insurance rates. A single accident, one speeding ticket, or DUI can lead to significant rate increases.

However, most auto insurance providers know nobody is perfect and some will penalize you less for a single mistake than others. The chart below gives you a company-by-company breakdown of how much rates go up for the average Nebraska driver based on common driving infractions.

| Company | Clean Record | One Accident | One Speeding Ticket | One DUI |

|---|---|---|---|---|

| Allstate | $2,778.41 | $3,105.70 | $3,132.72 | $3,779.52 |

| American Family | $2,167.41 | $2,167.41 | $2,351.41 | $2,167.41 |

| Farmers | $3,378.04 | $4,034.21 | $4,328.05 | $4,221.46 |

| Geico | $2,468.24 | $4,021.98 | $3,549.90 | $5,353.65 |

| Liberty Mutual | $5,344.48 | $6,456.53 | $6,294.37 | $6,826.89 |

| Nationwide | $1,841.14 | $2,087.26 | $2,660.35 | $3,795.39 |

| Progressive | $3,189.50 | $3,572.84 | $4,674.90 | $3,566.80 |

| State Farm | $2,267.34 | $2,437.70 | $2,608.08 | $2,437.70 |

| USAA | $1,769.47 | $2,004.52 | $2,227.91 | $3,326.12 |

So, as shown in the above chart, maintaining a clean driving record will save you several hundred dollars a year in premiums for most insurers. In some cases that savings can top $1,000 annually.

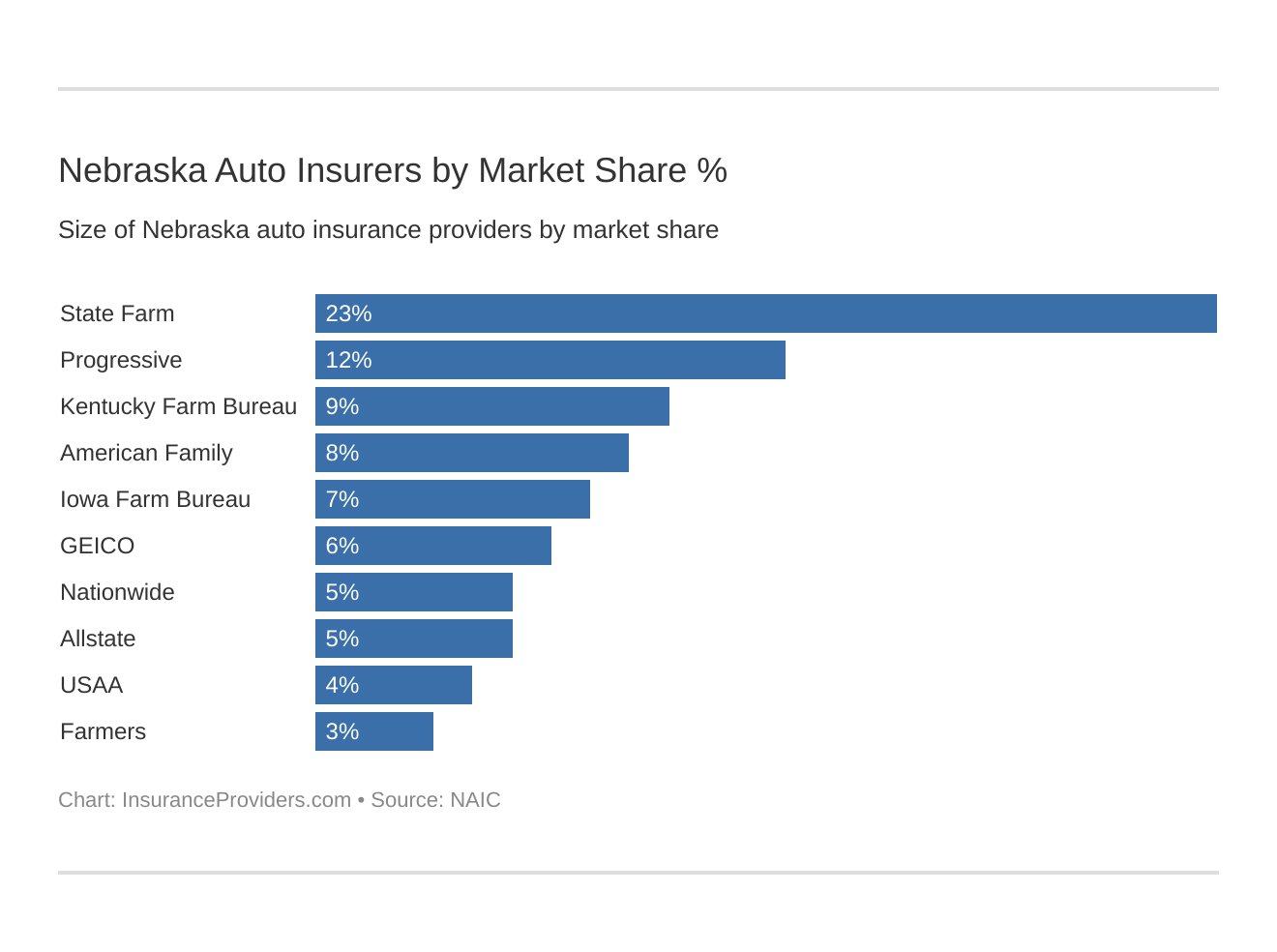

Which car insurance companies are the largest in Nebraska?

