The Full Nevada Auto Insurance Guide [Providers + Coverage]

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Chris Abrams

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Michael Leotta

Updated January 2024

| Nevada Statistics Summary | Details |

|---|---|

| Annual Road Miles | Total in State: 42,815 Vehicle Miles Driven: 25.3 million |

| Vehicles | Registered: 2.17 million Thefts: 10,185 |

| State Population | 3,034,392 |

| Most Popular Vehicle | Toyota RAV4 |

| Uninsured Motorists | 10.60% State Rank: 29th |

| Total Driving Fatalities | Speeding: 95 Drunk Driving: 89 |

| Average Annual Premiums | Liability: $681.56 Collision: $303.86 Comprehensive: $117.63 |

| Cheapest Provider | USAA Depositors Insurance |

Show me the money!

Nevada is known for showing (and taking) the money. Nevada is known for the nightlife of gambling and entertainment. It is also the largest producer of gold.

So, we want to keep the money where you like it – in your pocket.

Insurance can be tricky, where to get it and how much you need can be confusing. We are here to help. We have compiled a comprehensive look at insurance in Nevada.

What affects your rates? What companies are in your state? When should I renew my license? These are all questions and more we will be covering.

Ready to get a quote? We have you covered with that too. Enter your zip code and use our free comparison tool to get quotes now.

Nevada Car Insurance Coverage and Rates

Liability limits, comprehensive, collision, and more are terms you hear often when looking for insurance. But, what do they really mean?

We are going to look at what type of coverage you are required to have, how to show it, and other coverages you may want to take a look at when looking for insurance.

Between Reno’s famous air show, the nightlife of Las Vegas, and the Hoover Dam you have more enjoyable things to do or places to spend your money than insurance. So let’s go ahead and dig into all the world of insurance.

Nevada’s Car Culture

Shows like Counting Cars and Vegas Rat Rods show the love of nostalgic cars in Nevada. Both of these shows are filmed in Nevada’s very own Las Vegas.

But, Vegas isn’t the only city to show its love for cars. Reno, Nevada is home to the National Automobile Museum. This museum features over 200 cars portraying this history of cars from the 1800s to the current day.

And who would want to miss a massive open field of junked and painted cars carefully placed on top of each other? You can visit the International Car Forest of the Last Church in Goldfield to see this sight.

The state also has a love for racing. Las Vegas Motor Speedway hosts many NASCAR events.

While Nevada is known for the city lights of Las Vegas, not all of the state is like as populated. Nevada offers wide-open roads for drivers of all kinds to enjoy their vehicle of choice.

Nevada Minimum Coverage

It is never safe to drive without insurance, for you or for other drivers on the road. Nevada, like most states, requires a minimum amount of insurance all drivers must car on their vehicles.

| Insurance Required | Coverage |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person $50,000 per accident |

| Property Damage Liability Coverage | $20,000 per accident |

Let’s break down these required coverages.

- $20,000 per accident to cover the total property damage

- $25,000 per person to cover the bodily injury or death of any person

- $50,000 per accident to cover total bodily injury or death liability

Liability coverage is used to recover losses for the party not at fault. So, if you are the one driving and caused the accident liability coverage will not pay for your loss. You are the one held liable for the accident.

This is why most drivers opt to have higher amounts of coverage than the minimum required. We will take a look at more coverages available as we continue.

Forms of Financial Responsibility

Financial responsibility is the ability to pay for a loss that occurs if you cause it, also a fancy way of saying insurance.

Any time a police officer or government employee (DMV when registering a new car) request proof of insurance, you must be able to show proof.

Proof can be a declarations page of your policy or an identification card showing valid insurance. Nevada also allows drivers to show proof electronically on a mobile device. No more searching through your glove compartment.

Nevada also offers an easy way for law enforcement to check for uninsured drivers. Nevada LIVE is a database of all drivers that continuously validate drivers and their insurance.

Premiums as a Percentage of Income

As of 2018, the disposable income of an average Nevada resident was $49,176. So how much of that income is going towards your insurance?

Over the course of three years, Nevada insurance averages slightly above $1,000 annually making it a little under three percent going towards insurance.

This is much higher than the countrywide average of 2.5 percent.

Interested in finding out how much you personally put towards insurance? Check out our percentage calculator.

CalculatorPro

Core Coverage

TheNational Association of Insurance Commissioners takes the average premium of coverages offered by a state. This average is based on state minimum coverage.

| Coverage Type | Annual Costs in 2015 |

|---|---|

| Liability | $681.56 |

| Collision | $303.86 |

| Comprehensive | $117.63 |

| Combined | $1,103.05 |

As we discussed earlier, liability coverage is used when you are the driver at fault of the accident. Coverages, like comprehensive and collision, are coverages used to fix your vehicle no matter who is at fault.

Nevada does not mandate these coverages, but in the event of a leased or financed car, your dealer or financer may require them.

Keep reading to find out about more liability coverages you can add to your auto policy.

Additional Liability

Additional coverages you can add to your policy are medical payments (med pay) and uninsured/underinsured motorist coverage.

Med pay is an additional payment you can receive to help pay for medical bills. This coverage can be used regardless of fault and to anyone in the vehicle at the time of the accident.

Uninsured/underinsured motorist coverage is used when you are hit by a vehicle carrying either no coverage or not enough to cover your loss. This is great additional liability coverage to add to your policy, especially if you drive a luxury car and more expensive to fix.

Nevada rates 29th in the US for uninsured motorists.

When an insured is looking at how much a company pays out for losses, they would look at loss ratio. The loss ratio is premium earned to claims filed. For instance, if a company has $100,000 in earned premium and pays out $60,000 in claims, the loss ratio is 60 percent.

If the loss ratio is over 100 percent, the company isn’t making money and that could be an indicator of financial problems in the future. If the loss ratio is low, say 30-40 percent, then they do not pay out in claims.

| Loss Ratio | 2015 | 2014 | 2013 |

|---|---|---|---|

| Medical Payments (MedPay) | 79.00 | 78.32 | 81.58 |

| Uninsured/Underinsured Motorist Coverage | 98.40 | 107.13 | 101.86 |

Now let’s move on to look at other endorsements you can add to your policy.

Add-ons, Endorsements, and Riders

There are so many options that can be added to your auto policy to make sure you are fully covered. Below is a brief list of the most commonly used endorsements.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

It is always a great idea to talk to your agent and relay your needs so your agent can make sure you have the proper riders added and you have no gaps in coverage.

– Male vs. Female Rates

Check out our table below, information is provided by Quadrant Data.

| Loss Ratio | 2015 | 2014 | 2013 |

|---|---|---|---|

| Medical Payments (MedPay) | 79.00 | 78.32 | 81.58 |

| Uninsured/Underinsured Motorist Coverage | 98.40 | 107.13 | 101.86 |

Gender and age can affect how much you pay for insurance. Teen drivers pay a much higher premium than experienced, older drivers.

Men tend to pay slightly more than women, but some companies do not show a difference in gender.

Here we have averages listed for companies and ranked in order of highest to lowest.

