State Farm Homeowners Insurance Review [2026]

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Updated March 2024

| State Farm Insurance Overview | Details |

|---|---|

| Year Founded | 1922 |

| Current Executives | Chairman, President, and CEO – Michael L. Tipsord |

| Number of Employees | 56,788 |

| Total Sales/Assets | $81.7 billion/$272.5 billion |

| HQ Address | 1 State Farm Plaza Bloomington, IL, 61710 |

| Phone Number | 1-800-782-8332 |

| Company Website | www.statefarm.com |

| Premiums Written | $18,177,462,000 |

| Loss Ratio | 61.87% |

| Best For | New homebuyers, online shoppers, financial strength, most affordable, flood insurance, older homes, all around value, customer service |

Purchasing a home is one of the biggest investments people will make in their lives. There is much to be considered, such as a high risk for property damage and potential injury.

Like all investments, you need to protect your interests; for a home, that can be general upkeep, or a fresh coat of paint. You also need an insurance provider to cover you when that unexpected property loss or damage occurs. Aside from health, home property damage can be the most costly expense for consumers.

When it comes to finding the right kind of home insurance that meets your needs through a provider you can trust, do you really want to go with the budget-friendly option?

Certain things in life should come at full price, and certain low-cost options should make you wary, such as discount seafood and budget insurance. Don’t risk your home investment with the discount seafood version of a home insurance policy.

The catch-22 is that if you’re like the majority of homeowners, you’re working on a tight budget and need an affordable policy that won’t break the bank. Thankfully, the top insurance provider in the nation is not known for price gouging — quite the opposite.

State Farm, with its infectiously mindful jingle, is the largest home insurance provider in the nation.

From humble beginnings as an auto insurer, State Farm has grown substantially to become the top insurance provider in the nation among all categories, including home.

A financially stable Fortune 500 company is a perfect example of what sticking to your mission can accomplish. And State Farm’s mission has always been keeping policyholders’ interests at heart while conducting business in a person-to-person, community-driven way.

If you have invested your savings into a home, shouldn’t you find an insurance provider willing to invest in you and your community?

That company is State Farm. To better understand their home insurance options, we have done the research and provided a detailed overview, so you can be sure they are the right company that will meet your needs as a homeowner.

Read on as we take an in-depth look into State Farm and attempt to determine how they continue to pave the way ahead while managing to stay at the top of the insurance game.

If you are already convinced that the number-one insurance provider in the nation is the right company to protect your home, then try out our free online quote option to find out your estimated monthly rate. Just type in your ZIP code below, and we will guide you through the rest.

State Farm Ratings

Since you are already in the market for the best home insurance policy, it’s likely you understand your home, your family and friends living underneath its roof, and your belongings within that home are an investment. And just as creditors take their time and do the necessary homework on you before loaning any money, you need to do the same.

Understanding whether State Farm is a financially stable company is the best way you can safeguard your home investment and your future, and these watchdog organizations listed below provide just that information.

This chart gives you a quick look into both the financial stability of State Farm and how they operate on a customer service level.

Read more: State Farm General Insurance Company Review

| Agency | Rating |

|---|---|

| A.M. Best | A |

| Better Business Bureau (choose one state) | A+ |

| J.D. Power | 4/5 |

| Moody's | Aa1 |

| NAIC Complaint Index | .18% |

| Standard & Poor's | AA |

State Farm scores high marks across the board, with customer service being one of their best categories. For a company of their size, it is both surprising and comforting that State Farm places so much importance on customer satisfaction.

To give you a clearer idea of what each of these ratings means, we have provided a more detailed look into each of these watchdog organizations and what their rankings mean for you as a potential policyholder.

A.M. Best

Even credit ratings agencies need a ranking. Who and what determines which of those companies become a trusted source? In the case of credit ranking agencies, it usually comes down to a long history of being a reliable source in the financial industry. A.M. Best meets these standards and is one of the most-respected ratings agencies globally.

It makes our first on the list not because of the 28 countries they serve or their over 150 years of service. We place it first because they are the only agency that focuses only on the insurance industry.

With the backing of both the National Association of Insurance Commissioners and the U.S. Securities and Exchange Commission, A.M. Best is the gold standard for ranking insurance providers.

Below you’ll find a basic chart explaining their rating system. It provides a quick overview of what each letter grade means. It’s a sneak-peek preview of sorts into an insurance provider’s finances.

| A.M. Best's Rating Category | Rating Symbol |

|---|---|

| Exceptional | AAA |

| Superior | AA |

| Excellent | A |

| Good | BBB |

| Fair | BB |

| Marginal | B |

| Weak | CCC |

| Very Weak | CC |

| Poor | C |

State Farm holds its reputation well as the number-one insurance provider with an A++ rating from A.M. Best; the ranking is proof that, in this case, you can start to believe the hype surrounding State Farm and their home insurance policies.

According to this top credit ranking agency, State Farm is as close as you will get to a sure bet when it comes to financial stability, so it is safe to say that your money, home, and investment will be covered when you take out a policy with State Farm.

Better Business Bureau (BBB)

The Better Business Bureau (BBB) is a non-profit that provides customer-based reviews about businesses and their performance. Since 1912, the BBB has offered its services in its mission to better educate customers while holding businesses to a higher, more ethical standard.

The key here is that BBB offers its services free of charge as a non-profit; this helps the BBB to be less biased in their rankings. That means no tweaking the system to favor certain businesses.

The rankings themselves come from actual customer reviews and complaints. The BBB also measures how quickly and how well a business responds to each complaint. The rankings use a basic letter grade system of scoring, similar to most school report cards, listing grades from an A+ through F.

| Element | Range of Points That Can Be Earned or Deducted (Maximum to Minimum) |

|---|---|

| 1. Type of business | 0 to -41 |

| 2. Time in business | 8 to -10 |

| 3. Competency licensing | 0 or -41 |

| 4. Complaint volume | 20 to 2 |

| 5. Unanswered complaints | 20 to -21 |

| 6. Unresolved complaints | 10 to 1 |

| 7. Serious complaints | 15 to 0 |

| 8. Complaint analysis | 8 to -12 |

| 9. Complaint resolution delayed | 0 or -5 |

| 10. Failure to address complaint pattern | 0 or -5 |

| 11. Government action | 0 to -30 |

| 12. Advertising review | 0 to -41 |

| 13. Background information | 5 or 0 |

| 14. Clear understanding of business | 0 or -5 |

| 15. Mediation/arbitration | 0 to -41 |

| 16. Revocation | 0 or -10 |

State Farm Home Insurance received an A+ rating across the board, measuring up on both the national and local levels. According to the BBB, State Farm provides reliable and personable customer service; they are truly there for their policyholders when they need them the most.

Moody’s

Moody’s is one of the top three well-respected credit ranking agencies. They have been involved in the credit ranking business since 1909 with a proven history of reviewing the financial industry.

A positive ranking from Moody’s is close to all any company needs to solidify trust in their financial stability. As a policyholder, you want to know if the insurance provider you choose has the financial backing to pay out your claims in case of an emergency.

Moody’s letter grade rating system uses letter grades from AAA (highest) at the top signalling financial stability to C (lowest) at the bottom of the scale, signalling a financially unstable company.

In the case of State Farm, Moody’s granted the insurance group one of the highest ratings at Aa1. The insurance group is not only viewed as financially stable but also still capable of growing to become a more profitable company.

This means State Farm will weather the storms with you as a policyholder, and more importantly, pay out your claims after those storms.

Standards & Poor’s (S&P)

Standards & Poor’s (S&P) is the second of the top three credit ranking agencies. Opening its doors in 1888, S&P’s time, dedication, and continued reliability in reviewing/advising the financial community has given them a well-deserved reputation. They remain to this day a valued credit ranking agency with global influence.

S&P provides credit rankings but also is an excellent source for up-to-date information on company performance, as well. They use a similar letter grade system as Moody’s, with A as the highest ranking and D as the lowest.

Currently, in their ranking of financial status and stability, S&P places State Farm at the top as a strong financial contender in the insurance industry. The S&P score measures up with both Moody’s and A.M. Best with an AA review.

This is by no means the very top tier when it comes to reviews, but State Farm is still a financially solid company. Also, the slightly lower ranking brings some assurances that S&P did their homework and is not just riding on a wave of public opinion from the other credit ranking agencies.

NAIC Complaint Index

The NAIC is a watchdog organization dedicated solely to the insurance industry. They provide reviews, ratings, and analysis while also holding insurance companies liable to higher expectations and standards.

Their complaint index measures, in any given year, the number and variety of complaints against a given company and compares it to the national average for that year. The national average for the complaint index is always one.