For those drivers who would like to know which auto insurance carriers have the largest share of the market in Nebraska we have included the following table:

| Company | Direct Premiums Written | Percent of State Market |

|---|---|---|

| State Farm Group | $289,763 | 23.13% |

| Progressive Group | $156,315 | 12.48% |

| Kentucky Farm Bureau Group | $107,297 | 8.56% |

| American Family Insurance Group | $101,238 | 8.08% |

| Iowa Farm Bureau Group | $85,299 | 6.81% |

| Geico | $70,986 | 5.67% |

| Nationwide Corp Group | $67,749 | 5.41% |

| Allstate Insurance Group | $60,868 | 4.86% |

| USAA Group | $53,982 | 4.31% |

| Farmers Insurance Group | $43,084 | 3.44% |

Surprisingly, some regional insurers have edged out some of the largest insurance companies in the country when it comes to their market share in Nebraska. The Kentucky Farm Bureau Group and the Iowa Farm Bureau Group have a larger share of Nebraska’s auto insurance market than Geico and Nationwide Corp. Group.

Who are the largest Nebraska auto insurance companies? Find out in our chart below:

How many car insurance companies are available in Nebraska?

There are currently 34 auto insurance carriers that are considered to be domiciled in Nebraska (that’s a fancy term for saying they are considered legal residents there). But that does not mean that there are only 34 companies currently writing policies in Nebraska.

Insurers operating in other states can be licensed to sell auto policies in Nebraska, as well. Plus, some drivers may be covered by charter groups or other self-insured options that are not counted as insurance companies.

Nebraska Laws

Nebraska, like the other 50 states, writes its own laws governing how drivers are to behave while using its roads and how insurance companies must operate. While most state laws addressing driving and insurance are similar, each state has its own system.

Knowing how Nebraska’s driving and insurance laws are different from those in other states can help you avoid traffic tickets and ensure that your insurance coverage meets state standards. Luckily for you, we have provided a breakdown of Nevada’s driving and auto insurance laws here.

What are the car insurance laws in Nebraska?

Nebraska is part of the U.S. insurance regulatory framework designed to protect policyholders through the regulation of the insurance marketplace. It works with the NAIC and other insurance regulators to establish clear standards and coordinate their regulatory oversight.

The state is also active with the International Association of Insurance Supervisors and participates in all of that group’s standard-setting initiative to improve the supervision of insurers operating in the international marketplace.

How State Laws for Insurance are Determined

Nebraska, like most states, has delegated authority for regulating the auto insurance industry to the Nebraska Department of Insurance. The department allows insurance companies to charge premiums and award discounts based on a variety of different factors, including:

- The type of vehicle being insured

- Your prior insurance coverage

- How many miles you drive annually

- Your driving record

- Your age

- Your gender and marital status

- Where you live

- Your driving experience

- Whether you are using your vehicle for business purpose

- Your credit history

Windshield Coverage

Believe it or not, your windshield is considered an important piece of safety equipment that is regulated by the U.S. Department of Transportation, which sets the minimum standards for windshields in all 50 states.

Some states require auto insurers to replace damaged windshields free of charge, but that is not the case in Nebraska. However, most insurers will replace your windshield under a comprehensive policy once you have met the deductible (and some insurers will even waive the deductible).

Nebraska does not have any laws or regulations that specifically address how insurers repair or replace windshields. That means that your insurer is free to require that you use a specific repair shop and can use replacement parts that are not made by your vehicle’s manufacturer.

High-Risk Insurance

Like most states, to have your license reinstated after being convicted of a DUI or other serious driving offense, Nebraska requires your insurer to file proof of financial responsibility with the state DMV showing you have coverage.

The policies associated with this type of coverage commonly called “high-risk insurance” and the form insurers must file are commonly known as the SR-22.

If you fail to pay the premiums on an SR-22 policy, your insurer will notify the DMV and your license will be suspended.

High-risk insurance policies are more expensive than traditional policies and come with additional costs because insurers usually charge $50 to $100 annually to submit the SR-22 to the DMV. Typically, the form must be filed for three to five years.

Nebraska will require drivers who have been convicted of any of the following to file SR-22s:

- DUI or DWI

- Serious moving violations like speeding and reckless driving

- Failing to provide an officer with valid proof of insurance

- Providing an officer with falsified policy documents

- Driving on a license that has been revoked or suspended

- An excessive number of tickets

- Failure to pay some types of legal judgments

- Failure to pay child support

Low-Cost Insurance

Nebraska does not currently have a program in place to help low-income drivers purchase auto insurance. The only three states offering a government-funded program to help low-income families purchase car insurance are California, Hawaii, and New Jersey.

Automobile Insurance Fraud in Nebraska

Auto insurance fraud is a crime in Nebraska. That may seem like common sense, but many drivers do not fully understand what constitutes auto insurance fraud.

For example, drivers are often surprised to learn that the common practice inflating the value of items stolen during a vehicle break-in is considered criminal fraud in every U.S. state. Another common form of insurance fraud is lying about your address to get a lower rate.

