State Farm Auto Insurance Review [2026]

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated April 2024

| Key Info | State Farm Specifics |

|---|---|

| Year Founded | 1922 |

| Full Name | State Farm Mutual Automobile Insurance Company |

| Current Executives | Chairman, President, and CEO – Michael L. Tipsord |

| Numbers of Employees | Employees – 56,788 Independent Contractors – 19,000 |

| Total Revenue | 2018 – $81.7 billion |

| Total Assets | 2018 – $272.5 billion |

| Headquarters Address | State Farm Insurance One State Farm Plaza, Bloomington, IL 61710 |

| Phone Number | 800-STATE-FARM (800-782-8332) |

| Company Website | www.statefarm.com |

| Premiums Written | 41,963,578 |

| Loss Ratio | 62.57% |

| Best For | Property and Casualty Insurance, Life and Health, Banking, Annuities, and Mutual Funds |

State Farm is the nation’s largest auto insurance company with 41.9 million written premiums. With more than $272 million in total assets, the company employs a whopping 56,788 employees and 19,000 independent contractors.

State Farm is also present in different verticals, including home insurance, life insurance, banking, and mutual funds.

In fact, State Farm is a leading insurer across several insurance verticals:

- it is the largest auto insurer in the country since 1942

- the largest homeowners insurer in the U.S. since 1964

- And, the second-largest life insurer in the U.S. since 2016

However, rather than the size, the most important question here is if it is good for your needs.

Finding the best insurance company can be overwhelming. With so many options to choose from, you have to decide between cost, customer service, coverage, and many other factors.

This is precisely why this comprehensive review on State Farm Insurance will be useful for you.

In this guide, we will discuss State Farm’s ratings, rates, financial health, and coverage options. The comprehensive review on State Farm will help you understand all that you need to know about the insurer.

So, without further ado, let us take an in-depth look at the insurance provider.

Whenever you are ready, you can get auto insurance quotes using our FREE online tool. You just need your ZIP code to get started.

Cheap Car Insurance Rates

We have talked about the reputation, rating, and financial standing of the company.

However, we have not talked about one of the most important factors in your decision — pricing.

Knowing whether your current premium is inflated is important. You should have the complete picture to save on your premium.

We have partnered with Quadrant Data Solutions to give a detailed view of the pricing data.

In this section, we will talk about the average rates State Farm offers based on driving record, gender, and much more.

State Farm Availability and Rates by State

To consider an insurance provider, we should look at price, ratings, reputation, and financial health. But the first thing you should check if the carrier is available in your state.

The good news is that State Farm has been around for a long time and is now available in all 50 states and Washington D.C.

However, it doesn’t mean that State Farm offers the same rate in all 50 states. In the following table, you can see the average rates offered by State Farm in different states:

| State | State Farm Annual Premium | Average by State | Compared to State Average (+/-) | Compared to State Average (%) |

|---|---|---|---|---|

| Alabama | $4,798.15 | $3,566.96 | $1,231.19 | 34.52% |

| Alaska | $2,228.12 | $3,421.51 | -$1,193.39 | -34.88% |

| Arizona | $4,756.25 | $3,770.97 | $985.28 | 26.13% |

| Arkansas | $2,789.03 | $4,124.98 | -$1,335.95 | -32.39% |

| California | $4,202.28 | $3,688.93 | $513.35 | 13.92% |

| Colorado | $3,270.77 | $3,876.39 | -$605.63 | -15.62% |

| Connecticut | $2,976.24 | $4,618.92 | -$1,642.68 | -35.56% |

| Delaware | $4,466.85 | $5,986.32 | -$1,519.48 | -25.38% |

| District of Columbia | $4,074.05 | $4,439.24 | -$365.20 | -8.23% |

| Florida | $3,397.67 | $4,680.46 | -$1,282.79 | -27.41% |

| Georgia | $3,384.88 | $4,966.83 | -$1,581.95 | -31.85% |

| Hawaii | $1,040.28 | $2,555.64 | -$1,515.36 | -59.29% |

| Idaho | $1,867.96 | $2,979.09 | -$1,111.13 | -37.30% |

| Illinois | $2,344.88 | $3,305.48 | -$960.60 | -29.06% |

| Indiana | $2,408.94 | $3,414.97 | -$1,006.03 | -29.46% |

| Iowa | $2,224.51 | $2,981.28 | -$756.77 | -25.38% |

| Kansas | $2,720.00 | $3,279.62 | -$559.62 | -17.06% |

| Kentucky | $3,354.32 | $5,195.40 | -$1,841.09 | -35.44% |

| Louisiana | $4,579.12 | $5,711.34 | -$1,132.22 | -19.82% |

| Maine | $2,198.68 | $2,953.28 | -$754.60 | -25.55% |

| Maryland | $3,960.87 | $4,582.70 | -$621.83 | -13.57% |

| Massachusetts | $1,361.86 | $2,678.85 | -$1,316.99 | -49.16% |

| Michigan | $12,565.52 | $10,498.64 | $2,066.88 | 19.69% |

| Minnesota | $2,066.99 | $4,403.25 | -$2,336.27 | -53.06% |

| Mississippi | $2,980.48 | $3,664.57 | -$684.09 | -18.67% |

| Missouri | $2,692.91 | $3,328.93 | -$636.03 | -19.11% |

| Montana | $2,417.74 | $3,220.84 | -$803.11 | -24.93% |

| Nebraska | $2,438.71 | $3,283.68 | -$844.97 | -25.73% |

| Nevada | $5,796.34 | $4,861.70 | $934.64 | 19.22% |

| New Hampshire | $2,185.46 | $3,151.77 | -$966.32 | -30.66% |

| New Jersey | $7,527.16 | $5,515.21 | $2,011.94 | 36.48% |

| New Mexico | $2,340.66 | $3,463.64 | -$1,122.98 | -32.42% |

| New York | $4,484.58 | $4,289.88 | $194.70 | 4.54% |

| North Carolina | $3,078.65 | $3,393.11 | -$314.46 | -9.27% |

| North Dakota | $2,560.53 | $4,165.84 | -$1,605.32 | -38.54% |

| Ohio | $2,507.88 | $2,709.71 | -$201.84 | -7.45% |

| Oklahoma | $2,816.80 | $4,142.33 | -$1,325.53 | -32.00% |

| Oregon | $2,731.48 | $3,467.77 | -$736.29 | -21.23% |

| Pennsylvania | $2,744.23 | $4,034.50 | -$1,290.27 | -31.98% |

| Rhode Island | $2,406.51 | $5,003.36 | -$2,596.85 | -51.90% |

| South Carolina | $3,071.34 | $3,781.14 | -$709.80 | -18.77% |

| South Dakota | $2,306.23 | $3,982.27 | -$1,676.05 | -42.09% |

| Tennessee | $2,639.30 | $3,660.89 | -$1,021.59 | -27.91% |

| Texas | $2,879.94 | $4,043.28 | -$1,163.34 | -28.77% |

| Utah | $4,645.83 | $3,611.89 | $1,033.94 | 28.63% |

| Vermont | $4,382.84 | $3,234.13 | $1,148.71 | 35.52% |

| Virginia | $2,268.95 | $2,357.87 | -$88.92 | -3.77% |

| Washington | $2,499.78 | $3,059.32 | -$559.55 | -18.29% |

| West Virginia | $2,126.32 | $2,595.36 | -$469.04 | -18.07% |

| Wisconsin | $2,387.53 | $3,606.06 | -$1,218.53 | -33.79% |

| Wyoming | $2,303.55 | $3,200.08 | -$896.53 | -28.02% |

As per the table, State Farm offers a better value in the majority of the states. This means that in the majority of the states, State Farm offers great value.

However, in some states, the average premium for State Farm is much more than the state average.

Comparing the Top 10 Companies by Market Share

But how does State Farm fare against its competition?