| Company | Demographic | Average Annual Rate | Rank |

|---|---|---|---|

| Travelers Home & Marine Ins Co | Single 17-year old male | $18,350.69 | 1 |

| Safeco Ins Co of IL | Single 17-year old male | $15,639.03 | 2 |

| Safeco Ins Co of IL | Single 17-year old female | $14,026.77 | 3 |

| American Family Mutual | Single 17-year old male | $14,014.29 | 4 |

| State Farm Mutual Auto | Single 17-year old male | $13,863.57 | 5 |

| Allstate F&C | Single 17-year old male | $12,771.99 | 6 |

| Mid-Century Ins Co | Single 17-year old male | $11,728.64 | 7 |

| Travelers Home & Marine Ins Co | Single 17-year old female | $11,261.00 | 8 |

| Mid-Century Ins Co | Single 17-year old female | $11,011.64 | 9 |

| State Farm Mutual Auto | Single 17-year old female | $10,846.02 | 10 |

| American Family Mutual | Single 17-year old female | $10,708.72 | 11 |

| Allstate F&C | Single 17-year old female | $10,608.38 | 12 |

| Progressive Direct | Single 17-year old male | $10,231.11 | 13 |

| Progressive Direct | Single 17-year old female | $9,436.38 | 14 |

| Depositors Insurance | Single 17-year old male | $6,979.24 | 15 |

| Geico Cas | Single 17-year old female | $6,851.05 | 16 |

| Geico Cas | Single 17-year old male | $6,237.15 | 17 |

| USAA | Single 17-year old male | $5,987.19 | 18 |

| Depositors Insurance | Single 17-year old female | $5,805.75 | 19 |

| USAA | Single 17-year old female | $5,313.62 | 20 |

| Mid-Century Ins Co | Single 25-year old male | $4,434.89 | 21 |

| Mid-Century Ins Co | Single 25-year old female | $4,410.53 | 22 |

| State Farm Mutual Auto | Single 25-year old male | $4,378.51 | 23 |

| State Farm Mutual Auto | Single 25-year old female | $3,917.14 | 24 |

| American Family Mutual | Single 25-year old male | $3,653.13 | 25 |

| Safeco Ins Co of IL | Single 25-year old male | $3,637.13 | 26 |

| Allstate F&C | Single 25-year old male | $3,631.01 | 27 |

| State Farm Mutual Auto | Married 35-year old female | $3,496.78 | 28 |

| State Farm Mutual Auto | Married 35-year old male | $3,496.78 | 28 |

| Safeco Ins Co of IL | Single 25-year old female | $3,477.93 | 30 |

| Allstate F&C | Single 25-year old female | $3,436.69 | 31 |

| Safeco Ins Co of IL | Married 60-year old male | $3,434.95 | 32 |

| Mid-Century Ins Co | Married 60-year old male | $3,407.39 | 33 |

| Mid-Century Ins Co | Married 35-year old male | $3,398.72 | 34 |

| Safeco Ins Co of IL | Married 35-year old male | $3,335.64 | 35 |

| Mid-Century Ins Co | Married 35-year old female | $3,309.54 | 36 |

| Allstate F&C | Married 35-year old female | $3,213.12 | 37 |

| Allstate F&C | Married 35-year old male | $3,187.35 | 38 |

| State Farm Mutual Auto | Married 60-year old female | $3,171.99 | 39 |

| State Farm Mutual Auto | Married 60-year old male | $3,171.99 | 39 |

| American Family Mutual | Married 35-year old female | $3,166.61 | 41 |

| American Family Mutual | Married 35-year old male | $3,166.61 | 41 |

| American Family Mutual | Single 25-year old female | $3,166.61 | 41 |

| Allstate F&C | Married 60-year old male | $3,148.67 | 44 |

| Safeco Ins Co of IL | Married 35-year old female | $3,084.15 | 45 |

| Safeco Ins Co of IL | Married 60-year old female | $3,041.79 | 46 |

| Mid-Century Ins Co | Married 60-year old female | $3,017.95 | 47 |

| Depositors Insurance | Single 25-year old male | $2,994.55 | 48 |

| Allstate F&C | Married 60-year old female | $2,980.43 | 49 |

| Geico Cas | Married 60-year old male | $2,873.57 | 50 |

| American Family Mutual | Married 60-year old female | $2,821.83 | 51 |

| American Family Mutual | Married 60-year old male | $2,821.83 | 51 |

| Geico Cas | Married 60-year old female | $2,816.04 | 53 |

| Depositors Insurance | Single 25-year old female | $2,808.27 | 54 |

| Geico Cas | Married 35-year old female | $2,764.87 | 55 |

| USAA | Single 25-year old male | $2,740.28 | 56 |

| Geico Cas | Single 25-year old female | $2,737.80 | 57 |

| Geico Cas | Married 35-year old male | $2,674.83 | 58 |

| Travelers Home & Marine Ins Co | Single 25-year old male | $2,582.53 | 59 |

Read more: Mid-Century Insurance Company: Customer Ratings & Reviews

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Nevada Car Insurance Companies

The next part of this insurance equation is finding a company. There are so many different carriers you can choose from that it can be a little overwhelming trying to figure out which one is a great fit for your needs.

Rest assured we are going to take that burden off your back. We are going to cover all the good, and bad, with available companies in Nevada.

We will also take a look at their rates. Depending on your circumstances, your rate could be different from each company. For instance, some companies rate more for commuting while another may weigh more on credit history.

First up, we will take a look at financial rates and the best customer ratings.

– The Largest Companies Financial Rating

AM Best is a rating company that solely focuses on the insurance industry. As a global company, AM Best rates insurers across the country in their financial status.

| Providers (Listed by Size, Largest to Smallest) | A.M. Best Rating |

|---|---|

| State Farm Group | A++ |

| Geico | A++ |

| Progressive Group | A+ |

| Allstate Insurance Group | A+ |

| Farmers Insurance Group | A |

| USAA Group | A++ |

| Liberty Mutual Group | A |

| CSAA Insurance Group | A |

| American Family Insurance Group | A |

| Hartford Fire & Casualty Group | A+ |

State Farm, Geico, and USAA lead the pack with the highest financial rating.

– Companies with Best Ratings

We all want good rates when we are looking for insurance. Drivers want great coverage at the cheapest price. Once you find great coverage, you then want great customer service. No one wants to deal with a customer service representative that isn’t helpful or short in conversation.

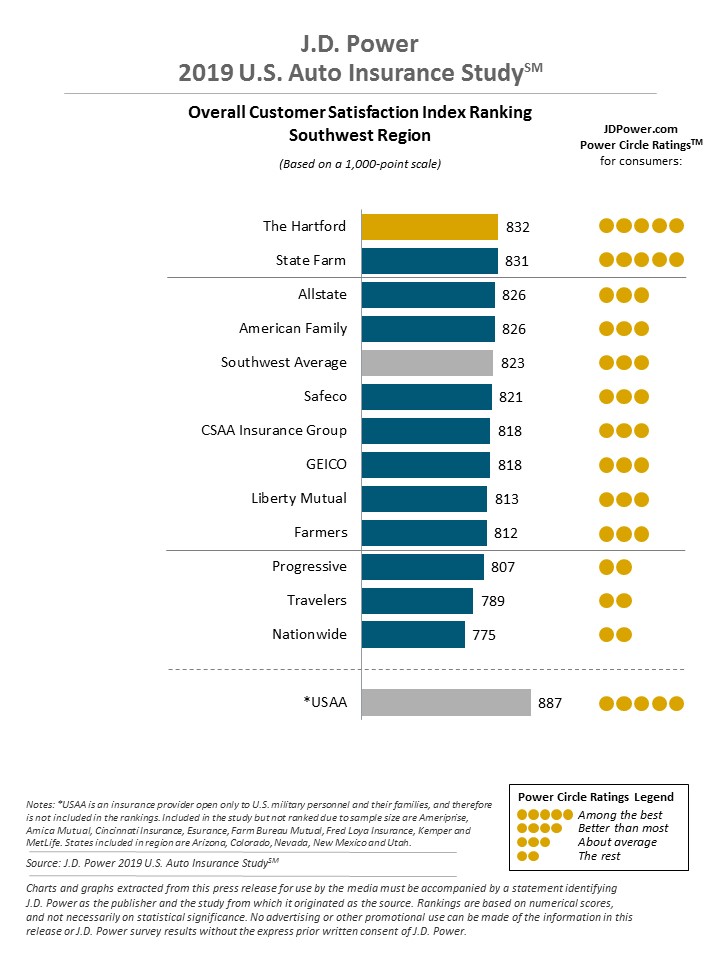

J.D. Power looks at services, products, and companies and rates them from customer reviews.

Out of the fourteen companies listed above, three make the list of “among the best.” USAA is listed and rated, but not included in the colored chart. Please remember USAA is for military, veterans, and eligible family members.

– Companies with Most Complaints in Nevada

With all the good sometimes there is also negative. All companies will eventually get a complaint. Keep in mind, some of these companies have thousands of customers so their complaint ratio is extremely low even with higher numbers of complaints.