According to the Nebraska Department of Insurance, insurance fraud is any deliberate deception committed against an insurance agent or insurance consumer to receive a financial benefit to which the claimant is not entitled.

Insurance fraud can occur in the process of buying, selling, using, or underwriting insurance. The department explains that most insurance fraud falls into thee categories: creating a fraudulent claim, overstating the amount of loss, and misrepresenting facts to receive payment.

If your insurer catches you committing insurance fraud, Nebraska state law requires them to report it to the Department of Insurance. You will not know who reported you because the state keeps the names of informants confidential. We also recommend contacting an attorney immediately if you believe you have been suspected of insurance fraud.

The Nebraska Department of Insurance has its own Insurance Fraud Prevention Division that conducts investigations either by itself or in conjunction with other state law enforcement agencies and is empowered to prosecute claims when the division believes it has discovered fraud.

The Insurance Fraud Prevention Division also undertakes studies of fraudulent insurance activities in Nebraska. Its 2018 Nebraska insurance fraud statistics said it had opened 272 investigations into auto insurance property fraud and 43 cases involving bodily injury claims made with auto insurers.

Statute of Limitations

If you have suffered any type of property damage or personal injury damage as the result of a traffic accident in Nebraska, you need to let your insurer (and the insurer of the other party if they are at fault) know about the accident as quickly as possible.

There is no statute of limitations in Nebraska for filing an insurance claim, but insurers require you to give them notice of an accident or event that could trigger a claim within a reasonable amount of time. In most cases that means within a few days, but under some circumstances that time period can be extended to a few weeks.

Filing an insurance claim quickly after an accident or incident helps protect your legal rights.

Your right to sue begins to run the day of the accident, and you want to retain as much time as possible to file a lawsuit if the insurer rejects your claim, a process that can take months.

In Nebraska, anyone wishing to file a lawsuit related to an accident has four years from the date of the accident to file in state court if you are seeking damages for personal injuries or reimbursement for damage to personal property.

In cases where someone dies, the decedent’s family or estate has two years from the date of death to file a claim. So if an accident victim manages to survive significant injuries from a car crash for six months before dying, the clock begins running on the date of death, not the accident date.

Nebraska-Specific Laws

Nebraska’s farming roots are evident when looking at its driver licensing laws. For example, 14-year-olds may drive to and from school, a legacy from the time when young teens needed to operate farm equipment and a recognition of how far some students live from their schools.

The state is also at the forefront when it comes to some driver safety issues. For example, drivers under the age of 18 may not use cell phones while driving and seniors 72 and over are required to renew their licenses in person.

Keep reading for a more detailed explanation of these provisions and other laws governing the licensing of Nebraska drivers.

What are the vehicle licensing laws in Nebraska?

The vehicles and trailers use Nebraska’s roadways must be registered, unless that specific category of vehicle is exempt from registration requirements. Generally, vehicles that are exempt from the requirement are classified as off-road vehicles and farm equipment.

In Nebraska, vehicles must be registered in the county where they spend most of their time and new vehicles must be registered within 30 days of purchase.

Unlike most states, Nebraska’s vehicle registration fees are determined at the county level. That means you need to contact the country treasurer for your county to get an estimate of how much it will cost to register your vehicle. The DMV also has an online tax estimator.

REAL ID

As of October 1, 2020, all Nebraska drivers will be required to have licenses that have the REAL ID star in the upper right-hand corner. That star shows that the licensee has undergone the REAL ID verification process that was required in the 2005 federal REAL ID Act.

The REAL ID Act established security standards for Nebraska’s driver’s licenses and ID cards. After October 2020, those drivers who have non-REAL ID licenses may still drive and buy age-regulated products, but they will be unable to board a commercial airline flight or enter a federal facility.

Because Nebraska requires that drivers renew their licenses every five years and the state began issuing REAL ID licenses in 2013, nearly everyone with a current Nebraska license is already compliant with the act. However, there are still drivers who have relocated from a non-compliant state and have yet to get a Nebraska license who remain non-compliant.

Penalties for Driving Without Insurance

It is illegal to drive a registered motor vehicle on Nebraska’s roads without valid proof of insurance or other acceptable proof of financial responsibility and the state police officers take that seriously.

Officers may cite you and immediately suspend your license for failing to provide an acceptable form of proof upon request. If that is not punishment enough, officers may also remove your license plates on the spot. You will need to show valid proof of insurance to get your license reinstated.

Fortunately, there is a grace period of 10 days in which, should a driver supply proof of insurance, the citation will be dismissed and the license and registration are reinstated at no cost to the driver. After 10 days a driver will have to pay separate $50 fees to have their license and registration reinstated ($100 in total), plus the license plate renewal fee.

Compare Insurance Providers Rates to Save Up to 75% Secured with SHA-256 Encryption

Teen Driver Laws

Nebraska’s driving laws are favorable to teen drivers, allowing teens to drive to and from school unaccompanied at ages as young as 14 under a special school-only permit.

School permits are issued to students who meet the following criteria:

- Live in a city of 5,000 or more residents

- Attend school outside a city with 5,000 or more residents

In districts where school permits are issued, the driver is also allowed to ferry family members to and from school, so long as they live in the same household. Finally, the school learner’s permit allows them to drive anywhere if accompanied by a driver who is 21 years old or older.