Here’s a look at how State Farm’s market share has changed over time:

In the following table, you can see the average rates offered by the top 10 companies.

| State | Average by State | State Farm | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | $3,566.96 | $4,798.15 | $3,311.52 | Data Not Available | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | $3,697.80 | $2,124.09 |

| Alaska | $3,421.51 | $2,228.12 | $3,145.31 | $4,153.07 | Data Not Available | $2,879.96 | $5,295.55 | Data Not Available | $3,062.85 | Data Not Available | $2,454.21 |

| Arizona | $3,770.97 | $4,756.25 | $4,904.10 | Data Not Available | $5,000.08 | $2,264.71 | Data Not Available | $3,496.08 | $3,577.50 | $3,084.74 | $3,084.29 |

| Arkansas | $4,124.98 | $2,789.03 | $5,150.03 | Data Not Available | $4,257.87 | $3,484.63 | Data Not Available | $3,861.79 | $5,312.09 | $5,973.33 | $2,171.06 |

| California | $3,688.93 | $4,202.28 | $4,532.96 | Data Not Available | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | $3,349.54 | $2,693.87 |

| Colorado | $3,876.39 | $3,270.77 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | Data Not Available | $3,338.87 |

| Connecticut | $4,618.92 | $2,976.24 | $5,831.60 | Data Not Available | Data Not Available | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | $6,004.29 | $3,190.00 |

| Delaware | $5,986.32 | $4,466.85 | $6,316.06 | Data Not Available | Data Not Available | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | $4,182.36 | $2,325.98 |

| District of Columbia | $4,439.24 | $4,074.05 | $6,468.92 | Data Not Available | Data Not Available | $3,692.81 | Data Not Available | $4,848.98 | $4,970.26 | Data Not Available | $2,580.44 |

| Florida | $4,680.46 | $3,397.67 | $7,440.46 | Data Not Available | Data Not Available | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | Data Not Available | $2,850.41 |

| Georgia | $4,966.83 | $3,384.88 | $4,210.70 | Data Not Available | Data Not Available | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | Data Not Available | $3,157.46 |

| Hawaii | $2,555.64 | $1,040.28 | $2,173.49 | Data Not Available | $4,763.82 | $3,358.86 | $3,189.55 | $2,551.83 | $2,177.93 | Data Not Available | $1,189.35 |

| Idaho | $2,979.09 | $1,867.96 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | Data Not Available | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $2,344.88 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $2,408.94 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | Data Not Available | $3,898.00 | $3,393.75 | $1,630.86 |

| Iowa | $2,981.28 | $2,224.51 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $5,429.38 | $1,852.57 |

| Kansas | $3,279.62 | $2,720.00 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $3,354.32 | $7,143.92 | Data Not Available | Data Not Available | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | $6,551.68 | $2,897.89 |

| Louisiana | $5,711.34 | $4,579.12 | $5,998.79 | Data Not Available | Data Not Available | $6,154.60 | Data Not Available | Data Not Available | $7,471.10 | Data Not Available | $4,353.12 |

| Maine | $2,953.28 | $2,198.68 | $3,675.59 | Data Not Available | $2,770.15 | $2,823.05 | $4,331.39 | Data Not Available | $3,643.59 | $2,252.97 | $1,930.79 |

| Maryland | $4,582.70 | $3,960.87 | $5,233.17 | Data Not Available | Data Not Available | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | Data Not Available | $2,744.14 |

| Massachusetts | $2,678.85 | $1,361.86 | $2,708.53 | Data Not Available | Data Not Available | $1,510.17 | $4,339.35 | Data Not Available | $3,835.11 | $3,537.94 | $1,458.99 |

| Michigan | $10,498.64 | $12,565.52 | $22,902.59 | Data Not Available | $8,503.60 | $6,430.11 | $20,000.04 | $6,327.38 | $5,364.55 | $8,773.97 | $3,620.00 |

| Minnesota | $4,403.25 | $2,066.99 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | Data Not Available | Data Not Available | $2,861.60 |

| Mississippi | $3,664.57 | $2,980.48 | $4,942.11 | Data Not Available | Data Not Available | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | $3,729.32 | $2,056.13 |

| Missouri | $3,328.93 | $2,692.91 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | Data Not Available | $2,525.78 |

| Montana | $3,220.84 | $2,417.74 | $4,672.10 | Data Not Available | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | Data Not Available | $2,031.89 |

| Nebraska | $3,283.68 | $2,438.71 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | Data Not Available | $2,330.78 |

| Nevada | $4,861.70 | $5,796.34 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,360.41 | $3,069.07 |

| New Hampshire | $3,151.77 | $2,185.46 | $2,725.01 | Data Not Available | Data Not Available | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | Data Not Available | $1,906.96 |

| New Jersey | $5,515.21 | $7,527.16 | $5,713.58 | Data Not Available | $7,617.00 | $2,754.94 | $6,766.62 | Data Not Available | $3,972.72 | $4,254.49 | Data Not Available |

| New Mexico | $3,463.64 | $2,340.66 | $4,200.65 | Data Not Available | $4,315.53 | $4,458.30 | Data Not Available | $3,514.38 | $3,119.18 | Data Not Available | $2,296.77 |

| New York | $4,289.88 | $4,484.58 | $4,740.97 | Data Not Available | Data Not Available | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | $4,578.79 | $3,761.69 |

| North Carolina | $3,393.11 | $3,078.65 | $7,190.43 | Data Not Available | Data Not Available | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | $3,132.66 | Data Not Available |

| North Dakota | $4,165.84 | $2,560.53 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | Data Not Available | $2,006.80 |

| Ohio | $2,709.71 | $2,507.88 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $2,816.80 | $3,718.62 | Data Not Available | $4,142.40 | $3,437.34 | $6,874.62 | Data Not Available | $4,832.35 | Data Not Available | $3,174.15 |

| Oregon | $3,467.77 | $2,731.48 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $2,744.23 | $3,984.12 | Data Not Available | Data Not Available | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | $7,842.47 | $1,793.37 |

| Rhode Island | $5,003.36 | $2,406.51 | $4,959.45 | Data Not Available | Data Not Available | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | $6,909.45 | $4,323.98 |

| South Carolina | $3,781.14 | $3,071.34 | $3,903.43 | Data Not Available | $4,691.85 | $3,178.01 | Data Not Available | $3,625.49 | $4,573.08 | Data Not Available | $3,424.77 |

| South Dakota | $3,982.27 | $2,306.23 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | Data Not Available | Data Not Available |

| Tennessee | $3,660.89 | $2,639.30 | $4,828.85 | Data Not Available | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | $2,738.52 | $2,739.28 |

| Texas | $4,043.28 | $2,879.94 | $5,485.44 | $4,848.72 | Data Not Available | $3,263.28 | Data Not Available | $3,867.55 | $4,664.69 | Data Not Available | $2,487.89 |

| Utah | $3,611.89 | $4,645.83 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | Data Not Available | $2,491.10 |

| Vermont | $3,234.13 | $4,382.84 | $3,190.38 | Data Not Available | Data Not Available | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | Data Not Available | $1,903.55 |

| Virginia | $2,357.87 | $2,268.95 | $3,386.80 | Data Not Available | Data Not Available | $2,061.53 | Data Not Available | $2,073.00 | $2,498.58 | Data Not Available | $1,858.38 |

| Washington | $3,059.32 | $2,499.78 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | Data Not Available | $2,262.16 |

| West Virginia | $2,595.36 | $2,126.32 | $3,820.68 | Data Not Available | Data Not Available | $2,120.80 | $2,924.39 | Data Not Available | Data Not Available | Data Not Available | $1,984.62 |

| Wisconsin | $3,606.06 | $2,387.53 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | Data Not Available | $2,975.74 |

| Wyoming | $3,200.08 | $2,303.55 | $4,373.93 | Data Not Available | $3,069.35 | $3,496.56 | $1,989.36 | $3,187.20 | $4,401.17 | Data Not Available | $2,779.53 |

State Farm is one of the affordable ones in the majority of the states. In fact, State Farm is the most affordable auto insurers in the following states:

- Alaska

- Connecticut

- Hawaii

- Idaho

- Massachusetts

- Minnesota

- Oklahoma

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

However, in Utah and Alabama, State Farm is the most expensive auto insurer.

Therefore, you must shop around to get the best rates when moving to a different state.

Average State Farm Male Versus Female Car Insurance Rates

State Farm takes gender into account while calculating insurance rates. A practice that is followed by all major insurance carriers.

Why?

Because studies have shown that males drivers are generally riskier than female drivers.

However, if you are based out of California, Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, and parts of Michigan, it is illegal to consider the gender of the applicant while deciding their insurance premium.

In the following table, we have highlighted the average rates offered by State Farm for varying demographics:

| Demographics | State Farm Average Premium |

|---|---|

| Single 17-year-old female | $5,953.88 |

| Single 17-year-old male | $7,324.34 |

| Single 25-year-old female | $2,335.96 |

| Single 25-year-old male | $2,554.56 |

| Married 35-year-old female | $2,081.72 |

| Married 35-year-old male | $2,081.72 |

| Married 60-year-old female | $1,873.89 |

| Married 60-year-old male | $1,873.89 |

The average rates differ by gender for young drivers. However, for drivers 35 years and older, State Farm doesn’t consider gender while calculating insurance rates.

The thing to note is that State Farm drops prices significantly as you gain experience as a safe driver.

Average State Farm Rates by Age

Age is another factor that may affect your insurance premium. As you can see in this chart, your rate may change based on your age group.

Average State Farm Rates by Make and Model

What car you drive can alter your premium rates.

According to the Insurance Information Institute (III.org), insurance companies consider the type of car you have to determine premium rates.

When you are shopping for your car, keep in mind that insurance costs can change depending on the car you finalize. Therefore, it is always better to understand the likely insurance premium that you might have to incur on your new ride.

Why are insurance rates depend on the car’s make and model?

Insurance companies consider many factors before determining your premium. The car you drive helps determine how safe the vehicle is and how well it will protect its occupants. The insurance companies are interested in the crash rating, safety technology, theft likelihood, etc.