The Nevada Division of Insurance has the 2018 Consumer Complaint Report listing all complaints in the state of Nevada.

| Insurance Company | Date Complaint Opened | Date Complaint Closed | Coverage Level 1 | Coverage Level 2 | Reason for Complaint | Reason Type | Department of Insurance Findings |

|---|---|---|---|---|---|---|---|

| KEY INSURANCE COMPANY | 01-02-2018 | 02-02-2018 | Private Passenger | Collision | Claim Handling | Delay | Compromised Settlement/Resol. |

| HORACE MANN INSURANCE COMPANY | 01-04-2018 | 03-02-2018 | Private Passenger | Collision | Claim Handling | Unsatisfactory Settle Offer | Company Position Upheld |

| American Family Mutual Insurance Company, S.I. | 01-04-2018 | 02-08-2018 | Private Passenger | Collision | Claim Handling | State Specific | Company Position Upheld |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-09-2018 | 03-08-2018 | Private Passenger | Collision | Claim Handling | Adjuster Handling Delay | Claim Settled |

| Geico Advantage Insurance Company | 01-10-2018 | 01-31-2018 | Private Passenger | Collision | Claim Handling | Denial of Claim Unsatisfactory Settle Offer | Company Position Upheld |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 01-15-2018 | 03-12-2018 | Private Passenger | Collision | Claim Handling | Adjuster Handling Delay | Claim Settled |

| BARSANTI, JOHN S FARMERS INSURANCE EXCHANGE | 01-18-2018 | 03-12-2018 | Private Passenger | Collision | Claim Handling | Adjuster Handling Coordination of Benefits Unsatisfactory Settle Offer | Company Position Upheld No Further Action Req/Rqd |

| American Family Mutual Insurance Company, S.I. | 01-24-2018 | 03-08-2018 | Private Passenger | Collision | Claim Handling | Delay | No Further Action Req/Rqd |

| STATE FARM FIRE & CASUALTY COMPANY | 01-27-2018 | 01-30-2018 | Private Passenger | Collision | Claim Handling | Unsatisfactory Settle Offer | No Further Action Req/Rqd |

| MENDOTA INSURANCE COMPANY | 01-29-2018 | 03-28-2018 | Private Passenger | Collision | Claim Handling | Delay Unsatisfactory Settle Offer | Compromised Settlement/Resol. |

| ALLSTATE FIRE AND CASUALTY INSURANCE COMPANY | 01-30-2018 | 03-08-2018 | Private Passenger | Collision | Claim Handling | Unsatisfactory Settle Offer | Company Position Upheld |

| FARMERS INSURANCE EXCHANGE | 02-06-2018 | 03-14-2018 | Private Passenger | Collision | Claim Handling | Unsatisfactory Settle Offer | No Further Action Req/Rqd |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 02-07-2018 | 03-07-2018 | Private Passenger | Collision | Claim Handling | Denial of Claim | Company Position Upheld |

| Geico CASUALTY COMPANY | 02-09-2018 | 03-01-2018 | Private Passenger | Collision | Claim Handling | Denial of Claim | Company Position Upheld |

| Geico Secure Insurance Company | 02-12-2018 | 03-14-2018 | Private Passenger | Collision | Claim Handling | Unsatisfactory Settle Offer | No Further Action Req/Rqd |

| AMERICAN ACCESS CASUALTY COMPANY | 02-12-2018 | 03-14-2018 | Private Passenger | Collision | Claim Handling | Delay | No Further Action Req/Rqd |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 02-13-2018 | 03-16-2018 | Private Passenger | Collision | Claim Handling | Unsatisfactory Settle Offer | Compromised Settlement/Resol. |

| UNITED SERVICES AUTOMOBILE ASSOCIATION | 02-14-2018 | 03-26-2018 | Private Passenger | Collision | Claim Handling | Delay | Claim Settled |

| Self Insured Services Company | 02-28-2018 | 03-05-2018 | Private Passenger | Collision | Claim Handling | Delay | Complaint Withdrawn |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 03-09-2018 | 03-29-2018 | Private Passenger | Collision | Policyholder Service | Coverage Question | No Further Action Req/Rqd |

| NEVADA GENERAL INSURANCE COMPANY | 01-10-2018 | 03-02-2018 | Private Passenger | Comprehensive | Claim Handling | Delay | Claim Settled |

| KEY INSURANCE COMPANY NMSW INC | 01-25-2018 | 02-09-2018 | Private Passenger | Comprehensive | Policyholder Service | Coverage Question Payment Not Credited | Compromised Settlement/Resol. Compromised Settlement/Resol. |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 02-01-2018 | 03-15-2018 | Private Passenger | Comprehensive | Claim Handling | Denial of Claim | Company Position Upheld |

| NEVADA GENERAL INSURANCE COMPANY | 01-30-2018 | 02-16-2018 | Private Passenger | Comprehensive | Claim Handling | Denial of Claim | State Specific |

| NEVADA GENERAL INSURANCE COMPANY | 01-30-2018 | 03-30-2018 | Private Passenger | Comprehensive | Claim Handling | Denial of Claim | Company Position Upheld |

| MID-CENTURY INSURANCE COMPANY PROGRESSIVE NORTHERN INSURANCE COMPANY | 01-02-2018 | 02-14-2018 | Private Passenger | Liability | Claim Handling | Delay | Company Position Upheld Company Position Upheld |

| ALLSTATE FIRE AND CASUALTY INSURANCE COMPANY | 01-02-2018 | 01-30-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim | Company Position Upheld |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 01-02-2018 | 02-28-2018 | Private Passenger | Liability | Claim Handling Policyholder Service | Coverage Question Post Claim Underwriting | Company Position Upheld |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 01-02-2018 | 01-03-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | No Further Action Req/Rqd |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-02-2018 | 01-22-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| STATE FARM FIRE & CASUALTY COMPANY | 01-02-2018 | 01-03-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | No Further Action Req/Rqd |

| NATIONWIDE MEMBER SOLUTIONS AGENCY, INC VICTORIA FIRE & CASUALTY COMPANY | 01-02-2018 | 03-05-2018 | Private Passenger | Liability | Policyholder Service Underwriting | Coverage Question State Specific | Compromised Settlement/Resol. No Further Action Req/Rqd |

| Geico Advantage Insurance Company | 01-02-2018 | 01-16-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | No Further Action Req/Rqd |

| NEVADA GENERAL INSURANCE COMPANY | 01-02-2018 | 03-02-2018 | Private Passenger | Liability | Claim Handling | Delay | No Further Action Req/Rqd |

| ALLSTATE PROPERTY & CASUALTY INSURANCE COMPANY | 01-02-2018 | 01-23-2018 | Private Passenger | Liability | Policyholder Service Underwriting | CLUE Reports Coverage Question | Company Position Upheld |

| JAMES RIVER INSURANCE COMPANY | 01-03-2018 | 03-06-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | No Further Action Req/Rqd |

| LARIOS GALVEZ, CARLOS OMAR OMAR STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY WHITMORE, BROOKS ELLIOT | 01-03-2018 | 03-01-2018 | Private Passenger | Liability | Policyholder Service Underwriting | Cancellation Coverage Question | Company Position Upheld No Further Action Req/Rqd No Further Action Req/Rqd |

| MID-CENTURY INSURANCE COMPANY | 01-03-2018 | 01-12-2018 | Private Passenger | Liability | Claim Handling | Adjuster Handling Unsatisfactory Settle Offer | Compromised Settlement/Resol. |

| American Family Insurance Company | 01-03-2018 | 03-05-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| BAXTER-BARTON, SUSAN N LUNDEEN AND ASSOCIATES LLC MENDAKOTA INSURANCE COMPANY | 01-03-2018 | 03-05-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| ESIS INC HERTZ CLAIM MANAGEMENT CORPORATION | 01-03-2018 | 03-23-2018 | Private Passenger | Liability | Claim Handling | Delay | Compromised Settlement/Resol. |

| LM GENERAL INSURANCE COMPANY | 01-03-2018 | 03-09-2018 | Private Passenger | Liability | Underwriting | Nonrenewal | Company Position Upheld |

| Geico CASUALTY COMPANY | 01-04-2018 | 01-17-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| PERMANENT GENERAL ASSURANCE CORPORATION | 01-04-2018 | 01-23-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| PLAIN INC PROGRESSIVE NORTHERN INSURANCE COMPANY | 01-04-2018 | 02-02-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| POLISEEK AIS INSURANCE SOLUTIONS INC PROGRESSIVE NORTHERN INSURANCE COMPANY | 01-04-2018 | 02-05-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question Premium Notice/Billing Premium Refund | Company Position Upheld No Further Action Req/Rqd |

| ALLSTATE PROPERTY & CASUALTY INSURANCE COMPANY | 01-04-2018 | 01-23-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| PROGRESSIVE NORTHERN INSURANCE COMPANY | 01-04-2018 | 02-27-2018 | Private Passenger | Liability | Policyholder Service | Premium Notice/Billing | No Further Action Req/Rqd |

| ACCEPTANCE INS AGENCY OF TENNESSEE INC NATIONAL GENERAL INSURANCE COMPANY | 01-04-2018 | 02-02-2018 | Private Passenger | Liability | Marketing & Sales Policyholder Service | Coverage Question State Specific | Company Position Upheld No Further Action Req/Rqd |

| FREEWAY INSURANCE SERVICES OFNEVADA, INC KEY INSURANCE COMPANY | 01-04-2018 | 01-23-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld No Further Action Req/Rqd |

| ALLSTATE FIRE AND CASUALTY INSURANCE COMPANY American Family Mutual Insurance Company, S.I. | 01-05-2018 | 03-07-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | No Further Action Req/Rqd No Further Action Req/Rqd |