When Nebraskans turn 14, they may apply for a school learner’s permit that allows them to begin to practice to earn their school permit. After passing the required written and vision tests, teens with a school learner’s permit can drive with a licensed parent or guardian for up to three months.

Two months after hitting their 14th birthday, students may apply for the school permit if they have at least two months’ experience driving under the school learner’s permit. However, prior to being issued the school permit, a teen must have either completed a state-approved driver’s education course or pass a written driving test.

Additionally, 14-year-olds must submit a form that states they have at least 50 hours of experience driving (10 of which were at night) with a licensed driver who is over the age of 21 and signed by the licensed driver.

At 15, Nebraskan teens are allowed to apply for a learner’s permit, to be issued when they pass a written and vision test. The tests are waived under certain conditions.

After receiving a learner’s permit, a teen must enroll in a driver’s safety course and will only be allowed to drive under the supervision of a driving instructor, parent, guardian, or other licensed driver over the age of 21.

Sixteen-year-olds with a learner’s permit and at least six months driving experience can obtain a provisional permit if they have fewer than three points on their driving record. The teen will again be required to pass a driving test and a written test, but that test may be waived if the teen drove on a school permit.

The provisional permit allows teens to drive alone, but not between the hours of 12 a.m. and 6 a.m. unless they are accompanied by a parent or licensed adult. There are exceptions to that rule if the teen is driving to and from work.

Additionally, for the first six months with a provisional license, a teen is not allowed to drive with more than one non-family member who is under the age of 19.

When teens have driven on a provisional license for one year, or have reached the age of 18, they may apply for an unrestricted license if they accumulated no more than three or more points on their driving record. Once again, there is a driving test that may be waived.

Older Driver License Renewal Procedures

Nebraska is one of the few states that has taken serious steps to ensure that older drivers are still competent to be behind the wheel of a car. Specifically, the state requires that all drivers who are 72 or older renew their licenses in person at the DMV.

DMV staff has received instruction on the symptoms of cognitive decline in seniors and staffers are allowed to use their discretion to determine whether a senior driver needs to retake the road or written tests.

DMV personnel are also required to perform a vision test for a senior renewal (but seniors may provide proof they passed an exam given by a professional in the past 90 days).

Finally, law enforcement officers or family members are also allowed to report someone as an unsafe driver. If reported as an unsafe driver, that individual must have an examination by an eye doctor and physician, then report to the DMV for a driving test.

The staff of the Nebraska DMV is also allowed to impose the following restrictions or conditions on older drivers after administering a driving test:

- Require glasses or corrective lenses

- Mechanical driving aids installed in vehicle

- Automatic transmissions only

- Outside mirrors

- No driving at nighttime

- No driving on the interstate

- Automatic turn signals only

- Driving limited to a specified area

- Driving only allowed below a specific speed

- Any other restrictions that may be specified by the DMV

New Residents

If you are moving to Nebraska and already have a valid driver’s license from a different state you will be required to get a valid Nebraska license within 30 days of your move. Out-of-state drivers will be required to produce the following:

- Proof of their U.S. citizenship or that they are a lawful resident

- Proof of their Nebraska residence (two documents required)

- A valid Social Security number that can be verified, proof that you have been exempted from social security requirements, or a valid foreign passport

New Nebraska residents will be required to surrender their out-of-state licenses and must take a vision or driver’s test if the licensing staff requests it. New residents with expired licenses will have their driving tests waived if the license expired in the previous year.

License Renewal Procedures

Like many other states, Nebraska allows drivers to renew their licenses online under certain circumstances. Generally, you will be allowed to do so if your name or physical description has not changed since your last renewal and the license is expiring before your 72nd birthday.

Nebraska drivers also have the option of renewing in person at their local DMV if they provide acceptable identification, two forms of proof of address, and pay the appropriate fees.

The Nebraska DMV sends licensed drivers a renewal notice 30 days before their license expires and the department recommends bringing the notice with you if you decide to renew in person.

Negligent Operator Treatment System (NOTS)

Nebraska drivers who are found to have committed motor vehicle-related violations will have points added to their driving records. If you accumulate too many points, you may lose your driving privileges.

As a general rule, accumulating 12 points in a two-year time period causes the automatic revocation of your operator’s license in Nebraska. Convictions will remain on your driving record for five years.

The following number of points are assessed for speeding violations in business and residential districts as well as county roads and state highways.

| Violation | Points assessed |

|---|---|

| 1-5 mph | 1 point |

| 6-10 mph | 2 points |

| 11-35 mph | 3 points |

| Over 35 mph | 4 points |

On interstate highways, the following points will be assessed for speeding.

| Violation | Points Assessed |

|---|---|

| 1-10 mph | 1 point |

| 11-15 mph | 2 points |

| 16-35 mph | 3 points |

| Over 35 mph | 4 points |

Finally, non-speeding violations will be awarded the following points.

| Violation | Points Assessed |

|---|---|

| Motor Vehicle Homicide | 12 points |

| Driving Under the Influence - third offense | 12 points |

| Failure to render aid in an accident you are involved in | 6 points |

| Driving under the influence - first and second offense | 6 points |

| Willful reckless driving | 6 points |

| Leaving the scene of an accident | 6 points |

| Reckless drivign | 5 points |

| Careless driving | 4 points |

| Failure to yield to a pedestrian causing bodily injury | 4 points |

| Using a handheld device to text while driving | 3 points |

| Negligent driving | 3 points |

| School bus crossing violation | 3 points |

| Failure to yield to a pedestrian with no bodily injury | 2 points |

| Failure to submit to an alcohol content test | 1 point |

| Operating a vehicle with no license or an expired license | 1 point |

| All other moving violations | 1 point |

Any person with fewer than 12 points on their driving record can enroll in a DMV-approved driver improvement course to have the points assessed against them reduced by two during the previous two years.

