Cheapest Auto Insurance for Motorcycles in 2026 (Save With These 10 Companies!)

Identify what are the cheapest motorcycles to insure, focusing on the best companies like Erie, USAA, and State Farm. Discover the reasons these providers are considered the most affordable for securing dependable motorcycle insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Dorothea Hudson has been professionally writing in many spheres since 2013. She has written on entertainment, insurance, finance, travel, technology, AI, renewable energy, crypto, fundraising, and real estate for many websites. Her work has been published for British retailer Marks and Spencer, Kroger Magazine, the Vision Group, and more. Her passions include writing, music, running, travel, te...

Dorothea Hudson

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Updated February 2024

Company Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Navigate the cheapest auto insurance companies for motorcycles with Erie, USAA, and State Farm. We delve into key factors influencing insurance premiums, from the type of motorcycle to the rider’s age and driving record. Erie emerges as the perfect balance between cost-effectiveness and comprehensive protection.

There is a wide range of factors that determine how cheap or expensive your motorcycle insurance will be. But here’s the standard rule among insurance companies: the less power your bike has, the cheaper it will be to insure. This article focuses on the cheapest motorcycles to insure.

Our Top 10 Best Companies: Cheapest Insurance For Motorcycles

| Company | Rank | See Pros/Cons | Monthly Rates | Multi-Policy Discount | "Best For" |

|---|---|---|---|---|---|

| #1 | Erie | $22 | Up to 20% | Competitive Rates | |

| #2 | USAA | $22 | Up to 15% | Customer Service | |

| #3 | State Farm | $33 | Up to 18% | Customizable Policies | |

| #4 | Progressive | $39 | Up to 25% | Accident Forgiveness | |

| #5 | American Family | $44 | Up to 22% | Multi-Policy Discounts | |

| #6 | Nationwide | $44 | Up to 20% | Bundling Discounts |

| #7 | Esurance | $49 | Up to 17% | Various Discounts | |

| #8 | Farmers | $53 | Up to 19% | Customizable Coverage | |

| #9 | Allstate | $61 | Up to 21% | Vanishing Deductible | |

| #10 | Liberty Mutual | $68 | Up to 16% | Online Convenience |

Of course, your insurance company must consider many other factors before you will know what your bottom line is when it comes to buying the cheapest insurance for motorcycles. Therefore, understanding what an auto insurance company considers when they determine your premiums will help you to make a better decision about your motorcycle choice. We also have a handy article, “Who are the best insurance companies?“, that allows you to compare insurance companies by financial strength ratings and the affordable price of products offered.

In this article, we’ll cover all of those topics. In the frequently asked question section, we’ll the cheapest sportbikes to insure, how to get cheap motorcycle insurance, and general motorbike insurance and motorcycle insurance topics. So read on to learn what you need to know to get the lowest possible motorcycle insurance rates. You can also begin shopping rates for your motorcycle by comparing prices across providers. Start by entering your ZIP code into our free insurance comparison tool.#1 – Erie Insurance: Competitive Affordability Leader

Erie Insurance emerges as a competitive affordability leader, offering budget-friendly motorcycle insurance without compromising on coverage.Jeff Root Licensed Life Insurance Agent

Pros

- Competitive rates: Erie offers some of the most competitive rates in the motorcycle insurance market.

- Safe rider discount: Customers can benefit from a Safe Rider discount of up to 15%.

- Multi-policy discount: Erie provides a Multi-policy discount of up to 20%.

Cons

- Limited discounts: While competitive, Erie may not offer as many discounts as some other providers.

- Coverage options: Some users may find the range of customizable coverage options less extensive compared to other companies.

Read more: Erie Insurance Review & Ratings

Free Motorcycle Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Service Excellence Champion

Pros

- Customer service: USAA is renowned for its exceptional customer service in the insurance industry.

- Multi-policy discount: Customers can enjoy a Multi-policy discount of up to 15%.

- Safe rider discount: USAA offers a Safe Rider discount of up to 10%.

Cons

- Membership requirement: USAA is available only to military members and their families, limiting eligibility.

- Limited physical presence: The company’s physical branches are not widely distributed, potentially affecting accessibility for some customers.

Read more: USAA Insurance Review & Ratings

#3 – State Farm: Tailored Policy Pioneer

Pros

- Customizable policies: State Farm stands out with highly customizable motorcycle insurance policies.

- Multi-policy discount: Customers can benefit from a Multi-policy discount of up to 18%.

- Safe rider discount: State Farm offers a Safe Rider discount of up to 12%.

Cons

- Premium costs: Some users may find State Farm’s premiums slightly higher than competitors.

- Limited online presence: The online interface may not be as robust as some other insurance providers.

Read more: State Farm Insurance Review & Ratings

#4 – Progressive: Forgiving Coverage Innovator

Pros

- Accident forgiveness: Progressive provides an Accident Forgiveness feature for motorcycle insurance.

- Multi-policy discounts: Customers can enjoy Multi-policy discounts of up to 25%.

- Wide range of coverage: Progressive offers a comprehensive range of coverage options for motorcycle insurance.

Cons

- Premiums may increase: While the Accident Forgiveness feature is beneficial, premiums may increase after an accident.

- Not available everywhere: Progressive may not be available in all locations, limiting accessibility.

Read more: Progressive Insurance Review & Ratings

Free Motorcycle Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Discount Diversity Leader

Pros

- Multi-policy discounts: American Family offers significant Multi-policy discounts of up to 22%.

- Coverage options: The company provides a wide range of coverage options for motorcycle insurance.

- Safe rider discount: Customers can benefit from a Safe Rider discount of up to 18%.

Cons

- Geographical limitations: American Family’s services may not be available nationwide, potentially limiting accessibility.

- Online experience: Some users may find the online experience less user-friendly compared to other providers.

Read More: American Family Insurance Review & Ratings

#6 – Nationwide: Bundling Advantage Provider

Pros

- Bundling discounts: Nationwide offers attractive discounts for bundling motorcycle insurance with other policies.

- Safe rider discount: Customers can benefit from a Safe Rider discount of up to 15%.

- Coverage options: Nationwide provides a variety of coverage options for motorcycle insurance.

Cons

- Limited online features: The online platform may lack some of the features offered by competitors.

- Average customer service: While decent, Nationwide’s customer service may not be as exceptional as some other providers.

Read more: Nationwide Insurance Review & Ratings

#7 – Esurance: Online Convenience Specialist

Pros

- Various discounts: Esurance offers a variety of discounts, making it easier for customers to save on premiums.

- Multi-policy discount: Customers can enjoy a Multi-policy discount of up to 17%.

- Online convenience: Esurance provides a user-friendly online platform for easy policy management.

Cons

- Limited physical presence: Esurance may lack physical branches, affecting customers who prefer in-person interactions.

- Coverage options: Some users may find Esurance’s coverage options less extensive compared to other providers.

Read more: Esurance Insurance Review & Ratings

Free Motorcycle Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers Insurance: Tailored Coverage Customizer

Pros

- Customizable coverage: Farmers Insurance stands out with highly customizable motorcycle insurance coverage.

- Multi-policy discount: Customers can benefit from a Multi-policy discount of up to 19%.

- Safe rider discount: Farmers Insurance offers a Safe Rider discount of up to 16%.

Cons

- Premium costs: Some users may perceive Farmers Insurance premiums as higher compared to competitors.

- Online experience: The online platform may not offer the same level of convenience as some other providers.

Read more: Farmers Insurance Review & Ratings

#9 – Allstate: Deductible Magic Specialist

Pros

- Vanishing deductible: Allstate provides a unique Vanishing Deductible feature for motorcycle insurance.

- Multi-policy discount: Customers can enjoy a Multi-policy discount of up to 21%.

