What is instant life insurance?

Are you curious about the concept of instant life insurance? This article provides a comprehensive explanation, discussing the benefits and drawbacks of this type of coverage. Discover everything you need to know to make an informed decision about instant life insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated September 2023

Instant life insurance is a type of life insurance that provides coverage immediately upon application approval. It offers a quick and convenient solution for individuals looking to protect their loved ones financially in the event of their death. In this article, we will explore the concept of instant life insurance, the process of obtaining it, its benefits, potential drawbacks, and key factors to consider when choosing a policy.

Understanding the Concept of Instant Life Insurance

Definition and Basic Principles of Instant Life Insurance

Instant life insurance, also known as immediate issue life insurance or no-exam life insurance, is a form of life insurance that does not require a medical examination. Traditional life insurance policies often involve lengthy underwriting processes, including medical tests and evaluations, which can delay coverage for weeks or even months. In contrast, instant life insurance policies are designed to provide coverage quickly, sometimes within minutes or hours of application approval.

When it comes to instant life insurance, the convenience factor is a major draw for many individuals. In a world where time is of the essence, the ability to secure life insurance coverage without the need for medical exams or extensive paperwork can be a significant advantage. This streamlined approach allows people to obtain the protection they need promptly, providing peace of mind for themselves and their loved ones.

Furthermore, the speed at which instant life insurance policies are processed can be particularly beneficial in certain situations. For instance, individuals who are planning to travel abroad or engage in high-risk activities may need coverage immediately to ensure financial protection during these endeavors. Instant life insurance can cater to these specific needs, offering a quick and efficient solution.

How Instant Life Insurance Differs from Traditional Life Insurance

One of the key differences between instant life insurance and traditional life insurance is the underwriting process. While traditional life insurance policies typically involve comprehensive medical underwriting to assess the applicant’s health and lifestyle factors, instant life insurance policies generally rely on simplified underwriting. This means that immediate coverage can be granted based on the applicant’s responses to a few health-related questions. As a result, instant life insurance is often an attractive option for those who want to secure coverage without the hassle of a medical examination.

However, it is important to note that the simplified underwriting process of instant life insurance may come with certain limitations and exclusions. Due to the lack of in-depth medical evaluation, these policies may have lower coverage amounts or higher premiums for individuals with pre-existing health conditions. This is because the insurance provider assumes a higher level of risk by not thoroughly assessing the applicant’s health status.

Despite these limitations, instant life insurance can still be a valuable option for many individuals. For those who are relatively healthy and do not have complex medical histories, instant life insurance offers a convenient way to obtain coverage quickly and efficiently. It provides a viable alternative to traditional life insurance, especially for those who may have concerns about the time-consuming nature of the underwriting process.

Moreover, instant life insurance can be particularly beneficial for individuals who have been previously denied coverage due to health reasons. By eliminating the need for medical exams, these policies offer a second chance for those who have been turned away by traditional insurance providers. This inclusivity allows more people to protect themselves and their loved ones, regardless of their health status.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Process of Getting Instant Life Insurance

Getting instant life insurance can provide you with peace of mind knowing that your loved ones will be financially protected in the event of your passing. While the process may seem daunting at first, it is actually quite straightforward and can be completed online or over the phone. In this article, we will walk you through the eligibility criteria and the steps involved in applying for instant life insurance.

Eligibility Criteria for Instant Life Insurance

Before applying for instant life insurance, it is essential to understand the eligibility criteria set by insurance providers. While specific requirements can vary between providers, applicants typically need to meet certain age and health-related conditions.

Most instant life insurance policies are available to individuals within a certain age range, often between 18 and 65. This ensures that the policyholder is in the prime of their life and can benefit from affordable premiums. Additionally, individuals in good health or with minor health conditions tend to have a higher chance of being eligible for instant coverage.

Insurance providers may ask applicants to disclose any pre-existing medical conditions or engage in a medical examination. This information helps the insurer assess the risk associated with providing instant coverage. It is important to be honest and transparent when answering these questions, as any misrepresentation could lead to complications in the future.

Steps to Apply for Instant Life Insurance

The application process for instant life insurance is typically straightforward and can be completed online or over the phone. Here are some common steps involved:

- Gather the necessary information: Collect details such as personal identification, contact information, and financial data. This information is crucial for the insurer to assess your eligibility and determine the appropriate premium for your coverage.