| PROGRESSIVE NORTHERN INSURANCE COMPANY | 01-05-2018 | 02-21-2018 | Private Passenger | Liability | Claim Handling | Delay | Claim Settled |

| Geico CASUALTY COMPANY | 01-05-2018 | 01-18-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Claim Settled |

| ALLSTATE FIRE AND CASUALTY INSURANCE COMPANY | 01-06-2018 | 01-19-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Company Position Upheld |

| ALLSTATE FIRE AND CASUALTY INSURANCE COMPANY | 01-08-2018 | 02-01-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| NEVADA GENERAL INSURANCE COMPANY | 01-08-2018 | 03-29-2018 | Private Passenger | Liability | Claim Handling | Delay Denial of Claim | Compromised Settlement/Resol. |

| NATIONWIDE AFFINITY INSURANCE COMPANY OF AMERICA | 01-08-2018 | 03-06-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| 21st CENTURY INSURANCE COMPANY | 01-08-2018 | 03-06-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| CSAA General Insurance Company | 01-08-2018 | 02-14-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| AMERICAN ACCESS CASUALTY COMPANY | 01-09-2018 | 01-09-2018 | Private Passenger | Liability | Claim Handling | Delay | Company Position Upheld |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 01-09-2018 | 02-07-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | No Further Action Req/Rqd |

| Geico CASUALTY COMPANY | 01-09-2018 | 03-07-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| PROPERTY AND CASUALTY INSURANCE COMPANY OF HARTFORD | 01-09-2018 | 02-08-2018 | Private Passenger | Liability | Marketing & Sales | Misrepresentation Premiums Misquoted | Compromised Settlement/Resol. |

| ALLSTATE FIRE AND CASUALTY INSURANCE COMPANY | 01-10-2018 | 02-16-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| Geico CASUALTY COMPANY | 01-10-2018 | 02-08-2018 | Private Passenger | Liability | Claim Handling | Delay | Company Position Upheld |

| AMERICAN ACCESS CASUALTY COMPANY | 01-10-2018 | 01-24-2018 | Private Passenger | Liability | Claim Handling | Delay | No Further Action Req/Rqd |

| RENO SPARKS CAB COMPANY | 01-10-2018 | 01-22-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim | No Jurisdiction |

| CSAA General Insurance Company | 01-10-2018 | 02-16-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | No Further Action Req/Rqd |

| AMERICAN ACCESS CASUALTY COMPANY | 01-10-2018 | 02-02-2018 | Private Passenger | Liability | Claim Handling | Delay | Claim Settled |

| USAA GENERAL INDEMNITY COMPANY | 01-11-2018 | 03-02-2018 | Private Passenger | Liability | Claim Handling | Subrogation | Company Position Upheld No Further Action Req/Rqd |

| Geico Choice Insurance Company | 01-11-2018 | 01-26-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| USAA GENERAL INDEMNITY COMPANY | 01-11-2018 | 03-08-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 01-11-2018 | 03-29-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | No Further Action Req/Rqd |

| AMERICAN ACCESS CASUALTY COMPANY | 01-11-2018 | 01-12-2018 | Private Passenger | Liability | Claim Handling | Delay | No Further Action Req/Rqd |

| PROGRESSIVE NORTHERN INSURANCE COMPANY | 01-11-2018 | 01-29-2018 | Private Passenger | Liability | Claim Handling | Delay | Compromised Settlement/Resol. |

| Geico Choice Insurance Company | 01-12-2018 | 01-17-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | No Further Action Req/Rqd |

| Geico GENERAL INSURANCE COMPANY | 01-12-2018 | 02-05-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | Company Position Upheld |

| CSAA General Insurance Company | 01-12-2018 | 03-08-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| 21ST CENTURY ASSURANCE COMPANY | 01-12-2018 | 02-07-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| ACCEPTANCE INS AGENCY OF TENNESSEE INC Geico Advantage Insurance Company MENDAKOTA INSURANCE COMPANY | 01-12-2018 | 01-30-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld Company Position Upheld Company Position Upheld |

| FARMERS INSURANCE EXCHANGE | 01-12-2018 | 02-09-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim | Company Position Upheld |

| HENDRIX INSURANCE, L.L.C. HENRY, LISA ANN PROGRESSIVE NORTHERN INSURANCE COMPANY | 01-12-2018 | 02-06-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld No Further Action Req/Rqd No Further Action Req/Rqd |

| STANDARD FIRE INSURANCE COMPANY (THE) | 01-13-2018 | 02-06-2018 | Private Passenger | Liability | Claim Handling | Delay Denial of Claim | Referred for Disciplinary Act. |

| Geico Choice Insurance Company | 01-13-2018 | 01-29-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| Hasson, Cheryl A STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-14-2018 | 03-08-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld No Further Action Req/Rqd |

| AMERICAN ACCESS CASUALTY COMPANY FIRST CLASS INSURANCE SERVICES INC | 01-16-2018 | 03-06-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. No Further Action Req/Rqd |

| MERCURY CASUALTY COMPANY | 01-16-2018 | 02-14-2018 | Private Passenger | Liability | Claim Handling | Delay | No Further Action Req/Rqd |

| AMERICAN ACCESS CASUALTY COMPANY | 01-17-2018 | 02-23-2018 | Private Passenger | Liability | Claim Handling | Delay | Company Position Upheld |

| AMERICAN ACCESS CASUALTY COMPANY | 01-17-2018 | 03-02-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Company Position Upheld No Further Action Req/Rqd |

| KEY INSURANCE COMPANY | 01-17-2018 | 03-05-2018 | Private Passenger | Liability | Claim Handling | Delay | Claim Settled |

| DIVISION OF INSURANCE | 01-17-2018 | 01-30-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Insufficient Information |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-18-2018 | 03-05-2018 | Private Passenger | Liability | Claim Handling | Delay | Claim Settled |

| KEY INSURANCE COMPANY | 01-18-2018 | 03-05-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Compromised Settlement/Resol. |

| FARMERS INSURANCE EXCHANGE | 01-18-2018 | 01-31-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question Premium Refund | Company Position Upheld |

| Geico Advantage Insurance Company | 01-18-2018 | 02-27-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Company Position Upheld |

| ALLSTATE FIRE AND CASUALTY INSURANCE COMPANY | 01-19-2018 | 03-01-2018 | Private Passenger | Liability | Claim Handling | Delay | Claim Settled |

| STATE FARM FIRE & CASUALTY COMPANY | 01-22-2018 | 02-28-2018 | Private Passenger | Liability | Claim Handling | Delay | Claim Settled |

| LIBERTY MUTUAL FIRE INSURANCE COMPANY | 01-22-2018 | 03-05-2018 | Private Passenger | Liability | Claim Handling | Delay | Claim Settled |

| AMERICAN ACCESS CASUALTY COMPANY GOMEZ ENTERPRISE GROUP INC | 01-22-2018 | 03-13-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. No Further Action Req/Rqd |

| USAA CASUALTY INSURANCE COMPANY | 01-22-2018 | 03-05-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Claim Settled |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-23-2018 | 02-02-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim | Company Position Upheld |

| HANSEN & HANSEN AGENCY INC KEY INSURANCE COMPANY | 01-23-2018 | 03-13-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld No Further Action Req/Rqd |

| COUNTRY PREFERRED INSURANCE COMPANY EVANS, BRIDGET MARIE | 01-23-2018 | 02-26-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. No Further Action Req/Rqd |

| NEVADA DIVISION OF INSURANCE | 01-23-2018 | 01-30-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Insufficient Information |

| COAST NATIONAL INSURANCE COMPANY | 01-23-2018 | 03-12-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim Unsatisfactory Settle Offer | Company Position Upheld |

| Geico Advantage Insurance Company | 01-23-2018 | 02-09-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| LM GENERAL INSURANCE COMPANY | 01-23-2018 | 02-14-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld Compromised Settlement/Resol. |

| STATE FARM FIRE & CASUALTY COMPANY | 01-24-2018 | 03-05-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim | Claim Settled |

| ESURANCE PROPERTY AND CASUALTY INSURANCE COMPANY | 01-24-2018 | 03-19-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| ALLSTATE INDEMNITY COMPANY | 01-24-2018 | 02-14-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Overturned |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-24-2018 | 03-05-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Company Position Upheld |

| ABCEDE INSURANCE AGENCY LLC SHELTER MUTUAL INSURANCE COMPANY | 01-24-2018 | 02-26-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. No Further Action Req/Rqd |

| DUFFIELD, ROXANNE STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-24-2018 | 02-26-2018 | Private Passenger | Liability | Marketing & Sales Policyholder Service | Coverage Question Failure to Submit Application | Compromised Settlement/Resol. No Further Action Req/Rqd |