What are the rules of the road in Nebraska?

Before taking to the roads in Nebraska, it’s a good idea to review some of the basic laws, rules, and regulations for driving in the state. Understanding and complying with Nebraska’s driving rules will help keep you from getting ticketed, which often leads to higher insurance rates.

Fault vs. No-Fault

Nebraska, like most other states, uses a traditional fault-based systemwhen it comes to determining who is responsible for paying for the damage caused by an auto accident, including personal injuries, vehicle damage, and lost income.

If you are injured in an accident in Nebraska and are not at fault, you generally have three options:

- Filing a claim with your insurer, who will likely turn around and file a claim with the at-fault driver’s insurer (if you are not the party at fault)

- Filing a claim directly with the insurance carrier for the at-fault driver (known as a “third party claim”)

- Filing a lawsuit in state court seeking damages from the at-fault driver

It should be noted that the at-fault driver’s insurance carrier will only pay damages up to the coverage limit of that driver. If your damages exceed the driver’s coverage limit, then you will need to file a lawsuit directly against the at-fault driver.

In other words, if the at-fault driver only has $50,000 per accident in coverage (the state minimum), and you and your passengers run up $100,000 in hospital bills as a result of your injury, the insurer will only be required to pay for $50,000 of that.

Seat Belt and Car Seat Laws

Seat belts are mandatory in Nebraska for the driver and anyone else riding in one of the front seats. Also, children who are between the ages of 6 and 18 are required to wear seat belts or ride in an approved car seat, regardless of where they are sitting.

When a driver has a provisional permit, all vehicle occupants must wear a seat belt.

Nebraska’s seat belt law is a secondary law, which means that a driver can only be cited for failing to comply if they are being charged with an additional offense (such as speeding, failure to stop, etc.). Those who fail to comply with the law face a $25 fine.

Children under the age of eight must ride in an approved safety seat and children must use a rear-facing seat until the age of two. Additionally, children under eight must ride in the back seat when it is equipped with a seatbelt and the seats are not already in use by a younger child.

Children and teens under the age of 18 are prohibited from riding on the bed of a pickup truck unless they are participating in a parade.

Keep Right and Move Over Laws

Nebraska is one of a number of states that requires drivers in the left lane to move right, even if they are exceeding the speed limit. In other words, drivers have a legal duty to only use the left-hand lane for passing.

Similar “move over” laws have been adopted in 25 other states, despite claims from critics that the laws condone speeding.

Nebraska’s law enforcement officers also enforce its move over law with regard to stopped emergency vehicles. The law requires drivers on multi-lane roads and highways to move out of the lane nearest any emergency vehicles that are present.

Finally, if a driver on a two-lane road in Nebraska encounters a stopped emergency vehicle with its lights on, the driver may be cited for failing to slow down, regardless of the reason the emergency vehicle stopped.

Speed Limits

Nebraska’s laws regulating the speed of drivers mandate an “absolute” speed for specified types of roads. If you exceed those speed limits, you are considered to be guilty of speeding.

Additionally, under certain conditions, you may be found guilty of driving at an unreasonable speed if you are found to be driving at a speed that is unsafe for the driving conditions (more on that below). These are Nebraska’s absolute speed limits by road type:

| Speed Limit (MPH) | Road Type |

|---|---|

| 20 | Business districts |

| 25 | Residential districts |

| 25 | Urban construction zones |

| 35 | Rural construction zones |

| 50 | Unpaved highways |

| 55 | Paved highways that are not part of the state system |

| 60 | Most parts of the state highway system |

| 65 | State expressways |

| 65 | State highways |

| 70 | Interstate highways |

Nebraska law bars drivers from driving at a speed greater than is reasonable and prudent given the current driving conditions. The law also states that drivers must reduce their speed when appropriate: when approaching curves, crossings, hill crests or there is inclement weather.

Traffic fines for specified speeding infractions are laid out in Nebraska law. These are the possible fines:

| Amount | Miles Per Hour Over the Posted Speed Limit |

|---|---|

| $10 | 1 to 5 mph |

| $25 | 5 to 10 mph |

| $75 | 10 to 15 mph |

| $125 | 15 to 20 mph |

| $200 | 20 to 35 mph |

| $300 | More than 35 mph |

Nebraska didn’t feel the need to impose harsh penalties on drivers traveling just over the speed limit, with fines of $10 for going five mph or less over the posted speed limit and $25 for going over by 10 mph or less. However, the fines start ratcheting up quickly after that, topping out at $300 for more than 35 mph over the posted speed limit.