You can check out State Farm’s 2018 home insurance index score below:

| State Farm Home Insurance Policies | 2016 | 2017 | 2018 |

|---|---|---|---|

| Total Complaints | 484 | 436 | 347 |

| Complaint Index (better or worse than National Index) | .45% (better) | .39% (better) | .18% (better) |

| U.S. Market Share | 14.97% | 14.56%% | 2.65% |

| Total Premiums | $13,688,224,185 | $13,726,002,185 | $14,178,782,585 |

Complaints are bound to happen. The table above shows State Farm’s number of complaints over a three-year period.

For an insurance group as large as State Farm, a score of .18 in 2018 is quite low and bodes well for the customer service arm of the insurance provider.

With a national average set at 1.0, State Farm’s property insurance division finds itself not only well below the average, but exceeding expectations, especially in comparison to other insurance providers on a national level.

It is impressive that they score well below the national average for complaints received each year, and that that number continues to lower each year.

What does this mean for the consumer? State Farm runs a no-nonsense organization that operates smoothly in its day-to-day business. It’s nice to know when you place a claim that the most limited number of hiccups will occur in the process of receiving payment. The low frequency of complaints accurately reflects that type of high level of service.

J.D. Power

Because it is a young organization, having only opened shop in 1968, J.D. Power may not have the same pull in reviewing finances as, say, S&P or Moody’s, but they are quickly developing a name for themselves as a reliable source of company reviews.

One aspect that helps them stand out in the crowd is their ranking systems based on the individual industry; so if you are looking for a review of State Farm but only their home insurance division, look no further than J.D. Power.

The J.D. Power study uses a number ranking out of 1,000 as well as a zero to five scale for customer satisfaction, with five being the highest. As you can see below, State Farm is a top contender, placing second overall out of the nation’s top ten insurance providers for point total and finishing it off with a four-out-of-five rating for customer service, as well.

| 2019 J.D. Power U.S. Home Insurance Study | Customer Satisfaction Ranking (based on 1,000 point scale) | Power Circle Rating for Consumers – 2019 | Power Circle Rating for Consumers – 2018 |

|---|---|---|---|

| USAA | 878 | 5/5 | 5/5 |

| State Farm | 831 | 4/5 | 3/5 |

| Erie Insurance Group | 828 | 5/5 | 3/5 |

| Allstate | 814 | 3/5 | 3/5 |

| American Family Insurance | 808 | 3/5 | 3/5 |

| Farmers Insurance Group | 808 | 3/5 | 3/5 |

| Nationwide | 796 | 2/5 | 3/5 |

| Travelers | 796 | 2/5 | 2/5 |

| Liberty Mutual | 792 | 2/5 | 3/5 |

| Chubb Ltd Group | 775 | 2/5 | 4/5 |

While other credit ranking agencies may only give a rough overview of the company as a whole, J.D.Power is able to narrow the search and really give you a feel for the particulars. State Farm scores at the top of the list with 825 points out of 1,000 and a top rating for above average customer service.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Farm History

Aside from being the top insurance company in the U.S., State Farm is probably best known for its slogan: “Like a good neighbor, State Farm is there.”

The jingle dates back to the 1970s, but the neighborly mentality of State Farm as a company has remained intact since its inception as a Bloomington, Illinois, auto insurance provider in 1922.

Retired farmer and insurance salesman George Jacob “G.J.” Mecherle sold his first auto policy for $11.17, and the rest is history as the company gradually became the dominant provider of not just autos but all forms of insurance, including home.

The view was, as it always has been, to focus on the policyholders themselves and meeting their needs.

Around 1928, State Farm began to expand its reach and officially began offering insurance coverage to not just farmers but to potential policyholders living in smaller towns and even larger cities.

The extension of service called for a centralized base of operations, and the following year, construction would be completed on what is still the State Farm Home Office Building in Downtown Bloomington, Illinois.

Life insurance policies were the first to follow the booming auto insurance agency, and it was not until 1935 that State Farm began offering homeowners insurance through The Fire Company.

It only took Mercherle’s insurance agency fourteen years to become the number-one provider of auto insurance in the United States and then another 22 years to reach the number-one spot in the market of homeowners insurance.

Both positions they still hold to this day, while continuing to expand, with the State Farm Bank® arriving just before the turn of the century in 1999.

And how exactly has a company that started out originally as a single-line auto insurance company grown to be capable of offering around 100 products and services in five different types of businesses? By operating fairly and doing the right thing for their customers.

State Farm today has branched out to cover multiple policies, from automotive to life insurance and, yes, of course, home insurance, too. Currently, they are ranked number 36 on the Fortune 500 list of the largest companies; all of this managed by relying on a team of agents who exclusively sell State Farm insurance.

State Farm Market Share

If you have been reading up on investments, banking, credit ratings, etc. in preparation for choosing the right home insurance for you, you have probably come across the terms “market share” and “loss ratio”; both are generally tossed around as if any layperson should and would know the meaning.

Don’t worry. The terms are relatively self-explanatory. We are here to clarify, so you can focus on the important aspects of finding an insurance provider with an affordable policy that meets your needs.

Market share is what it sounds like. In this case, the market share is the percentage of the insurance industry as a whole that any given company controls. Or, to put it more simply, their share of the market. So why is this important?

The size of your insurance provider can affect many things, from what type of policy is offered right down to the cost of that policy.

Larger insurance providers may be able to offer lower rates and also tend to be able to pay out more claims. Although not true for every provider, it sure is true enough in State Farm’s case.

State Farm dominates the insurance market with an 18 percent market share. No other company listed even comes close to State Farm’s level of success. The other insurance providers rounding out the top 10 are not in the same ballpark.

| Company | 2016 Market Share | 2016 Premiums Written | 2017 Market Share | 2017 Premiums Written | 2018 Market Share | 2018 Premiums Written |

|---|---|---|---|---|---|---|

| State Farm | 19.26% | $17,613,109,000 | 18.63% | $17,556,871,000 | 18.40% | $18,177,462,000 |

| Allstate | 8.64% | $7,903,530,000 | 8.44% | $7,957,403,000 | 8.36% | $8,262,445,000 |

| Liberty Mutual | 6.74% | $6,164,379,000 | 6.86% | $6,471,114,000 | 6.74% | $6,655,452,000 |

| USAA | 5.84% | $$5,341,021,000 | 6.05% | $5,703,741,000 | 6.24% | $6,170,558,000 |

| Farmers | 6.03% | 5,515,277,000 | 5.96% | $5,617,990,000 | 5.86% | $5,795,044,000 |

In 2017, USAA took over fourth place from Farmers.

For State Farm, a few spikes and dramatic decreases do occur in the table above, but should not because for concern. An unusual increase in the number of claims caused by either a particularly rough hurricane season or even flash flooding can dramatically alter an otherwise productive year.

There are many uncontrollable factors at play in the home insurance game, so a single off year for a provider is not a large concern.

It is more the consecutive years of loss that should be your main concern when determining the financial stability of an insurance provider. And when it comes to consecutive years, State Farm has consistently shown an ability to keep its top ranking in the home insurance business.

As noted in the table above, State Farm did take a tumble financially speaking in 2017, a dip experts suggest was because of a lack of an online presence and usable apps. But that wrong has since been righted and is reflected in State Farm’s rapid increases in the number of premiums written between 2017 and 2018.

State Farm’s Position for the Future

The issues that plagued State Farm in 2017 seem to have since been fixed with some behind-the-scenes restructuring, leaving the company prepared and ready to continue its dominance in the home insurance industry.

State Farm displays an unrivaled commitment to each of its policyholders as they handle close to 36,000 claims made per day. With over 58,000 employees combined with the additional 9,000 independent contractor agents, State Farm is capable of servicing 83 million policies and of doing it well.

State Farm’s Online Presence

Being the nation’s top insurance provider, State Farm is at the forefront of technology with a strong, effective online presence that even bleeds into their well-functioning app.

Two of the biggest worries of working with a company as large as State Farm is that you will somehow get lost in the shuffle and you will have to sift through an unnecessary amount of information unrelated to your policy.

State Farm avoids those traditional worries by giving users a dedicated page to the home and property insurance line of their business. The home insurance frontpage is easily found with a quick search online or through the use of the navigation bar on their site.

This section covers the two primary forms of policies State Farm offers: Homeowner and Renter. However, it also includes various links for information on mobile homes in addition to the regular toolbar options to direct you around the site.

The pages are clean with no fuss, providing clear images and a direct approach to their message, especially when it comes to getting a quote online.