| NATIONWIDE AFFINITY INSURANCE COMPANY OF AMERICA | 01-25-2018 | 03-06-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| FAMILY INSURANCE STORE INC (THE) PROGRESSIVE NORTHERN INSURANCE COMPANY | 01-25-2018 | 03-08-2018 | Private Passenger | Liability | Claim Handling | Delay | Compromised Settlement/Resol. |

| Geico CASUALTY COMPANY | 01-25-2018 | 03-12-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Company Position Upheld |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 01-26-2018 | 02-26-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| Geico Advantage Insurance Company | 01-26-2018 | 02-14-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| Geico Advantage Insurance Company | 01-26-2018 | 02-14-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| UNITED AUTOMOBILE INSURANCE CO | 01-27-2018 | 03-12-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Company Position Upheld No Further Action Req/Rqd |

| Geico CASUALTY COMPANY | 01-27-2018 | 03-12-2018 | Private Passenger | Liability | Claim Handling | Comparitive Negligence | Company Position Upheld |

| Geico CASUALTY COMPANY | 01-27-2018 | 03-13-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim | Company Position Upheld |

| CSAA General Insurance Company | 01-28-2018 | 02-16-2018 | Private Passenger | Liability | Claim Handling | Adjuster Handling Delay | Compromised Settlement/Resol. |

| METROPOLITAN DIRECT PROPERTY AND CASUALTY INSURANCE COMPANY | 01-29-2018 | 02-07-2018 | Private Passenger | Liability | Claim Handling | Adjuster Handling Delay | No Jurisdiction Referred to Proper Agency |

| Geico Secure Insurance Company | 01-29-2018 | 02-15-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| AMERICAN ACCESS CASUALTY COMPANY | 01-29-2018 | 03-19-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Claim Settled |

| Geico COUNTY MUTUAL INSURANCE COMPANY STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-29-2018 | 03-20-2018 | Private Passenger | Liability | Claim Handling | Delay | No Further Action Req/Rqd No Jurisdiction |

| ALLSTATE INDEMNITY COMPANY KWAN, YUKIN | 01-29-2018 | 03-14-2018 | Private Passenger | Liability | Marketing & Sales | Fraud/Forgery | No Further Action Req/Rqd |

| HARTFORD INSURANCE COMPANY OF THE MIDWEST | 01-30-2018 | 03-21-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| STATE FARM FIRE & CASUALTY COMPANY | 01-30-2018 | 02-14-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| Geico CASUALTY COMPANY | 01-30-2018 | 03-07-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | Compromised Settlement/Resol. |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-31-2018 | 02-21-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim | Company Position Upheld |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 01-31-2018 | 03-08-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| Dragos, Valentin KEY INSURANCE COMPANY LIBERTY CHOICE INSURANCE, LLC | 01-30-2018 | 03-02-2018 | Private Passenger | Liability | Marketing & Sales Policyholder Service | Coverage Question Fraud/Forgery High Pressure Tactics Misrepresentation Other Violation of Ins Law | Compromised Settlement/Resol. No Further Action Req/Rqd Referred to Proper Agency |

| NATIONAL GENERAL INSURANCE COMPANY | 01-31-2018 | 03-30-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| CSAA General Insurance Company | 01-31-2018 | 03-30-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-31-2018 | 02-15-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Overturned |

| ARRINGTON, WILLIAM S CORBETT, DOTTY LYNN STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-31-2018 | 03-05-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question Surrender Problems | Compromised Settlement/Resol. No Further Action Req/Rqd No Further Action Req/Rqd |

| CSAA Insurance Exchange | 01-31-2018 | 03-07-2018 | Private Passenger | Liability | Policyholder Service Underwriting | Coverage Question State Specific | Compromised Settlement/Resol. |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-31-2018 | 03-12-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | No Further Action Req/Rqd |

| AMERICAN ACCESS CASUALTY COMPANY | 02-01-2018 | 03-30-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | No Further Action Req/Rqd |

| STATE FARM FIRE & CASUALTY COMPANY | 02-01-2018 | 03-08-2018 | Private Passenger | Liability | Policyholder Service | Premium Refund | Compromised Settlement/Resol. |

| AMERICAN ACCESS CASUALTY COMPANY | 02-01-2018 | 02-26-2018 | Private Passenger | Liability | Claim Handling | Delay | Company Position Upheld |

| CSAA General Insurance Company | 02-01-2018 | 03-07-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| LM GENERAL INSURANCE COMPANY | 02-01-2018 | 02-16-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Compromised Settlement/Resol. |

| Geico Choice Insurance Company | 01-29-2018 | 02-14-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | Company Position Upheld |

| ALLSTATE INDEMNITY COMPANY | 02-01-2018 | 02-23-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| DRAKE, CAROL S STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 02-02-2018 | 03-30-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld No Further Action Req/Rqd |

| GOMEZ ENTERPRISE GROUP INC | 02-02-2018 | 02-07-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Complaint Withdrawn |

| LM GENERAL INSURANCE COMPANY | 02-02-2018 | 02-06-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Compromised Settlement/Resol. |

| NATIONWIDE AFFINITY INSURANCE COMPANY OF AMERICA | 02-02-2018 | 02-14-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| STATE FARM FIRE & CASUALTY COMPANY | 02-02-2018 | 02-05-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Overturned |

| COUNTRY PREFERRED INSURANCE COMPANY HERZBERG, ERIC GORDON | 02-02-2018 | 03-01-2018 | Private Passenger | Liability | Policyholder Service Underwriting | Coverage Question State Specific | No Further Action Req/Rqd No Further Action Req/Rqd |

| LIBERTY MUTUAL FIRE INSURANCE COMPANY | 02-04-2018 | 03-07-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| Geico Advantage Insurance Company | 02-05-2018 | 03-02-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | Company Position Upheld |

| American Family Mutual Insurance Company, S.I. | 02-02-2018 | 03-14-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| CSAA General Insurance Company | 02-05-2018 | 02-23-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| FARMERS INSURANCE EXCHANGE | 02-05-2018 | 03-30-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| PROGRESSIVE NORTHERN INSURANCE COMPANY | 02-06-2018 | 02-21-2018 | Private Passenger | Liability | Claim Handling | Delay | Compromised Settlement/Resol. |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 02-06-2018 | 03-16-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 02-06-2018 | 03-14-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | No Further Action Req/Rqd |

| Geico Choice Insurance Company | 02-07-2018 | 03-06-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 02-07-2018 | 02-23-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Overturned |

| HARTFORD INSURANCE COMPANY OF THE MIDWEST | 02-07-2018 | 03-08-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| Geico Choice Insurance Company | 02-08-2018 | 02-26-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| MID-CENTURY INSURANCE COMPANY | 02-08-2018 | 02-22-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Company Position Upheld |

| ALLSTATE FIRE AND CASUALTY INSURANCE COMPANY | 02-08-2018 | 02-12-2018 | Private Passenger | Liability | Policyholder Service | State Specific | Complaint Withdrawn |

| ALLSTATE FIRE AND CASUALTY INSURANCE COMPANY | 02-08-2018 | 03-30-2018 | Private Passenger | Liability | Policyholder Service | Premium Notice/Billing | Compromised Settlement/Resol. |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 02-08-2018 | 03-02-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| ALLSTATE FIRE AND CASUALTY INSURANCE COMPANY | 02-08-2018 | 03-14-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Compromised Settlement/Resol. No Further Action Req/Rqd |

| COUNTRY CASUALTY INSURANCE COMPANY HARUTYUNYAN, GEVORG | 02-08-2018 | 03-13-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question Surrender Problems | Compromised Settlement/Resol. No Further Action Req/Rqd |

| Geico Advantage Insurance Company | 02-08-2018 | 02-27-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| Geico Choice Insurance Company | 02-09-2018 | 03-02-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | No Further Action Req/Rqd |

| PROGRESSIVE NORTHERN INSURANCE COMPANY | 02-09-2018 | 03-14-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim | No Further Action Req/Rqd No Jurisdiction |

| CSAA General Insurance Company KOLIAS, JOHN E | 02-09-2018 | 03-21-2018 | Private Passenger | Liability | Marketing & Sales Underwriting | Misrepresentation Premium & Rating | Company Position Upheld Company Position Upheld |

| AMERICAN ACCESS CASUALTY COMPANY | 02-09-2018 | 02-26-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| Geico GENERAL INSURANCE COMPANY | 02-09-2018 | 03-02-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| Geico Advantage Insurance Company | 02-09-2018 | 02-23-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 02-10-2018 | 03-20-2018 | Private Passenger | Liability | Underwriting | Refusal to Insure | Company Position Upheld |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 02-11-2018 | 03-26-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim | Company Position Upheld |