Ridesharing

In 2015, the Nebraska legislature approved a law allowing ridesharing services like Uber and Lyft to operate in the state. Prior to the law’s passage, ridesharing drivers were sometimes ticketed for operating as unlicensed taxis.

The law refers to the ridesharing companies as “transportation network companies” and are subject to the same requirements as Nebraska’s taxi cabs when it comes to insurance, vehicle safety, and other requirements.

The Nebraska Public Service Commission has been authorized to investigate complaints and ensure that the ridesharing services comply with state law.

Automation on the Road

Nebraska enacted legislation in June 2018 that allows autonomous vehicles to operate in the state.

The legislation allows automated vehicles to operate on any state road without a human driver physically present in the vehicle. It also requires the DMV to issue titles and registration for automated vehicles if they have been granted an exemption from federal motor vehicle safety standards. (For more information, read our “What are the car registration fees by state?“).

Should an automated vehicle be involved in an accident, the law requires the automated vehicle to remain at the crash scene and comply with state laws regarding motor vehicle accidents in the same manner as a human driver.

What are the safety laws in Nebraska?

In addition to laws regarding seat belts and driving speeds, Nebraska has enacted several other safety laws for drivers addressing issues such as driving while intoxicated and driving while texting on a cell phone.

DUI Laws

Nebraska has adopted the federal standard for determining whether an individual has been driving under the influence (DUI), which is a blood alcohol content (BAC) of 0.08 percent or more.

A driver may also be found to be DUI when that individual’s driving abilities have been impaired by an “appreciable degree.” Finally, Nebraska imposes more serious penalties when a driver has been found to have a BAC of more than 0.15 percent, which is more than twice the legal limit.

Drivers who have been arrested for DUI in Nebraska generally face criminal and administrative penalties (such as license suspension). The criminal penalties for DUI in Nebraska generally depend on the driver’s BAC and whether the driver has been previously convicted of a DUI within the past 15 years.

Despite state laws that usually mandate at least some jail time for all DUI infractions, Nebraska judges have the authority to impose suspended sentences where the sentence is spent on probation instead of in jail.

Nebraska offers resident drivers the right to waive their right to a hearing contesting their administrative license revocation and instead apply for an Ignition Interlock Permit (IIP). Drivers who are unsuccessful in challenging their administrative license revocation lose their right to request an IIP.

An IIP is installed in a vehicle to monitor the driver’s BAC and will lock the engine if it registers a BAC reading of 0.03 percent or more. Generally, the reading is generated by blowing into the device and the IIP runs random tests while the vehicle is being operated.

This chart lays out the penalties for DUI convictions in Nebraska, based on how any convictions a driver has had and the penalty imposed by the presiding judge:

| Penalty | First (more than 0.08%) | First High BAC (More than 0.15%) | Second | Second High BAC | Third | Third High BAC |

|---|---|---|---|---|---|---|

| Criminal Offense | Misdemeanor, 7 to 60 days in jail, $500 fine | Misdemeanor, 7 to 60 days in jail, $500 fine | Misdemeanor, 30 to 180 days in jail, $500 fine. | Misdemeanor, 90 days to 1 year in jail, up to $1,000 fine | Misdemeanor, 90 days to 1 year in jail and $1,000 fine | Felony, 180 days to three years in jail and up to $10,000 fine |

| License Revocation Period | 6 months, IID available | 1 year, IID available | 18 months, no IID eligibility for first 45 days | 18 months to 15 years | 15 years | 15 years |

| Penalty for Drivers Given Probation or Suspended Sentence | 60 day license revocation, $500 fine, IID available | 1 year license revocation with IID available, $500 fine and two days in jail or 120 hours community service | 18 month license revocation and IID eligible after 45 days, 10 days in jail or 240 hours community service | 18 month to 15 year license revocation, $1,000 fine and 30 days in jail with no IID eligibility for 45 days | 2 to 15 year license revocation, $1,000 fine and 30 days in jail, no IID eligibility for 45 days | 5 to 15 year license revocation, $1,000 fine and 60 days in jail, no IID eligibility for 45 days |

As you can see, for first-time offenders who do receive probation or a suspended sentence Nebraska’s penalties driving with BACs of 0.08 and 0.15 do not differ much beyond a longer license revocation for a BAC of 0.15. But when the defendant gets probation or a suspended sentence, the defendant with the 0.15 BAC will receive 120 hours of community service along with the longer revocation.

Yet for the third offense with a BAC of above 0.15, a defendant’s sentencing range is three times as long as the range for a 0.08 defendant and the fine is 10 times as much ($10,000 vs. $1,000).

Marijuana-Impaired Driving Laws

Nebraska drivers who have been charged with driving under the influence of marijuana face the same penalties as those charged with a DUI. However, unlike driving under the influence of alcohol, there is no field sobriety test for marijuana use.

The lack of any scientifically valid field test for marijuana use leaves law enforcement officers to rely on their training in identifying impaired drivers. Most Nebraska law enforcement officers are trained in identifying impaired drivers.

If you are suspected of driving under the influence of marijuana in Nebraska, you will be required to undergo a urine or blood test.

Attorneys defending drivers suspected of driving while high regularly argue that the field tests administered by officers too subjective. They also take issue with the drug and urine tests because they can only determine whether a driver has used marijuana in the days leading up to the test, not whether a driver was high when stopped.