- Choose the desired coverage amount: Determine the appropriate death benefit that suits your financial goals and the needs of your beneficiaries. Consider factors such as outstanding debts, mortgage payments, and future expenses when deciding on the coverage amount.

- Answer health-related questions: Provide accurate responses to the insurer’s health-related questions, which may include information about medical history, lifestyle habits, and occupation. This information helps the insurer assess the risk associated with providing instant coverage and determine the premium.

- Review and submit the application: Carefully review the application for accuracy and completeness before submitting it to the insurance provider. Any errors or missing information could delay the approval process.

- Wait for approval: After submitting the application, the insurer will assess it and may request additional information if necessary. The approval process typically takes a few business days. Once approved, you will receive instant coverage, giving you the peace of mind you deserve.

It is important to note that instant life insurance policies often come with a higher premium compared to traditional life insurance policies. This is because the insurer is taking on a higher risk by providing coverage without an extensive underwriting process. However, the convenience and immediate coverage provided by instant life insurance can outweigh the higher premium for many individuals.

Remember, instant life insurance is designed to provide quick coverage for those who need immediate protection. If you have complex medical conditions or require a larger coverage amount, it may be beneficial to explore traditional life insurance options that involve a more in-depth underwriting process.

Now that you have a better understanding of the eligibility criteria and the steps involved in applying for instant life insurance, you can make an informed decision about whether this type of coverage is right for you. Take the time to research different insurance providers, compare quotes, and consider your financial goals to ensure you choose the best policy for your needs.

Benefits of Instant Life Insurance

When it comes to securing life insurance, the speed and convenience of instant life insurance cannot be overstated. Traditional life insurance policies often involve lengthy waiting periods and require medical examinations, which can be time-consuming and inconvenient. However, with instant life insurance, these hurdles are eliminated, providing coverage quickly and efficiently.

Imagine being able to apply for life insurance and receive approval within minutes or hours. Instant life insurance offers just that. This is particularly beneficial for individuals who need immediate protection, such as those with significant financial obligations or health concerns. Whether you’re a young professional starting a family or a business owner looking to safeguard your loved ones, instant life insurance can be a game-changer.

Flexibility and Customization Options

Contrary to the common misconception that instant life insurance only offers limited coverage, many insurance providers offer flexible options that can be customized to meet individual needs. Instant life insurance policies often come in various types, such as term life insurance or whole life insurance, with different coverage durations and benefits.

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. This option is ideal for individuals who want coverage during their working years or until their financial obligations, such as mortgage payments or college tuition fees, are fulfilled. On the other hand, whole life insurance offers lifetime coverage, ensuring that your loved ones are protected no matter when you pass away.

Moreover, instant life insurance policies can be tailored to fit your budget and circumstances. Insurance providers understand that not everyone has the same financial capabilities, so they offer various coverage amounts and premium options. Whether you’re looking for a policy with a high coverage amount to secure your family’s future or a more affordable option that still provides sufficient protection, instant life insurance can accommodate your needs.

Furthermore, instant life insurance allows for customization beyond just coverage and premium options. Some policies offer additional riders or add-ons that can enhance your coverage. For example, you might have the option to add a critical illness rider, which provides a lump sum payout if you are diagnosed with a specified critical illness. This additional layer of protection can provide financial support during challenging times and ensure that you can focus on your recovery without worrying about the financial burden.

In conclusion, instant life insurance not only offers speed and convenience but also provides flexibility and customization options. Whether you need immediate coverage or want a policy that aligns with your specific requirements and budget, instant life insurance can be a reliable and practical solution. Take advantage of this modern approach to life insurance and secure your loved ones’ future with ease.

Potential Drawbacks of Instant Life Insurance

Limitations and Exclusions

Instant life insurance policies may have limitations and exclusions compared to traditional life insurance policies. These limitations can include lower coverage amounts, limited riders and add-ons, and stricter criteria for certain pre-existing health conditions. It is crucial to review the policy terms and conditions carefully to understand the scope of coverage and any potential restrictions that may apply.