| ESURANCE PROPERTY AND CASUALTY INSURANCE COMPANY | 02-12-2018 | 03-12-2018 | Private Passenger | Liability | Claim Handling | Delay | Company Position Upheld |

| METROPOLITAN GROUP PROPERTY & CASUALTY INSURANCE COMPANY | 02-12-2018 | 03-14-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| Geico CASUALTY COMPANY | 02-13-2018 | 02-23-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | Company Position Upheld |

| DIMOPOULOS ESQ, STEVE | 02-13-2018 | 02-22-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | No Jurisdiction |

| MENDOTA INSURANCE COMPANY | 02-13-2018 | 03-16-2018 | Private Passenger | Liability | Claim Handling | Delay | Company Position Upheld No Further Action Req/Rqd |

| PHOENIX INSURANCE COMPANY (THE) | 02-14-2018 | 02-16-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim | State Specific |

| Geico INDEMNITY COMPANY | 02-14-2018 | 03-02-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| MID-CENTURY INSURANCE COMPANY | 02-14-2018 | 03-14-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| AMERICAN ACCESS CASUALTY COMPANY | 02-14-2018 | 02-27-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| METROPOLITAN GROUP PROPERTY & CASUALTY INSURANCE COMPANY | 02-15-2018 | 03-16-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim | No Jurisdiction |

| PROGRESSIVE PREFERRED INSURANCE COMPANY | 02-19-2018 | 03-27-2018 | Private Passenger | Liability | Claim Handling | Comparitive Negligence Delay | Company Position Upheld |

| ARCHULETA, ROBIN DALE PROGRESSIVE SPECIALTY INSURANCE COMPANY | 02-20-2018 | 02-22-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Complaint Withdrawn |

| VIKING INSURANCE COMPANY OF WISCONSIN | 02-20-2018 | 02-27-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | No Further Action Req/Rqd |

| AMICA MUTUAL INSURANCE COMPANY | 02-20-2018 | 03-02-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 02-22-2018 | 03-13-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld No Further Action Req/Rqd |

| FARMERS INSURANCE EXCHANGE | 02-22-2018 | 03-23-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | Company Position Upheld |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 02-22-2018 | 03-23-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | No Further Action Req/Rqd |

| Geico INDEMNITY COMPANY | 02-23-2018 | 03-23-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | Company Position Upheld |

| SAFECO INSURANCE COMPANY OF ILLINOIS | 02-23-2018 | 03-05-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 02-26-2018 | 03-29-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 02-26-2018 | 03-29-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | Company Position Upheld |

| MATALLANA ENTERPRISES LLC MENDOTA INSURANCE COMPANY | 02-27-2018 | 03-30-2018 | Private Passenger | Liability | Policyholder Service Underwriting | Cancellation Coverage Question | Company Position Overturned Company Position Overturned |

| CSAA General Insurance Company | 02-28-2018 | 03-30-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | No Further Action Req/Rqd |

| Geico CASUALTY COMPANY | 02-28-2018 | 03-09-2018 | Private Passenger | Liability | Claim Handling | Delay Subrogation | Compromised Settlement/Resol. |

| COAST NATIONAL INSURANCE COMPANY | 02-28-2018 | 03-14-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| HARTFORD INSURANCE COMPANY OF THE MIDWEST | 03-01-2018 | 03-30-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| ALLSTATE INDEMNITY COMPANY VEGA, JAMES ELLIOT | 03-04-2018 | 03-13-2018 | Private Passenger | Liability | Policyholder Service | Abusive Service Premium Refund | Compromised Settlement/Resol. |

| Geico CASUALTY COMPANY | 03-05-2018 | 03-15-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| Geico Advantage Insurance Company | 03-05-2018 | 03-29-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| STATE FARM GENERAL INSURANCE COMPANY | 03-06-2018 | 03-21-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Insufficient Information |

| Geico CASUALTY COMPANY | 03-06-2018 | 03-28-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| CSAA General Insurance Company | 03-08-2018 | 03-14-2018 | Private Passenger | Liability | Claim Handling | Delay | Complaint Withdrawn |

| LOYA INSURANCE COMPANY | 03-09-2018 | 03-27-2018 | Private Passenger | Liability | Claim Handling | Adjuster Handling Delay Unsatisfactory Settle Offer | No Further Action Req/Rqd |

| NEVADA DIVISION OF INSURANCE | 03-09-2018 | 03-19-2018 | Private Passenger | Liability | Policyholder Service | Premium Notice/Billing | Insufficient Information |

| AMERICAN ACCESS CASUALTY COMPANY | 03-09-2018 | 03-16-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| CSAA General Insurance Company | 03-14-2018 | 03-16-2018 | Private Passenger | Liability | Claim Handling | Delay | No Further Action Req/Rqd |

| CSAA General Insurance Company | 03-14-2018 | 03-15-2018 | Private Passenger | Liability | Claim Handling | Delay | No Further Action Req/Rqd |

| SAFECO INSURANCE COMPANY OF AMERICA | 03-14-2018 | 03-16-2018 | Private Passenger | Liability | Claim Handling | Delay | Complaint Withdrawn |

| COUNTRY MUTUAL INSURANCE COMPANY | 03-15-2018 | 03-19-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim Unsatisfactory Settle Offer | No Further Action Req/Rqd |

| TEACHERS INSURANCE COMPANY | 03-16-2018 | 03-30-2018 | Private Passenger | Liability | Underwriting | Nonrenewal | Company Position Upheld |

| NATIONWIDE MUTUAL INSURANCE COMPANY | 03-19-2018 | 03-19-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim | Contract Provision No Further Action Req/Rqd |

| TRUMBULL INSURANCE COMPANY | 03-21-2018 | 03-26-2018 | Private Passenger | Liability | Policyholder Service | Premium Notice/Billing Premium Refund | No Jurisdiction |

| COUNTRY CASUALTY INSURANCE COMPANY MC FALL, JANET W | 03-26-2018 | 03-29-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | No Further Action Req/Rqd No Further Action Req/Rqd |

| NATIONAL DIRECT INSURANCE COMPANY | 03-27-2018 | 03-29-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | No Further Action Req/Rqd |

| UNITED FINANCIAL CASUALTY COMPANY | 02-06-2018 | 03-26-2018 | Private Passenger | Liability,Collision,Medical Payments | Claim Handling | Denial of Claim | Company Position Upheld |

| STATE FARM FIRE & CASUALTY COMPANY | 01-10-2018 | 03-27-2018 | Private Passenger | Physical Damage | Claim Handling | Delay | Company Position Upheld |

| NEVADA GENERAL INSURANCE COMPANY | 01-29-2018 | 03-19-2018 | Private Passenger | Rental Reimbursement | Claim Handling | Unsatisfactory Settle Offer | Compromised Settlement/Resol. |

| Geico Advantage Insurance Company | 01-11-2018 | 01-23-2018 | Private Passenger | Un/Under Insured Motorist | Policyholder Service | State Specific | No Further Action Req/Rqd |

| STATE FARM FIRE & CASUALTY COMPANY | 01-10-2018 | 02-12-2018 | Private Passenger | Claim Handling | Unsatisfactory Settle Offer | Company Position Upheld | |

| DIVISION OF INSURANCE | 02-12-2018 | 02-12-2018 | Private Passenger | Claim Handling | State Specific | Insufficient Information |

Looking at a company’s list of complaints can help determine if that company is a good fit for your needs and if you may have trouble with them in the future.

Read more: CSAA General Insurance Company Review

– Cheapest Companies in Nevada

So, let’s get down to it – which companies are the cheapest?

We looked at the top ten largest companies in Nevada and compared each of them to the state average. Take a look at how these companies compare.

| Company | Average | Compared to State Average | |

|---|---|---|---|

| Allstate F&C | $5,372.21 | $571.17 | 10.63% |

| American Family Mutual | $5,439.95 | $638.92 | 11.74% |

| Mid-Century Ins Co | $5,589.91 | $788.87 | 14.11% |

| Geico Cas | $3,660.03 | -$1,141.00 | -31.17% |

| Safeco Ins Co of IL | $6,209.68 | $1,408.64 | 22.68% |

| Depositors Insurance | $3,474.93 | -$1,326.10 | -38.16% |

| Progressive Direct | $4,048.92 | -$752.12 | -18.58% |

| State Farm Mutual Auto | $5,792.85 | $991.81 | 17.12% |

| Travelers Home & Marine Ins Co | $5,349.64 | $548.60 | 10.25% |

| USAA | $3,072.26 | -$1,728.78 | -56.27% |

USAA, Depositor’s Insurance, and Geico are the cheapest insurance companies when comparing to the state average. Progressive is also a company well below the state average premium.