- Safe rider discount: Allstate offers a Safe Rider discount of up to 17%.

Cons

- Higher premiums: Allstate’s premiums may be higher compared to some other motorcycle insurance providers.

- Claims process: The claims process may be perceived as more bureaucratic compared to competitors.

Read more: Allstate Insurance Review & Ratings

#10 – Liberty Mutual: Digital Convenience Leader

Pros

- Online convenience: Liberty Mutual offers an online platform for convenient policy management.

- Multi-policy discounts: Customers can benefit from Multi-policy discounts of up to 16%.

- Usage-based insurance: Liberty Mutual may provide discounts for safe driving habits through its usage-based insurance program.

Cons

- Limited discounts: Liberty Mutual may not provide as many discounts as some other insurance providers.

- Coverage options: Some users may find the coverage options less flexible compared to competitors.

Read more: Liberty Mutual Review & Ratings

Free Motorcycle Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

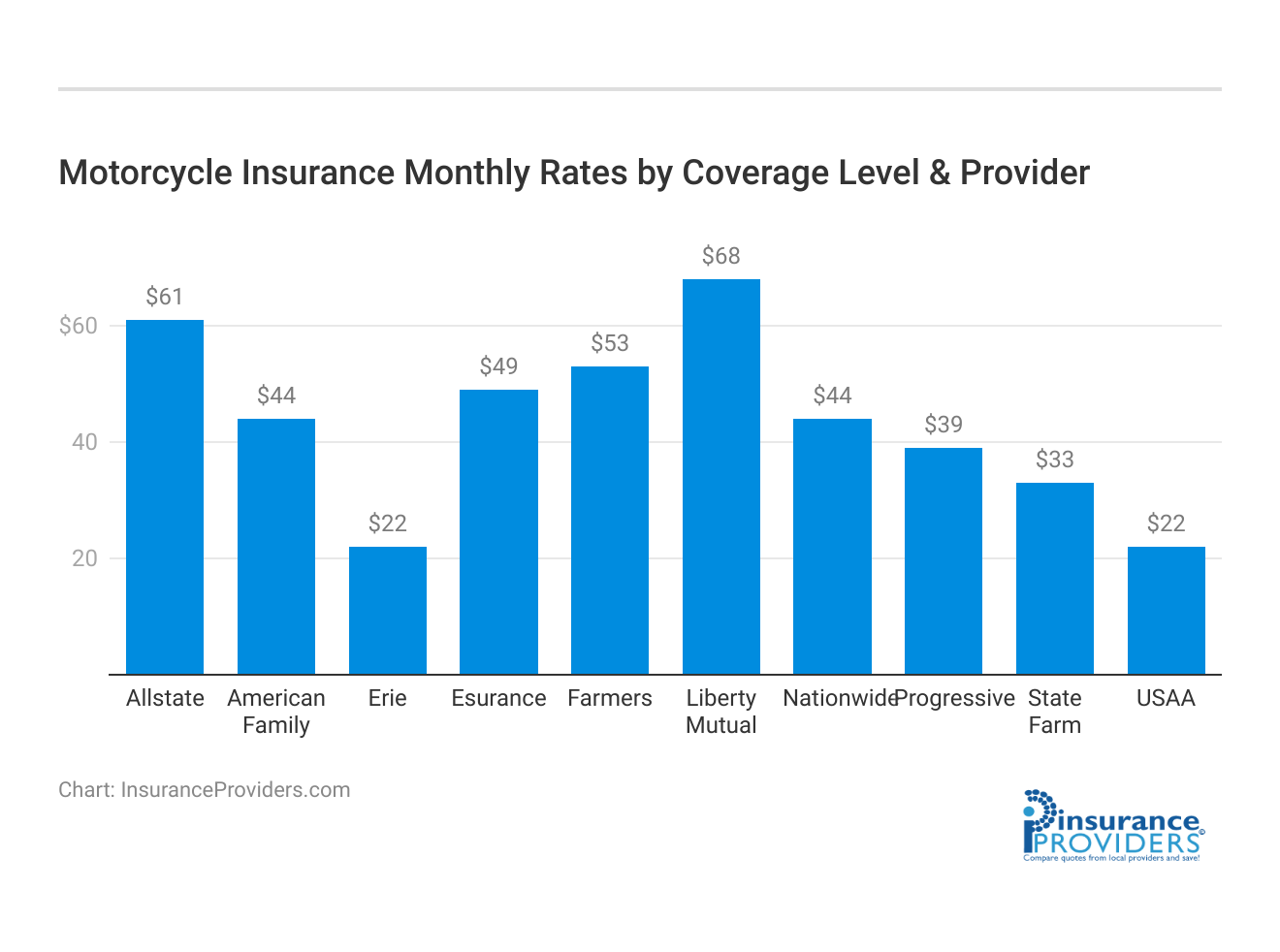

How much is auto insurance for motorcycles?

Navigating motorcycle insurance options involves striking a balance between affordability and coverage. This analysis dissects average monthly rates for the cheapest plans, whether you prioritize minimum legal coverage or seek the comprehensive protection of full coverage. Explore these insights for a concise overview of tailored motorcycle insurance options.

Average Monthly Auto Insurance Rates for Cheapest Insurance For Motorcycles

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Erie | $22 | $58 |

| USAA | $22 | $59 |

| State Farm | $33 | $86 |

| Progressive | $39 | $105 |

| American Family | $44 | $117 |

| Nationwide | $44 | $115 |

| Esurance | $49 | $128 |

| Farmers | $53 | $139 |

| Allstate | $61 | $160 |

| Liberty Mutual | $68 | $174 |