All this information helps insurance companies determine the risk involved with your policy. A car will cost less to insure if it has high safety ratings, and it doesn’t cost a ton to repair.

In the following table, you can see the average rates offered by State Farm for different types of vehicles:

| Make and Model | State Farm |

|---|---|

| Average | $3,260.00 |

| 2015 Honda Civic Sedan | $3,024.24 |

| 2018 Honda Civic Sedan | $3,189.99 |

| 2015 Ford F-150 | $3,204.23 |

| 2015 Toyota RAV4 XLE | $3,226.02 |

| 2018 Toyota RAV4: XLE | $3,418.33 |

| 2018 Ford F-150 | $3,497.17 |

Read more: Toyota Motor Insurance Company Review

As you can see, an easy to repair car such as Honda Civic has the least expensive premium. Whereas, the Ford F-150 is the most expensive to insure.

Average State Farm Commute Rates

Certain insurance companies tend to increase your premium depending on how much you drive in a year.

Why? Higher the mileage, the higher the risk of a claim.

State Farm is among those companies that tend to raise premium depending on your annual mileage.

| Commute | Average Annual Premium |

|---|---|

| 10-mile commute. 6000 annual mileage. | $3,175.98 |

| 25-mile commute. 12000 annual mileage. | $3,344.01 |

The company may raise your premium by an average of $168 for driving around 12,000 miles annually. This is higher than the competition. You can expect to pay an even higher premium if you plan to drive longer than 12,000 miles.

Average State Farm Coverage Level Rates

It is advisable that you purchase coverage based on your requirements. E.g., if you have substantial assets, we highly recommend that you purchase additional liability coverage. Experts recommend that you should buy liability coverage equal to your asset value.

Sometimes you may require specific types of coverage to add to your policy. How much and what type of coverage you purchase has a direct impact on your premium amount.

Why? Because any additional coverage that you purchase increases the risk of the insurer. To compensate for their risk exposure, companies will increase your insurance premium.

The amount by which your premium will increase is dependent on the carrier and the coverage type that you want to purchase.

In the following table, you can see the average rates offered by State Farm for varying levels of coverage.

| Coverage Type | Average Premium |

|---|---|

| High | $3,454.80 |

| Medium | $3,269.80 |

| Low | $3,055.40 |

For high coverage, State Farm may charge approximately $400 per year over the premium rate for the low coverage. However, these are average rates and may not apply to you.

To make an informed choice, you will need to understand different types of coverage.

The low coverage is usually the minimum liability coverage required by law to drive in your state. After that, depending on your requirements, you can add coverage.

Some of the optional coverages that you can purchase are:

- Collision

- Comprehensive

- MedPay

- Uninsured/Underinsured Motorist

- Personal Injury Protection

Average State Farm Credit History Rates

Your credit history is also one of the factors that might impact your auto insurance rates.

Why?

Insurance carriers also use your credit score to calculate the insurance rates. It helps companies calculate your risk profile.

See the following video to understand how credit scores are used in auto insurance calculation:

A high credit score may indicate that you are low risk.

According to Experian, the average credit score in the country is 675.

Any score higher than 675 would indicate that you have a good credit score. Anything less 675, and your credit might be categorized as either fair or poor.

In the following table, you can see the average rates offered by State Farm for different credit levels.

| Credit Level | Average rate by State Farm |

|---|---|

| Good | $2,174.26 |

| Fair | $2,853.00 |

| Poor | $4,951.20 |

State Farm is among the insurance companies that do penalize drivers with a poor credit score. A driver with a poor credit score is expected to pay around $2,776 more than a driver with a good credit score.

Despite that State Farm may charge a penalty for poor credit, the rate still may be cheaper than other competitors.

Average State Farm Driving Record Rates

Driving record is the most direct and important factor impacting your insurance rates. It helps the insurance carrier understand the risk involved in insuring you.

A poor driving record may indicate a higher risk to the insurance carrier. Higher the risk, the higher will be your premium.

Therefore, a clean driving record will help you save a lot on your insurance premium.

Insurance companies can access your motor vehicle report (MVR) to learn more about your driving record. An MVR report may provide the following information:

- Traffic and parking tickets

- Convictions

- Accidents

State Farm, like other insurance carriers, penalizes drivers with poor driving records. In the following table, you can see the average rates offered by State Farm by driving offenses.

| Driving Offense | State Farm Average Rate |

|---|---|

| Clean record | $2,821.18 |

| With one speeding violation | $3,186.01 |

| With one accident | $3,396.01 |

| With one DUI | $3,636.80 |

State Farm is expected to increase your premium by more than $800 if you are convicted for a DUI offense. A DUI conviction indicates that you are a driving risk and can potentially cost the company significant claim losses.

If you have a poor driving record, you may have to pay a significantly higher premium. In some cases, companies might deny you insurance coverage. In such a case, you may secure high-risk insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Coverages Offered

Thus far, we have talked about the average pricing, customer rating, financial health, and reputation of the company.

But what are we buying?

The types of coverage offered by an auto insurance company are important.

Because all insurers offer coverage for the basic requirements, but few do not cover specific requirements. You must make sure that the insurer covers all the requirements you need before signing the dotted line.

In this section, we will talk about the coverages and programs offered by State Farm.

Types of Coverages Offered

State Farm offers almost all of the coverages offered by the competition. Although the coverage availability may differ by state, here is a broad list of the coverages provided by State Farm:

- Liability Coverage – Except New Hamshire, all states require some level of liability insurance. Liability insurance kicks in to cover bodily injury or property damage done to another car or person as a result of an accident caused by you

- Collision Coverage – This is an optional coverage that you can purchase to cover the vehicle damage done to your car as a result of an accident

- Comprehensive Coverage – This is also an optional coverage that helps protect you against loss in case of unexpected and unpredictable events such as vandalism, hail, or car theft

- Uninsured Motorist Coverage – This coverage kicks if an uninsured driver who causes an accident can not pay for your medical or property damage bills

- Underinsured Motorist Coverage – This kicks in if a driver with insufficient coverage causes an accident and ca not fully cover the bill for you medical or property damage

- Medical Payments Coverage – MedPay coverage covers the medical expenses for you and passengers after an accident

- Rideshare Driver Coverage – If you drive for rideshare companies like Uber, you need rideshare insurance. Your private insurance coverage doesn’t apply when you are driving for rideshare companies

- Emergency Road Service Coverage – This kicks in if your car has broken down and you need help on the road

State Farm’s Bundling Options

We know that shopping for insurance can be overwhelming. You need to research the companies, the coverage you need, and the best rate you can get. It can be confusing and very time-consuming.

To get the best price for your car insurance policy, you must understand the factorsimpacting your auto insurance.

A clean driving record, good credit, your location, etc., are important factors determining your insurance rates. However, bundling your auto insurance with a home or life insurance policy can also help you reduce costs.

Since State Farm also offers home and life insurance policies, it is easy to bundle different policies and cut costs.

State Farm offers the following types of insurance policies that you can bundle:

- Home and Property

- Life

- Health

- Disability

- Small Business

- Liability

- Identity Restoration

If you like the ease of having multiple policies with a single provider, bundling different policies can be a great way to earn a discount.

State Farm Discounts

Keeping a clean record and availing bundling options are not the only ways to save on your insurance premiums. Depending on your profile, you can also qualify for discounts offered by insurance carriers.

Luckily, State Farm offers various discounts. Here’s a list of around 20 discounts that State Farm offers:

State Farm Available Discounts

| Discount | Amount |

|---|---|

| Anti-lock Brakes | 5% |

| Anti-Theft | 15% |

| Claim Free | 15% |

| Defensive Driver | 5% |

| Distant Student | Varies |

| Driver's Ed | 15% |

| Driving Device/App | 50% |

| Good Credit | Varies |

| Good Student | 25% |

| Homeowner | 3% |

| Low Mileage | 30% |

| Married | Varies |

| Military | Varies |

| Multiple Policies | 17% |

| Multiple Vehicles | 20% |

| Newer Vehicle | 40% |

| Paperless/Auto Billing | $2 |

| Passive Restraint | 40% |

| Safe Driver | 15% |

| Vehicle Recovery | 5% |

Some of the discounts offered are related to the car you drive — e.g., if your car has anti-lock brakes, you can qualify for a 5 percent discount. For teen drivers, being a good student can earn them as much as a 25 percent discount.

State Farm’s Programs

In the modern competitive environment, insurance companies also offer value-added services that help them retain customers.