Now we are going to dig into what makes rates different for each company. We will look at the commuting time, credit history, and more of what goes into getting your annual premium.

– Commute Rates by Companies

First up, we are going to look at commuting. If you travel to work, you could have a higher premium. Why? Well, it does make sense. The more you are on the road you have more of an opportunity to get into an accident or suffer some type of loss.

Let’s take a look.

| Group | Commute and Annual Mileage | Annual Average |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $5,372.21 |

| Allstate | 25 miles commute. 12000 annual mileage. | $5,372.21 |

| American Family | 10 miles commute. 6000 annual mileage. | $5,365.30 |

| American Family | 25 miles commute. 12000 annual mileage. | $5,514.60 |

| Farmers | 10 miles commute. 6000 annual mileage. | $5,589.91 |

| Farmers | 25 miles commute. 12000 annual mileage. | $5,589.91 |

| Geico | 10 miles commute. 6000 annual mileage. | $3,595.74 |

| Geico | 25 miles commute. 12000 annual mileage. | $3,724.32 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $6,209.68 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $6,209.68 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $3,474.93 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $3,474.93 |

| Progressive | 10 miles commute. 6000 annual mileage. | $4,048.92 |

| Progressive | 25 miles commute. 12000 annual mileage. | $4,048.92 |

| State Farm | 10 miles commute. 6000 annual mileage. | $5,620.99 |

| State Farm | 25 miles commute. 12000 annual mileage. | $5,964.71 |

| Travelers | 10 miles commute. 6000 annual mileage. | $5,349.64 |

| Travelers | 25 miles commute. 12000 annual mileage. | $5,349.64 |

| USAA | 10 miles commute. 6000 annual mileage. | $3,031.47 |

| USAA | 25 miles commute. 12000 annual mileage. | $3,113.04 |

American Family, Geico, State Farm, and USAA are companies that do differ in rates in regards to commuting time. If you do have a longer commute, those companies may still have better rates but be aware you are getting rated on your commuting time.

Coverage Level Rates by Companies

As we mentioned earlier, you must have the minimum required insurance limits on your vehicle. But, we also mentioned, you should think about having higher limits when you purchase insurance. So, what is it going to cost you?

Below we compared three levels of coverage with each company.

| Group | High Coverage | Medium Coverage | Low Coverage |

|---|---|---|---|

| Allstate | $5,996.34 | $5,459.03 | $4,661.25 |

| American Family | $5,393.25 | $5,761.62 | $5,164.99 |

| Farmers | $6,228.36 | $5,520.67 | $5,020.70 |

| Geico | $4,158.52 | $3,569.08 | $3252.50 |

| Liberty Mutual | $6,860.63 | $6,130.66 | $5,637.73 |

| Nationwide | $3,555.75 | $3,472.59 | $3,396.47 |

| Progressive | $4,747.61 | $3,891.68 | $3,507.46 |

| State Farm | $6,335.31 | $5,770.83 | $5,272.40 |

| Travelers | $5,871.04 | $5,367.41 | $4,810.46 |

| USAA | $3,452.99 | $3,040.54 | $2,723.24 |

As you can see, with some companies the rate increase for a higher coverage isn’t as high as maybe you would have thought.

Some companies, like Nationwide and American Family, have a difference of around two hundred dollars between the low coverage and high coverage.

Always get the quote. You may think it will be too expensive and you can not afford the premium, but remember this table – sometimes it is a lot cheaper than you think.

– Credit History Rates by Companies

The credit history used for insurance rates is a little different than what they are used for in major purchases like a car or home.

Insurance companies use your credit score, but only certain factors of your credit that would affect your ability to pay your premiums.

Some states, such as California and Massachusetts, do not use credit as a factor in rating your insurance. Nevada does use credit. So, let’s take a look at how your credit can affect Nevada car insurance rates.

| Group | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $4,203.10 | $4,948.32 | $6,965.19 |

| American Family | $4,447.03 | $5,149.36 | $6,723.48 |

| Farmers | $4,947.61 | $5,259.25 | $6,562.87 |

| Geico | $2,906.32 | $3,660.03 | $4,413.75 |

| Liberty Mutual | $4,254.31 | $5,442.36 | $8,932.36 |

| Nationwide | $2,935.04 | $3,385.24 | $4,104.51 |

| Progressive | $3,721.17 | $3,982.49 | $4,443.10 |

| State Farm | $2,650.28 | $4,161.60 | $10,566.65 |

| Travelers | $4,952.60 | $5,245.45 | $5,850.87 |

| USAA | $2,169.22 | $2,650.41 | $4,397.15 |

Take a look at State Farm. The difference between good credit and poor credit is almost $8,000 a year. If you do have a poor credit score, Travelers or Progressive may be a good fit due to rates not as drastically being influenced by your credit.

– Driving Record Rates by Companies

Your driving record is one of the more obvious factors of rating your insurance premium. You see flashing blue lights in your rearview mirror and you know you have fees, court costs, and increased insurance premium.

Let’s see how much that ticket, accident, or DUI conviction costs you.

| Group | Driving Record | Annual Average |

|---|---|---|

| Allstate | With 1 DUI | $6,436.49 |

| Allstate | With 1 accident | $5,357.99 |

| Allstate | With 1 speeding violation | $5,142.85 |

| Allstate | Clean record | $4,551.49 |

| American Family | With 1 DUI | $6,522.19 |

| American Family | With 1 accident | $6,061.79 |

| American Family | With 1 speeding violation | $4,801.28 |

| American Family | Clean record | $4,374.55 |

| Farmers | With 1 DUI | $6,162.80 |

| Farmers | With 1 accident | $5,942.38 |

| Farmers | With 1 speeding violation | $5,599.97 |

| Farmers | Clean record | $4,654.50 |

| Geico | With 1 DUI | $4,929.65 |

| Geico | With 1 accident | $4,081.33 |

| Geico | With 1 speeding violation | $3,104.75 |

| Geico | Clean record | $2,524.40 |

| Liberty Mutual | With 1 DUI | $7,295.91 |

| Liberty Mutual | With 1 accident | $7,257.65 |

| Liberty Mutual | With 1 speeding violation | $5,751.46 |

| Liberty Mutual | Clean record | $4,533.69 |

| Nationwide | With 1 DUI | $4,476.45 |

| Nationwide | With 1 accident | $3,586.11 |

| Nationwide | With 1 speeding violation | $3,048.57 |

| Nationwide | Clean record | $2,788.60 |

| Progressive | With 1 DUI | $4,249.70 |

| Progressive | With 1 accident | $4,642.62 |

| Progressive | With 1 speeding violation | $3,929.54 |

| Progressive | Clean record | $3,373.82 |

| State Farm | With 1 DUI | $5,792.84 |

| State Farm | With 1 accident | $6,323.66 |

| State Farm | With 1 speeding violation | $5,792.84 |

| State Farm | Clean record | $5,262.04 |

| Travelers | With 1 DUI | $7,262.46 |

| Travelers | With 1 accident | $5,704.83 |

| Travelers | With 1 speeding violation | $4,604.96 |

| Travelers | Clean record | $3,826.30 |

| USAA | With 1 DUI | $4,348.40 |

| USAA | With 1 accident | $2,951.67 |

| USAA | With 1 speeding violation | $2,646.40 |

| USAA | Clean record | $2,342.56 |

Having a driving under the influence conviction will cause your rate to spike the most. Not only can they harm or take lives, but a conviction could also drain your wallet.

Largest Car Insurance Companies in Nevada

State Farm leads the pack as the largest insurance company writing in Nevada.

| Company Name | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $451,330 | 80.27% | 19.06% |

| Geico | $333,584 | 80.44% | 14.09% |

| Progressive Group | $236,952 | 64.05% | 10.01% |

| Allstate Insurance Group | $214,394 | 59.62% | 9.05% |

| Farmers Insurance Group | $207,969 | 63.14% | 8.78% |

| USAA Group | $140,660 | 79.65% | 5.94% |

| Liberty Mutual Group | $128,200 | 80.86% | 5.41% |

| CSAA Insurance Group | $117,964 | 66.05% | 4.98% |

| American Family Insurance Group | $69,913 | 74.88% | 2.95% |

| Hartford Fire & Casualty Group | $53,168 | 79.29% | 2.24% |

State Farm is followed by Geico and Progressive as the largest writing companies.

