What happens to debt when you die?

Curious about the fate of your debts after you pass away? Discover what happens to debt when you die and gain insight into the legal and financial implications. Uncover the posthumous consequences of debt in this informative article.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated September 2023

Dealing with the loss of a loved one can be a difficult and emotional time. Amidst the grieving process, there are also practical matters that need to be addressed. One such matter is what happens to the debt left behind by the deceased. Understanding the concept of debt after death is essential for both the family and the executor handling the estate. Let’s delve into this subject to gain a clearer understanding.

Understanding the Concept of Debt After Death

When it comes to financial matters, death can introduce a whole new set of complexities. One such complexity is the concept of debt after death. Legally speaking, debt after death refers to any outstanding financial obligations that a person had before passing away. It encompasses a wide range of debts, including credit card debt, mortgage debt, student loan debt, auto loan debt, and more. These debts can vary in size and impact, leaving loved ones grappling with the aftermath.

It’s important to note that debt after death does not automatically transfer to the deceased person’s family or loved ones. Instead, it becomes a liability of the deceased person’s estate. The estate, in simple terms, refers to the sum total of a person’s assets and liabilities. It is through the estate that the debts are managed and resolved.

The Legal Definition of Debt After Death

Delving deeper into the legal aspect, debt after death is subject to specific regulations and laws. These laws can vary from one jurisdiction to another, making it crucial to seek professional guidance to navigate this intricate landscape. In general, however, the estate is responsible for settling the outstanding debts using the available assets.

When a person passes away, their estate enters a legal process known as probate. Probate involves validating the deceased person’s will, identifying their assets and liabilities, and distributing the remaining assets to the rightful beneficiaries. During this process, the debts are given priority and must be settled before any assets can be distributed. If the estate lacks sufficient assets to cover all the debts, the debts may go unpaid, leaving creditors with limited recourse.

Common Misconceptions About Debt After Death

Dealing with debt after death can be emotionally challenging, and misconceptions surrounding this topic can exacerbate the anxiety and confusion. It’s essential to debunk some common misconceptions to gain a clearer understanding of the situation.

One of the most prevalent misconceptions is that family members are automatically responsible for the deceased person’s debts. However, this is not the case in most situations. The responsibility for the debts lies with the estate, not the family members. Family members are generally not personally liable for the deceased person’s debts unless they co-signed or guaranteed the debt themselves. It’s crucial to recognize that the estate is a separate legal entity, distinct from the deceased person’s loved ones.

Another misconception is that the debts disappear upon the death of the debtor. Unfortunately, this is not true. The debts remain valid, and the estate must address them appropriately. It’s important to consult with a legal professional who specializes in estate planning and probate to ensure a thorough understanding of the specific laws and regulations in your jurisdiction.

Understanding the concept of debt after death can help individuals and families navigate the complexities of estate planning and probate. By seeking professional advice and staying informed, it is possible to minimize the burden of debt and ensure a smoother transition for loved ones during an already challenging time.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Different Types of Debt are Handled After Death

Dealing with the aftermath of a loved one’s passing can be a challenging and emotional time. In addition to the emotional toll, there are also practical matters that need to be addressed, including the handling of any outstanding debts. Understanding how different types of debt are handled after death is crucial for both the deceased person’s estate and their surviving loved ones.

Credit Card Debt

Credit card debt is one of the most common types of debt individuals carry. After death, the handling of credit card debt can vary depending on the circumstances. In most cases, the credit card company will attempt to collect the debt from the deceased person’s estate. This means that any assets left behind, such as property, investments, or bank accounts, may be used to settle the outstanding debt.

However, it’s important to note that if there are insufficient assets in the estate to cover the debt, the credit card debt may go unpaid. In such cases, the debt is typically not passed down to the deceased person’s family members or loved ones. However, there is an exception to this rule if the credit card was jointly held with another person, such as a spouse. In such situations, the joint account holder may become responsible for the debt.

Mortgage Debt

When it comes to mortgage debt, the handling of the debt after death can be complex and depends on various factors. If the deceased person had a co-signer or a joint homeowner, such as a spouse, that person will likely become responsible for the remaining mortgage payments. This is because the co-signer or joint homeowner agreed to be equally liable for the debt when they signed the mortgage agreement.

On the other hand, if the mortgage was solely in the name of the deceased, the lender may utilize the proceeds from the sale of the property to settle the debt. In many cases, the lender will work with the deceased person’s estate to sell the property and use the proceeds to pay off the mortgage. However, if the sale doesn’t cover the entire debt, the remaining balance may be forgiven by the lender.

Student Loan Debt

Unlike other types of debt, student loan debt is generally not discharged upon the death of the borrower. This means that the responsibility for repaying the student loans may fall on the deceased person’s estate. However, it’s important to note that the handling of student loan debt can differ depending on whether the loans are federally funded or privately held.

If the student loans were federally funded, they may be forgiven upon the death of the borrower. This means that the estate would not be responsible for repaying the loans. On the other hand, if the student loans are private, they may still need to be repaid by the deceased person’s estate. It’s crucial to check the terms and conditions of the loan agreement and consult with an attorney if needed to understand the specific obligations.

Auto Loan Debt

Auto loan debt is another common type of debt that individuals may have at the time of their death. The handling of auto loan debt is typically similar to other secured debts. If the deceased person had an auto loan, the lender has the right to repossess the vehicle if the loan is not paid off.

In some cases, the lender may allow the estate or the family to continue making the loan payments to keep the vehicle. This can be particularly beneficial if the vehicle is vital for the surviving family members’ transportation needs. However, it’s essential to review the loan agreement and communicate with the lender to understand the options available and ensure compliance with the terms of the loan.

Dealing with the handling of different types of debt after death can be a complex and overwhelming process. It’s recommended to seek professional advice from an attorney or financial advisor who specializes in estate planning and probate to ensure that all necessary steps are taken and that the debt is handled appropriately.

The Role of the Executor in Handling Debt

Responsibilities of the Executor

The executor of a deceased person’s estate plays a crucial role in handling the debt after death. In addition to the emotional toll of losing a loved one, the executor must navigate the complex world of finances and legal obligations. The executor is responsible for identifying and locating all outstanding debts, notifying creditors, and ensuring that the debts are paid from the assets of the estate.

One of the first tasks for the executor is to gather all the necessary documents to get a clear picture of the deceased person’s financial situation. This includes bank statements, credit card bills, loan documents, and any other relevant records. It can be a daunting task, especially if the deceased person did not leave behind an organized system for managing their finances.

Once the executor has a comprehensive list of the deceased person’s debts, they must notify the creditors of the death. This involves sending a copy of the death certificate and any other required documents to each creditor. It’s important for the executor to keep accurate records of all communications with creditors to prevent any misunderstandings or complications.

How Executors Pay Off Debts

Executors typically follow a specific process to pay off debts from the deceased person’s estate. After notifying the creditors of the death, the executor must request any outstanding balances. This step is crucial to ensure that all debts are accounted for and nothing is overlooked.

Once the executor has a clear understanding of the outstanding debts, they can begin the process of gathering the necessary funds from the estate’s assets. This may involve selling assets such as property, vehicles, or valuable possessions. It can be a challenging and time-consuming task, especially if there are multiple creditors with different payment requirements.

After obtaining the necessary funds, the executor must prioritize the debts and pay them off in a specific order. Certain debts, such as funeral expenses and taxes, may take precedence over others. The executor must carefully manage the available funds to ensure that all debts are paid off as efficiently as possible.

In some cases, there may not be sufficient funds in the estate to cover all the debts. This can present a difficult situation for the executor, as they may need to sell additional assets or negotiate with creditors to reach a settlement. It requires careful negotiation skills and a deep understanding of the legal and financial implications.

Throughout the process of handling the deceased person’s debts, the executor must maintain open and transparent communication with creditors. This helps to build trust and prevent any potential disputes or legal complications. It’s a delicate balancing act, as the executor must ensure that the debts are paid off while also protecting the interests of the estate and its beneficiaries.

In conclusion, the role of the executor in handling debt after death is a complex and challenging task. It requires meticulous attention to detail, strong organizational skills, and a deep understanding of financial and legal matters. The executor must navigate through the maze of outstanding debts, communicate effectively with creditors, and manage the estate’s assets to ensure that all debts are paid off in a fair and efficient manner.

The Impact of Debt on Inheritance

How Debt Can Reduce Inheritance

When someone passes away with outstanding debts, it can have a significant impact on the inheritance left for their loved ones. If the deceased person’s estate has significant debt and limited assets, the debts may consume a substantial portion of the estate, leaving less for distribution to beneficiaries. In some cases, there may not be any assets remaining after the debts are paid off, resulting in no inheritance for the beneficiaries.

Protecting Your Inheritance from Debt

There are several legal ways to protect your inheritance from debt. One method is to create a trust, which can help shield assets from creditors and ensure that they pass directly to the intended beneficiaries. Additionally, proper estate planning, including the use of life insurance policies and payable-on-death accounts, can provide additional protection for your loved ones and help mitigate the impact of debt after your passing. Consulting with an estate planning attorney can help you explore the best options for your specific situation.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Plan for Debt After Death

Estate Planning and Debt

Proactive estate planning is essential to help minimize the impact of debt after death. Working with an experienced estate planning attorney can help you create a comprehensive plan that addresses your specific financial situation and goals. It’s important to review and update your plan regularly to ensure it reflects any changes in your debt, assets, or family circumstances.

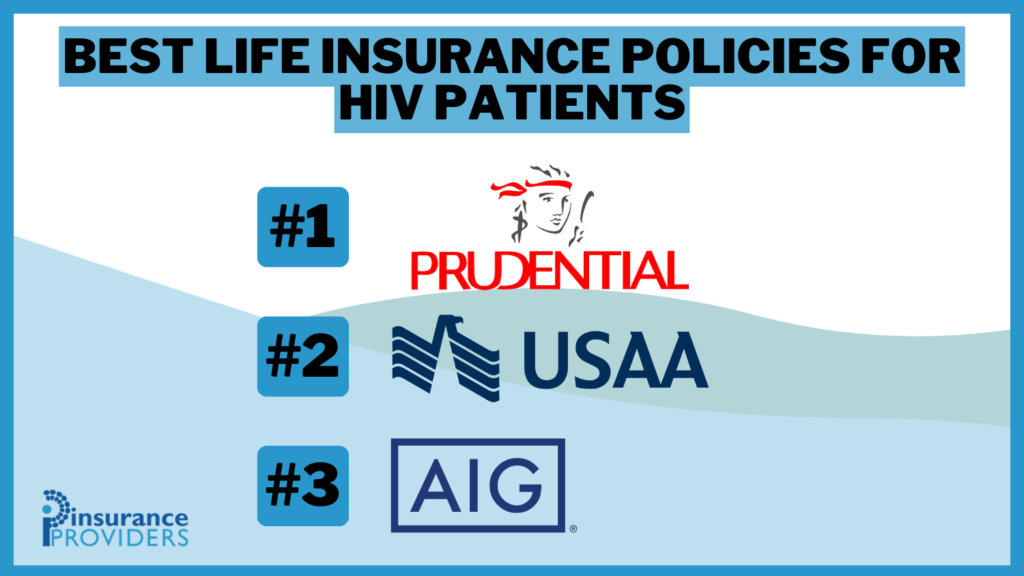

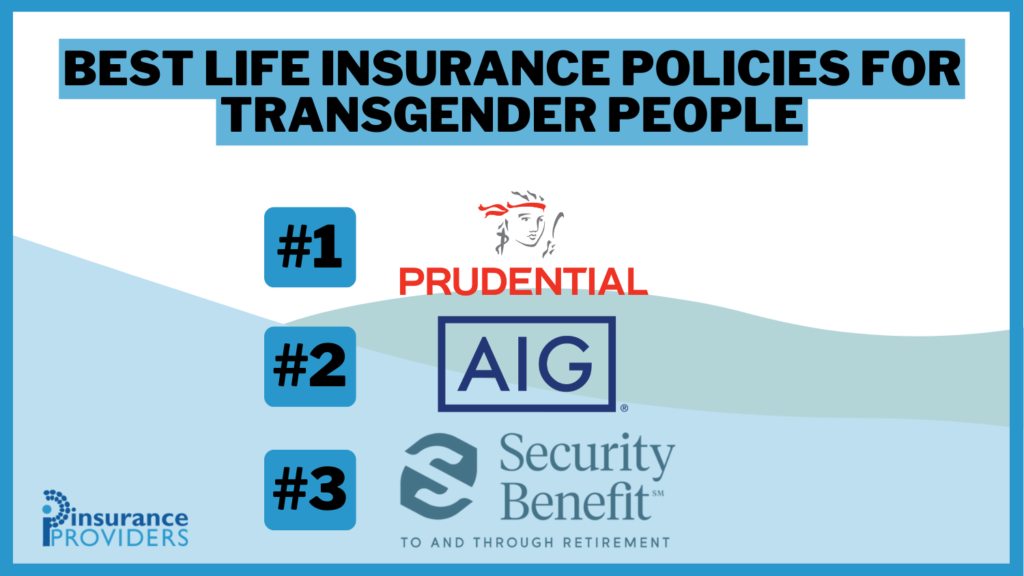

Life Insurance and Debt

Life insurance can be a valuable tool in managing debt after death. By designating beneficiaries on a life insurance policy, you can provide them with a source of funds to help offset any outstanding debts. This can alleviate the burden on the estate and ensure that your loved ones receive the financial support they need during a difficult time.

Legal Ways to Protect Assets from Debt

Besides trusts, there are other legal strategies that can help protect your assets from debt. These may include gifting assets during your lifetime, creating a limited liability company (LLC) or family limited partnership (FLP), or utilizing homestead exemptions. Understanding the specific laws in your jurisdiction is crucial, as they may vary from state to state.

In conclusion, dealing with debt after death can be a complex and challenging process. Understanding the legal definitions and implications, as well as the role of the executor, can help alleviate some of the confusion and uncertainty. Proper estate planning, including thoughtful consideration of your financial obligations, can help protect your loved ones and ensure that your legacy is preserved. By taking proactive steps and seeking professional guidance when needed, you can navigate the complexities of debt after death with confidence and peace of mind.

Frequently Asked Questions

What happens to debt when you die?

When you die, your debts do not simply disappear. They become part of your estate and are usually paid off using your assets before any remaining assets are distributed to your beneficiaries.

What is an estate?

An estate refers to the total sum of a person’s assets, including property, investments, and any debts they owe, at the time of their death.

Who is responsible for paying off the deceased person’s debt?

The responsibility of paying off the deceased person’s debt falls on their estate. The executor or administrator of the estate is typically responsible for managing the process of paying off the debts using the assets of the estate.

What happens if the deceased person’s assets are not enough to cover their debts?

If the deceased person’s assets are not sufficient to cover their debts, the debts are generally considered uncollectible. However, this may vary depending on the jurisdiction and the type of debt. In some cases, certain debts may be prioritized and need to be paid off before others.

Can creditors go after the deceased person’s family to collect the debt?

In general, creditors cannot go after the deceased person’s family members to collect the debt. However, if a family member co-signed a loan or is a joint account holder, they may be held responsible for the debt. It is important to review the specific circumstances and consult with a legal professional to understand the obligations.

Can life insurance be used to pay off debts after death?

Yes, life insurance can be used to pay off debts after death. If the deceased person had a life insurance policy, the proceeds can be used to cover outstanding debts, ensuring that the burden does not fall on the estate or the family members.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.