Distracted Driving Laws

It is illegal to text and drive in Nebraska. However, it is a secondary infraction and law enforcement officers may not cite you unless you are committing a separate driving offense.

Additionally, drivers under the age of 18 with a learner’s permit are not allowed to use cell phones while driving.

Driving in Nebraska

Two factors that will significantly impact your Nebraska auto insurance premiums are vehicle thefts and road fatalities. That is because some cars’ makes and models are more likely to be stolen than others, and some areas of Nebraska are more prone to fatal accidents than others.

Since vehicle thefts and motor vehicle death statistics can factor into your insurance rates, we have compiled a helpful list of some of the publicly available information here.

How many vehicle thefts occur in Nebraska?

It should be no surprise that Nebraska’s largest city, Omaha, led the state in vehicle thefts for 2017, according to FBI data. However, the number of thefts is surprising. The FBI said there were 3,500 cases of motor vehicle theft in Omaha for 2017.

For the FBI’s purposes “motor vehicle theft” includes both successful thefts and attempted thefts, so that does not mean 3,500 vehicles were actually stolen that year. After Omaha, the FBI’s vehicle theft numbers drop substantially with 153 reported in Bellevue and 25 for Norfolk. No other cities or towns reported more than 12 for that year.

As for which vehicles were the most stolen in Nebraska, we have compiled the following list:

| Vehicle Type | Model Year | Thefts |

|---|---|---|

| Chevrolet Pickup (Full Size) | 1996 | 196 |

| Ford Pickup (Full Size) | 1999 | 168 |

| Honda Civic | 1997 | 165 |

| Honda Accord | 1996 | 157 |

| Dodge Pickup (Full Size) | 2001 | 102 |

| Jeep Cherokee/Grand Cherokee | 1999 | 70 |

| Chevrolet Impala | 2006 | 68 |

| GMC Pickup (Full Size) | 2015 | 61 |

| Toyota Camry | 2000 | 49 |

| Chevrolet Pickup (Small Size) | 1998 | 43 |

It shouldn’t come as a surprise for a state where the most popular vehicle is a pickup truck that three of the five most stolen vehicles were pickup trucks, but it is surprising that the Honda Civic and Honda Accord were the third- and fourth-most popular cars to steal.

How many road fatalities occur in Nebraska?

Let’s face it, while it’s a big state, there simply aren’t that many people living in Nebraska. The state’s small population size comes into focus when it comes to the number of people who die on its roads each year compared to states with larger populations.

This chart breaks down Nebraska’s road fatalities for 2018, based on data collected by the NHTSA.

| Type | Number of Fatalities |

|---|---|

| Total Traffic Fatalities | 230 |

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 165 |

| Motorcycle Fatalities | 23 |

| Drivers Involved in Fatal Crashes | 353 |

| Pedestrian Fatalities | 24 |

| Bicycle and Other Cyclist Fatalities | 0 |

In 2018, 230 people died on Nebraska’s roads, which is a small fraction of the deaths reported for states like Texas (3,642) and California (3,563).

Most Fatal Highway in Nebraska

It will come as no surprise to Nebraska residents that the highway with the most fatalities is Interstate 80. It is the only interstate that runs across the entire state and is a major east-west thoroughfare for cross country traffic.

The violent winter and summer storms that roll across Nebraska are one factor in that high death rate, as are drivers taking advantage of the long, straight highway with few hills to exceed the speed limit. Plus, the monotony of some stretches of I-80 leads some drivers to lose focus.

During the past decade, there have been 179 fatal crashes on that resulted in 235 fatalities on the portion of I-80 that stretches across Nebraska.

Fatal Crashes by Weather Condition and Light Condition

With both summer rainstorms and blizzards regularly hitting the state, Nebraska’s drivers need to deal with a broad variety of inclement road conditions that sometimes result in fatal accidents. However, most fatal accidents in the state are not weather-related, as this chart for 2017 shows:

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 109 | 29 | 38 | 9 | 1 | 186 |

| Rain | 2 | 2 | 2 | 0 | 0 | 6 |

| Snow/Sleet | 5 | 0 | 2 | 0 | 0 | 7 |

| Other | 2 | 1 | 2 | 1 | 0 | 6 |

| Unknown | 0 | 0 | 2 | 0 | 3 | 5 |

| TOTAL | 118 | 32 | 46 | 10 | 4 | 210 |

Maybe Nebraskans drive more carefully in inclement weather, but 0f the 2010 fatal crashes in 2017, 186 of them involved dry roads. What’s more, more than half of them took place during daylight hours.