When it comes to minimum coverage, Erie and USAA stand out as the most budget-friendly options, offering plans at a mere $22 per month. State Farm follows closely at $33, providing a slightly higher level of coverage at an affordable rate. These rates represent the baseline protection required by law, ensuring riders meet legal requirements without breaking the bank.

For those prioritizing cost-effectiveness while meeting essential coverage needs, Erie and USAA emerge as top contenders. Stepping up to full coverage provides a more comprehensive shield against potential risks. Progressive takes the lead in affordability for full coverage, offering it at $105 per month, closely followed by USAA at $109.

State Farm and Esurance also maintain competitive rates at $86 and $114, respectively. While Allstate and Liberty Mutual command higher premiums for full coverage at $160 and $174, they may attract riders seeking more extensive protection and additional benefits.

What kind of motorcycle insurance do you need?

Just like auto insurance, your state probably has minimum motorcycle insurance requirements that you must fulfill in order to drive legally. Usually, this consists of bodily injury liability insurance and property damage liability insurance. However, liability coverage is just the minimum, and it won’t pay for damages to your motorcycle or person if you cause an accident. If you want to protect your bike, it is highly recommended that you add collision insurance and comprehensive coverage to your motorcycle policy. Depending on the auto insurance company, there might also be a variety of additional coverage options you can consider adding, such as medical payments coverage, personal injury protection, and uninsured/underinsured motorist coverage.

What is the average cost of motorcycle insurance coverage?

The average cost of insurance coverage for a motorcycle in the United States is around $700 per year. However, what you pay will depend on a variety of personal factors, as well as which insurance provider you choose and how much coverage you buy. We’ll discuss some of these factors below.

Free Motorcycle Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How does the type of motorcycle affect the cost of insurance?

As mentioned above, the type of bike you have will affect your insurance rate. The less power your bike has, the less it will cost to insure. Sports bikes are the most expensive bikes to insure (read our “Which are the cheapest sport bikes to insure?” for more information) for two reasons. They have a lot of power and the expectation is that they will be used to race other bikes. This dramatically increases the risk of a motorcycle accident, which means the insurance company assumes that they are going to pay out a claim. In addition to having a lot of speed, sports bikes are considered by insurance companies as more difficult to handle. Again, this increases the risk of an accident to the driver of the bike; a risk that will be reflected in the cost of your premiums. Given these factors, it’ll be worth it to investigate what are the cheapest sportbikes to insure. While some people don’t consider sports bikes to be motorcycles, insurance companies do. All motorcycles and sports bikes are classified as motorcycles, so keep that in mind if you are considering a sports bike in the near future. If you are considering a bigger motorcycle with a lot of power, you will still pay more insurance than you would on a motorcycle with less power, but it will be less costly than a sports bike. Larger motorcycles offer more stability when riding, which reduces your risk when your drive. In addition, the insurance company isn’t going to assume that you are going to race your motorcycle if you purchase a large motorbike. Don’t assume that a Harley falls into this category; they make sports bikes as well. Essentially, if your motorcycle has the name sport in it, expect to pay more. Smaller motorcycles are usually the cheapest motorcycles to insure as long as they have small engines. Smaller engines mean less speed, which equates to less risk. Don’t confuse smaller motorcycles with scooters, scooters fall under a different category with the insurance company. Interestingly, if you were to purchase a Harley Davidson V-Rod, with its 122HP engine, you would pay much less for your annual insurance than if you purchased the Suzuki Hayabusar, which has a 1340cc engine (about 130HP). Even though they are close in engine power, the Suzuki can reach speeds of nearly 200 mph while the Harley can only reach a top speed of 114 mph. The weight and size of the Harley require more horsepower even to move and are too heavy to reach the higher speeds. This is a big reason why sports motorcycles and motorbikes are so expensive to insure; they can reach the speeds that equally powerful engines on larger bikes simply can’t hope to.

What other factors affect the cost of motorcycle insurance?

Getting a hard fast number on the average rate of motorcycle insurance is difficult. That is because there are so many factors the insurance company has to consider. Some people pay as little as $50 a month for insurance for their motorcycle while others pay $400 to $500 a month. Age of motorcycle: While the type of motorcycle you buy is important, the age of the bike is important too. Just like a car, the older your vehicle is, the less expensive it will be to insure. That is because the value is reduced and the amount the insurance company would have to pay to replace your bike reduces as well. The exception, of course, is if you purchase a classic motorcycle. If you get it registered as a classic and have it inspected and valued, then your insurance will probably be more expensive to reflect that value. Your age: Your rates are also determined by your age. The younger you are the more you will pay. If you are 18 you can expect to pay 2 to 3 times more than someone who is 25. A 25-year-old will pay more than a 35-year-old and after that the rates pretty much even out. Driving record: Your driving record will have a major impact on the premiums you pay. The insurance company already considers your motorcycle a risk. As long as your previous record indicates that your behavior increases the risk of an accident, they will charge accordingly. A clean driving record will do you wonders in terms of trying to find affordable insurance. Further, you may find it very difficult to get insurance at all if you have a lot of points on your license or have made any recent claims due to accidents that you have caused. Other factors that will impact your motorcycle insurance rates include your credit score, where you live, if you have a college degree, if you’re married, and if you have multiple vehicles insured with the company.

How can you keep your motorcycle insurance rates low?

Keeping your rates low is important but there are some things that may currently be out of your hands. For example, if you already have a bad driving record, you are simply going to have to wait that one out. Typically, it takes three years of good driving to have a noticeable impact on your rates. Your age is out of your hands as well. There are some things that you can do to keep your rates down: Buy security devices. If you haven’t already, buy security devices for your motorcycle. According to the National Traffic Safety Administration (NHTSA), motorcycles are three times more likely to be stolen. You will find that if you purchase anti-theft devices, you will get a lower rate. If you have a tracking device on your motorcycle, then your rates will be reduced further. Make room in your garage to park your bike. If you don’t have a garage, consider adding a storage shed to your home. The initial expense will be quickly overcome with the savings that you will get for parking your motorcycle indoors. Sometimes there is a deeper discount for parking in a brick building over other types of structures but not everyone has that option. Don’t forget your deductible. While you don’t want to scrimp on the amount of coverage that you purchase, the more the better is the general rule. You can increase your deductible to help negate some of that cost. Make sure, however, that your deductible is manageable. Take a course. Any Motorcycle Safety Foundation certified courses will also affect your rates positively as well. Check local driving schools and motorcycle shops to determine when the next available class is. Join a local motorcycle club. There are certain organizations that promote safe cycling and traveling in groups. If you are a member of some of these, some insurance companies will offer you a discount. According to the National Highway Traffic Safety Administration, over 98,000 people were involved in motorcycle accidents in 2009. Nearly 5,000 of those ended in the death of the person driving the motorcycle and 87,000 ended in injury to the person driving the motorcycle. 50% of those accidents were caused by the motorcyclist.

Free Motorcycle Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Auto Insurance on Motorcycles

Case Study 1: USAA’s Military Precision – John’s Secure Ride

John, a military veteran, sought motorcycle insurance that understood his unique needs. Choosing USAA, he found not just reliable coverage but also a tailored approach catering to military personnel. This case study showcases how USAA’s commitment to understanding its customers’ backgrounds leads to a secure and personalized insurance experience.

Case Study 2: Budget-Friendly Bliss – Sarah’s Choice with Erie Insurance

Sarah, a young professional on a tight budget, needed affordable motorcycle insurance without compromising coverage. Erie Insurance emerged as her solution, providing competitive rates and meeting her coverage needs. This case study highlights how individuals can secure reliable motorcycle insurance on a limited budget with providers known for cost-effective offerings.

Case Study 3: State Farm’s Adventure Tailoring – Mark’s Off-Road Experience

Mark, an adventurous motorcycle enthusiast, required coverage that accommodated his off-road journeys. State Farm’s tailored policies for riders like him provided the flexibility he needed. This case study illustrates how providers like State Farm go beyond traditional coverage to create personalized solutions for motorcycle enthusiasts with specific needs.

Case Study 4: Progressive’s Flexibility in the City – Lisa’s Dynamic Ride

Lisa, a city commuter, sought motorcycle insurance that adapted to her changing lifestyle. Progressive, known for its innovative and flexible coverage options, provided a plan that adjusted to Lisa’s evolving needs. This case study emphasizes how innovative insurance providers like Progressive can cater to diverse lifestyles, offering a level of adaptability that traditional plans may lack.

Frequently Asked Questions

What are the factors that determine motorcycle insurance premiums?

Several factors influence motorcycle insurance premiums, including the make and model of the motorcycle, the rider’s age and driving experience, the rider’s location, the motorcycle’s usage (commuting or recreational), the rider’s claims history, and the desired coverage options.

Are there specific motorcycles that tend to have lower insurance costs?

Yes, certain motorcycles generally have lower insurance costs due to various factors. These factors can include the motorcycle’s engine size, power output, repair costs, theft rates, and safety features.

Which types of motorcycles are typically cheaper to insure?

Generally, smaller and less powerful motorcycles tend to have lower insurance premiums. These can include lightweight motorcycles, scooters, mopeds, and cruisers with engines under 500cc. However, insurance rates may still vary based on other factors mentioned earlier.

Are there any specific motorcycle models known for having lower insurance rates?

While insurance rates can differ between insurance providers, some motorcycles have been reported to have relatively lower insurance costs. Examples include smaller sport bikes like the Honda CBR300R or Yamaha YZF-R3, entry-level cruisers like the Kawasaki Vulcan S, and popular scooters such as the Honda PCX150 or Vespa Primavera.

Do custom motorcycles or modified bikes have different insurance rates?

Custom motorcycles or bikes with modifications may have higher insurance rates than their stock counterparts. Customizations that increase the motorcycle’s value or performance can potentially affect the cost of repairs, replacement parts, and the overall risk profile, resulting in higher premiums.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.