They offer an online learning center about home insurance named Simple Insights®. The learning center helps give State Farm a larger online presence while also showcasing some helpful tips and knowledge.

Most homeowner insurance sites offer at least a home inventory tool and State Farm does not disappoint on this front. Their continued offers of helpful housing information, even for non-policyholders, is an encouraging gesture that also brings an increased sense of trust.

Through Simple Insights®, State Farm states that this may be a monetary transaction, but from the top CEO down to your own personal agent, they truly have your best interest at heart when it comes to protecting you, your family, and your home.

A quote and a find an agent option are also included as separate links at the bottom of the homeowners insurance web page.

The search engine for agent search offers a more personalized list of agent information including a recent photo, address, email, and telephone number. Detailed descriptions of products and services are offered, and finally, there is the inclusion of links to each agent’s personal site, as well.

State Farm’s Commercials

There is no shortage of commercials for the nation’s top insurance provider as the PR machine is well oiled and in full effect. They even go so far as having a section of their website devoted to their own commercials, so no need for a search on YouTube when it comes to commercial hunting for a State Farm advertisement.

Many of these commercials are dedicated to autos, but one involves property and homeowners insurance policies.

The commercial attempts to strike a humorous cord about a woman’s She Shed that has been struck by lightning. Her agent is only a phone call away, placing an emphasis on trust, reliability, and neighborly closeness.

A large percentage of the commercials take a celebrity or sports figure and have them endorse State Farm through a humorous situation.

There is no shortage of available advertisements for State Farm. Their continued efforts in promoting their brand and image are just one of the many reasons they are still number one.

State Farm in the Community

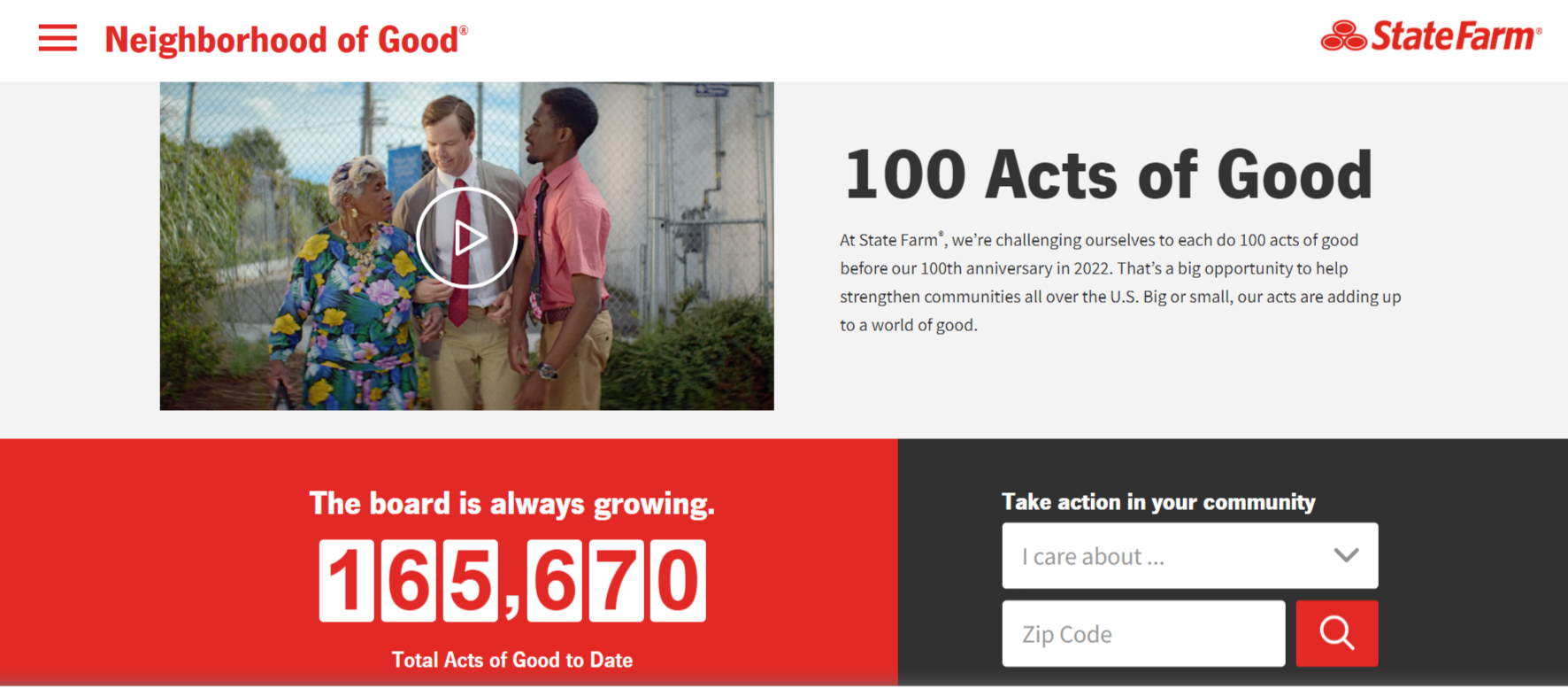

State Farm prides itself on giving back to the community, the very same communities where their dedicated agents live. Since “like a good neighbor” is practically their entire mission statement, it only seems appropriate that they would lend a helping hand.

State Farm’s 100 Acts of Good program is a measure of good faith on State Farm’s part to act and promote charitable activity in the community. They hope to also inspire individuals in the community to look out for volunteer work, as well.

A search engine is conveniently placed on the page to help you find acts of good even in your neighborhood.

All of these acts of good are to be accomplished, in addition to their other charity work, before their 100th anniversary in 2022.

The quick search in our own area supplied a multitude of options for charitable work in the given area; it searched quickly and supplied real results as well as a long list of contributor stories.

State Farm also sponsors a number of scholarships and educational opportunities for underprivileged students through financial support.

It is through these charitable donations and volunteer actions that State Farm truly proves they are not only a neighbor but an active member of the communities they serve.

State Farm’s Employees

Even with the mandate that agents must be dedicated State Farm insurance sellers to operate under the good neighbor banner, the insurance provider still manages to employ over 58,000 regular employees without including the additional 19,000 independent contractor agents working for them.

Altogether, these employees manage to handle around 83 million policies. A company is only as good as the employees who work there, and with State Farm, we think you will find there is almost too much good being shared all around.

Age of Employees and Tenure

According to surveys conducted by Payscale, State Farm is not a young person’s entry-level game, which is good news considering the policy you take out is covering one of your largest investments. The company has the highest number of employees just starting out their careers.

The experience levels skew in favor of a younger market at 37 percent just starting their careers, but with eager employees along with some more experienced staff to fill out the ranks (20 percent experienced and 18 percent mid-career), you can be sure your claims will in the least be taken seriously and handled properly.

The average age for employees is 36 years old with a tenure that generally reaches about three years.

Employee Experience

State Farm employees report a slightly above-average response when it comes to employee satisfaction. It does not measure as the best place to work, but employees seem content with their employer, the position they hold, and the pay they receive in commiseration.

The survey conducted by Payscale shows positive attitudes among employees about job satisfaction.

This rating is based off of more surveyed responses than any other insurance provider reviewed by Payscale. With over 70 percent of employees satisfied, the achievement then seems like a bigger deal, as State Farm is a much larger company than most providers.

Awards and Accolades

State Farm has a long history of getting awards and making top 10 lists, aside from their market share performance. More recently, they have been named a one of Top 100 Most Military Friendly Employer as well a Top Company for Executive Women.

As further evidence for their previously mentioned award, the gender breakdown for State Farm slightly skews toward the female gender with 59.2 percent and only 40.8 percent of their employees being male. You can still pick and choose your agent, but kudos to State Farm for promoting females in the workplace.

In comparison to three other top insurance providers, State Farm is top when it comes to gender equality and promoting female empowerment in the workplace.

Here is just a taste of State Farm’s long list of accolades that includes:

- FORTUNE Magazine’s World’s Most Admired Companies

- Top Companies for Women Technologists

State Farm Cheap Home Insurance Rates

Not everything can be about creditworthiness and employee/customer satisfaction. When it comes down to it, the main question will always come down to cost. Can you afford the coverage offered for your home insurance investment? We are talking dollars and cents now — how much will your insurance cost?

State Farm may be the number-one insurance provider in the nation, but none of that matters if you simply can not afford the premium.

Thankfully, their size tends to work in favor of the policyholder, allowing State Farm to offer some of the lowest premiums, particularly as the cost of dwelling coverage goes up.

State Farm Availability

State Farm Home Insurance policies are available in all 50 states. There are more than 19,000 State Farm Agents servicing more than 83 million policies, which means you can buy a State Farm policy no matter where you live in the U.S.

State Farm offers 24/7 claims service online or by phone; With an excellent financial stability rating and a high customer satisfaction rating, State Farm is truly the full package deal.

State Farm Compared to the Top 10 by Market Share

Not a single company in the top 10 of the nation’s leading insurance providers holds a candle to the measure of the market share that State Farm controls.

| Company | Direct Premiums Written ($) | % Market Share | Loss Ratio |

|---|---|---|---|

| State Farm | 18,177,462,000 | 18.50% | 61.87% |

| Allstate | 8,262,445,000 | 8.36% | 65.55% |

| Liberty Mutual | 6,655,452,000 | 6.74% | 52.60% |

| USAA | 6,170,558,000 | 6.24% | 79.77% |

| Farmers Insurance Group | 5,795,044,000 | 5.86% | 78.80% |

| Travelers | 3,766,277,000 | 3.81% | 69.34% |

| American Family Insurance | 3,276,280,000 | 3.32% | 63.74% |

| Nationwide | 3,184,627,000 | 3.22% | 77.83% |

| Chubb Ltd Group | 2,832,082,000 | 2.87% | 91.87% |

| Erie Insurance Group | 1,675,976,000 | 1.70% | 66.03% |

In addition to controlling the home insurance market, it does seem that State Farm generally gives back and, with a respectable loss ratio percentage, claims get paid out when filed. You will not see any hassle on that end and any savings go into cheaper premiums offered to policyholders.

With discounts that benefit their charitable programs, as well as providing even lower premium rates for existing policyholders, it is no wonder competitors cannot find traction to gain on State Farm’s lead in market share.

State Farm Sample Rates

Sample rates in Pasadena, California, based on homes that are 1–3 years old with only a $1,000 deductible clearly show State Farm as the winner among the top 10 insurance providers.

In that survey of top providers in California, State Farm measures up pretty evenly in the $200,000 range only to significantly outpace the remaining top 10 as the coverage amount increases to $500,000. The chart below shows the average dollar amount for premiums on policies covering up to $500,000.

| Dwelling Coverage Pasadena, Los Angeles County, CA | $200,000 | $350,000 | $500,000 |

|---|---|---|---|

| State Farm | $427 | $690 | $972 |

| Farmers Insurance Group | $899 | $1,386 | $1,869 |

| USAA | $448 | $811 | $1,154 |

| Allstate | $421 | $734 | $1,047 |

| Liberty Mutual (as Liberty Ins Corp) | $656 | $866 | $1,076 |

| Nationwide | $439 | $668 | $961 |

| Travelers | $408 | $585 | $795 |

| American Family Insurance | N/A | N/A | N/A |

*CA rates based on home age of 1º3 years old, $1,000 deductible

*SOURCE: California Department of Insurance

It is clear that State Farm more than measures up to the competition, allowing its sizable gains to trickle down to slightly discounted prices for their policyholders. None of the remaining top home insurance contenders have the financial backing to provide such low monthly prices.

On a $200,000 home, they are capable of matching the competitors around $420; once the cost of dwelling coverage increases above $300,000, policyholders see the value in comparison to the remaining insurance providers. The premiums rise but remain below average cost, holding at just below $700 for $350k in coverage and a little over $950 for $500k in coverage.

In comparison to other providers, State Farm offers the most in savings, with around $100 off in comparison to close competitors and up to $1,000 when compared to the not-too-distant Farmers.

Coverage Offered

State Farm is currently divided into five different lines of business, including property and casualty, life and health, annuities, mutual funds, and banking products. The primary form of homeowners insurance the provider offers is through the traditional line of property and casualty insurance.

State Farm Policy Types

State Farm offers all types of insurance policies, from traditional single-family homeowners to renters and condos.

State Farm offers the following policies under the umbrella of home insurance:

- HO-3 – Special Form Homeowners

- HO-4 – Renters

- HO-6– Condo

- HO-7 – Mobile Home

- DP – Landlord

Now, let’s take a closer, more detailed look into what each policy type entails.

Homeowners

State Farm offers a traditional homeowners policy, otherwise known as an HO-3. The standard HO-3 will cover your personal property and dwelling structure against any damage or loss caused by multiple perils, such as vandalism, fire, and theft.

Obviously, this coverage is with certain conditions and exclusions listed in the contracts fine print, like no coverage for earthquakes or flooding.

Condo

This is homeowners insurance provided for those individuals who own or co-opt condominium structures. Condo insurance is not generally hard to find, but comparison shopping condo insurance may leave you with limited options.

Otherwise, called HO-6 or “walls-in” insurance, this policy covers the condo unit for multiple perils, as well as including coverage for both living expenses due to uninhabitable residences and personal liability. The policy generally does not cover condo building, thus the “walls-in” pseudonym.

Read more: HO-6 vs. Renters Insurance: What You Need to Know

Renters

State Farm offers renters insurance, otherwise known as an HO-4 policy. This policy offers coverage for personal property within the rented property. The physical structure is not covered under an HO-4.

Mobile Home

Known as an HO-7, mobile home insurance will cover pretty much everything a standard homeowners policy does, except only for a manufactured home. The policy protects the physical structure along with your personal property within and can even include personal liability coverage, as well.

Landlord

Landlord insurance will cover the physical property you rent out against damages and property loss. This will not cover personal belongings, as that is up to the actual renters.

State Farm’s Standard Homeowners Policy

A standard homeowners policy initially only provided coverage for risk of property loss or damage due to fire, but the policies of today are set up to cover risk from perils including fire and every known accident or uncontrollable weather incident in between. The convenience of a standard homeowners policy is that multiple risks are covered under one unified policy.

The typical homeowners policy will provide insurance protection for the following:

- Home – The physical home structure, as well as attached structures like garages.

- Personal property – Coverage for the actual contents within each home, such as appliances, jewelry, furniture, and clothing. For more expensive items, policyholders can take out more exacting policies to cover the cost while most types of property have a set dollar amount as a limit.

- Personal liability – This will cover any injury that happens on your property to you, family members, and guests.

- Loss of use or additional living expense – If a home is damaged by a covered peril, loss-of-use coverage helps meet the costs of hotel bills, apartment or rental homes, eating out, and other living expenses while the home is being repaired. This policy section can also reimburse a homeowner for lost income if a room in the home was rented out. This is sometimes insured on an actual-loss-sustained basis.

- Other structures – This will cover any additional structures not connected to the home, such as a shed, guesthouse, or detached garage.

- Medical payments – This is known in the insurance business as a guest-medical payment; this will cover the potential medical bills of any injury to a third-party guest that occurs on your property through an accident.

As mentioned previously, State Farm’s standard homeowners policy makes specific mention of certain exclusions and exceptions to the term multiple perils. Typical exclusions include damage from earth movement, flood, and mold.

These can generally be added to a policy through an endorsement and payment of an additional premium.

Replacement cost is also offered by State Farm in case the dwelling and property within the home are deemed not salvageable. This type of coverage is normally on an actual-cash-value basis.

State Farm’s Bundling Options

Combining your purchase of a home, condo, or renters and your car insurance policies with State Farm puts money back in your pocket.

State Farm’s Discounts

State Farm offers a limited selection of discount opportunities to clients.

State Farm Available Discounts

| Discount | Amount |

|---|---|

| Anti-lock Brakes | 5% |

| Anti-Theft | 15% |

| Claim Free | 15% |

| Defensive Driver | 5% |

| Distant Student | Varies |

| Driver's Ed | 15% |

| Driving Device/App | 50% |

| Good Credit | Varies |

| Good Student | 25% |

| Homeowner | 3% |

| Low Mileage | 30% |

| Married | Varies |

| Military | Varies |

| Multiple Policies | 17% |

| Multiple Vehicles | 20% |

| Newer Vehicle | 40% |

| Paperless/Auto Billing | $2 |

| Passive Restraint | 40% |

| Safe Driver | 15% |

| Vehicle Recovery | 5% |

The majority of these will only be applicable if you bundled your home insurance policy with your automotive. However, the multiple policy, claims free, good credit, and military would all apply to discounting your homeowner policy.

Security Discounts

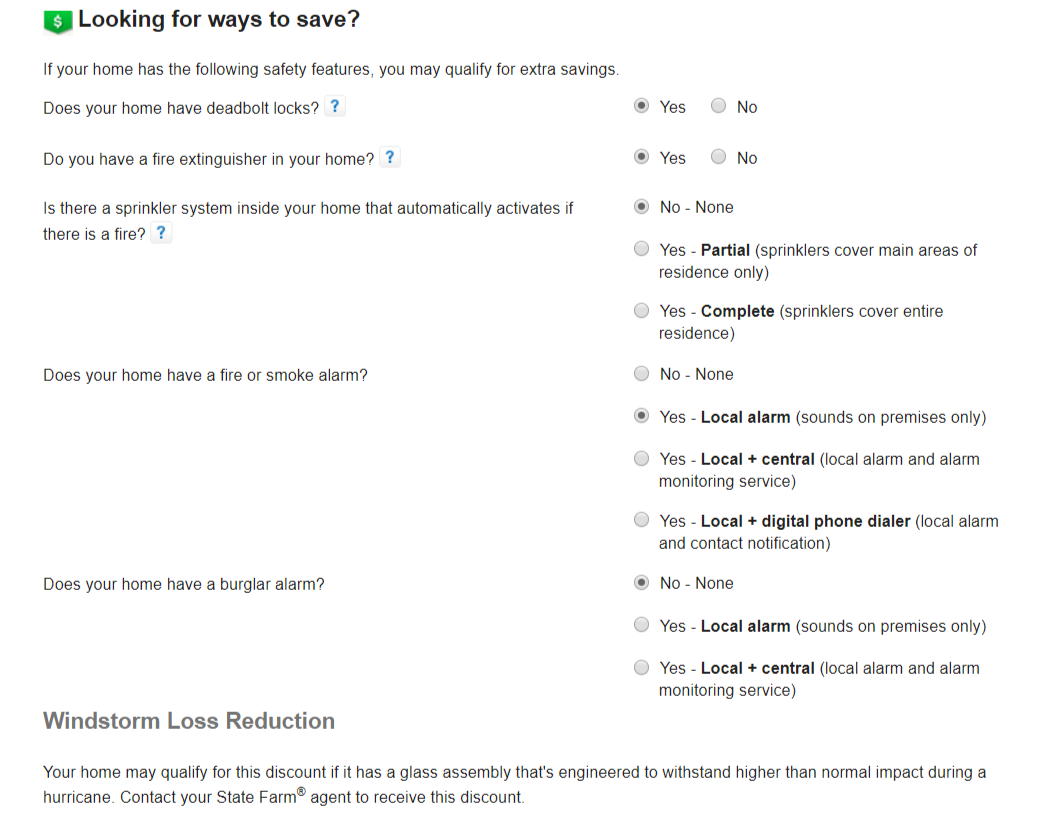

State Farm offers homeowners average discounts for safeguarding their homes from potential damage or property loss. This includes installing fire sprinklers, smoke or burglar alarms, and impact-resistant roofing. The safer your home is from the risk of damage, the cheaper your monthly rate will get.

Bundling Discounts

State Farm offers a discount for taking out multiple policies, particularly for homes and auto. You can save up to 17 percent if you have homeowners, renters, condo, or life insurance in addition to vehicle insurance.

Additional Discounts

State Farm also offers discounts for a claim-free history.

State Farm Programs

State Farm’s Simple Insights® program is a cleverly named online learning center offering reference articles, advice, and tips on insurance and how to protect your assets. This blog-like site also helps create a broader and more defined online presence for the company.

Also offered is the State Farm Companies Foundation Scholarship Program, which awards scholarships to 100 recipients each spring. Eligible candidates must be legal dependents of State Farm associates. Winners receive $5,000 for up to four years of undergraduate study.

The State Farm website also features a page dedicated to the community involvement of the company. Efforts include grants to nonprofits and other charitable causes, participation in a STEM initiative, advocacy for home and auto safety and awareness, and investment in the Community Reinvestment Act (CRA).

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Policy

State Farm allows you to cancel your policy by phone, mail or fax, and in person.

Cancellation Fee

There are typically no cancellation fees.

Is there a refund?

You will receive a prorated refund even if you end up canceling with half of your policy term still in effect.

How to Cancel

You can cancel by phone, mail or fax, and also in person.

By phone.

- You’ll typically need to have the following: policy number, name, date of birth, and SSN.

- Cancellations by phone are typically effective immediately or can be scheduled for a date in the future.

- If you’re switching providers, you may need to provide the new provider’s name, policy number, and effective date.

By mail or fax. Write a letter that includes:

- Your name, address, and phone number.

- Your State Farm policy number and the date and time you want your policy to end.

- If you’re switching providers, your new insurer’s name, policy number and policy start date.

Sign, date, and mail your letter at least two weeks before your intended cancellation date to:

Corporate Headquarters

State Farm Insurance

One State Farm Plaza

Bloomington, IL 61710

Or fax: 888-633-0405 or 905-750-5002.

In-person. Bring the following:

- Your name, address, and phone number.

- Your State Farm policy number and the date and time you want your policy to end.

- If you’re switching providers, your new insurer’s name, policy number and policy start date.

If you decide to go through with the cancel, you will need to provide your agent with:

- Policy number

- Name

- Date of birth

- SSN

- Cancel effective date

When can I cancel?

With State Farm, you can feel free to cancel at any time during your policy term.

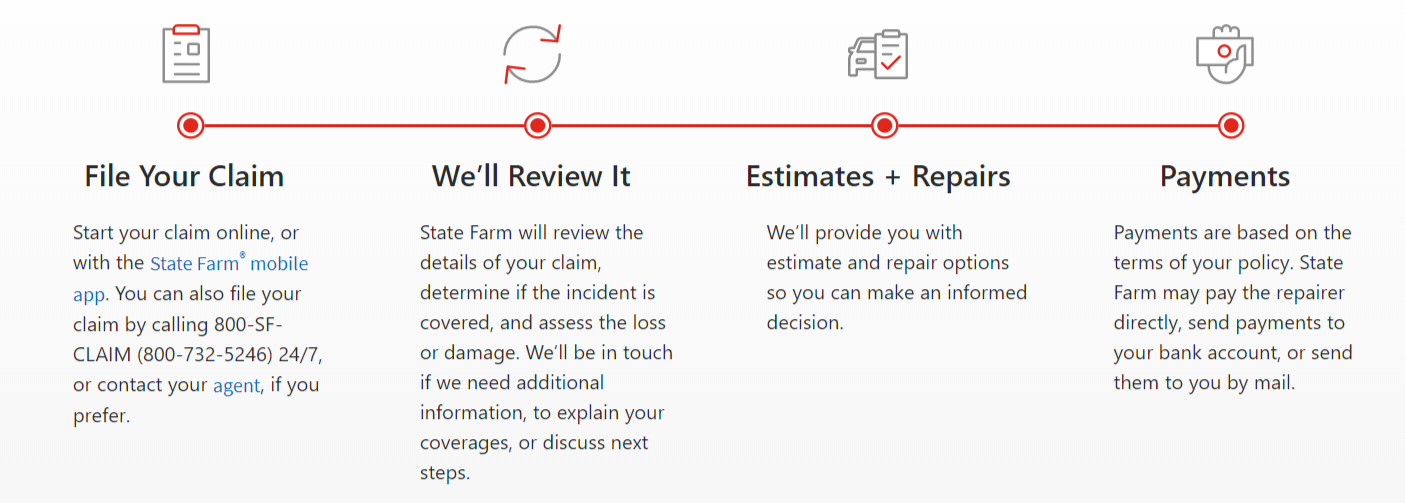

How to Make a Claim

As much as we hate to admit it, accidents happen more often than you would think. When unexpected property loss or damage does happen, it’s important that you are familiar with how to file a claim as a State Farm policyholder.

Follow these easy steps, and you are well on your way to getting your claim processed and eventual payment for damages.

Ease of Making a Claim

Claims can be filed with State Farm:

- Online

- With the mobile app

- By calling 800-SF-CLAIM (800-732-5246) (available 24/7)

- By contacting your agent.

When you make a claim, you’ll need the following list of replacement inventory for the property damage, including photos, model numbers, age, brand names, place of purchase, and finally the purchase price.

Premiums Written

State Farm has the most premiums in the home insurance business by a long shot, covering over 10 million more than its closest competitor.

| State Farm by Multiple Home Perils | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| 2016 | 17,613,109 | 54.20% | 19.26 % |

| 2017 | 17,556,871 | 80.93% | 18.63% |

| 2018 | 18,177,462 | 61.87% | 18.40% |

The high number of premiums written in 2018 signifies steady growth with 2017 perhaps best described as a year to regroup and rebuild for an even better future.

Loss Ratio

Whereas market share is pretty self-explanatory, loss ratio is more complex, but it’s easy enough to explain.

According to Investopedia, a loss ratio represents the number of paid-out claims in comparison to the amount of premiums written in any given year. So the loss ratio reflects how much money is coming in versus how much they are paying out.

The acceptable range for a loss ratio percentage is somewhere between 40 and 75 percent.

A loss ratio of under 40 percent is too low as the company is taking in more money than they are paying out. This usually points to a provider being stingy with paying out claims. And a loss ratio of over 75 percent is too high, which, over consecutive years, will lead to bankruptcy.

As mentioned in the previous section, State Farm’s 2017 spike in loss ratio seems to be indicative of a recovery period involving new tech and short-lived price hikes. After some restructuring, this brief dip then led the business to thrive in 2018 and beyond.

A State Farm spokesman mentioned in response to 2017 figures that since “our business is highly cyclical, short-term results do not provide a complete picture of a company’s long-term performance.

“We remain financially strong and continue to have the resources to be there when our customers need us. State Farm continues to strengthen its financial standing, and we are seeing improvements from the decisions we’ve made in the marketplace.”

<blockquote

Policyholders can take some comfort in knowing the size of State Farm grants it the ability to roll with a punch or two and still be able to rebound in the long-term.

Before making any final decisions about your insurance company, it is important to learn as much as you can about your local insurance providers, and the coverage they offer. Call your local insurance agent to clear up any questions that you might have. Questions to consider asking include, “What is the best coverage plan for me/my family/my situation?” “What are the minimum coverage requirements in my state and what form of coverage do you recommend?” “Do you guys offer any bundle discounts if I take out both my auto insurance and home insurance with you?” and “What is the average rate of insurance quotes you guys offer?”

Before making any big insurance decisions, use our free tool to compare insurance quotes near you. It’s simple, just plug in your zip code, and we’ll do the rest!

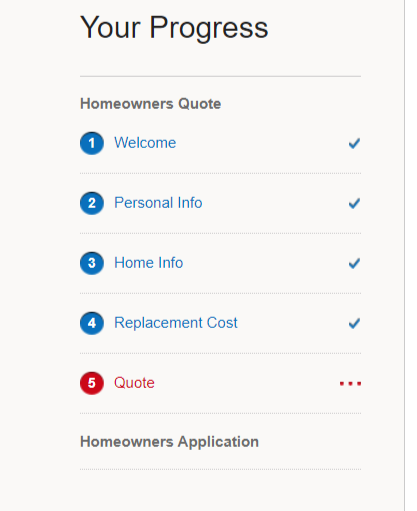

How to Get a Quote Online

It seems that industry experts are of the opinion that State Farm dropped the “tech” ball in the years from 2013 to 2015. The company fell behind when it came to having an online presence or even mobile phone-based apps and services for its policyholders.

All that seemed to be a thing of the past, and by 2017, State Farm had successfully rebounded with a stronger online presence and a fully functioning app. The company has since adjusted nicely to the online world and even offers a simple online quote process.

Step One: Enter Your ZIP Code

The process starts at State Farm’s homeowner insurance webpage where you type in your ZIP code.

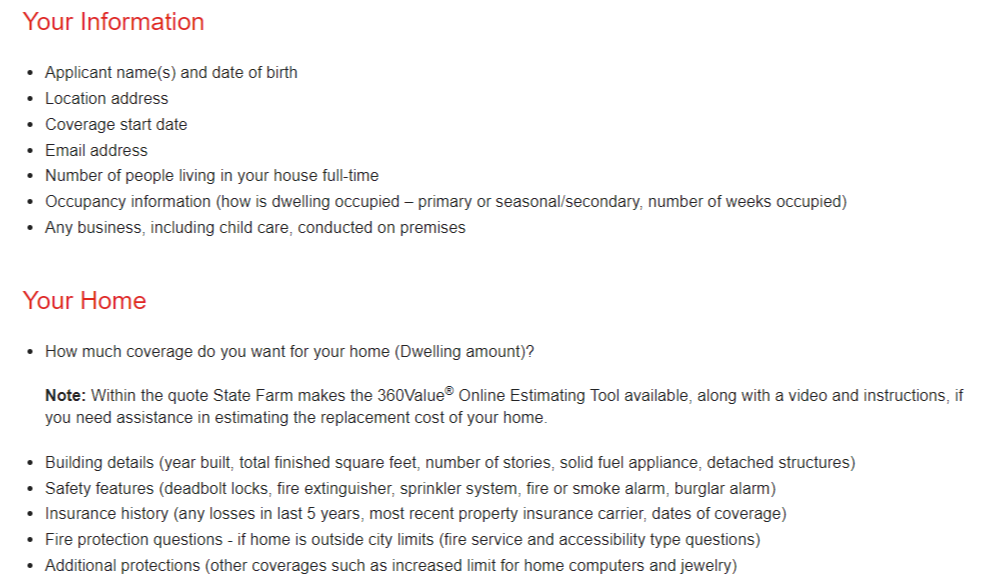

The State Farm Quote Checklist below is a list of information required to get a homeowners insurance quote.

Another nice feature is the option to save your progress at any point during the quote process to continue your quote later.

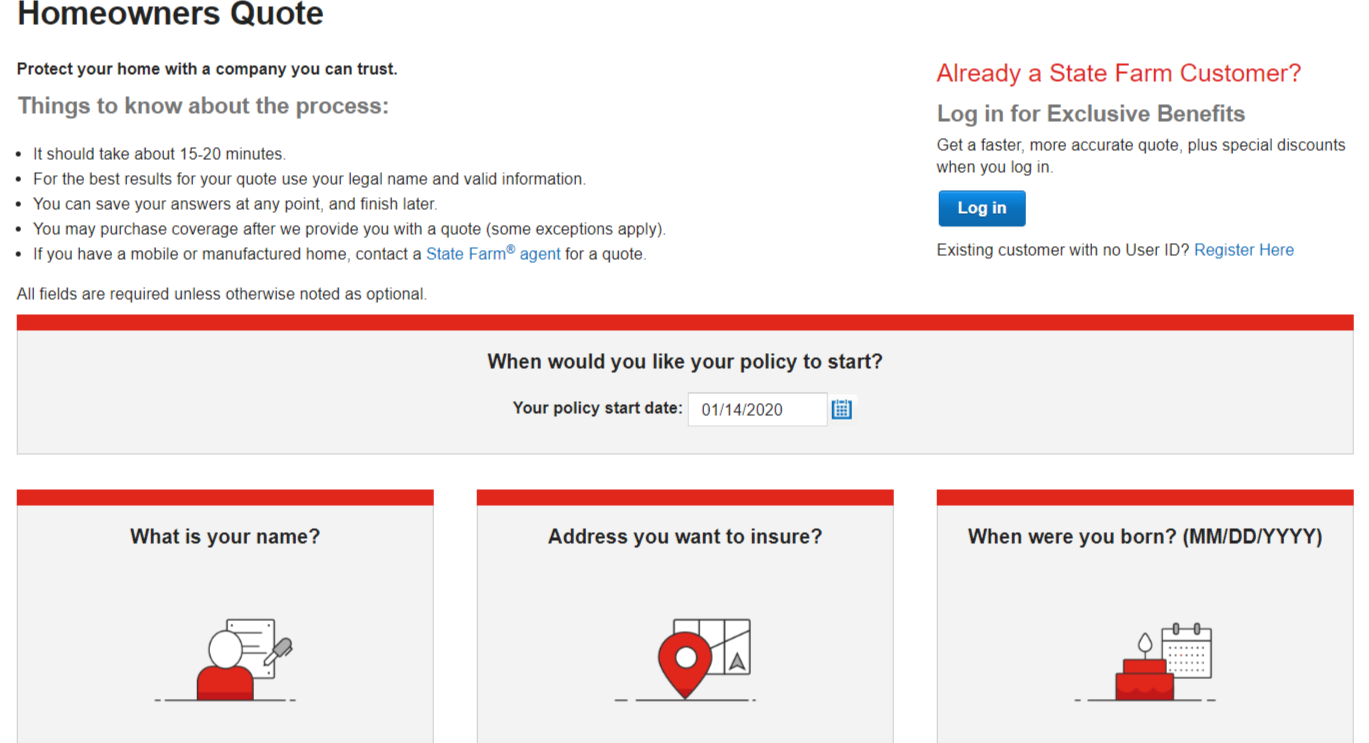

Step Two: Enter Home Information

After typing in your ZIP code, you are redirected to the next page. Here you are prompted to provide brief information about name, age, and address.

State Farm’s process is direct and takes little preparation to get the most accurate quote. Once this basic information is provided, you are redirected to the personal information form.

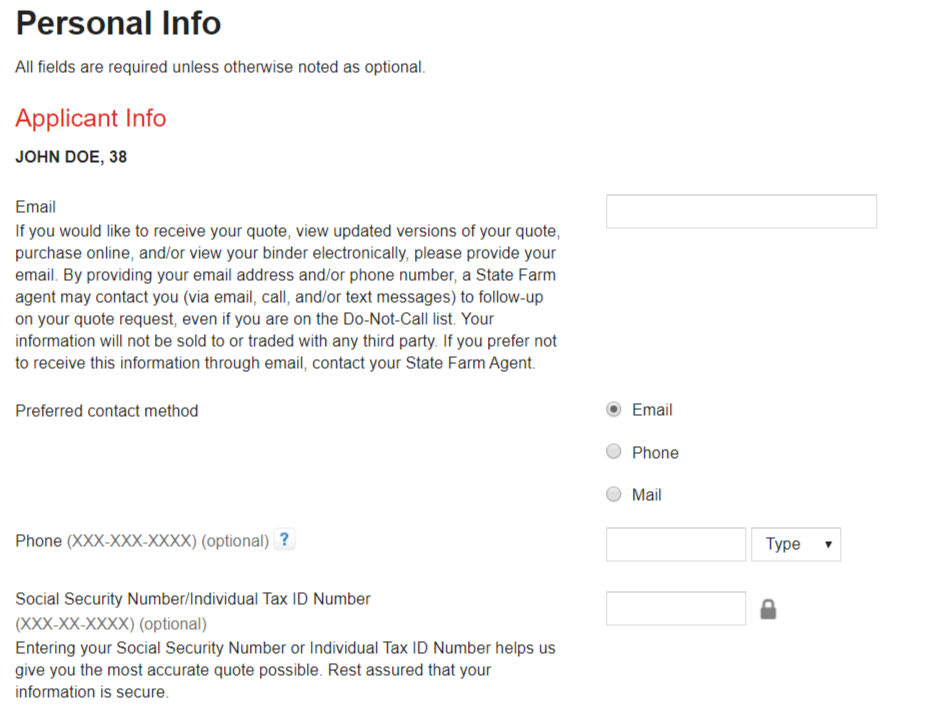

Step Three: Enter Personal Information

The next page asks you to include some basic personal information, mainly regarding email, telephone, and an optional Social Security inclusion section.

If you are uncomfortable with providing your Social Security number, feel free to leave it out. State Farm can still provide you an accurate quote with this exclusion. They only request this to get a better understanding of who you are which is essential to providing the most accurate estimate for your potential monthly rate.

Step Four: Add More Home Details

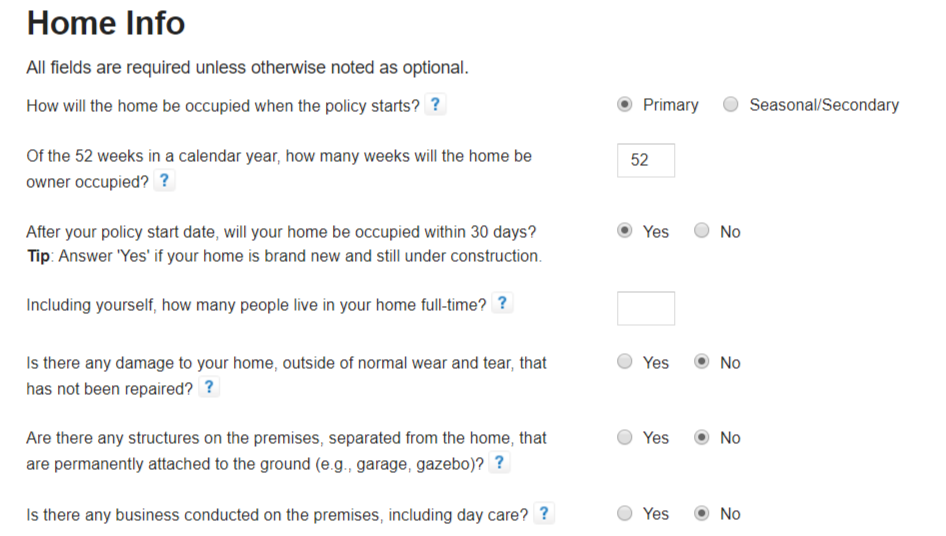

You are prompted to provide basic home information on the next page.

This section gets slightly more detailed with an emphasis on potential savings.

The final category in this section covers some basic insurance history of your home.

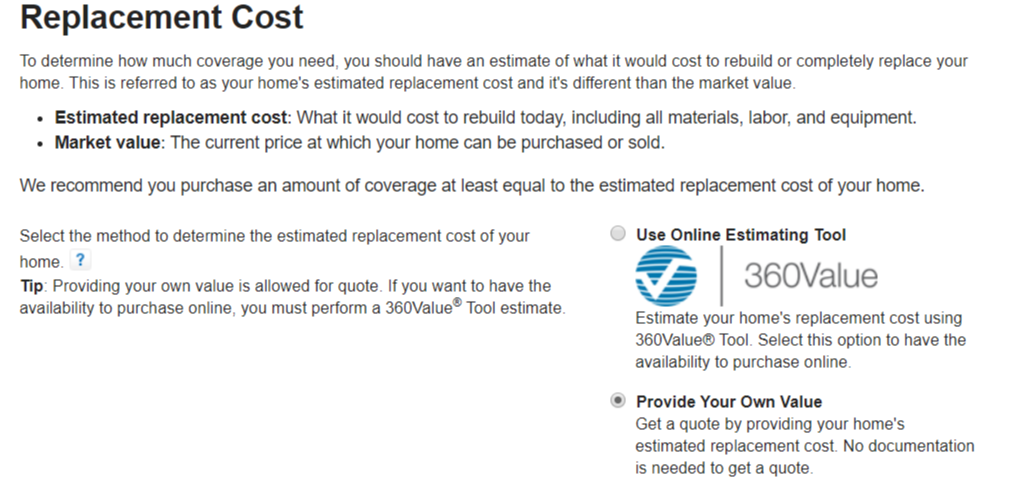

Step Five: Calculate Replacement Cost

The next page gives the option of either use a home value estimator tool to better calculate the value of your home or to provide your own estimated value.

The assistance tool for estimating the value of your home will help you get a more accurate estimate when you complete the online quote process. It is not a necessary step, but one that can increase your quote’s accuracy. With the most accurate quote, you can get the best idea of State Farm can assist you as your home insurance provider.

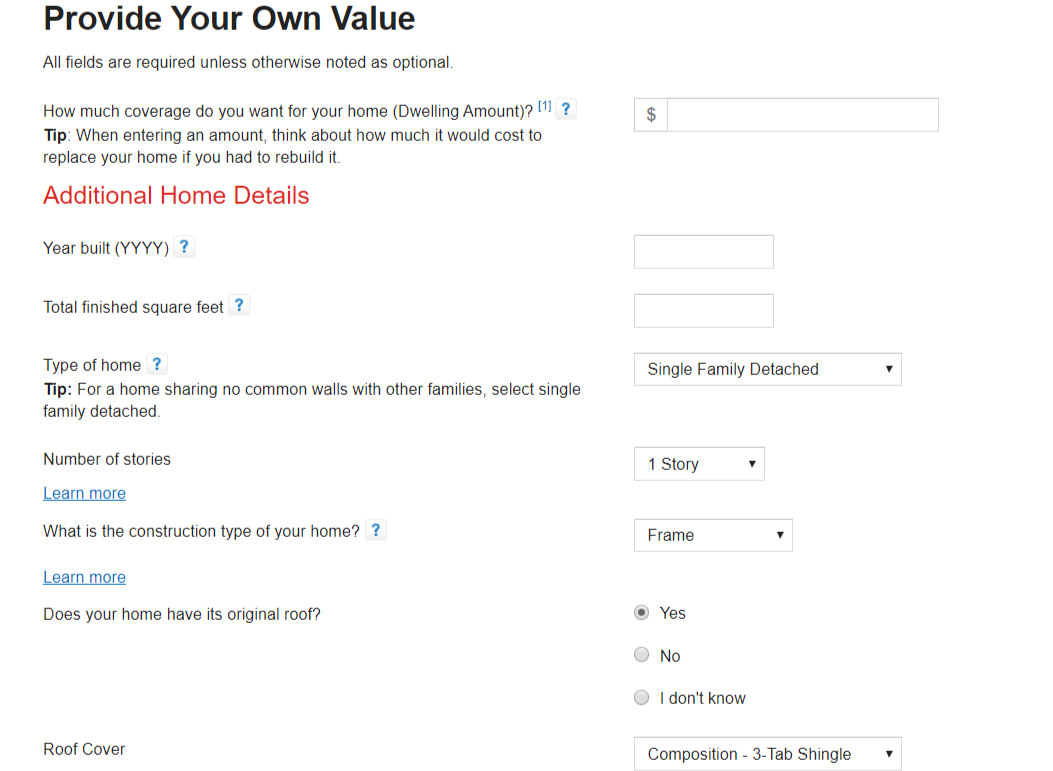

Step Six: Add Final Home Details

When choosing to provide your own estimated replacement cost for your home, you are redirected to another round of basic questions regarding your home history.

The home info proceeds to a second page that gathers information about plumbing, electrical, heating, and roofing.

Step Seven: Get Your Quote

The final step is actually not much of a step at all. It consists of receiving your online quote with no wait time. An estimated quote is given immediately based on the information provided.

Once provided with your estimated quote, you can make a more educated decision about how much an insurance policy from State Farm will run you on a monthly basis. It also gives you a better idea of the types of discounts they offer and how much coverage you will be able to afford.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

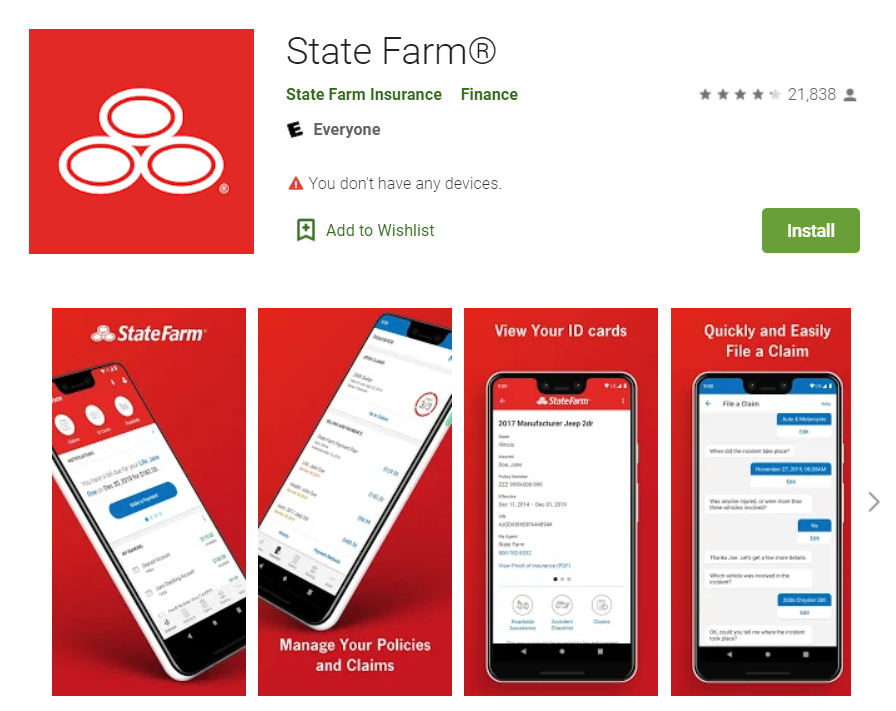

Design of Website/App

From 2013 to 2015, State Farm fell behind its competitors on mobile phone-based apps and services for its policyholders. But, as mentioned previously, in 2017 the company rebounded and made drastic improvements to mobile tools, including a depreciation calculator and an option to pay annual premiums online.

The website design is clean with plenty of negative space and limited writing on the wall. This offers a direct message on each page, which is necessary for a company with so many divisions.

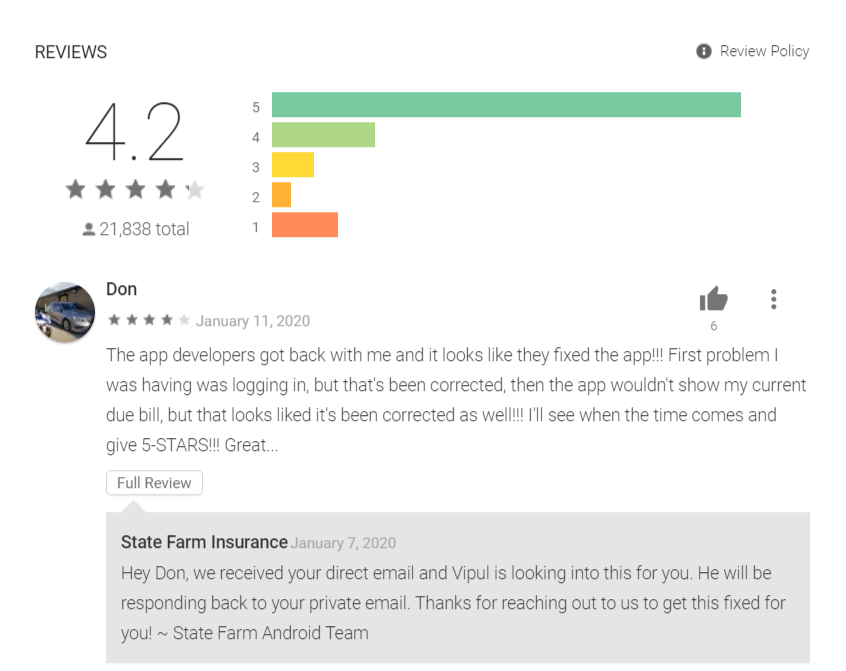

The mobile State Farm app allows customers to file and manage claims, access ID cards, upload photos and documents, contact an agent, access accounts, view and manage insurance policies, and pay insurance premiums.

As seen on Google Play store, State Farm seems committed to the mobile game with an overall positive response to their mobile app for its ease of function.

State Farm’s direct responses to customers on the rating message board evince an increased level of care and attention.

Pros and Cons

We have included a nice table of pros and cons to sum it all up and help you better weigh your options.

| Pros | Cons |

|---|---|

| State Farm has incredible financial stability so no worries about your investment in your home investment. | State Farm's large size allows it to operate with impunity. No competition means price hikes and alterations can occur with little effect to State Farms overall profit gain. |

| Personalized agents dedicated only to State Farm offer that "good neighbor" feel they always rave about. | Fear of getting lost in the shuffle at such a large corporation. |

| Rates are significantly less or equal to competitor prices. | Rates and price hikes can alter as in 2017 based on the company's long term plans. In the short term, you may lose financially speaking. |

We might have made up our mind about State Farm as a respected home insurance provider, but we will let you decide on your own.

The Bottom Line

State Farm has made it to the top by offering superior customer service, complete package policy offerings, and quick responses to claims.

Their size allows them to offer competitive rates that only get better the higher your coverage goes. The company website offers plenty of information and convenient tools, including noteworthy informational articles and community involvement programs.

Most of all, we get the feeling that State Farm’s “like a good neighbor” slogan is genuine. Their customer service is top-notch and their charitable programs and volunteer efforts extend to helping out communities in need.

Moreover, if you decide State Farm isn’t for you, there are no cancellation fees and the process of canceling is simple.

If you are as ready as we are to make State Farm your neighborly insurance provider of choice, then take the next step and get a detailed estimate of your potential monthly rate with our free online quote option. Just type in your ZIP code below, and we will guide you through the rest. It is that easy.

Frequently Asked Questions

What is State Farm Homeowners Insurance?

State Farm Homeowners Insurance is a type of insurance policy that provides coverage for individuals who own a home. It offers financial protection in case of damage or loss to your house and its contents, as well as liability coverage for accidents that occur on your property.

What does State Farm Homeowners Insurance cover?

State Farm Homeowners Insurance typically covers damage caused by fire, windstorms, lightning, hail, theft, vandalism, and certain types of water damage. It may also provide liability coverage if someone is injured on your property and you are found legally responsible.

How can I get a quote for State Farm Homeowners Insurance?

You can get a quote for State Farm Homeowners Insurance by visiting their website or contacting a State Farm agent. They will ask you a series of questions about your property and personal circumstances to provide you with an estimate of the cost.

Can I customize my State Farm Homeowners Insurance policy?

Yes, State Farm offers various coverage options that you can customize to fit your specific needs. You can choose the level of coverage for your dwelling, personal property, liability, and additional endorsements or riders to add extra protection.

How is the cost of State Farm Homeowners Insurance determined?

The cost of State Farm Homeowners Insurance depends on several factors, including the location and size of your home, the age and condition of the property, the coverage limits you choose, your deductible amount, your claims history, and other personal factors.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.