State Farm offers the following useful programs for customers:

- Accident Forgiveness – In this program, your insurance rates won’t increase after your first at-fault accident. You have to be accident-free for three years at State Farm to qualify

- Car Rental and Travel Expense – If your car is in the garage after a claimable accident, State Farm will pay for a rental car. If the accident happened more than 50 miles from your home residence, the company would also cover for your lodging, meals, and transportation

- Emergency Road Coverage – Under this program, State Farm will help you in case your car breaks down or runs out of gas

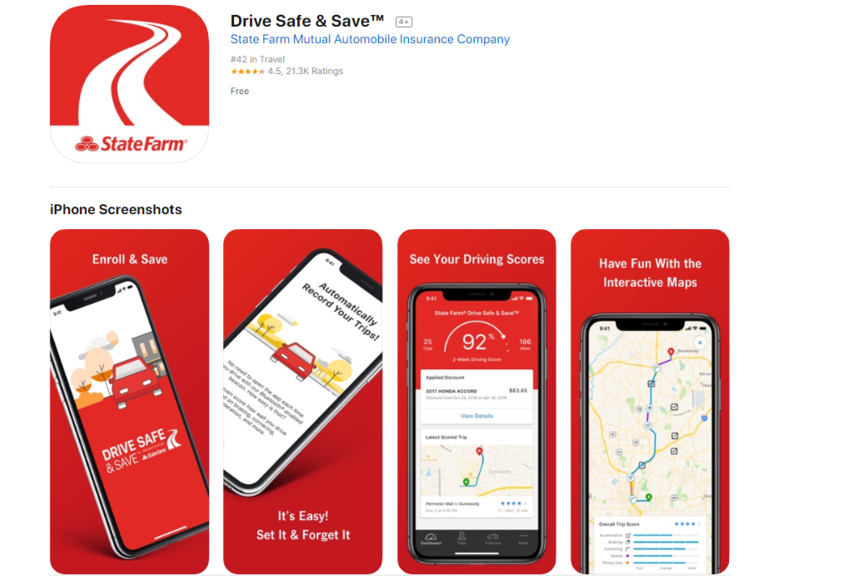

- Usage-based App – State Farm offers a telematics-based Drive Safe & Save™ App that can potentially offer discounts for safe driving habits. If you want to find out more about this app, read our State Farm Safe and Save service review.

State Farm offers almost all of the coverages and discounts offered by the competition. However, what stands out is the fact that State Farm is one of the most cost-effective insurance companies in many of the states.

Read more:

State Farm’s Ratings

Let’s be clear. Why do we purchase insurance?

So that in times of need, the insurer can process our claims reasonably quickly.

To fulfill this requirement, the insurance company must have financial standing coupled with great customer service. While we can analyze the financial data and read some customer reviews, but we may not have the time and resources to do a comprehensive analysis.

This is why rating agencies are so useful for reviewing a company.

In this section, we will leverage some of the leading rating agencies to understand the relative strengths and weaknesses of State Farm Insurance. We will talk in-depth about the company’s financial rating, customer rating, complaint ratio, and more.

But, first here’s the snapshot of the ratings State Farm received from prominent rating agencies:

| Rating Agency | State Farm Ratings |

|---|---|

| A.M. Best | A++ |

| Better Business Bureau | A+ (New York, NY) |

| Consumer Affairs | 3.8/5 (Overall Satisfaction) |

| Consumer Reports | 89 |

| J.D. Power | 4/5 (Overall Satisfaction) |

| Moody’s | Aa1 (State Farm Life) |

| NAIC Complaint Index Ratio | 0.57 (2018) |

| S&P | AA |

State Farm is rating highly by the leading rating agencies. But let us dig a bit deeper to see how that can be relevant for you.

A.M. Best

Understanding the financial health of the insurance company is vital. We should make sure that the insurer is financially capable of handling its current financial obligations and, therefore, able to settle future claims obligations.

However, we understand that no one has the time to go through the financial reports and filings of all the companies before finalizing the insurer.

To enable the financial analysis, we can leverage the rating from A.M. Best, which is one of the most reputed insurance credit rating agencies in the insurance industry.

A.M. Best assigns insurance companies ratings ranging from A++ to D.

As per A.M. Best State Farm is an A++ rated insurance company.

What does it mean for you?

An A++ rating indicates that State Farm is financially stable and can meet its contract and policy obligations.

Better Business Bureau

Better Business Bureau or BBB ratings are designed to help consumers by providing information about a business before you do business with them.

The information is expected to help you make sound buying decisions.

BBB assigns ratings from A+ (highest) to F (lowest) and based on the following factors:

- Business’s complaint history with BBB

- Type of business

- Length of time a business has been in operation

- Transparency of business practices

- Failure to honor commitments to BBB

- Licensing and government actions that are known to BBB

State Farm has an A+ rating from BBB in the state of New York.

Moody’s Rating

Moody’s is another important rating agency to help understand the financial health of an auto insurer.

Moody’s rating is one of the top three credit-rating agencies in the world. It rates the debt status of a company on a scale of Aaa (highest quality) and C (lowest quality).

As per Moody’s, the State Farm Mutual Automobile Insurance Company was assigned a credit rating of Aa1. However, due to business reasons, Moody’s last rated the State Farm Automobile Insurance Company in 2009. The rating of Aa1 signifies the financial strength and stability of the automobile insurance division of State Farm.

The latest rating available for State Farm family is for the State Farm Life Insurance Company, and it is also rated Aa1. This signifies that State Farm faces very low credit risk and is in a position to meet its credit obligations.

S&P Rating

Another of the top three credit rating agencies is the S&P Rating. Just like Moody’s, S&P Rating helps us understand the credit health of a company.

Standard & Poor’s rates the creditworthiness of a company on a scale of AAA (highest quality) and D (lowest quality).

As per S&P, State Farm Automobile Insurance Company was assigned a rating of AA in 2019. The AA rating signifies that the company’s capacity to meet its financial commitments on the obligation is s very strong.

NAIC Complaint Index

We thus far discussed ratings about the financial health of State Farm. However, financial health is not the only factor that you should evaluate while choosing your insurance provider.

Customer service is another important factor that you should keep in mind. Feedback from existing customers might be one of the best indicators of customer service.

The National Association of Insurance Commissioners (NAIC) publish a complaint index for all major insurance companies. You can review the index to learn more about the service quality of the insurance provider you are considering.

For State Farm, we have put together the relevant information from NAIC in the following table:

| Index | 2016 | 2017 | 2018 |

|---|---|---|---|

| Total Complaints | 9,206 | 1,481 | 1,402 |

| Complaint Index | 2.16 | 0.52 | 0.57 |

| National Complaint Index | 0.78 | 1.2 | 1.16 |

| Better or worse than National Complaint Index | Worse | Better | Better |

| US Market Share | 16.64% | 16.66% | 15.84% |

| Total Premiums Written | $35,685,484,012 | $38,588,069,994 | $39,059,618,736 |

In the competitive market, insurance companies are always looking for ways to retain customers. The best way to do it? Of course, provide great customer service.

We see from the table above that State Farm drastically reduced customer complaints in the last three years. In 2016, State Farm registered more than 9,000 complaints — this means a very high complaint index of 2.16 (national average:0.78).

In 2017 and 2018, the complaints reduced, and the complaint index fell below the national average — meaning improved service quality.

J.D. Power

However, complaints data can only show a partial story. Complaints data can not account for how customers feel about the product and service.

Sometimes, consumers may not need to file complaints but will have an opinion about the service quality. This is where customer satisfaction comes in.

But how do you measure customer satisfaction? It might be really tedious for us to go through comments made by existing customers.

We leverage customer satisfaction ratings published by J.D. Power U.S. Auto Insurance Study. These ratings are based on comprehensive consumer studies for large auto insurance companies.

J.D. Power ranks auto insurance companies across regions and five categories: interaction, policy offerings, price, billing process, policy information, and claims.

| Region | State Farm Customer Satisfaction (out of 1,000) | Compared to Other Companies |

|---|---|---|

| California | 824 | Better than most |

| Central | 828 | About average |

| Florida | 834 | About average |

| Mid-Atlantic | 834 | About average |

| New England | 844 | Better than most |

| New York | 845 | Better than most |

| North Central | 841 | Better than most |

| Northwest | 820 | About average |

| Southeast | 853 | Better than most |

| Southwest | 831 | Among the best |

| Texas | 835 | About average |

State Farm scores in the range of 820 to 853 in customer satisfaction ratings. The company is rated ‘better than most’ in six out of 11 regions covered in the J.D. Power ratings.

Consumer Reports

Consumer Reports provide another way to gauge what existing customers think about the service quality of an auto insurance provider.

Consumer Reports is an independent nonprofit organization that strives to help people make informed purchase decisions.

So what is the consumer verdict about State Farm?

State Farm received a rating of 89 out of 100.

State Farm Company History

State Farm was founded in 1922 by a retired farmer as a way to provide auto insurance to farmers in Illinois at competitive rates.

State Farm sold the first auto policy for $11.17.

Within 20 years, the company was the largest auto insurer in the country.

At present, the company has over 100 products, 19,000 agents, and 58,000 employees. State Farm has moved beyond auto insurance and is now a market leader in home and life insurance categories as well.