Fatalities (All Crashes) by County

Nebraska has 93 counties, ranging in population from 566,880 (Douglas County) to 465 (Arthur County). Those population differences can also be seen in the traffic fatality numbers, broken down by county here:

| County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Adams | 2 | 1 | 5 | 3 | 7 |

| Antelope | 2 | 5 | 2 | 3 | 0 |

| Arthur | 0 | 0 | 0 | 0 | 0 |

| Banner | 0 | 0 | 0 | 0 | 0 |

| Blaine | 0 | 1 | 0 | 0 | 0 |

| Boone | 1 | 1 | 0 | 0 | 0 |

| Box Butte | 2 | 1 | 1 | 2 | 0 |

| Boyd | 0 | 0 | 1 | 0 | 0 |

| Brown | 1 | 1 | 1 | 0 | 1 |

| Buffalo | 6 | 5 | 9 | 6 | 7 |

| Burt | 0 | 0 | 2 | 3 | 1 |

| Butler | 1 | 4 | 1 | 2 | 2 |

| Cass | 8 | 7 | 1 | 3 | 6 |

| Cedar | 3 | 4 | 4 | 3 | 2 |

| Chase | 3 | 0 | 1 | 1 | 2 |

| Cherry | 2 | 2 | 3 | 6 | 2 |

| Cheyenne | 2 | 3 | 1 | 0 | 1 |

| Clay | 4 | 5 | 1 | 0 | 2 |

| Colfax | 0 | 1 | 4 | 2 | 4 |

| Cuming | 4 | 0 | 0 | 2 | 3 |

| Custer | 4 | 3 | 1 | 1 | 1 |

| Dakota | 4 | 3 | 6 | 0 | 0 |

| Dawes | 0 | 3 | 1 | 1 | 2 |

| Dawson | 7 | 8 | 9 | 7 | 5 |

| Deuel | 0 | 0 | 1 | 0 | 1 |

| Dixon | 0 | 1 | 0 | 0 | 0 |

| Dodge | 7 | 7 | 3 | 7 | 2 |

| Douglas | 34 | 53 | 36 | 43 | 44 |

| Dundy | 0 | 0 | 1 | 0 | 1 |

| Fillmore | 1 | 0 | 1 | 1 | 1 |

| Franklin | 1 | 1 | 0 | 0 | 1 |

| Frontier | 1 | 0 | 0 | 2 | 0 |

| Furnas | 1 | 1 | 0 | 0 | 0 |

| Gage | 1 | 9 | 3 | 0 | 4 |

| Garden | 0 | 0 | 0 | 0 | 1 |

| Garfield | 0 | 0 | 1 | 0 | 1 |

| Gosper | 1 | 0 | 0 | 0 | 1 |

| Grant | 0 | 0 | 0 | 1 | 0 |

| Greeley | 0 | 0 | 0 | 0 | 0 |

| Hall | 6 | 5 | 5 | 11 | 5 |

| Hamilton | 1 | 1 | 1 | 1 | 3 |

| Harlan | 1 | 1 | 1 | 1 | 1 |

| Hayes | 0 | 0 | 0 | 1 | 0 |

| Hitchcock | 0 | 0 | 2 | 2 | 0 |

| Holt | 0 | 2 | 0 | 2 | 1 |

| Hooker | 0 | 0 | 0 | 0 | 0 |

| Howard | 2 | 0 | 0 | 0 | 3 |

| Jefferson | 2 | 0 | 0 | 2 | 0 |

| Johnson | 0 | 2 | 2 | 1 | 0 |

| Kearney | 1 | 0 | 4 | 1 | 0 |

| Keith | 2 | 2 | 6 | 6 | 5 |

| Keya Paha | 2 | 0 | 0 | 0 | 0 |

| Kimball | 1 | 3 | 1 | 2 | 3 |

| Knox | 1 | 0 | 3 | 2 | 1 |

| Lancaster | 23 | 21 | 15 | 18 | 18 |

| Lincoln | 8 | 3 | 13 | 6 | 1 |

| Logan | 0 | 0 | 0 | 1 | 1 |

| Loup | 0 | 0 | 0 | 0 | 2 |

| Madison | 1 | 4 | 10 | 6 | 8 |

| Mcpherson | 0 | 0 | 0 | 0 | 0 |

| Merrick | 3 | 1 | 4 | 1 | 1 |

| Morrill | 4 | 1 | 0 | 1 | 2 |

| Nance | 2 | 0 | 0 | 0 | 0 |

| Nemaha | 0 | 3 | 3 | 0 | 2 |

| Nuckolls | 0 | 1 | 0 | 1 | 0 |

| Otoe | 1 | 4 | 0 | 2 | 3 |

| Pawnee | 2 | 2 | 0 | 0 | 0 |

| Perkins | 0 | 1 | 0 | 0 | 0 |

| Phelps | 0 | 5 | 3 | 4 | 1 |

| Pierce | 6 | 3 | 1 | 0 | 3 |

| Platte | 3 | 3 | 4 | 4 | 1 |

| Polk | 2 | 0 | 1 | 1 | 1 |

| Red Willow | 1 | 0 | 0 | 3 | 3 |

| Richardson | 1 | 2 | 1 | 2 | 1 |

| Rock | 0 | 1 | 1 | 0 | 1 |

| Saline | 0 | 7 | 1 | 0 | 1 |

| Sarpy | 3 | 9 | 7 | 11 | 10 |

| Saunders | 4 | 6 | 5 | 5 | 3 |

| Scotts Bluff | 5 | 4 | 9 | 6 | 5 |

| Seward | 11 | 3 | 1 | 1 | 13 |

| Sheridan | 3 | 3 | 2 | 3 | 3 |

| Sherman | 1 | 1 | 1 | 0 | 0 |

| Sioux | 0 | 0 | 1 | 0 | 0 |

| Stanton | 5 | 1 | 0 | 1 | 1 |