When it comes to instant life insurance, it is important to understand that convenience often comes at a cost. While these policies offer quick coverage without the need for extensive medical examinations, they may not provide the same level of comprehensive protection as traditional life insurance options. This means that there may be certain limitations and exclusions that could impact the coverage you receive.

For example, instant life insurance policies often come with lower coverage amounts compared to their traditional counterparts. This means that if you have substantial financial obligations or dependents who rely on your income, an instant policy may not provide sufficient coverage to meet their needs. Additionally, these policies may have limited riders and add-ons, which can further restrict the flexibility and customization of your coverage.

Furthermore, instant life insurance policies may have stricter criteria for certain pre-existing health conditions. This means that if you have a medical history that includes certain illnesses or conditions, you may not be eligible for coverage under an instant policy. It is essential to carefully review the policy terms and conditions to ensure that you meet all the necessary requirements and that there are no surprises when it comes to your coverage.

Cost Implications

While instant life insurance can provide quick coverage, it is worth considering the potential cost implications. As instant life insurance often involves streamlined underwriting processes, insurers may charge higher premiums to account for the increased risk associated with providing coverage without comprehensive medical assessments. It is advisable to compare quotes from different insurance providers to ensure you are getting the best value for your coverage needs.

When it comes to instant life insurance, the convenience of quick coverage may come at a price. Insurers offering instant policies often streamline the underwriting process, which means they may not have a comprehensive understanding of your health and lifestyle factors that could impact your risk profile. To compensate for this increased risk, insurers may charge higher premiums compared to traditional life insurance policies.

It is important to carefully consider the cost implications of instant life insurance and assess whether the convenience of quick coverage outweighs the potential financial burden. While the premium may seem affordable at first glance, it is essential to review the policy terms and conditions to ensure that you are getting the best value for your coverage needs.

Comparing quotes from different insurance providers can help you determine whether the cost of an instant life insurance policy is competitive. By obtaining multiple quotes, you can assess the premiums offered by different insurers and evaluate the coverage and benefits they provide. This comparison can help you make an informed decision and ensure that you are not overpaying for your instant life insurance coverage.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Key Factors to Consider When Choosing Instant Life Insurance

Understanding Your Insurance Needs

Before purchasing instant life insurance, it is crucial to assess your insurance needs carefully. Consider factors such as your financial obligations, future plans, and the well-being of your dependents. Evaluate the appropriate coverage amount and duration that would provide adequate financial protection for your loved ones in the event of your passing.

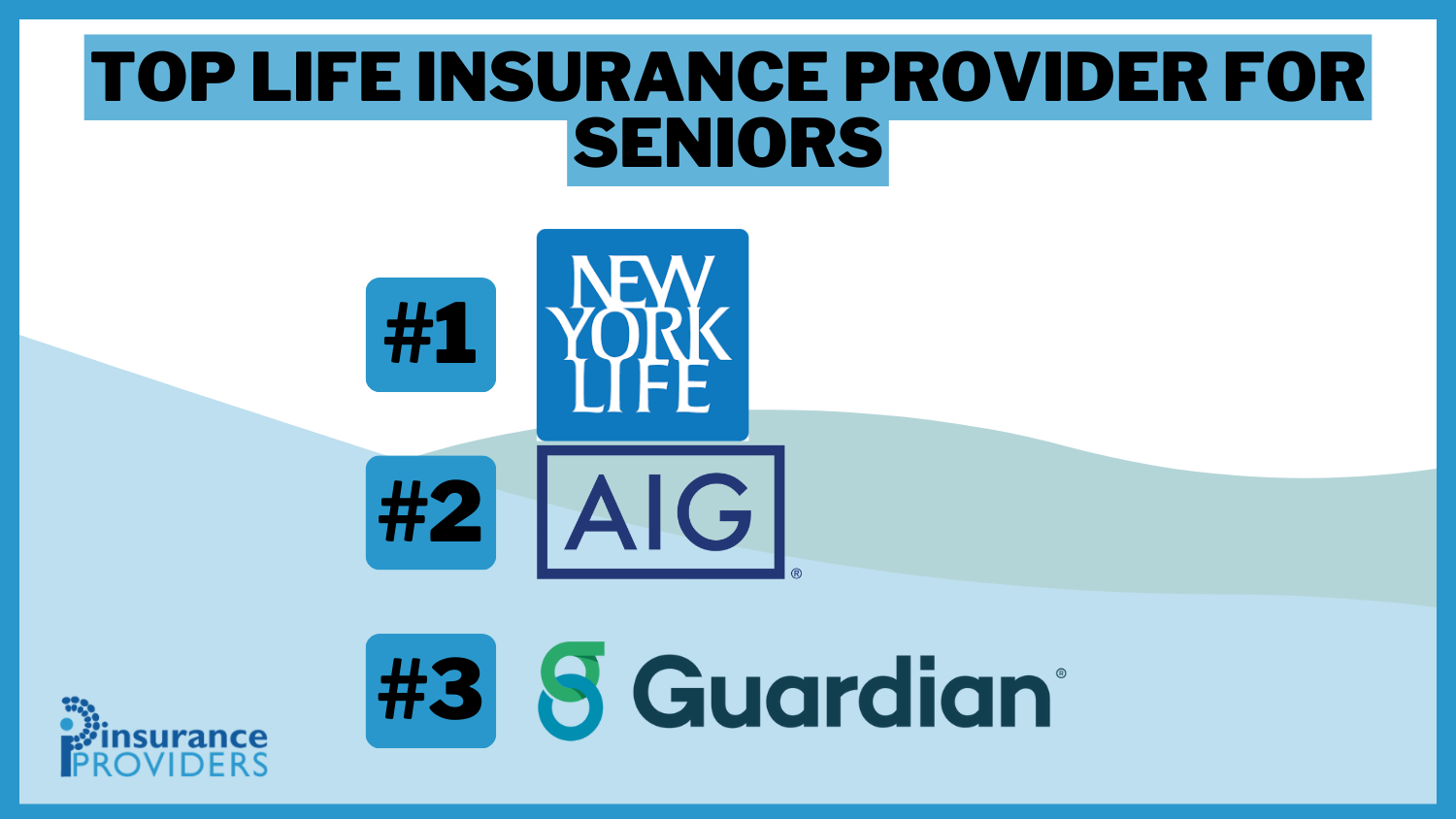

Comparing Different Instant Life Insurance Providers

While the speed and convenience of instant life insurance are appealing, it is still essential to compare offerings from different providers. Look for reputable insurers with a strong track record and positive customer reviews. Evaluate their policy terms, coverage options, premium rates, and customer service. By conducting thorough research, you can make an informed decision and choose an instant life insurance policy that meets your needs.

In conclusion, instant life insurance provides individuals with a quick and convenient option for securing coverage without the need for a medical examination. It offers benefits such as speed, convenience, and customization options. However, it is essential to be aware of potential drawbacks such as limitations, exclusions, and potential cost implications. By thoroughly considering eligibility criteria, understanding the application process, and evaluating various providers, individuals can make an informed decision and choose the most suitable instant life insurance policy for their needs.

Frequently Asked Questions

What is instant life insurance?

Instant life insurance is a type of life insurance policy that provides coverage immediately upon approval, without the need for a medical exam or extensive underwriting. It offers a quick and convenient way to secure life insurance coverage.

How does instant life insurance work?

Instant life insurance typically works by allowing individuals to apply for coverage online or over the phone. The application process is simplified and often requires answering a few health-related questions. If approved, the policy goes into effect immediately, providing coverage from day one.

What are the advantages of instant life insurance?

Instant life insurance offers several advantages, such as quick approval and coverage, no medical exams or extensive paperwork, and convenience. It is particularly beneficial for individuals who need immediate life insurance protection or those who prefer a simplified application process.

Who is eligible for instant life insurance?

Eligibility for instant life insurance varies depending on the insurance provider. Generally, individuals who are in good health and meet certain age requirements (typically between 18-65 years) are eligible. However, specific eligibility criteria may differ between insurance companies.

Is instant life insurance more expensive than traditional life insurance?

The cost of instant life insurance can vary depending on factors such as age, health condition, coverage amount, and the insurance provider itself. In some cases, instant life insurance may be slightly more expensive than traditional life insurance policies that require a medical exam. However, the convenience and immediate coverage it offers may outweigh the potential price difference for many individuals.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.