State Farm is a Fortune 500 company doing in business in five verticals:

- Property and Casualty insurance

- Life and Health insurance

- Annuities

- Mutual Funds

- Banking products

However, you must know the financial health and outlook to decide if State Farm insurance is best for you.

In this section, we will discuss the company’s finances, outlook, advertising, community service, and much more.

State Farm’s Market Share

State Farm is the largest auto insurer in the country since 1942 and currently has around 43.7 million auto insurance policies in force in the U.S. But, how much of the market is serviced by State Farm?

To know about the relative position of the company, we should look at its market share in the U.S. But wait — what is market share?

According to Investopedia, ‘Market share represents the percentage of an industry, or a market’s total sales, that is earned by a particular company over a specified period.’

Simply put, it is the portion of the market controlled or serviced by the company. State Farm, being the largest company, will have the largest market share.

But by how much?

According to the latest report on market share by the National Association of Insurance Commissioners (NAIC), these are the top five auto insurance companies in the country:

- State Farm (17 percent)

- Berkshire Hathaway (Geico) (13 percent)

- Progressive Group (11 percent)

- Allstate Insurance (9 percent)

- USAA (6 percent)

However, State Farm’s market share has been steadily declining for the last four years.

| Years | State Farm | Geico | Progressive | Allstate | USAA |

|---|---|---|---|---|---|

| 2018 | 17.01 | 13.41 | 10.97 | 9.19 | 5.87 |

| 2017 | 18.07 | 12.79 | 9.84 | 9.26 | 5.68 |

| 2016 | 18.26 | 11.89 | 9.15 | 9.7 | 5.45 |

| 2015 | 18.68 | 10.77 | 8.7 | 9.97 | 5.17 |

State Farm’s market share declined from 18.68 percent in 2015 to 17.01 percent in 2018. The nearest competitor, Geico, has been steadily increasing its market share — increasing from 10.77 percent in 2015 to 13.41 percent in 2018.

State Farm’s Position for the Future

State Farm has been steadily losing market share to its competitors. Geico, Progressive, and USAA have been steadily gaining market share.

However, the change in market share can be attributed to several factors, including customer retention, customer acquisition, new market entry, etc.

To maintain and grow market share, State Farm has been innovating its product offerings. The company launched the Drive Safe & Save telematics insurance program that uses a mobile app to track your driving behavior and helps determine your insurance premium.

The company launched a wholly-owned subsidiary HiRoad, which is insurance through a mobile app. HiRoad designed to offer consumer convenience of securing car insurance through a mobile app. The company will use the mobile app to record your driving habits and change your monthly premium.

State Farm’s Online Presence

State Farm has a strong online presence through its website, statefarm.com. To help manage your policy with State Farm, you can also use their mobile apps.

You can use the website to seek quotes and learn more about auto insurance in your state. To get in touch with State Farm, you can call the toll free number 800-782-8332 (800-State Farm).

State Farm’s Commercials

We may remember the State Farm slogan — Like a good neighbor, State Farm is there.

After using the slogan for nearly 40 years, the company changed its slogan to ‘Here to help life go right.’

The company has also launched a campaign that features commercials that focus on educating customers about their products or services. For example, the company uses this commercial to showcase its Drive Safe & Save Discount®:

Another example was the use of humor to talk about the new driver insurance program:

https://www.youtube.com/watch?v=gKmy6ecGsZw

State Farm in the Community

State Farm’s old slogan — Like a good neighbor, State Farm is there is — is still part of the company’s mission. State Farm has an extensive community outreach program aimed at making a positive impact on communities across the country.

Community involvement projects at State Farm are catered towards:

- Auto and home safety programs

- Disaster preparedness and recovery programs

- Education, economic empowerment and community development projects

Some examples of community development programs supported by State Farm include:

- Community Grants – Good Neighbor Citizenship

- Youth Education

- Safety Programs

Below is the video highlighting the Good Neighbor Citizenship grant offered by State Farm:

State Farm’s Employees

Another great way to learn about the culture at State Farm is to look at what employees had to say about the company.

Why?

Because if the company maintains a great work culture, the service quality you will receive may also be better.

The company offers opportunities to grow personally and professionally through a variety of programs. Here’s a video showcasing how State Farm help employees evolve:

https://www.youtube.com/watch?v=O6wSr1ZDmfc

State Farm employs more than 58,000 employees and around 19,000 contractors. To attract more talent, the company invests in the skill development of its employees. This is reflected in the number of employer recognition awards won by the company:

- 2019 Top 100 Most Military Friendly Employer

- 2019 Most Admired Company

- 2019 National Recognition for Equality

- 2019 Top Companies for Executive Women

- 2018 AnitaB.org Top Company for Women Technologists

- 2018 LATINA Style’s 50 Best Companies for Latinas to Work

- 2018 Best Companies for Multicultural Women

- 2018 Best Companies for Diversity

- 2018 Hispanic Association on Corporate Responsibility (HACR) – Corporate Inclusion Index (CII)

- 2017 CEO Cancer Gold Standard Accreditation

- 2017 Best Companies

- 2017 LearningElite Winner

- 2015 Save 10 Employer Recognition

- 2015 Fit-Friendly Worksite

- 2014 InfoWorld/Forrester Enterprise Architecture Award

- 2014 Best Employers for Healthy Lifestyles

To understand what employees think about State Farm as an employer, let us analyze Glassdoor and Payscale.

The average employee rating of State Farm is 3.1 out of 5, with 45 percent of them ready to recommend the company to their friends. The company was among the top 100 places (ranked 38th) to work in the 2011 Glassdoor Best Places to Work awards.

At Payscale, employees rated State Farm at 3.3 in overall satisfaction. Employees gave the company the highest marks in Manager Relationships (4/5), followed by Manager Communication (3.8/5), and Learning and Development (3.6/5).

The ratings received by State Farm were similar to other auto insurers and, therefore, may not provide any differentiating factor in the overall product and service offering.

Compare Insurance Providers Rates to Save Up to 75% Secured with SHA-256 Encryption

Canceling Your Policy

Sometimes we may have to cancel our policy because we may have a better deal somewhere else, or we may no longer need a car.

There are insurance companies that may make it difficult to cancel the policy. What happens when you cancel your policy with State Farm?

In this section, we will cover everything related to policy cancellation at State Farm. Continue reading to see how you can seamlessly cancel your auto insurance policy.

But before you cancel, remember you cannot have a gap in your insurance coverage. If you have a registered car, you should always switch carriers.

Read more: How to Cancel State Farm Auto Insurance

Cancellation Fee

It is not clear on the State Farm’s website if they charge a cancellation fee. However, you can expect a small cancellation fee if you are canceling midway of your renewal cycle.

If you are canceling after your renewal cycle, there may not be any cancellation fee. We suggest you check with State Farm or your broker to verify the cancellation fee.

Is there a refund?

If you have prepaid your auto insurance for six months and are looking to cancel before the end of your renewal cycle, you can expect a refund.

The premiums are prorated, and State Farm will refund the amount equal to the time left on the policy.

How to Cancel (Step-by-Step Guide)

If you have decided to cancel your policy with State Farm, you can do it in person, by mail, or by phone.

Just remember before canceling your policy, have a new insurer. When you start your cancelation, State Farm representatives will ask about the new policy number. It is required for them to report cancellation of policy to the local insurance bureau/DMV.

If you cancel your policy without securing a new insurer, you will have a gap in your coverage. This is a big red flag that may result in shooting up your premium.

Canceling Over Phone

You can call your local agent to cancel your insurance policy. You will need the following information (which you need irrespective of the method):

- Policy number

- Name and registered phone number of the policyholder

- Social Security Number

- new provider’s name, policy number and effective date / or bill of sale of your car

Cancellations by phone can be effective immediately or scheduled for a date in the future.

Canceling by Mail

To cancel a policy by mail, you will need to write a letter that includes the information below.

- Your name, address, and phone number

- Your State Farm policy number and the date and time you want your policy to end

- If you’re switching providers, your new insurer’s name, policy number and policy start date

- If you’ve sold your vehicle, proof of plate forfeiture or your bill of sale

Sign, date, and mail your letter at least two weeks before your intended cancellation date, leaving time for shipping and processing, to the address below.

Corporate Headquarters

State Farm Insurance

One State Farm Plaza

Bloomington, IL 61710

Canceling In Person

Visit your local agent with the information mentioned above to cancel your policy in-person.

When can I cancel?

You can cancel your policy anytime. However, you may have to pay a cancellation fee if you are canceling midway your renewal cycle.

You should check with your local agent or your online account to make sure the cancellation went through smoothly.

How to Make a Claim

We purchase auto insurance to protect us financially in case of an accident. If you need to make a claim, it can be overwhelming where to start.

In this section, we will show you how to file a claim with State Farm.

Ease of Making a Claim

State Farm offers a variety of ways to file a claim.

Here’s a list of methods you can use to file a claim:

- Online – Customers can file online at State Farm’s website

- Mobile App – State Farm’s mobile app allows customers to file on their smartphones

- Phone – Call 800-SF-CLAIM (800-732-5246)

- In Person – Customers can visit a local agent to file a claim

Except for the in-person method, all other methods give you the flexibility to file your claim 24/7.

You need the following information to file a claim successfully:

- Date and time of the incident

- Vehicles involved

- Description of the incident

- Description of damages

- Location of incident

Premiums Written and Loss Ratio

State Farm is the country’s largest auto insurer. Therefore, naturally, the company is writing out a lot of policies.

Let us look at the premium data from the National Association of Insurance Commissioners (NAIC) for State Farm:

| Year | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| State Farm Written Premiums | $35,588,209,000 | $39,194,660,000 | $41,817,416,000 | $41,963,578,000 |

In the last four years, written premiums have been steadily increasing for State Farm. This is good news, not just for the company but also for the customers.

If a company has higher claims and lower premiums, it will be forced to charge higher premiums. The growth is also an important indicator of the stability of the insurer.

Another factor that is important to understand is the loss ratio.

A loss ratio is calculated as the ratio of amount paid in claims to the amount earned in premiums. A loss ratio of 60 indicates that the company spent $60 on claims out of every $100 earned in premiums.

If the loss ratio is very high, it would indicate that the company is earning less than the risk exposure. This would mean that the insurer will increase premiums to compensate for the risk.

On the other hand, if the loss ratio is too low, it could mean that the company is not efficient in paying out legitimate claims.

Let us review the NAIC data to understand how State Farm fares:

| Loss ratio (%) | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| State Farm | 66.1 | 77.02 | 68.79 | 63 |

| Industry Average | 65.5 | 71.1 | 68.4 | 63.9 |

The loss ratio of State Farm is very close to the industry average and therefore indicates that the company has priced the risk appropriately.

How to Get a Quote Online

Insurance has changed drastically over the years. No need to visit an agent to get an insurance quote, you can do that online using a simple form.

Online quotes make it easy to get multiple quotes and compare before making a decision.

Here’s the step-by-step guide about State Farm’s online quote process.

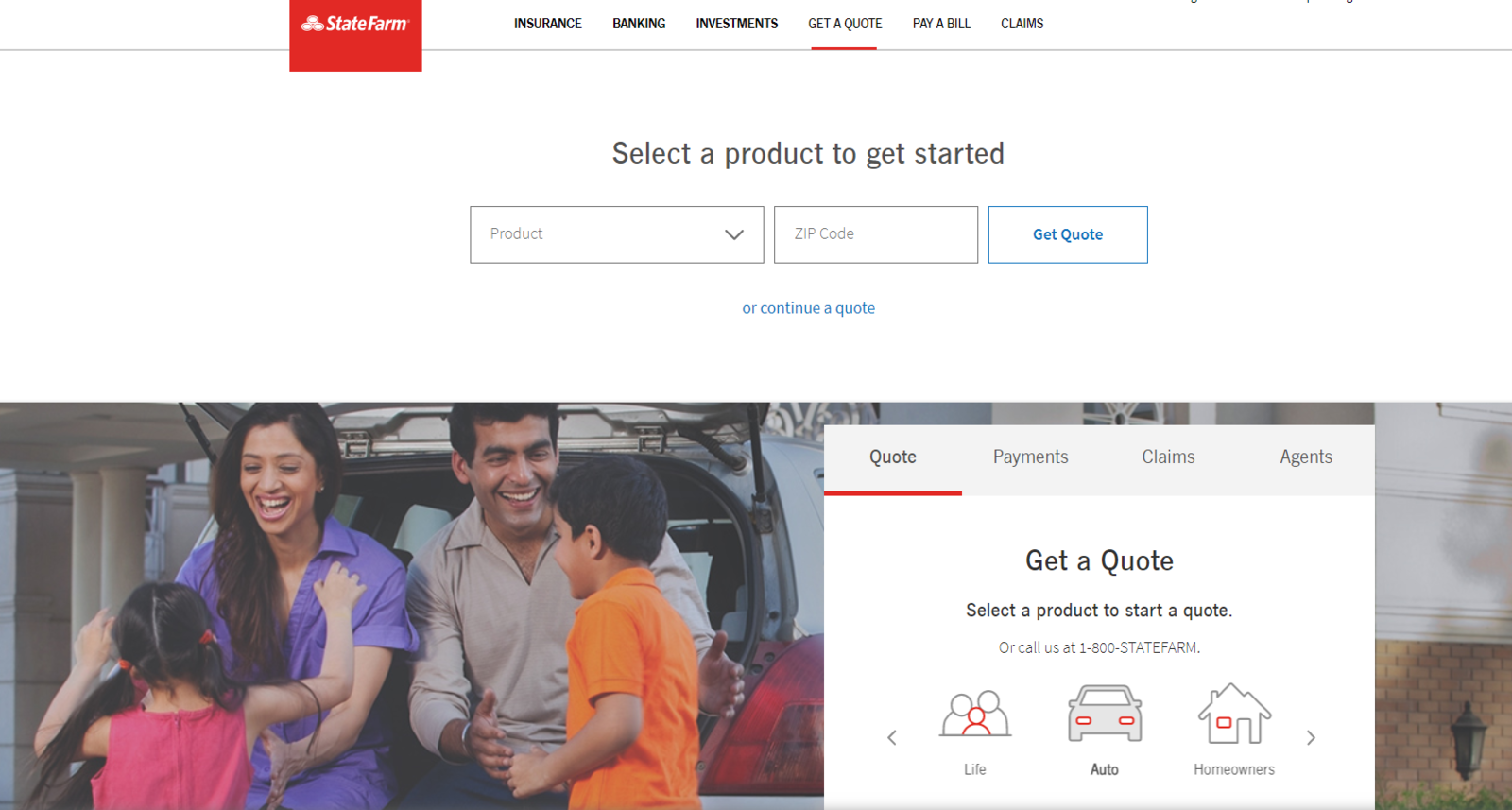

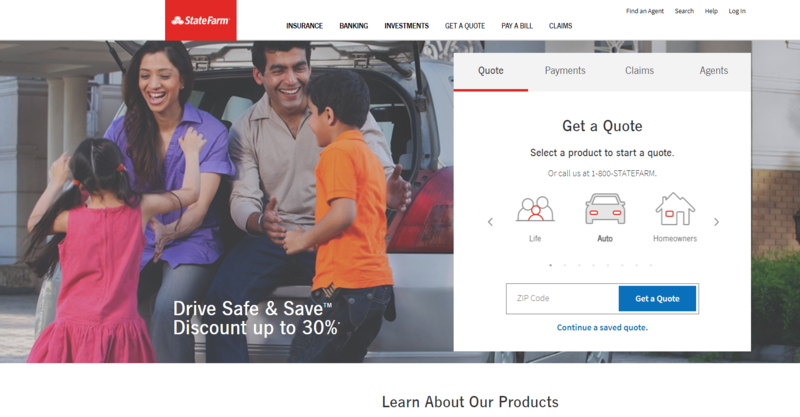

Step One: Visit State Farm’s Website

Head over to the State Farm’s website, where you will see a quote box on the homepage.

Go ahead and click the “Get a Quote” tab on the top banner, or inside the large box. In either case, you’ll be prompted to select “Auto” insurance. Enter your ZIP code to continue.

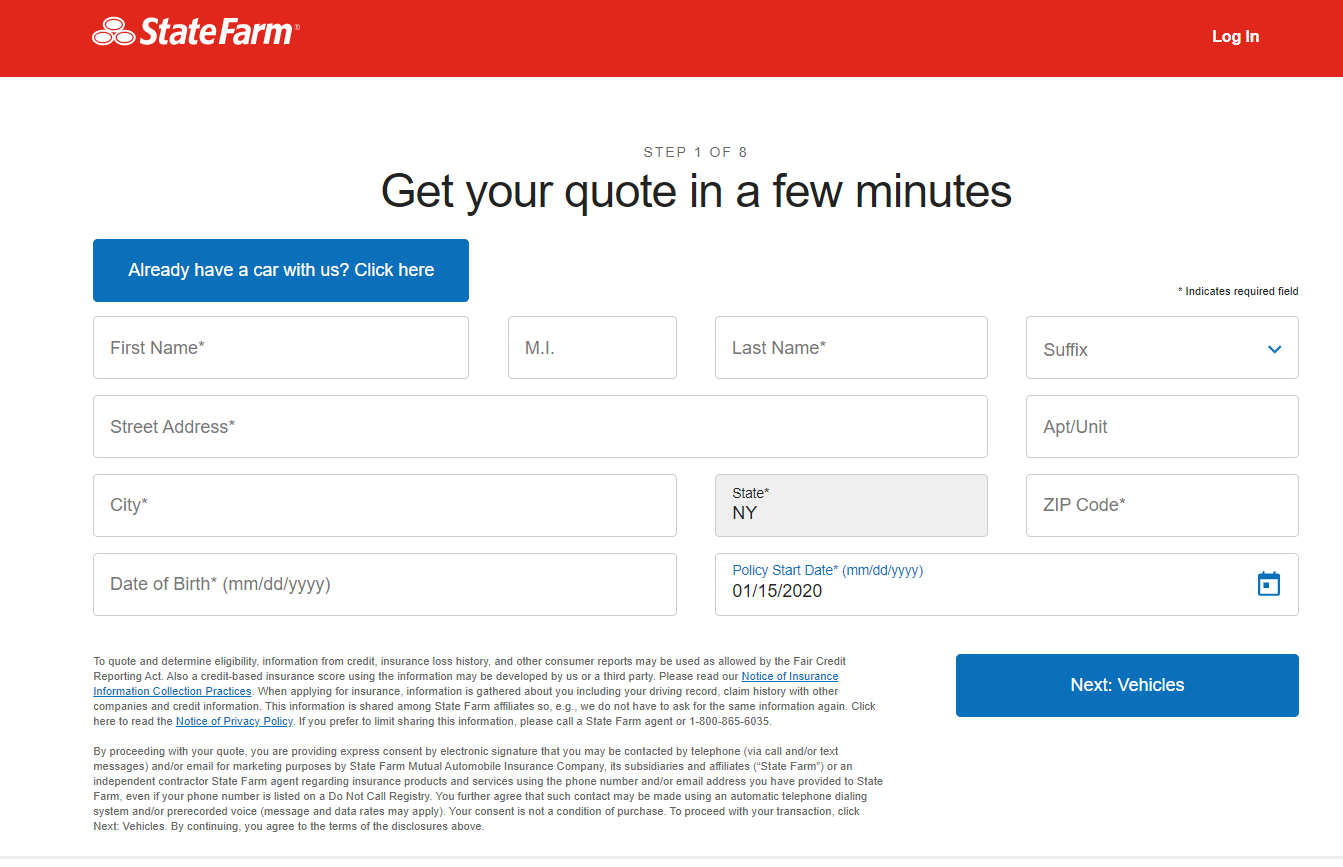

Step Two: Enter Personal Information

On the next page, you will have to fill up a brief form with your personal information.

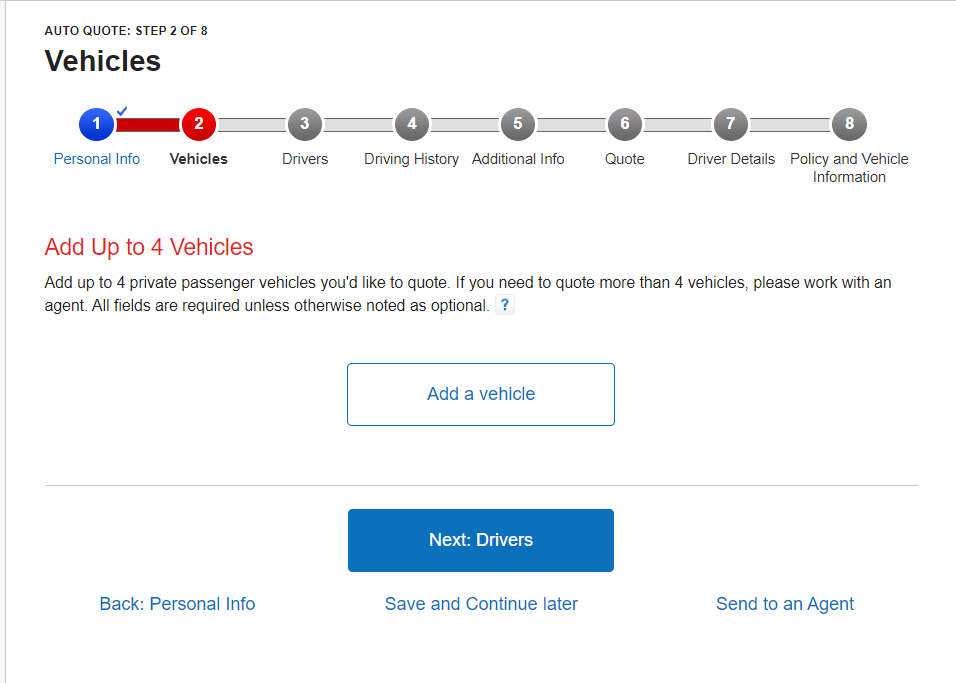

Step Three: Enter Vehicle Information

Next, you have to enter the details about your vehicles. You can enter up to four vehicles.

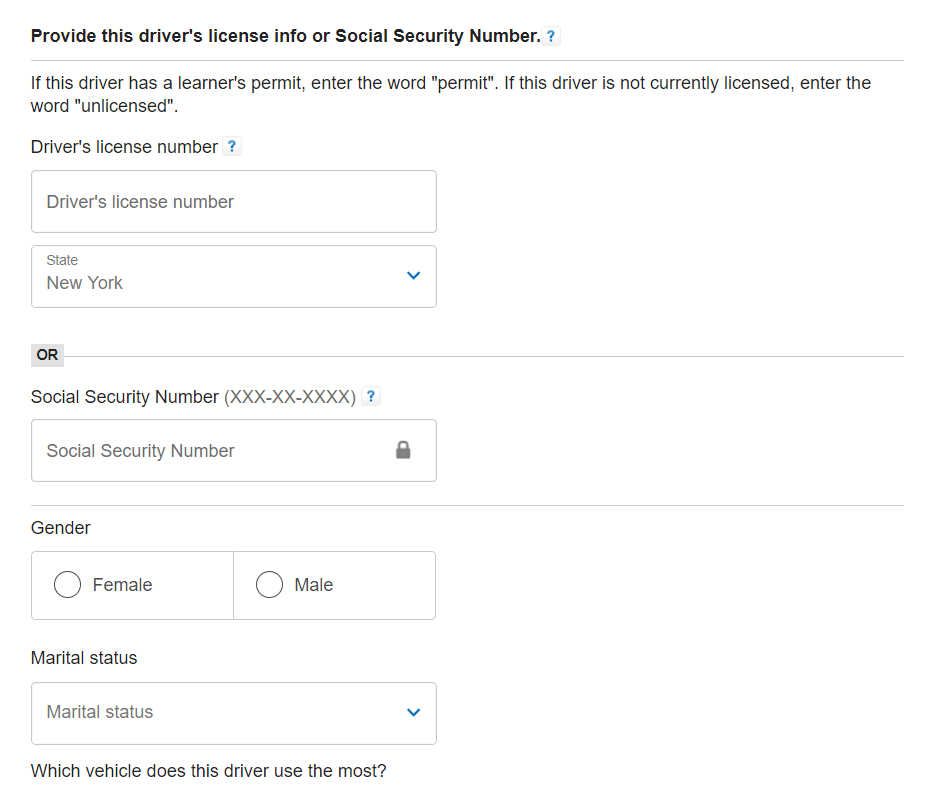

Step Four: Enter Driving Information

After entering your vehicle’s details, you have to enter the details of all the drivers who are going to drive the car.

You can either furnish your social security number or your driver’s license number.

Step Five: Enter Additional Information

In this section, State Farm will ask about your existing coverage. It will also ask you about the type of coverage you need so that you get a customized quote.

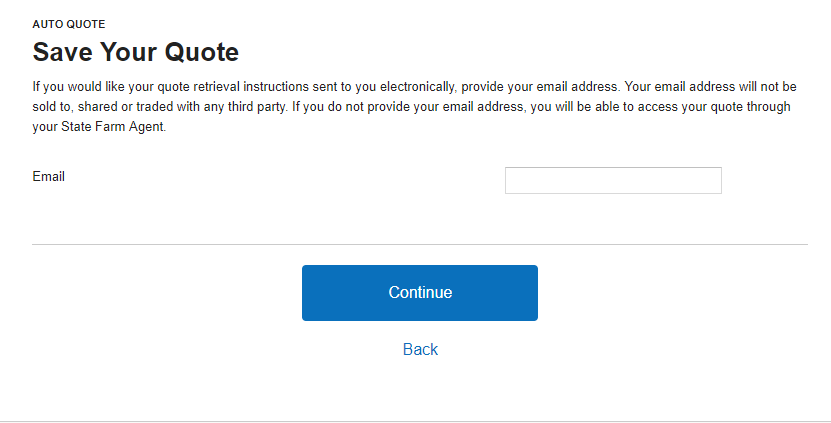

Step Six: Save Quote

The final step is to save your quote. You can provide an email address where State Farm will send over a copy for your review.

Here’s the summary of the information you will need to apply:

| Information Required | Document Types |

|---|---|

| Vehicle Information | Year, Make, Model, Body style (or VIN) |

| Vehicle mileage | |

| Ownership | |

| Garaged address | |

| Name of registered owner | |

| Prior insurance carrier and expiration date | |

| Purchase date | |

| Driver Information | Driver name and date of birth |

| Driver's license number and state issued | |

| Driving History | Ticket and accident history |

| License suspension information |

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Design of Website and App

Have you found yourself deleting an app because of poor usability or technology glitches?

In the modern connected world, the design and usability of a website and app determine a large portion of the customer satisfaction.

In this section, we will briefly review State Farm’s website and mobile app design.

Website

State Farm’s website is simple and easy to navigate. The important categories are highlighted in the top banner.

You can also login to your account to manage your policy or file a claim directly from the website. Each menu option gives you several subtopics to help you navigate. E.g., clicking on insurance will drop down a menu that has all the insurance categories that State Farm offers.

You can also use the search button to find anything specific on the website. If you need help, click on the help button, and you can connect with customer support. Before reaching out to customer support, you can also read the FAQs as it might save you some time.

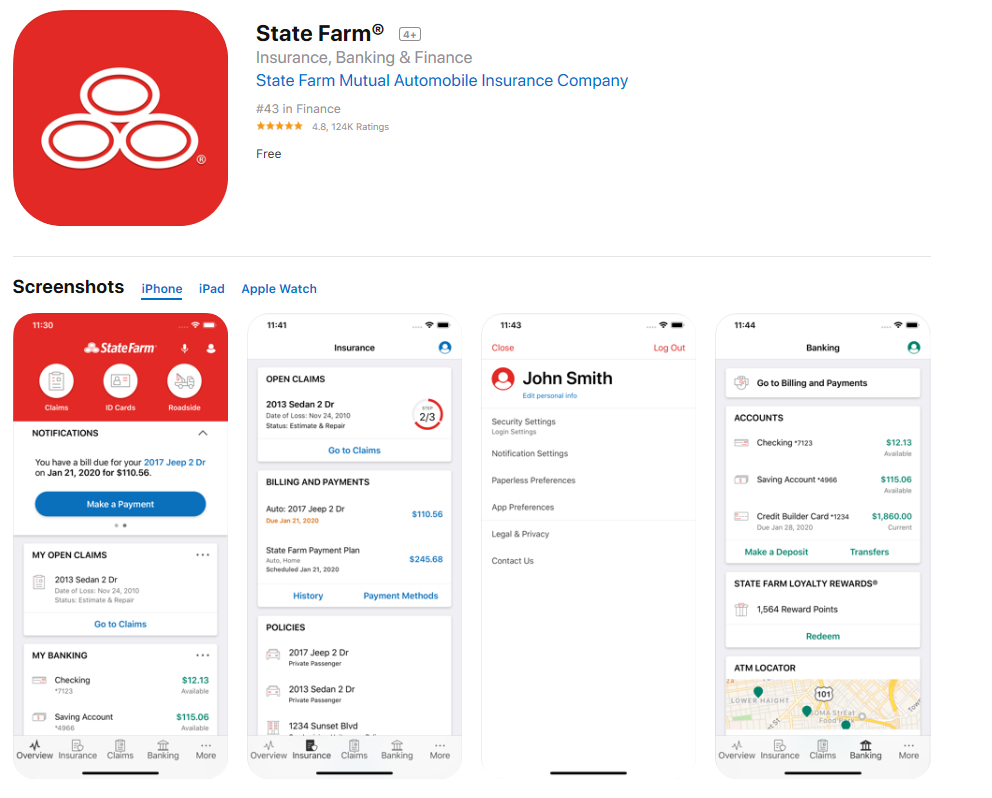

Mobile App

State Farm created apps so that customers can manage their policies on the go. The apps can be used to make payments, file a claim, access policy ID cards, get roadside assistance, and more.

The app has a rating of 4.8 out of 5 on the Apple app store and 4.2 on the Google Play Store. The negative reviews have to do with login bugs and compatibility issues in older phones. Otherwise, the application received many positive reviews.

State Farm also has a usage-based app called Drive Safe & Save that can track your driving behavior and helps determine your insurance premium.

The Drive Safe & Save app also received a fantastic rating of 4.5 out of 5. The app got praise for all the driving details it can capture but received negative reviews on battery performance.

Pros and Cons

In the following table, let us recap what we learned about State Farm:

| Pros | Cons |

|---|---|

| Has the third-lowest average premium among the top 10 providers | Rates can be pricey depending on where you live |

| Consistently strong financial standing and solid rankings | Could stand to offer more discounts, like federal employees, green vehicles, and occupational |

| Policies are available in all 50 states | Received an "about average" Power Circle Ranking in 5 out of 11 regions |

| Customers have a variety of online options and an easy-to-use app | Limited add-ons are available |

State Farm is a nationally available insurance company that has a strong financial and customer ratings. In many states, the company is among the cheapest providers of auto insurance. However, it may not have the best customer service in some of the states.

The Bottom Line

State Farm is the largest auto insurance company in the country and is still growing at a healthy rate. The company has a strong financial rating and good customer reviews.

You can use its well-designed website or highly rated apps to connect and manage your policy.

If you decided to choose State Farm, you would get an affordable insurance policy from the oldest name in the game.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Company Car Insurance FAQs

Here are some frequently asked questions on State Farm.

Where can I get my insurance IDs?

You can use the website to view, print, and email a new insurance card. Or you can also request State Farm to mail you the ID card. Another option is to pull up your ID through the mobile app.

Can I make payments online?

Yes, you can sign into State Farm’s website or mobile app to make payments. You can also set up an auto-pay option.

How long do you have to add a new car to your policy?

You have to typically inform State Farm that you have purchased a new car within seven to 30 days of the purchase.

Does State Farm cover windshield repairs and replacements?

State Farm covers both windshield repairs and replacements, depending on the extent of the damage. Your deductible may apply. (For more information, read our “Will auto insurance pay for windshield repairs?“).

How do I cancel my State Farm insurance policy?

Before you cancel your policy, enter your ZIP code in our quote comparison tool below. Once you have secured new insurance, you can call or visit your local agent to cancel your policy. You would need the following information:

- Social Security Number

- State Farm Policy Number

- Name/Policy Number of New Insurer (or Bill of Sale)

You can also mail the above information directly to State Farm:

Corporate Headquarters

State Farm Insurance

One State Farm Plaza

Bloomington, IL 61710

Before making any final decisions on your insurance company, it is important to learn as much as you can about your local insurance providers, and the coverages they offer. Call your local insurance agent to clear up any questions that you might have. Questions to consider asking include, “What is the best coverage plan for me/my family/my situation?” “What are the minimum coverage requirements in my state and what form of coverage do you recommend?” “Do you guys offer any bundle discounts if I take out both my auto insurance and home insurance with you?” and “What is the average rate of insurance quotes you guys offer?”

Before making any big insurance decisions, use our free tool to compare insurance quotes near you. It’s simple, just plug in your zip code and we’ll do the rest!

Frequently Asked Questions

What is State Farm Auto Insurance?

State Farm Auto Insurance is a type of insurance coverage offered by State Farm Insurance, one of the largest insurance providers in the United States. It provides protection for drivers and their vehicles against financial losses resulting from accidents, theft, vandalism, and other covered events.

What types of coverage does State Farm Auto Insurance offer?

State Farm Auto Insurance offers a range of coverage options, including:

- Liability Coverage: This covers bodily injury and property damage to others if you’re at fault in an accident.

- Collision Coverage: This covers the cost of repairs or replacement if your vehicle is damaged in a collision with another vehicle or object.

- Comprehensive Coverage: This covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This covers expenses if you’re involved in an accident with a driver who doesn’t have sufficient insurance coverage.

- Medical Payments Coverage: This covers medical expenses for you and your passengers, regardless of fault.

- Personal Injury Protection (PIP): This coverage, available in certain states, provides broader medical and lost wage benefits than medical payments coverage.

Can I customize my State Farm Auto Insurance policy?

Yes, State Farm Auto Insurance allows policyholders to customize their coverage to some extent. You can adjust your coverage limits and add optional coverages based on your needs and preferences. Optional coverages may include rental reimbursement, emergency roadside service, and rideshare coverage for drivers who work for companies like Uber or Lyft.

How are State Farm Auto Insurance premiums determined?

State Farm considers several factors when determining auto insurance premiums. These factors may include your age, driving history, vehicle type, location, credit history, and the coverage options you choose. Insurance premiums may also vary based on state-specific regulations and discounts you may qualify for, such as safe driving discounts or multi-policy discounts.

How can I file an auto insurance claim with State Farm?

To file an auto insurance claim with State Farm, you can follow these general steps:

- Contact State Farm: Notify State Farm as soon as possible after the incident. You can reach them by phone, online through their website, or via the State Farm mobile app.

- Provide necessary information: Be prepared to provide details about the accident or incident, including the date, time, location, description, and information about other parties involved.

- Document the damage: Take photos or videos of the damage to your vehicle and any other relevant evidence.

- Cooperate with the claims process: Follow the instructions provided by State Farm, which may include getting repair estimates, arranging for vehicle inspections, or providing additional documentation as required.

- Keep records: Maintain copies of all documents related to your claim, including correspondence with State Farm and receipts for any expenses incurred.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.