Number of Insurers by State

Nevada residents have 882 insurers to choose from when looking for insurance.

| Property & Casualty Insurance | Totals |

|---|---|

| Domestic | 9 |

| Foreign | 873 |

| Total | 882 |

Domestic insurers simply mean the company was formed in the state. While foreign means the company was created out of state. The overwhelming majority of available insurers come from out of state.

Nevada Laws

We covered the confusing part of insurance now to venture into even more confusing territory – laws.

We are going to dig through some of Nevada’s laws. We will take a look at certain state laws and licensing laws along with road safety and distracted driving laws.

Car Insurance Laws

State laws can affect car insurance laws. Ceratin laws, like windshield, fraud, and statute of limitations, determine how insurance is filed in the event of a loss.

How State Laws for Insurance are Determined

Nevada insurance companiesmust file rates for approval prior to use. They are filed with the state insurance department.

Windshield Coverage

Driving down the road, you hear the crack of a rock on your windshield. Do you have coverage to repair or replace your windshield?

There are no unique laws in Nevada regarding windshields. Nevada insurers do not require certain repair shops to be used, but you may be held responsible for the difference in price.

No laws regarding aftermarket parts.

If you add comprehensive coverage to your auto insurance policy, you may have windshield coverage. Some companies offer windshield replacement under comprehensive.

High-Risk Insurance

Are you considered high-risk? Do you need SR-22 filing on your insurance? If your answer is yes, you may not qualify for insurance in a voluntary market.

Too many tickets or DUI convictions can make it hard to obtain insurance from just any company. Sometimes, it may push you into a residual market.

Nevada offers the Nevada Automobile Insurance Plan.

This plan is not a low-cost insurance plan. It is considered a last resort since you must have insurance to drive.

If you need SR-22, you may still qualify for a voluntary market insurance plan. Drivers needing an SR-22 filing have either been convicted of driving without coverage or have a lengthy record. SR-22 is not insurance. It is filed by your insurance company to your Department of Motor Vehicles office to verify you do have insurance coverage.

Low-Cost Insurance

At this time, Nevada does not offer a low-cost insurance plan.

The best way to get the cheapest insurance is to keep a clean record, good credit, and shop around your insurance.

You can start here by entering your zip code to get a free, no-obligation quote.

Compare Insurance Providers Rates to Save Up to 75% Secured with SHA-256 Encryption

Automobile Insurance Fraud in Nevada

Insurance fraud is considered a serious crime.

If you are convicted of insurance fraud in Nevada, you can face up to four years in prison and have a fine of up to $5,000.

You can also be ordered to pay restitution.

So what is a fraudulent act? Below is taken from the state law regarding what insurance fraud is.

1. “Insurance fraud” means knowingly and willfully:

(a) Presenting or causing to be presented any statement to an insurer, a reinsurer, a producer, a broker or any agent thereof, if the person who presents or causes the presentation of the statement knows that the statement conceals or omits facts, or contains false or misleading information concerning any fact material to an application for the issuance of a policy of insurance.

(b) Presenting or causing to be presented any statement as a part of, or in support of, a claim for payment or other benefits under a policy of insurance, if the person who presents or causes the presentation of the statement knows that the statement conceals or omits facts, or contains false or misleading information concerning any fact material to that claim.

(c) Assisting, abetting, soliciting or conspiring with another person to present or cause to be presented any statement to an insurer, a reinsurer, a producer, a broker or any agent thereof, if the person who assists, abets, solicits or conspires knows that the statement conceals or omits facts, or contains false or misleading information concerning any fact material to an application for the issuance of a policy of insurance or a claim for payment or other benefits under such a policy.

(d) Acting or failing to act with the intent of defrauding or deceiving an insurer, a reinsurer, a producer, a broker or any agent thereof, to obtain a policy of insurance or any proceeds or other benefits under such a policy.

(e) As a practitioner, an insurer or any agent thereof, acting to assist, conspire with or urge another person to commit any act or omission specified in this section through deceit, misrepresentation or other fraudulent means.

(f) Accepting any proceeds or other benefits under a policy of insurance, if the person who accepts the proceeds or other benefits knows that the proceeds or other benefits are derived from any act or omission specified in this section.

(g) Employing a person to procure clients, patients or other persons who obtain services or benefits under a policy of insurance for the purpose of engaging in any act or omission specified in this section, except that such insurance fraud does not include contact or communication by an insurer or an agent or representative of the insurer with a client, patient or other person if the contact or communication is made for a lawful purpose, including, without limitation, communication by an insurer with a holder of a policy of insurance issued by the insurer or with a claimant concerning the settlement of any claims against the policy.

(h) Participating in, aiding, abetting, conspiring to commit, soliciting another person to commit, or permitting an employee or agent to commit any act or omission specified in this section.

Nevada has an insurance fraud unit that only deals with and investigates fraudulent claims. If you suspect fraud is being committed, please report to:

- Online form

- Website: ag.nv.gov

- By phone: 775-684-1100 (Carson City office),702-486-3420 (Las Vegas office), 775-687-2100 (Reno office)

Statute of Limitations

The statute of limitations is the time frame you have to file a lawsuit.

This is different than filing the initial claim with your insurance company. You must file the claim as soon as possible to avoid more damage and loss of evidence.

In Nevada, residents have two years for personal injury and three years for bodily injury.

Vehicle Licensing Laws

Just like your car needs insurance, you need a license to operate a vehicle.

Whether you are new to Nevada or just need to renew your license, we are going to take a look at how to keep you as the driver legal on the roads.

Real ID

In 2005, Congress passed the Real ID Act. This act tightens up laws in the issuance of driver’s licenses. If you state complies with the regulations set by Congress, you can use your driver’s license to board commercial flights and as identification to enter federal buildings.

Nevada is a complaint state for the Real ID.

This program is completely optional, but if you fly commercially or ever need to obtain entry on a military base or other federal property you will need to update your license.

Nevada residents have until October 1, 2020, or until their license expires to change to the Real ID-compliant license.

Penalties for Driving Without Insurance

Driving without insurance is illegal and dangerous.

The below chart is taken from the Nevada Department of Motor Vehicles.

| Length of Lapse: | 1-30 Days | 31-90 Days | 91-180 Days | 181 Days or More |

|---|---|---|---|---|

| First Offense | ||||

| Reinstatement Fee | $251 | $251 | $251 | $251 |

| Fine | $250 | $500 | $1,000 | |

| SR-22 Insurance | Yes | Yes | ||

| Second Offense | ||||

| Reinstatement Fee | $501 | $501 | $501 | $501 |

| Fine | $500 | $500 | $1,000 | |

| SR-22 Insurance | Yes | Yes | ||

| Third Offense | ||||

| Reinstatement Fee | $751 | $751 | $751 | $751 |

| Fine | $500 | $750 | $1,000 | |

| SR-22 Insurance | Yes | Yes | Yes | Yes |

| Driver License Suspension | Min. 30 days | Min. 30 days | Min. 30 days | Min. 30 days |

Multiple offenses can cost you suspensions, fines, reinstatement fees, and even require SR-22 filing for your insurance.

Teen Driver Laws

At fifteen years and six months, teens can hold a learner’s permit. Drivers with a learner’s permit must have 50 hours of driving with 10 hours being at night. Teens with a learner’s permit must drive with a licensed driver 21 years or older.

Once a driver has possessed a learner’s permit for six months with no violations, they are ready to receive their minor license. Teen drivers ready for their minor license must go to DMV with a legal guardian and pass a behind the wheel test.

This license allows them to drive alone, but with restrictions. Teens with a minor license must follow these restrictions:

- For the first six months, drivers can only transport passengers 18 and older unless immediate family members.

- Teens can not drive between 10 pm and 5 am, unless from a school activity or work. This restriction is until the driver turns 18.

All teen drivers and passengers must wear seatbelts.

Older Driver License Renewal Procedures

At age 65, residents of Nevada must renew their licenses every four years. Drivers over the age of 65 can renew online, by mail, or in person. Every other renewal must be done in person. At age 71, all drivers must show proof of adequate vision at the time of renewal.

New Residents

Welcome to Nevada.

You must be a legal resident of Nevada to hold a Nevada state license. In order to have a Nevada state license, you must surrender your out-of-state license. You must also bring proof of identity, proof of residence, and social security card.

License renewal procedures

Drivers 65 years and younger must renew their licenses every eight years. You can renew your license online or by mail if you chose to have a four-year license. Every eight years you must go in person to your local DMV office.

If you are late renewing your license, you must pay a $10 fee. If your license has been expired for more than a year, you must take the written test. The skills test is required if your license has been expired for four or more years.

Negligent Operator Treatment System (NOTS)

You can be convicted of reckless driving for the following offenses: