Top Term Life Insurance Coverage: What You Need to Know [2026]

The top term life insurance coverages protect your family at a lower cost than whole life insurance policies. The cheapest companies are Minnesota Life and Mass Mutual, where term life insurance for 25-year-old nonsmokers can be as low as $8/mo, and policyholders can later convert to a whole life policy.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Imani Francies is a finance and insurance writer who has strong media and communication skills with a bachelor's degree from Georgia State University. She began her writing career freelancing with various blogs and internships while working full-time as an early childhood educator. She has significant experience in both print and online media as a writer, editor, and author. She works efficient...

Imani Francies

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Updated March 2024

- Term life insurance only lasts a predetermined amount of time, such as 10 years

- Term life insurance policies are cheaper than other types of life insurance

- Policyholders have the option to convert term life to whole life insurance

Deciding to purchase life insurance is an important decision that can help you protect your family for the future. However, with the different types of life insurance policies and companies out there, the decision can feel impossible. (For more information, read our “Top Family Life Insurance: What You Need to Know“).

This complete guide to the top term life insurance coverage will cover why term life insurance’s basic terms could be a great policy option for you. Once you are ready to look for term life coverage, you can use our free quote comparison tool to find cheap term life insurance coverage.

Top Term Life Insurance Companies by Market Share

If you need help looking for a good term life insurance company, you can start with the top 10 companies by market share, according to the National Association of Insurance Commissioners (NAIC):

Top 10 Life Insurance Companies by Market Share

| Rank | Companies | Direct Written Premium | Market Share |

|---|---|---|---|

| 1 | Northwestern Mutual | $10,517,115,452 | 6.42% |

| 2 | Metropolitan Group | $9,821,445,953 | 6.00% |

| 3 | New York Life | $9,295,848,300 | 5.68% |

| 4 | Prudential | $9,128,805,060 | 5.57% |

| 5 | Lincoln National | $8,769,303,174 | 5.36% |

| 6 | MassMutual | $6,854,713,057 | 4.19% |

| 7 | Aegon/Transamerica | $4,809,856,650 | 2.94% |

| 8 | John Hancock | $4,640,905,017 | 2.83% |

| 9 | State Farm | $4,633,004,963 | 2.83% |

| 10 | Minnesota Mutual | $4,422,100,028 | 2.70% |

You can see some of our choices below.

- Allstate – Offers term life insurance that you can choose to bundle with auto, home, renters, or any other type of policy they offer

- New York Life – Strong financial ratings with almost two centuries of service to their customers

- Northwestern Mutual – Rated highly by customers on the J.D. Power rating scale

- State Farm – Life insurance with level premiums and an equal death benefit on their term life

These companies are sure to have a term life policy that is exactly what you need.

Read more:

- Top Life Insurance Coverage: What You Need to Know

- Best Life Insurance Policies for Smokers

- Understanding Guaranteed Life Insurance

- How much life insurance coverage do you need?

Average Monthly Life Insurance Rates

When it comes to what is the best term life insurance rates with any policy, it isn’t overly complicated. The table below shows the average monthly rates for top life insurance companies.

Average Monthly Term Life Insurance Rates for Non-Smokers by Age – $100,000 / 10-Year Term

| Non-Smoker Age & Gender | Prudential | Lincoln National | MassMutual | Aegon/ Transamerica | John Hancock | State Farm | Minnesota Life |

|---|---|---|---|---|---|---|---|

| 25-Year-Old Female | $12.25 | $9.46 | $8.36 | $9.89 | $8.78 | $12.44 | $7.04 |

| 25-Year-Old Male | $13.83 | $9.46 | $9.23 | $11.27 | $9.64 | $14.27 | $7.37 |

| 30-Year-Old Female | $12.25 | $9.46 | $8.53 | $9.72 | $8.78 | $13.14 | $7.04 |

| 30-Year-Old Male | $13.92 | $9.46 | $9.23 | $10.06 | $9.64 | $14.70 | $7.37 |

| 35-Year-Old Female | $12.25 | $9.56 | $8.88 | $10.66 | $8.78 | $14.44 | $7.15 |

| 35-Year-Old Male | $13.92 | $9.56 | $9.31 | $11.09 | $9.64 | $15.23 | $7.48 |

| 40-Year-Old Female | $13.30 | $9.94 | $10.10 | $12.47 | $9.45 | $15.49 | $8.14 |

| 40-Year-Old Male | $15.67 | $10.61 | $10.53 | $13.33 | $10.63 | $16.36 | $8.25 |

| 45-Year-Old Female | $16.28 | $12.69 | $11.58 | $14.02 | $11.54 | $20.71 | $10.01 |

| 45-Year-Old Male | $17.68 | $14.53 | $12.97 | $15.65 | $13.10 | $20.79 | $11.00 |

| 50-Year-Old Female | $21.27 | $15.95 | $14.62 | $17.46 | $14.80 | $23.49 | $12.65 |

| 50-Year-Old Male | $21.88 | $20.74 | $16.97 | $20.21 | $15.81 | $26.54 | $14.74 |

| 55-Year-Old Female | $23.80 | $21.50 | $20.28 | $25.89 | $19.58 | $29.67 | N/A |

| 55-Year-Old Male | $28.18 | $27.66 | $24.10 | $30.10 | $22.44 | $34.45 | N/A |

| 60-Year-Old Female | $29.49 | $29.84 | $28.19 | $36.98 | $27.30 | $40.98 | N/A |

| 60-Year-Old Male | $37.72 | $39.03 | $35.50 | $42.66 | $35.15 | $51.50 | N/A |

| 65-Year-Old Female | $41.13 | N/A | $42.64 | $59.94 | $37.74 | $59.51 | N/A |

| 65-Year-Old Male | $58.45 | N/A | $61.68 | $71.29 | $55.74 | $83.09 | N/A |

Read more:

- Massachusetts Mutual Life Insurance Company Review

- Minnesota Life Insurance Company Review

- The Lincoln National Life Insurance Company Review

You should work on prolonging your life to the best of your ability. If you smoke, compare how much higher you’ll pay for a term life policy.

Average Monthly Term Life Insurance Rates for Smokers by Age – $100,000 / 10-Year Term

| Smoker Age & Gender | Prudential | Lincoln National | MassMutual | Aegon/ Transamerica | John Hancock | State Farm | Minnesota Life |

|---|---|---|---|---|---|---|---|

| 25-Year-Old Female | $20.65 | $18.64 | $17.41 | $15.05 | $21.47 | $19.14 | $13.97 |

| 25-Year-Old Male | $25.90 | $23.19 | $20.02 | $17.37 | $25.93 | $22.19 | $16.60 |

| 30-Year-Old Female | $21.35 | $19.38 | $18.54 | $15.65 | $23.06 | $21.05 | $14.77 |

| 30-Year-Old Male | $26.87 | $23.44 | $21.15 | $17.46 | $27.45 | $23.23 | $17.74 |

| 35-Year-Old Female | $22.23 | $20.48 | $20.45 | $17.97 | $24.81 | $23.32 | $15.34 |

| 35-Year-Old Male | $27.57 | $23.81 | $23.49 | $20.30 | $29.09 | $24.36 | $18.54 |

| 40-Year-Old Female | $27.39 | $26.26 | $25.76 | $25.20 | $29.61 | $28.71 | $20.14 |

| 40-Year-Old Male | $35.00 | $32.91 | $29.59 | $29.93 | $35.72 | $31.32 | $23.23 |

| 45-Year-Old Female | $39.12 | $39.92 | $33.67 | $33.28 | $35.63 | $35.76 | $29.18 |

| 45-Year-Old Male | $46.38 | $43.41 | $40.03 | $41.02 | $44.29 | $40.98 | $36.39 |

| 50-Year-Old Female | $56.35 | $48.04 | $45.50 | $52.20 | $47.25 | $48.37 | $40.28 |

| 50-Year-Old Male | $63.62 | $65.37 | $56.82 | $65.45 | $63.86 | $56.81 | $52.17 |

| 55-Year-Old Female | $73.33 | $62.22 | $67.00 | $81.96 | $63.44 | $66.38 | N/A |

| 55-Year-Old Male | $91.62 | $92.14 | $86.14 | $103.11 | $93.43 | $79.87 | N/A |

| 60-Year-Old Female | $98.53 | $92.58 | $93.27 | $124.01 | $92.52 | $106.14 | N/A |

| 60-Year-Old Male | $133.09 | $144.29 | $130.07 | $156.69 | $153.91 | $124.58 | N/A |

| 65-Year-Old Female | $135.37 | N/A | $130.07 | $206.31 | $136.32 | $172.26 | N/A |

| 65-Year-Old Male | $200.03 | N/A | $196.63 | $252.32 | $256.29 | $196.45 | N/A |

Read more: Top Life Insurance Provider for Seniors

You should cut out at least some of the greasy food and hit the gym. Some term life insurance companies will even give you an extra benefit if they can tell that you’ve been putting in the effort to stay in shape.

Another example is to get a term life insurance no medical exam policy, where you will be given a flat rate not dependent on your health.

Read more:

- John Hancock Life & Health Insurance Company Review

- John Hancock Life Insurance Company (USA) Review

- Life Insurance Medical Exam: What to Expect

Factors That Affect Your Life Insurance Rates

If life insurers gave every customer the same flat premium every month, they would lose money before they ever had any. Instead, an underwriter will ask you questions and then use a term life insurance calculator to find your rates based on risk.

What affects your term life insurance quotes can be boiled down to a few common risk groupings. The more likely you are to die during the life of the policy, the more likely you will have to pay higher premiums.

So buckle up, cut back on the risky behavior, and hit the gym for the best rates you can get.

Compare Insurance Providers Rates to Save Up to 75% Secured with SHA-256 Encryption

Term Life Insurance Coverage

First, you’re probably wondering, what is term life insurance? Often referred to as pure life insurance, term life guarantees a predetermined premium for a predetermined number of decades. The longer the policy, the more you can expect to pay for your life insurance coverage.

With your level term life insurance premium rates, you know exactly how much your family will be receiving as long as you make your premium payments and meet your policy’s requirements. (For more information, read our “Understanding Level Term Life Insurance: What is it and how does it work?“).

Key Terms

As with all legal contracts, there are a lot of words that only lawyers use to mean simple things.

- Insurability – How an insurer determines if you will be accepted into the policy

- Term – A period of time in which your policy covers your death

- Premium – What you pay each month to maintain your coverage

- Guaranteed Level – Guarantees that your premiums and death benefit will be the same for the length of your policy

- Return of Premiums – This allows you to get a portion of your premiums back if you outlive your policy.

Before you get wrapped up in the red tape, it’s a good idea to familiarize yourself with these terms.

Insurability

Your insurability is how much financial risk the insurer will take on during your policy. The more likely the insurance company is to have to pay out the death benefit, the more you will have to pay to cover that risk.

An insurer will determine your rates through a process called underwriting. An underwriter will look at the different risk factors in your life such as your current health and habits.

With term life, your coverage will expire if you outlive the term. If you were to decide to purchase another policy, your insurability would automatically be worse than when you signed up.

Term Length

The term of your policy is how long you’ll continue to have coverage. It is usually a number of decades that depend on your insurability.

If your policy runs out and you have to buy a new one, your rates will automatically be higher. As discussed previously, a renewable or convertible policy allows you to further your coverage while saving on your premiums.

Premiums

A premium is a monthly payment you make for the life of your policy. These vary from person to person depending on your life. If your policy expires, you will lose out completely on everything you paid into the policy.

Guaranteed Level

If your insurer tells you that your premiums are guaranteed level, you can expect your death benefit and premiums to be equal for the life of your policy.

Guaranteed level term policies are the easiest way to get coverage for a period of your life.

Return of Premium

If you don’t like the idea of losing out on your investment when your policy expires, you can get a portion of your premiums back with this additional rider. The best return of premium life insurance policy will allow you to get a portion back. (For more information, read our “Understanding Return of Premium Life Insurance“).

It won’t be anywhere near your death benefit or what you paid, but it’s a good idea for those who don’t like the idea of losing out entirely on their investment.

How Term Life Insurance Works

With a term life policy, you pay your premiums every month to ensure your coverage for the duration of your policy. It is regarded as the most hassle-free option for life insurance.

Unlike with whole life, there is no cash value. Because of this, your premiums will be much cheaper, though you lose out more on your investment.

Term life is perfect for preparing to take care of your family or any situation that would suffer if you were to pass away.

Readmore: Understanding Direct Term Life Insurance

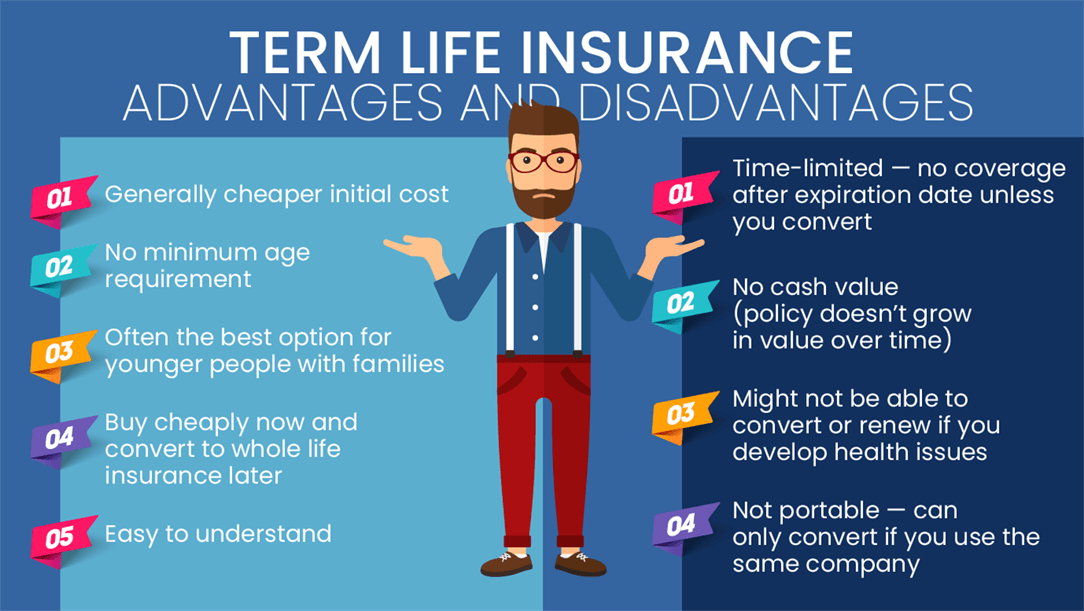

So, overall, it doesn’t get much more basic than a traditional term life policy. To recap, here are some advantages and disadvantages when considering term life insurance.

Now that you know the advantages and disadvantages of a term life policy, let’s talk about who should buy term life insurance.

Read more: How to Buy Life Insurance

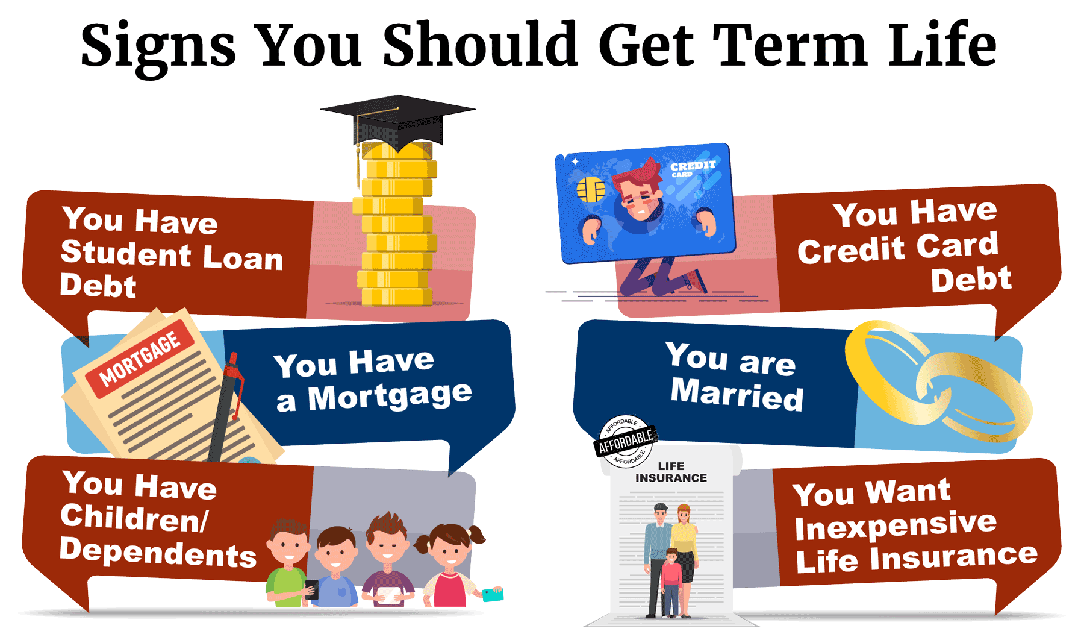

Who Should Buy Term Life Insurance

Term life can help with a variety of different situations in your life.

- New families will find term life ideal for securing their new family’s future should anything happen to either provider

- Young adults will automatically pay less than if they waited until they were 35 and decided they really need it

- Retirees will find term most ideal for setting up an inheritance or trust for children or grandkids

- Business owners, especially those early in their professional life, will find that the death benefit can keep their business afloat during the leadership transition

If you don’t fit into one of these categories, don’t worry. The good thing about term life is that almost everyone can find a use for it. The graphic below lists some reasons why you should buy term life insurance.

The hassle-free coverage may allow for less investment for you, but it will save a lot of confusion down the line.

Types of Term Life Insurance Policies

Term life is actually a general name for a variety of policies that last for a term. There are a number of term life policies that allow you to customize your coverage to your lifestyle. Here are a few:

Level Term Life Insurance

A traditional term life policy will allow for guaranteed level premiums and death benefits. However, while it offers equal coverage and payments, you lose out 100 percent of your investment.

As discussed previously, this policy can be used by almost anyone.

Increasing Term Life Insurance

With an increasing term policy, your death benefit will increase at a steady rate as you achieve more success in your personal life. This is great for younger people who expect that their future is headed in a successful direction.

That being said, the whole purpose of understanding life insurance is being aware of life’s uncertainty. That is also something to consider with an increasing term policy.

Decreasing Term Life Insurance

What is decreasing term life insurance? Like the increasing term policy, the decreasing term changes as the policy goes on. The death benefit and premiums will decrease in value until the end of the term when they will be virtually nothing. (For more information, read our “Understanding Decreasing Term Life Insurance“).

This policy is designed for those with families that will need less coverage as time goes on. As children age and leave the house, they will provide for themselves instead of relying on you.

However, what you save on premiums could be used to invest and provide your own coverage so you no longer need the death benefit.

Renewable Term Life Insurance

What happens if I outlive my term life insurance? With a term life policy, your coverage will run out when the term expires. This is the one downside of term life insurance vs whole life. When you apply for a new policy, you’ll find that you will have to pay much more for the same coverage you had before.

That’s why insurers created the renewable term life policy to allow you to know exactly how much you’ll have to pay to continue your coverage. The rates usually increase each renewal at a steady rate until a certain age.

Read more: Annual Renewable Term Life Insurance: What It Is and How It Works

Convertible Term Life Insurance

A convertible term policy offers the coverage and confidence of term with the option to switch to a permanent policy later in life. With this policy, your rates will be the same when you switch to whole life as they would have been the day you signed up for the term policy.

That makes this an option to consider if you’re worried about proving insurability along the line. Below is a simplified breakdown of the policy type’s benefits as well as its detractions.

Pros & Cons of Term Life Policies by Type

Pros & Cons of Term Life Policies by Type

| Term Life Policy Types | Pros | Cons |

|---|---|---|

| Level | Simple, hassle-free coverage for a period of your life | No potential for additional wealth If you outlive the policy, you will have no protection |

| Renewable | Lets you continue your coverage at a slightly increasing rate | Ends at a certain age, at which point you won’t be eligible for any policy |

| Increasing | The death benefit increases over time to give you more coverage | Your premiums also increase each month |

| Decreasing | Your premiums and coverage decrease over time, making it more affordable | If something happens and you need more coverage, you’ll be out of luck |

| Convertible | This policy offers the option to convert to a whole life policy at the same rate as the day you signed up | There may be special qualifications you have to meet that aren’t immediately noticeable, so make sure you know the specifics of your policy |

As you can see, each policy type has perks, but there are also negatives to consider when deciding which policy is right for you.

Should I convert my term life insurance to whole life? The answer depends heavily on your life and what you are looking for in a policy. (For more information, read our “Term vs Whole Life Insurance: Which is better?“).

Shopping for Term Life Insurance Quotes

There are a lot of things to consider when you purchase a new life insurance policy. You should look at your current life and circumstances. If you have any bad habits, bad health, or anything else that is a risk to your life, you should try to minimize that before you apply.

Most life insurance companies or individuals sell term life insurance like Dave Ramsey. You can buy life insurance online, or at least start the process, right here on this page by clicking on the quote tool.

Read more: Is buying life insurance worth the cost?

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Changing Your Term Life Insurance Policy

During the life of your term policy, you may feel the need to change your policy to more permanent coverage so that your investment doesn’t go to waste.

Converting Your Term Life Insurance

With a policy that has a conversion option built-in, you will have the ability to convert to permanent life insurance after a certain point as long as you have paid your premiums. You won’t have to choose term life insurance versus convertible life insurance.

This is an appealing option because your whole life rates will be the same as they were when you first applied for your term life policy. This will translate into untold savings. So, in that sense, when you think of which is better, term or whole life insurance, the answer is term. (For more information, read our “Term vs Permanent Life Insurance: Which is better?“).

Pros & Cons of Term Life Insurance

Like all life insurance policies, there are positives and negatives to this type of life insurance.

Pros & Cons of Term Life Insurance

| Pros | Cons |

|---|---|

| Affordable and simple coverage for most families | If the policy runs out and you die before you get a new one, you will lose your coverage. |

| Good sized death benefit during the policy | No ability to earn cash value |

| Sometimes option to renew at a slightly increasing rate | After a certain age, once your policy runs out you have no option for future coverage |

If you need coverage for only a certain time in your life and you don’t mind losing out on your investment, you would find a term life policy just right for you.

Term Life Insurance: The Bottom Line

Getting a life insurance policy is imperative if you want to make sure that your family’s future is covered no matter what. With a term life insurance policy, you can have coverage for just as long as you need it with some options to convert.

If you would like to cover a specific period of time in your life, such as a budding young family or new business, or you just want to plan ahead for the inevitable rising costs of final expenses like funerals, you will find a term life insurance would be perfect for your family and livelihood.

We hope this life insurance guide was helpful. Ready to find your term life insurance policy? Use our FREE quote tool to find your term life insurance rates.

Frequently Asked Questions

What is term life insurance?

Term life insurance is a type of life insurance policy that provides coverage for a specific period, known as the term. If the insured person passes away during the term, the policy pays out a death benefit to the beneficiaries.

How does term life insurance work?

With term life insurance, you pay regular premiums for the duration of the policy’s term. If you pass away during this time, your beneficiaries receive the death benefit.

What are the advantages of term life insurance?

Term life insurance offers affordable premiums, flexibility in choosing the term length, and the ability to customize coverage to suit your specific needs.

Who should consider buying term life insurance?

Term life insurance is ideal for individuals who want coverage for a specific period, such as parents with young children, individuals with mortgage or debt obligations, and business owners looking to protect their business interests.

Can I convert my term life insurance to a permanent policy?

Many term life insurance policies offer the option to convert to a permanent policy without the need for additional underwriting.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.